TradingView Broker List

TradingView is a powerful charting platform widely used by traders for comprehensive technical analysis and as a social network that enables users to interact and share trading ideas. However, since TradingView does not support direct trading without a broker, many traders look for brokers that offer seamless integration with the platform.

The key idea is for traders to select a TradingView-supported broker that offers highly competitive trading conditions, enabling them to minimize trading costs while seamlessly executing trades on the TradingView platform.

This enables traders to maximize the benefits of TradingView's advanced charting tools and social features, all while keeping trading fees to a minimum. By selecting such brokers, users can stay within the TradingView ecosystem, analyzing charts and executing trades effortlessly without needing to switch between platforms.

With TradingView, investors gain valuable insights into both short-term and long-term market trends, empowering them to make informed decisions. It also helps identify optimal entry points, stop-loss, and take-profit levels. Fortunately, several brokers offer direct integration with TradingView, allowing traders to chart and trade on a single platform. Below is a list of some of the best brokers supported by TradingView.

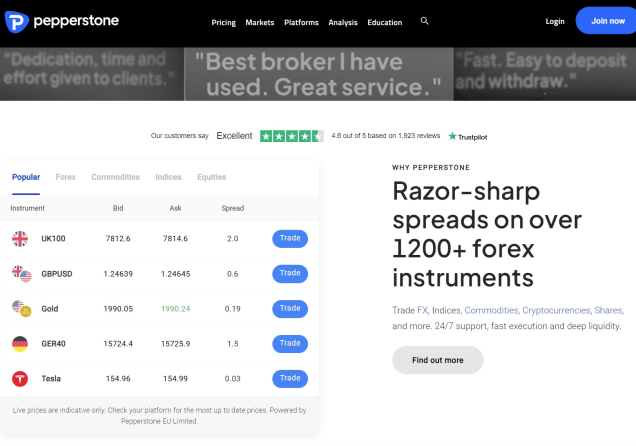

Pepperstone

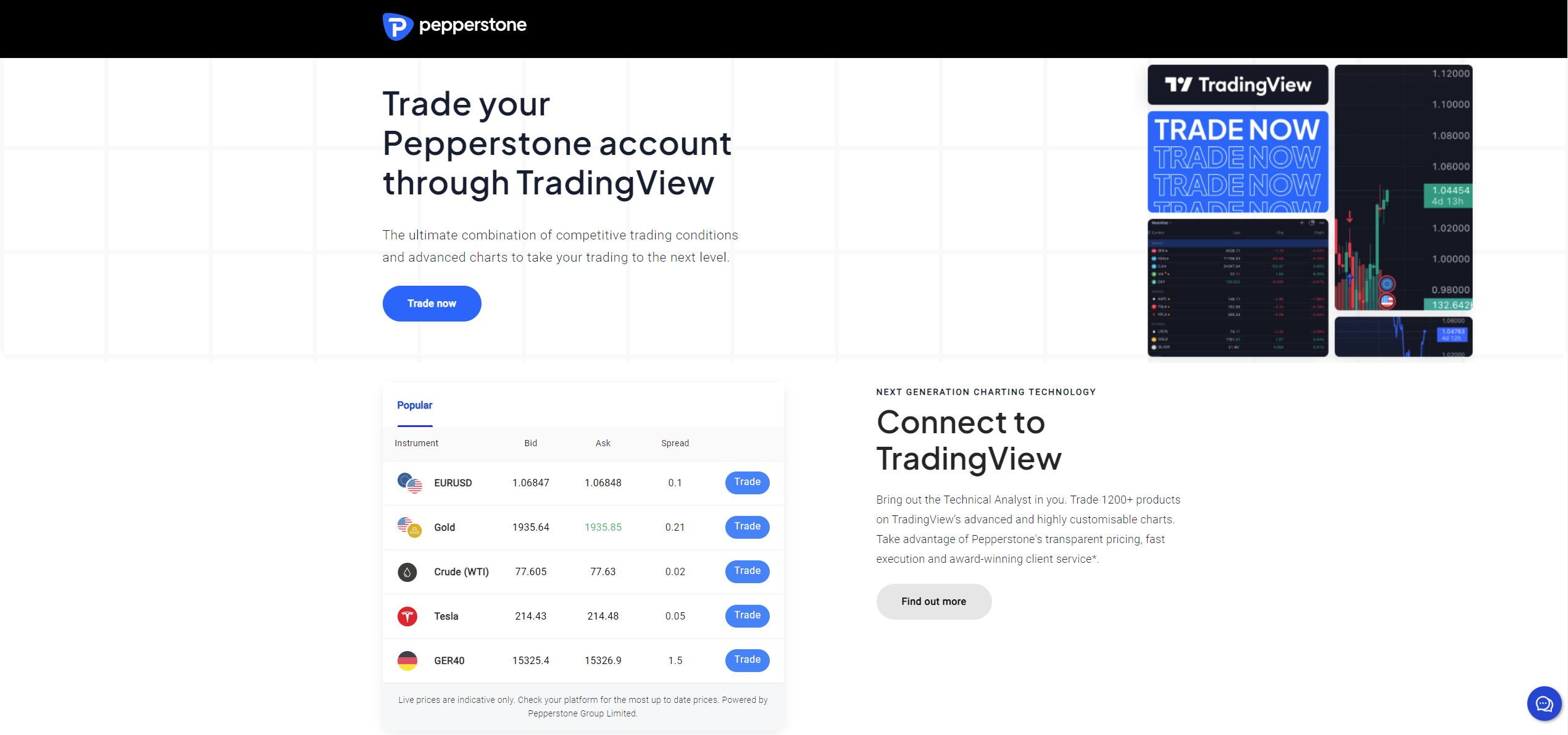

Pepperstone is often rated as one of the best brokers that supports TradingView. The company offers seamless integration with this trading platform and boasts superior execution times. According to Pepperstone's official website, most trades are executed in under 60 milliseconds. In addition to TradingView, Pepperstone provides access to MT4, MT5, and cTrader.

Pepperstone is heavily regulated by multiple tier-one regulatory bodies, including the FCA in the UK, CySEC in Cyprus, BaFin in Germany, and ASIC in Australia. It is advisable to trade only with companies regulated by reputable organizations. While regulations alone cannot guarantee safety, they significantly reduce risks and provide a layer of security.

Pepperstone provides access to over 1,200 CFD financial instruments through TradingView's advanced, highly customizable charting platform. Traders using the TradingView platform have access to instruments from the forex, stocks, cryptocurrency, indices, ETFs, commodities, and indices markets. Such diversity in trading instruments is one of the reasons Pepperstone is one of the best brokers in the UK and the world.

When it comes to trading fees, Pepperstone delivers a highly competitive trading environment. Spreads on the Standard Account for major currency pairs can be as low as 1.0 pip, with average spreads closely aligned at approximately 1.2 pips. This surpasses typical market standards and offers traders a competitive edge in terms of cost efficiency. For traders seeking even tighter spreads, the Raw Spread Account offers spreads starting from 0.0 pips. This account includes a small commission fee, set at $3.50 per side per lot for TradingView clients.

Update to: 01/25 - Pepperstone is currently running a promotion where you can claim a free 3-month TradingView Essential subscription via the link below. Existing account holders can also take advantage of this offer, but it’s not automatic—you’ll need to contact your account manager to get it.

The promo is available in the Asia-Pacific region, UK, European Economic Area, and LATAM regions, it is only not available to clients from Australia and UAE.

75.3% of retail CFD accounts lose money

Forex.com

Forex.com is one of the most prominent brokers that works with the TradingView system. The company launched in 2001 and is providing forex brokerage services to this date. The company has regulations from the FCA. This provides some legitimacy to the broker as the FCA is a Tier-1 regulator. It is also licensed and authorised in the US by the CFTC and the NFA. Interestingly enough, Forex.com has been ranked as the No. 1 FX broker in the US** (**Based on client assets per the 2022 monthly Retail Forex Obligation reports published by the CFTC).

Apart from offering access to TradingView, Forex.com also features other platforms such as the MetaTrader 4. This is one of the best trading tools in the market. It is responsive and ensures fast execution of trades. Forex.com also provides WebTrader and its in-house-built Forex.com Trader to clients. The minimum deposit on Forex.com is $100 and the maximum deposit is $10,000. In the US, the markets available to clients include forex, futures and future options. In other parts of the world such as the UK or Germany, clients can trade CFDs on a variety of assets like Forex, stocks, cryptocurrencies or commodities. All these markets hold significant risks. Investors should only invest amounts they can afford to lose.

76-77% of retail investor accounts lose money when trading CFDs with this provider.

City Index

City Index offers various trading platforms for all kinds of traders in the market. These include MetaTrader 4, WebTrader, mobile apps, and TradingView. Incredibly, traders can use TradingView to place orders directly from the charts. As such, this platform is not only available as an analysis tool. Better yet, traders have access to some of the fastest order execution times on this trading platform. Further, there are a plethora of global markets available to trade. These include forex, commodities, bonds, indices, and shares. In total, there are over 5,000 different individual assets.

The fees for trading these markets are some of the lowest with spreads starting from as low as 0.5 pips for major currency pairs. Additionally, there are no commissions charged on the different markets. The only market that charges commissions is the shares market. City Index has a stellar reputation when it comes to regulations. Specifically, this broker has regulatory licenses from the FCA in the UK, the ASIC in Australia, and the CySEC in Cyprus. These are three of the world’s top financial regulators suggesting that City Index is willing to follow strict laws in the market.

71% of retail investor accounts lose money when trading CFDs with this provider.

OANDA US

OANDA is a forex broker with a vibrant history in the market. The company started providing its services in 1996. OANDA is regulated by ASIC in Australia, the FCA in the UK and the CFTC in the US. Regulators watch over brokers to ensure they are not defrauding investors. Furthermore, OANDA provides some of the best trading software available. These include TradingView, MetaTrader 4 & 5, and their in-house-built OANDA Trade. These are highly responsive apps for fast trade executions.

The company assures clients of some of the tightest spreads in the market. Tight spreads ensure clients pay low costs and save more long-term. OANDA allows investors to trade in various markets, but its prime focus is on the forex market. These markets hold significant risks. Investors should only invest amounts they can afford to lose. The company does not have a minimum deposit amount. Additionally, there is no minimum balance required to maintain an account.

Forex trading involves significant risk of loss and is not suitable for all investors.

TradeStation

TradeStation is another broker that TradingView supports. The company launched in 1982 but launched its online services in 2001. This broker allows clients to trade stocks, ETFs, crypto, Futures and more. The company boasts a wide selection of trading products. Additionally, there are three different account types to choose from. These include individual and joint accounts, retirement accounts and entity accounts.

For a trading platform, the company provides its in-company built TradeStation Platform. The platform is available as a desktop application, a web trader and a mobile application. This way, the company can serve traders of all kinds. TradeStation is regulated by the SEC and is a member of the Securities Investor Protection Corporation. The company also has regulations from FINRA. The regulatory status and the company’s deep history give it legitimacy among traders. Still, investors should only invest amounts they can afford to lose.

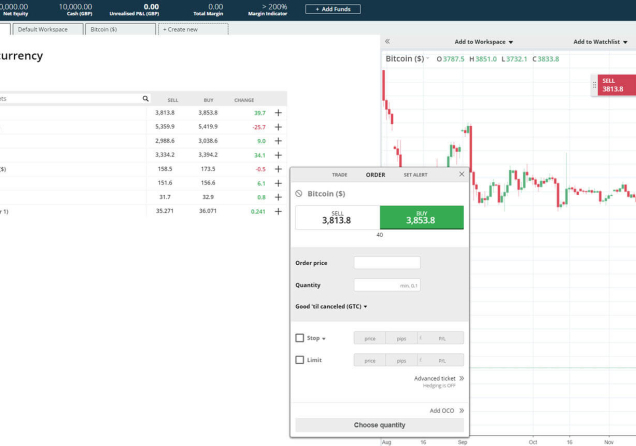

How To Connect Your Broker Account to TradingView

Trading on TradingView is very easy. All you need is an account with a supported broker. Then the steps are very easy.

- Open TradingView and log into your TradingView account. If you don’t have a TradingView account, then you will need to create one.

- Next, open a chart and click on Trading Panel at the bottom.

- Then choose your supported broker, say OANDA.

- Next, log into your broker account.

- Tick the accounts that you wish to use and click allow.

- You are now ready to place your orders. You will see 4 tabs namely, Positions, Orders, Account Summary and Notifications log.

Full List of TradingView Supported Brokers

The brokers above are not the only ones supported by TradingView. In fact, TradingView is continuously increasing the number of brokers and crypto exchanges they are working with. Here is a full list of companies currently supported by TradingView;

- OANDA

- Forex.com

- TradeStation

- FXCM

- Alpaca

- Gemini.

- AMP.

- iBroker

- Saxo

- Tradovate

- WH Selfinvest

- Alor

- IronBeam

- Tiger Brokers

- Capital.com

- Currency.com

- Chaka

- Tickmill

- Global Prime

- Timex

- BingX

- EasyMarkets

- Optimus Futures

- Bitstamp

- Pepperstone

- Ally Invest

- FTX

- Eightcap

- Interactive Brokers

- BlackBull Markets

- Tradier

- Dorman Trading

- OKX

- City Index

- Orama

How Much Does TradingView Cost?

TradingView has 5 different plans to accommodate all kinds of traders. These include the Basic, Pro, Pro+, Premium, and Ultimate plans. Each of these plans has different costs and different clients receive different features depending on the plan they pay for. The Basic plan is the free plan that is free until a user is ready. People can use this plan to test out how all markets are performing but the features are limited.

The Pro plan costs $14.95 per month and offers more charts, intervals, and indicators compared to the Basic plan. Specifically, this plan offers 5 indicators, 2 charts in one layout, 20 active price alerts, and 20 active technical alerts on indicators, strategies, or drawings. On top of that, it is ad-free. The Pro+ plan, which costs $29.95 per month, is an upgrade to the features of the Pro plan. It comes with 10 indicators, 4 charts in a layout, 100 active price alerts, 100 active technical alerts on indicators, strategies, or drawings, and 10 saved chart layouts.

The Premium plan has the highest precision and maximum data to capture all possible opportunities. This plan costs $59.95 per month and comes with 25 indicators per chart, 8 charts per layout, 400 active price alerts, 400 active technical alerts on indicators, strategies, or drawings, and unlimited saved chart layouts. Finally, the Ultimate plan, which costs $499.95 per month, comes with all the best features in one package. Under this plan, traders can opt into professional data.

Positively, when you pay for either the Pro, Pro+, or Premium plan on an annual basis, you get 16% off which is equivalent to 2 free months.

Can I trade directly from TradingView?

Yes, it is possible to trade directly from TradingView. TradingView does allow traders to place orders straight from the platform’s charts. However, you will need a broker that supports TradingView integration hence allowing you to place your orders directly on the platform. Many TradingView-supported brokers will allow you to trade instruments from the forex, cryptocurrencies, stocks, indices and commodity markets directly on the charting platform.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.