Best Brokers for Crude Oil Trading

Crude oil is one of the most widely traded commodities on brokerage platforms. As a globally sought-after asset, it provides traders with opportunities to profit from price movements influenced by geopolitical developments, shifts in supply and demand, and broader macroeconomic trends.

A key advantage of crude oil trading is the ability to speculate on its price without physically owning the asset. To maximise the trading experience, selecting the right broker is crucial for investors. In this article, we will explore the best brokers for crude oil trading, highlighting their key features to see what sets them apart.

Understanding Crude Oil Trading

Crude oil is a naturally occurring, unrefined petroleum product composed of hydrocarbon deposits and other organic materials. It is a fossil fuel formed from the remains of ancient organisms buried under layers of sediment and rock over millions of years. There are three main crude oil benchmarks, which include Brent Crude and West Texas Intermediate (WTI).

- Brent Crude - This is a light sweet crude oil extracted from the North Sea that is used as a benchmark for European and global oil pricing.

- West Texas Intermediate (WTI) - This is a light, sweet crude oil benchmark primarily traded on the New York Mercantile Exchange (NYMEX) that is used as a benchmark for U.S. crude oil prices.

- Dubai/Oman Crude - This is a heavy sour crude oil extracted from Dubai used as a benchmark for Middle Eastern oil exports to Asia

Brent and West Texas Intermediate are the main benchmarks traded on forex/CFD brokers worldwide. There are other benchmarks that exist, but are not as commonly traded.

Factors to Consider When Choosing a Broker For Crude Oil Trading

Before diving into the list of the best brokers, it’s important to understand the key factors to consider when choosing a broker for crude oil trading. Here are the key things that traders should consider:

- Regulation - The regulatory status of a company is the most important thing to consider when choosing a broker. Ensure the broker you choose is regulated by a reputable financial authority, such as the FCA (UK), the DFSA (Dubai), the ASIC (Australia), or the CySEC (Cyprus). Regulation ensures that the broker adheres to strict financial standards and maintains a fair trading environment.

- Spreads and Other Fees - Low spreads and trading fees are crucial for maximising profitability, especially in a volatile market like crude oil.

- Trading Platforms - A reliable and user-friendly trading platform is essential for executing trades efficiently. Choose a broker that provides robust and intuitive trading platforms, such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), among others.

- Asset Variety - While your primary focus may be crude oil, a broker offering a wide range of commodities, forex, indices, and other assets can provide additional trading opportunities.

With these factors in mind, let us look at some of the best brokers for crude oil trading.

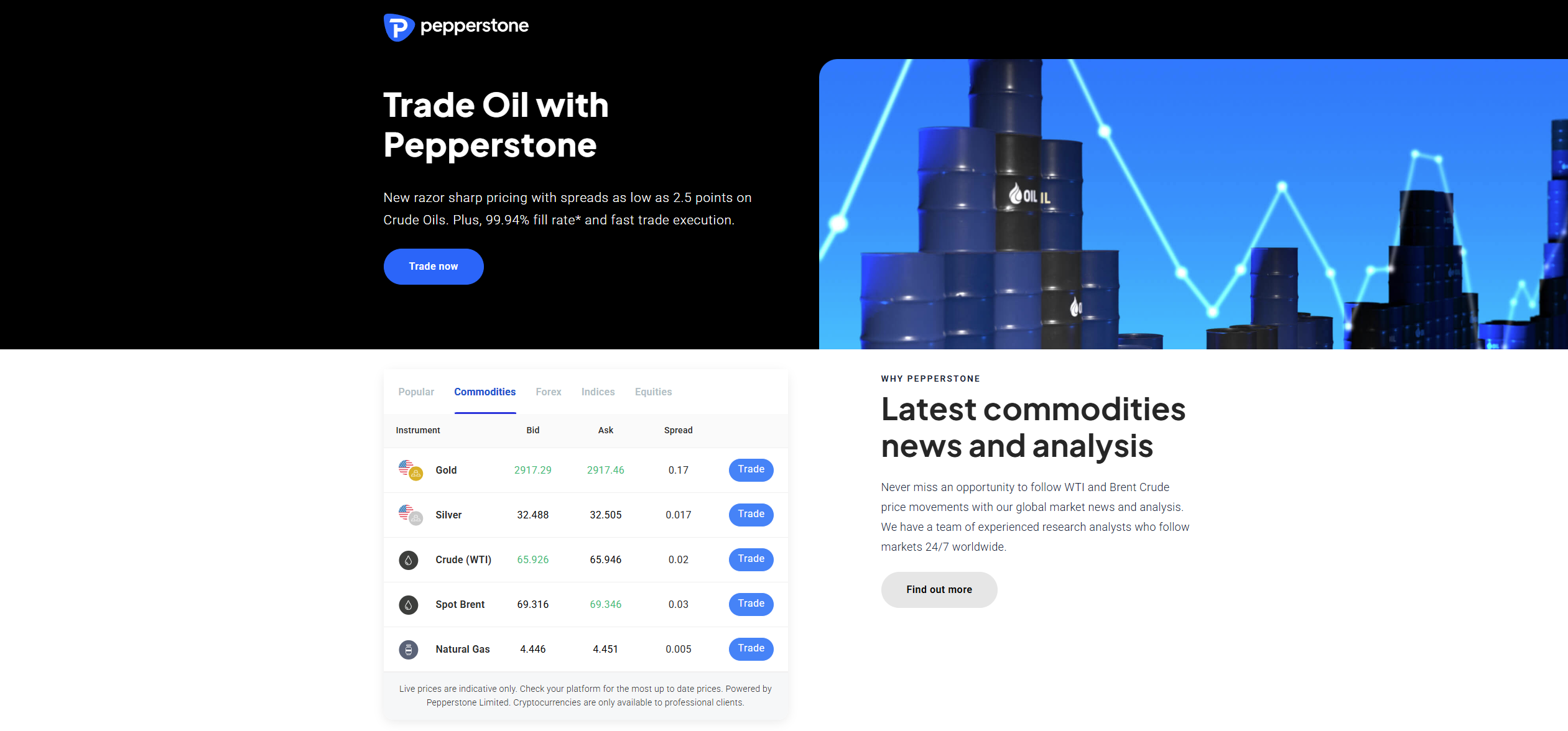

Pepperstone

Pepperstone stands out as one of the leading brokers for crude oil trading. It provides access to both Brent Crude (SpotBrent) and West Texas Intermediate (SpotCrude) via CFDs. Pepperstone has competitive spreads on these assets, offering a minimum spread of 2.0 pips and an average spread of 2.4 pips. These conditions are available across both the Standard and Razor accounts, making Pepperstone a strong choice for traders seeking cost-effective crude oil trading opportunities.

Aside from crude oil, Pepperstone offers a deep collection of other market products. Specifically, the broker supports the trading of over 1,200 CFDs on forex, other commodities like gold, indices, shares, ETFs, and cryptocurrencies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, TradingView, cTrader, and Pepperstone Trading Platform.

Further, Pepperstone is a well-regulated broker which holds licenses from various financial authorities. It operates under the regulation of the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, and the BaFin in Germany, among others. This regulatory oversight is one of the factors that contribute to Pepperstone's reputation as a leading broker for crude oil trading.

75.3% of retail CFD accounts lose money

Exness

Exness is another prominent broker that offers crude oil trading, providing access to WTI and Brent crude oil CFDs. The West Texas Intermediate crude oil is available under the ticker USOIL while the Brent Crude is available with the ticker UKOIL. Both are available as CFDs. Notably, Exness provides competitive conditions for crude oil traders, which vary depending on the account.

On the Standard account, Brent Crude has an average spread of 9.8 pips, while WTI has a tighter average spread of 1.7 pips, with no commissions charged on either. For the Pro account, the average spread for Brent Crude is 6.9 pips, and WTI’s average spread is 1.2 pips. both still commission-free. On the Zero account, both Brent Crude and WTI offer an average spread of 0.0 pips, but commissions apply.

For Brent Crude, the commission is $32.5 per side per lot, while for WTI, it is $6.25 per side per lot. Finally, the Raw Spread account features an average spread of 5.5 pips for Brent Crude and 0.4 pips for WTI. This account charges a commission of $3.5 per side per lot for both crude oil assets.

Exness provides a wide range of trading platforms, including MetaTrader 4, MetaTrader 5, and Exness Terminal, catering to various trader preferences. The broker also provides user-friendly mobile trading apps, enabling traders to manage their positions on the go. Beyond crude oil, Exness offers access to other global market products. These include CFDs on forex, indices, other commodities, cryptocurrencies, and stocks.

In terms of regulation, Exness operates under the oversight of several financial authorities. These include the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

XM

XM is another popular choice for traders looking to trade crude oil. This broker offers both WTI and Brent crude oil, both as cash and futures CFDs. The Brent cash CFD is available under the ticker BRENTCash, while the futures CFD has the ticker BRENT. On the other hand, the WTI cash CFD is available under the ticker OILCash, and its futures CFD has the symbol OIL. All four of these assets feature a minimum spread of 3.0 pips and a similar average of 3.0 pips. XM does not charge any commissions on crude oil trading.

Aside from providing access to these key energy benchmarks, XM also offers many other market products to trade. In total, this broker offers access to over 1,400 different products including CFDs on forex, equity indices, shares, cryptocurrencies, commodities, metals, stocks, and energies. The trading platforms available for traders to use include MetaTrader 4 and MetaTrader 5, along with the XM Trading app.

Regarding regulation, XM holds regulatory licenses from a variety of organisations. These include the CySEC, the ASIC, and the FSC in Belize.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

FP Markets

FP Markets is also a strong contender for crude oil trading, providing access to both WTI and Brent crude oil CFDs. These products are available both as cash CFDs and futures CFDs with competitive spreads. WTI futures CFD is available with an average spread of 5.0 pips, while the WTI cash CFD has an average spread of 3.0 pips. On the other hand, Brent Crude futures CFD has an average spread of 6.0 pips, and its cash CFD has an average spread of 3.0 pips. FP Markets does not charge commissions on crude oil.

FP Markets supports a variety of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView. Aside from Crude Oil, trailers have access to plenty of other trading instruments, totalling over 10,000 assets. In particular, FP Markets supports the trading of CFDs on forex, cryptocurrencies, indices, other commodities (such as gold and silver), ETFs, bonds, metals, and stocks.

On another note, FP Markets operates under the supervision of several authorities. These include the ASIC, the CySEC, the FSCA, and the CMA, among others.

72.44% of retail CFD accounts lose money

eToro

eToro is a globally renowned broker that offers a unique and user-friendly platform for crude oil trading. The broker provides access to both Brent Crude and West Texas Intermediate (WTI) through CFDs, allowing traders to speculate on price movements without owning the physical asset. eToro is particularly popular for its social trading features, which enable users to copy the trades of other investors.

eToro offers competitive spreads on crude oil, with no commissions charged on trades. WTI Crude oil is available on eToro under the ticker OIL with spreads from as low as 5.0 pips, while Brent Crude oil is available with the symbol EuroOIL and features spreads from 6.0 pips. The trading platform available to use is the broker’s own eTor platform. It is available as a web platform and a mobile app, allowing investors to trade on the go.

In addition to crude oil, eToro provides access to a wide range of assets. These include CFDs on forex pairs, commodities, indices, stocks, ETFs, and cryptocurrencies. eToro also supports the trading of real stocks and cryptocurrencies. Further, eToro has a strong regulatory background with licenses from the FCA, the CySEC, the ASIC, and the MFSA in Malta, among others.

61% of retail investor accounts lose money when trading CFDs with this provider.

Tickmill

Tickmill is another strong contender for crude oil trading, offering CFDs on both Brent and WTI crude oil. Traders can access these instruments with competitive spreads and zero commissions. Brent Crude is available under the ticker BRENT, while WTI Crude has the symbol XTIUSD. The broker provides these assets on its trading platforms with an average spread starting from 4.0 pips for both Brent and WTI crude oil.

Traders can access crude oil CFDs through MetaTrader 4, MetaTrader 5, and the Tickmill Trader platform. The broker operates on a no-dealing desk (NDD) model, ensuring fast execution speeds with minimal slippage. Beyond crude oil, Tickmill offers a wide range of other trading instruments. These include CFDs on forex, stock indices, metals, bonds, other commodities, and cryptocurrencies.

On another note, Tickmill holds regulatory licenses from several authorities. It operates under the regulation of the FCA in the UK, the CySEC in Cyprus, and the DFSA in Dubai, among others. This regulatory oversight ensures that Tickmill follows strict financial standards and maintains a fair trading environment.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

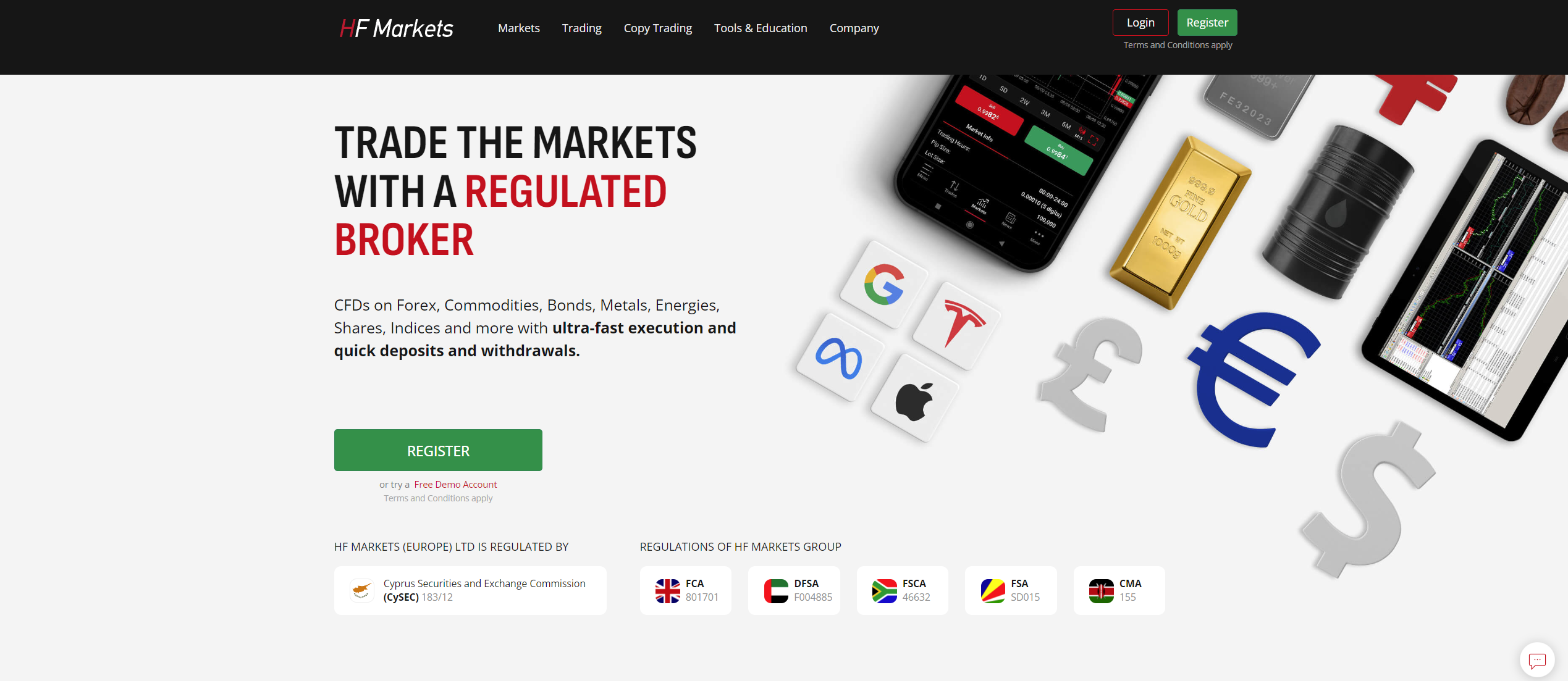

HFM

HFM is another reputable broker that offers crude oil trading. The broker provides access to both Brent Crude (UKOIL) and West Texas Intermediate (USOIL) through CFDs, with competitive spreads. There are two types of crude oil assets on HFM: spot CFDs and futures CFDs.

The UKOIL spot type has a spread of 4.0 pips on the Premium, Pro, and Zero accounts, while the Top-up Bonus account has a slightly higher spread of 5.0 pips. In comparison, the UKOIL future type has a uniform spread of 7.0 pips across all four accounts. For the USOIL spot, the spread is 9.0 pips on the Premium, Pro, and Zero accounts, but it is lower at 6.0 pips on the Top-up Bonus account. Meanwhile, the USOIL future type has a uniform spread of 11.0 pips across all four account types.

In addition to crude oil, HFM offers a wide variety of other trading instruments. These include CFDs on forex currency pairs, indices, stocks, metals, commodities, bonds, ETFs, and cryptocurrencies. One of HFM’s strengths is its diverse trading platforms. The broker supports MetaTrader 4, MetaTrader 5, and its proprietary HFM Platform.

Finally, HFM is a well-regulated broker in several jurisdictions. It operates under the strict supervision of the FCA, the CySEC, the FSC, the FSCA, and the FSA in Seychelles, among others.

68% of retail investor accounts lose money when trading CFDs with this provider.

Key Factors Affecting Crude Oil Prices

Crude oil prices are influenced by a combination of a variety of factors. Below is a brief look at these factors:

- Supply and Demand Dynamics - Oil prices are primarily driven by the balance between supply and demand. When supply exceeds demand, prices drop, while shortages drive prices up.

- OPEC Decisions - The Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) play a crucial role in oil prices by setting production quotas. When OPEC cuts production, prices typically rise due to reduced supply, whereas increasing output can lower prices. Their policies are a major factor in global oil market stability.

- Political Instability - Wars and political instability in key oil-producing regions like the Middle East, can disrupt supply chains, leading to price spikes. Additionally, sanctions on major producers, such as Iran or Venezuela, limit exports, reducing global supply and pushing prices higher.

- Market Speculation - Markets and investor sentiment heavily influence oil prices. Traders speculate on future supply and demand trends, which can cause price volatility. Perceptions of geopolitical risks or economic shifts also drive market behavior.

- Government Policies - Environmental regulations, such as carbon taxes or emissions standards, can reduce demand or increase production costs. Government subsidies for oil production or taxes on consumption also influence prices.

There are several other factors that influence the prices of crude oil on a global scale. These can include weather events, such as hurricanes, technological advancements like the development of alternative energy sources, and other factors like global pandemics. It is important to stay updated on these various factors for the best crude oil trading experience.

Closing Remarks

Crude oil is one of the most popular commodities that people trade online. Understanding the key factors that influence crude oil prices, such as OPEC decisions, supply and demand dynamics, and political instability, is essential for the best trading experience. Remember that crude oil trading carries a lot of risk. Traders should approach it with caution and proper risk management.

Additionally, choosing the right broker for crude oil trading is a crucial step for investors. The brokers we have featured here offer robust platforms and competitive conditions suitable for various trading styles. Nonetheless, this is not an exhaustive list. There are many other brokers that support crude oil trading. By considering factors such as regulation, trading costs, and other factors, traders can choose a broker that aligns with their goals and trading strategies. Ultimately, the best broker for crude oil trading is the one that meets the individual needs of a trader.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.