Swap Free vs Standard Account - How Do They Differ?

Forex trading involves numerous account types tailored to suit various trading styles, religious beliefs, and financial goals. Two common types are the Standard Account and the Swap-Free Account (also known as an Islamic account). Understanding how these accounts differ is critical for traders, especially those adhering to Islamic religious beliefs. While both account types provide access to financial markets, they differ significantly in terms of structure and target audience.

In this article, we’ll explore what Standard and Swap-Free accounts are, how they differ, and how they function. We will also look at their benefits, drawbacks, and how they cater to different trading preferences and requirements.

What is a Swap-Free Account?

To understand what a swap-free account is, we need to grasp the basics of Islamic Finance principles. In standard forex and CFD trading, holding positions overnight usually involves swap fees, which are a form of interest charge. However, under Islamic finance principles, earning or paying interest (Riba) is prohibited. For this reason, traditional trading accounts are not suitable for Muslim traders, as they violate Shariah compliance.

A Swap-Free Account, also referred to as an Islamic Forex Account, is designed to comply with Islamic Sharia law. These accounts achieve this by completely eliminating overnight charges. Instead of swaps, some brokers may charge an administrative fee or adjust spreads slightly to compensate for the lack of swap charges. This completely depends on the broker’s internal policies. The eligibility for these accounts also depends on the broker’s policies and will be different across different brokerages.

Advantages of Swap-Free Accounts

- No Swap Fees - The primary advantage is the absence of overnight interest charges. This makes swap-free accounts compliant with Islamic finance principles and appealing to traders who hold positions for extended periods.

- Sharia Compliance - Swap-free accounts cater to Muslim traders who need to adhere to Islamic financial laws. This ensures they can participate in forex trading without violating their beliefs.

Disadvantages of Swap-Free Accounts

- Alternative Fees - To compensate for the lack of swap, brokers may introduce other charges such as wider spreads, administrative fees, or higher commissions. This could potentially make overall trading costs higher than a standard account, especially for short-term traders.

- Limited Availability - While many reputable brokers offer Swap Free accounts, the specific terms and availability might differ geographically or among brokers.

- Potential Restrictions - Certain brokers may limit the duration for which positions can be held swap-free or restrict specific instruments or trading strategies.

Who is the Swap Free Account Best Suited For? - Swap Free accounts are ideally suited for Muslim traders who need to comply with Sharia law and avoid interest-based transactions. Muslim traders are the main demographic for these types of accounts as they comply with Sharia law. However, these accounts are also preferred by Long-term traders who hold positions for extended periods and want to avoid swap fees, regardless of religious beliefs.

What is a Standard Account?

A Standard Forex Account is the most common account type offered by forex brokers. It is designed for traders of varying experience levels and typically includes swap fees for positions held overnight. The exact swap fee varies depending on the broker, the asset being traded, and the size of the trade. Most brokers publish their swap rates on their websites to promote transparency in trading.

These accounts are versatile and cater to a wide range of trading styles, from scalping to long-term position trading. They are the default choice for most traders unless specific requirements, such as religious considerations, necessitate an alternative account type.

Advantages of Standard Accounts

- Universal Availability - Standard Accounts are offered by virtually all forex brokers, with no special eligibility requirements.

- No Alternative Fees - The primary mechanism for overnight positions is the swap, without the need for alternative fees or markups to compensate for the absence of a swap.

- Tighter Spreads - These accounts often feature lower spreads compared to swap-free versions. However, some brokers like XM keep the trading conditions the same as with Standard accounts, including no markups on spreads and no additional fees.

Disadvantages of Standard Accounts

- Swap Fees - On Standard accounts, positions held overnight incur swap fees. These can accumulate significantly for long-term traders or in currency pairs with high interest rate differentials.

- Not Suitable for All Religious Beliefs - For traders adhering to Sharia law, the concept of earning or paying interest (riba) is prohibited, making standard accounts unsuitable.

Who is the Standard Account Best Suited For? - Standard accounts are generally best suited for all kinds of traders who do not have religious restrictions against earning or paying interest.

Key Differences Between Swap-Free and Standard Accounts

The key distinction between a Swap Free and a Standard account lies in how overnight positions are handled regarding interest charges. Standard accounts charge swap fees (overnight interest) on positions held past the daily rollover. Swap Free accounts, by definition, do not. This makes Swap Free accounts compliant with Islamic Sharia law, whereas Standard accounts are not.

However, remember that some brokers may charge alternative fees in place of swap charges. Some brokers may feature wider spreads, administration fees, or commissions to compensate for the absence of swap. On the Standard account, these alternative charges are absent.

Where Can You Find Brokers Offering Swap-Free and Standard Accounts?

Many leading forex brokers offer both Standard and Swap Free (Islamic) accounts to accommodate the diverse needs of their clientele. It's crucial to check each broker's specific terms and conditions for their Swap Free accounts, as they can vary significantly. Here are a few examples of well-regarded brokers that typically offer both Standard and Swap Free options:

Exness

Exness is one of the top forex and CFD brokers that provides both Standard and Swap-Free (Islamic) accounts. This broker features five different trading accounts, which include the standard, the standard cent, the pro, the raw spread, and the zero accounts. The broker provides swap-free versions of each of these trading accounts.

The spreads that traders pay depend on the account they choose. The standard account offers spreads from as low as 0.2 pips for major currency pairs. In contrast, the standard cent account offers spreads from 0.3 pips for major currency pairs. Meanwhile, the pro account has a spread from as low as 0.1 pips. These three accounts do not charge commissions.

On the other hand, the zero account has spreads from 0.0 pips on the top 30 instruments, plus a commission starting from $0.05 per side per lot. Finally, the Raw Spread account features a spread from 0.0 pips plus a commission of up to $3.5 per side per lot. As mentioned, there is a swap-free version for each of Exness’ five accounts. However, just like with other brokers on this list, eligibility depends on the country of the trader. Traders can check which countries Exness supports for automatic swap-free accounts.

Interestingly, Exness also offers in non-Islamic countries swap-free trading for certain assets (such as gold, indices, cryptocurrencies and some forex pairs). This applies if you do not trade mostly during trading hours and regularly hold large amounts of orders open overnight.

On the Exness broker site, traders have access to a variety of market products. These include CFDs on forex, metals, cryptocurrencies, energies, stocks, and indices. To trade these markets, traders can use MetaTrader 4, MetaTrader 5, and Exness Terminal.

Further, Exness stands out as a well-regulated broker. It holds regulatory licenses from several financial organisations. These include the JSC in Jordan, the FCA in the UK, the CySEC in Cyprus, and the FSCA in South Africa, among others.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Pepperstone

Pepperstone is another top global broker that offers both standard and swap-free accounts. On the standard account, this broker offers spreads from as low as 1.0 pips for major currency pairs with no commission charged. Positively, the broker keeps the trading conditions the same on its Islamic account. However, the Pepperstone Islamic account charges an admin fee to positions held for 5 days or above. The admin charge is $100 per standard lot.

The standard account allows traders to access more than 1,400 different market products. These include CFDs on forex, shares, ETFs, indices, cryptocurrencies, commodities, and currency indices. In contrast, the Pepperstone Islamic account only offers CFDs on forex and metals. Additionally, this account does not offer access to exotic currency pairs. Eligibility for a Pepperstone Islamic account depends on the country of the trader. Residing in a country other than the ones that Pepperstone supports may make you ineligible for an Islamic account.

On a positive note, this broker supports several advanced trading platforms. These include MetaTrader 4, MetaTrader 5, TradingView, cTrader, and its own Pepperstone Trading Platform. Importantly, Pepperstone also offers a Razor account with spreads from 0.0 pips plus a commission that depends on the trading platform a trader uses. Please note that once you open a Pepperstone Swap-free Account, you will not be able to trade on a standard or a razor account.

In terms of regulations, Pepperstone does not disappoint. The broker operates under the supervision of the DFSA in Dubai’s DIFC, the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, and the BaFin in Germany, among others.

75.3% of retail CFD accounts lose money

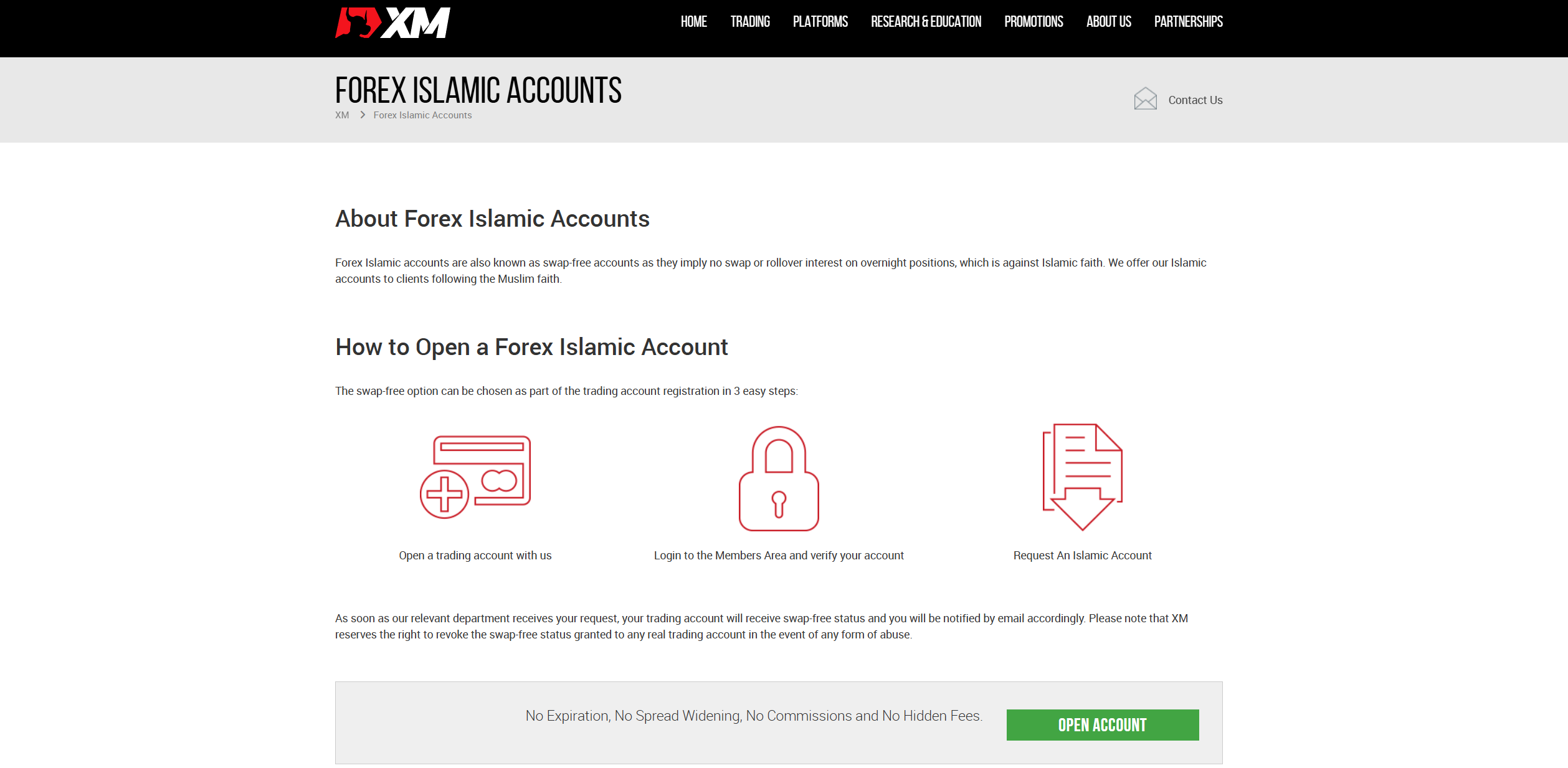

XM

XM is a globally recognized forex and CFD broker that offers both Standard and Swap-Free (Islamic) accounts to accommodate the trading needs of diverse clients. At a glance, the features of the account include no interest/swap charges on overnight positions, no spread widening, and positions that can be held with no time limit.

Unlike most brokers who substitute swap fees by widening the spread on Islamic accounts, XM does not do that and does not impose any additional charges.

The Islamic account on XM offers spreads as low as 0.8 pips for major currency pairs with no commission charged. This is the same as the XM Ultra Low accounts. In comparison, the standard account has spreads from as low as 1.6 pips for major currency pairs with no commission charged.

Traders on XM can access a wide variety of products. These include CFDs on forex, stocks, indices, shares, energies, cryptocurrencies, and precious metals. Additionally, clients enjoy a great line-up of trading platforms to choose from. These include MetaTrader 4, MetaTrader 5, and the XM trading app.

Finally, XM is a regulated broker, which helps with its reputation in the market. This company is regulated by the CySEC, the ASIC, and the FSC. Such regulations make XM stand out as one of the best brokers with a swap-free and standard account.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

FP Markets

FP Markets has two main accounts on its broker site, which include the standard and the raw account. The broker offers a swap-free (Islamic accounts) version of both of these accounts. The standard account offers spreads from as low as 1.0 pips with no commission charged. In contrast, the raw account has spreads from 0.0 pips plus a commission of $3 per side per lot.

In contrast, the Standard Islamic account features spreads from as low as 1.0 pips with no extra commission. In contrast, the Raw Islamic account offers spreads from 0.0 pips with a commission of $3 per 100,000 traded. The Islamic accounts on FP Markets are available exclusively on MetaTrader 4 and MetaTrader 5.

Importantly, FP Markets charges an administrative fee when trading on an Islamic account. The specific fee varies depending on the asset a client is trading. For a few select instruments, there is a grace period of 5 nights where traders can hold positions overnight with no admin fee charged. The information on the exact instruments is readily available on FP Markets’ website.

FP Markets supports a deep collection of over 10,000 different instruments. These include CFDs on forex, indices, metals, commodities, stocks, bonds, and ETFs. Finally, FP Markets is under the supervision of the CySEC, the ASIC, and the FSCA, among others.

72.44% of retail CFD accounts lose money

Closing Remarks

Choosing between a Swap-Free and a Standard account ultimately comes down to your personal trading needs, religious beliefs, and strategy preferences. Swap-Free accounts are ideal for Muslim traders who must comply with Sharia law. They are also ideal for long-term traders who want to hold positions for extended periods while avoiding the accumulation of overnight interest charges. However, these accounts may come with trade-offs such as wider spreads, administrative fees, or limited asset access, depending on the broker.

Standard accounts, on the other hand, are suitable for the vast majority of traders, offering tight spreads, broad market access, and straightforward fee structures. They remain the default choice for those without specific religious restrictions. Fortunately, there are several reputable brokers that offer both account types, giving traders the flexibility to choose what best aligns with their goals. When selecting a broker and account type, always review the broker’s terms carefully.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.