Tickmill Classic vs Raw Account: Full Comparison

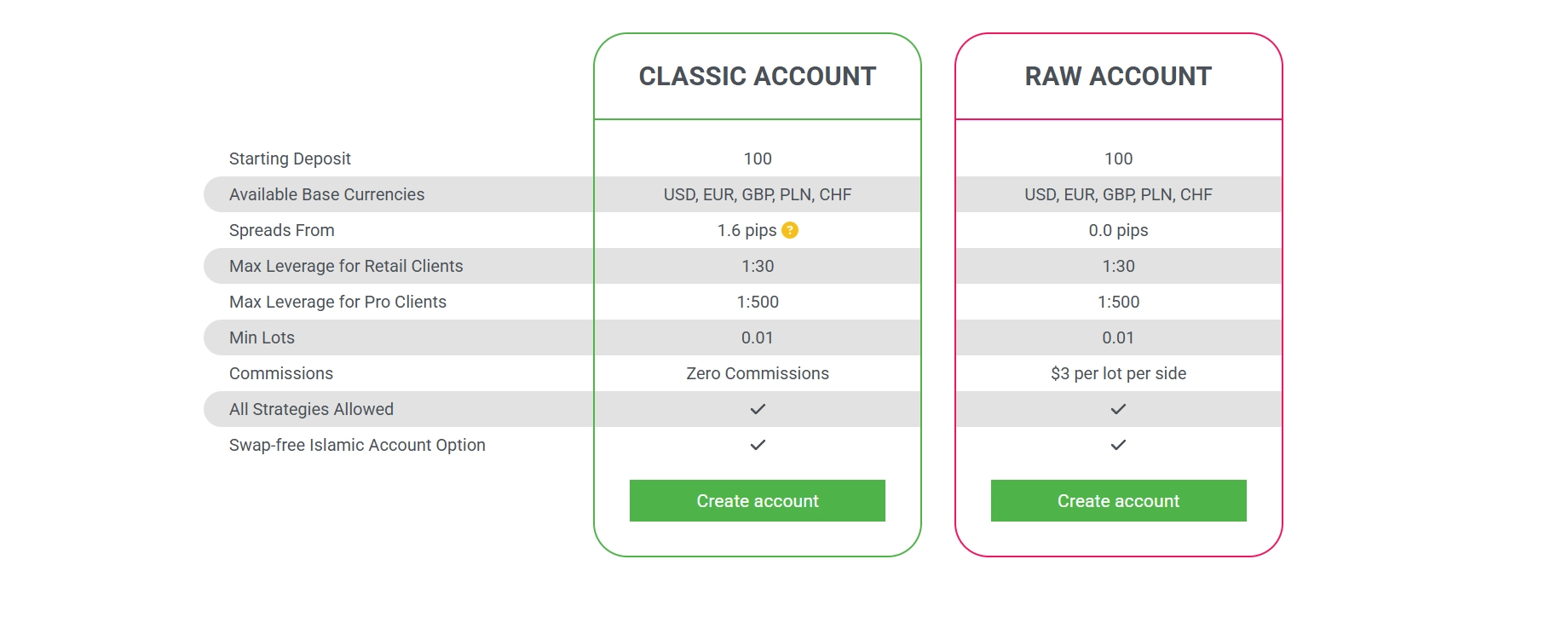

Choosing the right trading account is essential to managing your costs and maximising performance. Tickmill is a well-regarded broker that offers two main account types tailored for different trading styles. Tickmill’s two main account types include the Classic Account and the Raw Account. Each account type offers distinct advantages depending on your strategy, experience level, and pricing preferences.

In this article, we compare the Tickmill Classic and Raw accounts, highlighting key differences such as spreads, commissions, and the types of traders each account is best suited for. By the end, you’ll have the clarity needed to choose the account that best aligns with your trading goals and overall approach.

Tickmill Classic Account

The Tickmill Classic Account is designed to offer a user-friendly trading experience. This account provides a simple trading environment that can accommodate the majority of traders online. With no commission fees and spreads starting from 1.6 pips, this account gives you straightforward access to global markets without the complexity of extra charges.

Moreover, the Classic account provides reliable order execution, access to popular trading platforms, and a wide range of tradable instruments. Below is a highlight of the key features of the Tickmill Classic account.

Key Features of the Tickmill Classic Account

- Starting Deposit - $100 – an accessible minimum that suits most retail traders.

- Spreads - Variable, starting from 1.6 pips. This is ideal for traders who want commission-free pricing, with all fees factored into the spreads.

- Available Base Currencies - USD, EUR, GBP, and ZAR. This offers flexibility and greater account control.

- Minimum Lot Size - 0.01 (micro lots). This is perfect for micro-trading for risk management through position sizing.

- Platforms - This account supports the use of MetaTrader 4, MetaTrader 5, Tickmill Trader, and the revolutionary TradingView.

- Trading Strategies - All trading strategies are allowed, including scalping, hedging, and the use of Expert Advisors (EAs).

- Islamic Account Option - Swap-free accounts are available upon request.

With the Classic Account, you can trade CFDs on 62 forex pairs, major global stocks, indices, crude oil, precious metals like gold and silver, bonds, and cryptocurrencies like Bitcoin and Ethereum.

One unique feature of the Classic Account is that charts display raw market prices and spreads without markup. This ensures greater transparency when trading.

Who is the Tickmill Classic Account Ideally Suited For?

- New Forex Traders: The inherent simplicity of the commission-free, spread-based pricing model makes the Classic Account an ideal option for new traders in the forex market. It allows them to concentrate on understanding the fundamental dynamics of the market without the added layer of complexity associated with calculating separate commission charges.

- Swing Traders: Individuals who typically hold their trading positions for periods spanning several days or even weeks may find the all-inclusive nature of the spread particularly convenient and cost-effective.

- Traders Prioritising Simplicity: A segment of traders inherently prioritises the straightforward and uncomplicated nature of commission-free trading, even if it entails accepting wider spreads in comparison to commission-based alternatives. The Classic Account directly caters to this specific preference for simplicity and ease of cost calculation.

- People Who Trade Less Frequently: For those with lower trading volumes or smaller position sizes, the commission-fee structure of the Classic Account can prove to be advantageous in managing the overall trading expenses.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

The Tickmill Raw Account

The Tickmill Raw Account is designed for experienced and high-volume traders who want direct market access with ultra-tight spreads and low-cost commissions. This account is ideal for scalpers, day traders, and algorithmic traders looking to minimise trading costs and capitalise on small market moves.

With spreads starting from 0.0 pips, the Raw Account connects traders directly to interbank pricing from top-tier liquidity providers. Unlike the Classic Account, the Raw Account charges a commission of $3 per lot per side (round-trip $6). This pricing structure makes it a favourite among pro traders who prioritise cost-efficiency and speed.

Key Features of the Tickmill Raw Account

- Starting Deposit: This account also requires a minimum deposit of $100.

- Spreads: As mentioned, this account offers raw spreads starting from 0.0 pips. Traders have access to price streams from the interbank market.

- Available Base Currencies: USD, EUR, GBP, ZAR – giving traders flexibility in account funding.

- Minimum Trade Size: 0.01 lots (micro lots). This account supports flexibility in position sizes.

- Commission: $3 per lot per side. This commission is fixed and transparent with no hidden fees.

- Platforms: This account is also compatible with MetaTrader 4, MetaTrader 5, Tickmill Trader, and TradingView.

- Trading Strategies - All trading strategies are allowed, including scalping, hedging, and the use of Expert Advisors (EAs).

- Swap-Free Islamic Account Option: Available for traders who follow Sharia law.

With this account, you can trade over a variety of CFD instruments, including 62 forex pairs, major stocks, global stock indices, oil, gold and silver, bonds, and leading cryptocurrencies like Bitcoin and Ethereum.

Who is the Tickmill Raw Account Ideally Suited For?

- Experienced Forex Traders: Individuals who with a deeper understanding of the dynamics of raw spreads and are entirely comfortable with the mechanics of a separate commission structure may find this account most ideal.

- Scalpers: Traders who capitalise on minute price fluctuations within extremely short timeframes need the absolute tightest possible spreads and the fastest available execution speeds.

- Day Traders: Active traders who open and close their trading positions within the same trading day can significantly reduce their overall trading costs on this account. The ultra-low raw spreads are a standout feature.

- Algorithmic Traders: Traders who rely on automated trading systems, such as Expert Advisors (EAs), require consistent, reliable, and low-cost execution. The Raw account delivers this on top of other advantages.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

Key Differences Between The Tickmill Classic and Raw Accounts

The core difference between the Tickmill Classic and Raw accounts is in the trading fee structure. The Classic Account uses a spread-only pricing model, meaning there are no commission fees. The broker's fee is already included in the wider spreads, which start from 1.6 pips.

On the other hand, the Raw Account offers tight interbank spreads starting from 0.0 pips. However, it charges a fixed commission of $3 per lot per side ($6 round-trip per standard lot). This structure provides lower overall trading costs in high-liquidity conditions, especially for active traders.

Both accounts offer the same minimum trade size of 0.01 lots and support for all trading strategies, including scalping, hedging, and algorithmic trading. They also provide access to several advanced trading platforms, along with Islamic swap-free options.

Available Assets on Tickmill

Tickmill offers a well-rounded selection of CFD instruments from across several major asset classes. This variety enables traders to trade more than one global market instrument on the same account. All instruments are traded via CFDs, allowing for leveraged trading and both long and short positions. Here is a breakdown of the assets available on all Tickmill accounts:

- Forex - Tickmill provides access to over 60 forex pairs, covering major pairs such as EUR/USD, GBP/USD, and USD/JPY, as well as a range of minors and exotics.

- Stock Indices - Traders can speculate on the performance of leading global indices, including the US30 (Dow Jones), SPX500 (S&P 500), NAS100 (Nasdaq 100), and UK100 (FTSE 100), among others.

- Bonds - Tickmill offers CFDs on government bonds, enabling traders to diversify their portfolios and speculate on interest rate movements. These instruments provide exposure to fixed-income securities without direct ownership.

- Commodities - The platform includes a range of commodity CFDs, such as precious metals like Gold and Silver, as well as energy commodities like Crude Oil and Natural Gas.

- ETFs - Tickmill supports CFD trading on a selection of Exchange-Traded Funds (ETFs). ETFs offer diversified exposure to various sectors, industries, or geographical regions, allowing traders to gain broad market exposure through a single instrument.

- Cryptocurrencies - Tickmill also supports CFD trading on key cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. These assets offer high volatility and 24/7 trading opportunities.

Tickmill's Reputation and Regulation

Tickmill has cultivated a strong and reputable standing as a globally recognised online broker. It has regulatory oversight by multiple financial authorities. This ensures a high level of client protection and adherence to stringent regulatory standards. The broker operates under the regulation of the FCA in the UK, the CySEC in Cyprus, the FSA in Seychelles, and the FSCA in South Africa.

Moreover, Tickmill stands out for its impressive user rating online. On Trustpilot, this broker has a rating of 4.1 stars out of 5 after over 1,000 reviews. Over 60% of these reviews are 5-star reviews, demonstrating a high level of customer satisfaction.

Final Verdict: Which Tickmill Account Is Right for You?

Ultimately, the decision between the Tickmill Classic and Raw Account depends on how you approach the markets and what matters most to you as a trader. If you’re just starting out or prefer a simple, all-inclusive pricing model, the Classic Account provides a stress-free trading environment with no commissions and predictable costs. It’s especially suitable for traders who take a more measured approach, holding positions longer or trading less frequently.

On the other hand, the Raw Account is designed for traders who demand the tightest possible spreads and are comfortable with commission-based pricing. It’s the go-to choice for scalpers, day traders, and those using automated systems. Such traders need the lowest costs and fastest execution speeds. Regardless of the account type you choose, Tickmill delivers reliable technology, flexible trading conditions, and top-tier regulation.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.