Pepperstone Razor vs Standard: Account Comparison

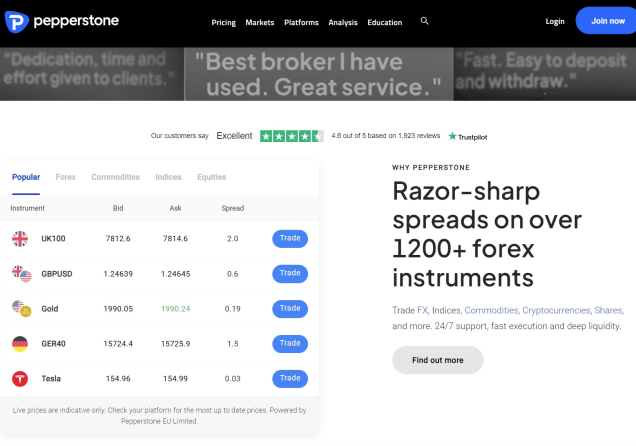

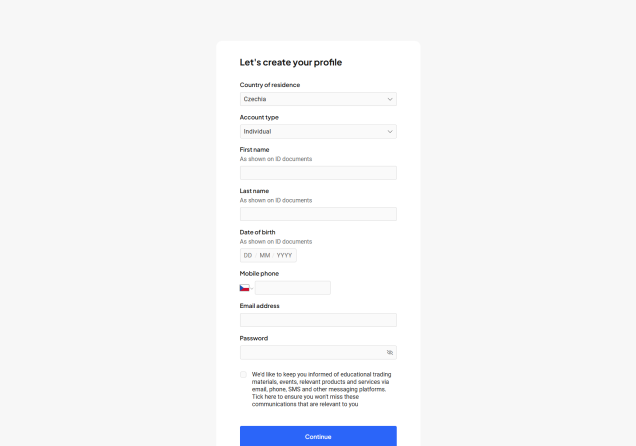

Pepperstone has established itself as a leading online broker, known for its competitive pricing, fast execution, and a wide range of trading instruments. A crucial decision for any trader choosing Pepperstone is selecting the right account type. Pepperstone offers two primary account options, the Razor Account and the Standard Account. While both provide access to the same extensive range of markets, they cater to different trading styles and preferences.

In this article we’ll compare the Pepperstone Razor account with the Pepperstone Standard account. We will detail the differences in spreads, commissions, and overall suitability for various trading styles.So here is the Pepperstone Razor vs Standard account comparison.

Pepperstone Razor Account

The Pepperstone Razor Account is designed to offer more control over trading costs for active traders, including scalpers, high-frequency traders, and those who use algorithmic trading strategies. It provides raw spreads, allowing traders to potentially minimise their trading costs. Below are the key features of the Pepperstone Razor account.

Key Features and Benefits

- Raw Spreads: The standout feature of the Razor Account is access to raw spreads, often starting from 0.0 pips on major currency pairs during highly liquid market conditions. This means Pepperstone adds no markup to the spreads. This setup allows for institutional-grade pricing, making it ideal for scalpers, day traders, high-frequency traders, and those using automated strategies.

- Commission-Based: To compensate for the raw spreads, Pepperstone charges a commission per trade. Commissions on the Pepperstone Razor Account are charged separately from the spread and vary slightly depending on the trading platform used: cTrader charges $6 USD per round-trip per standard lot, while both MetaTrader, MetaTrader 5, TradingView, and the Pepperstone Trading Platform charge $7 USD per round-trip per standard lot.

- Suitable for Experienced Traders: This account is generally preferred by experienced traders who understand the dynamics of raw spreads and are comfortable with the commission structure. It is ideal for those who prioritise minimising spreads and are willing to pay a commission to achieve that.

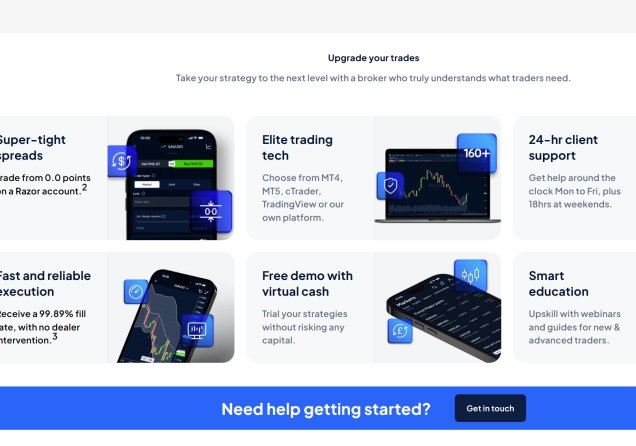

- Platforms and Tools: The Razor Account is available on multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Pepperstone Trading Platform, and TradingView. These platforms offer advanced charting tools, technical indicators, and automated trading capabilities. Pepperstone also provides additional tools to enhance the trading experience.

- Execution Speed: Pepperstone is known for its fast execution speeds, which are crucial for traders using the Razor account. Pepperstone’s average execution speed varies between under 30 milliseconds and around 60 milliseconds, depending on the server location tied to the Pepperstone entity managing your account.

- Deep Liquidity: Pepperstone provides access to deep liquidity pools, ensuring that traders can execute large orders with minimal slippage.

Who is the Razor Account Suitable For?

Scalpers: Traders who seek to capitalise on small price movements over very short timeframes. With spreads as low as 0.0 pips and rapid execution speeds, the Razor Account provides scalpers with the tight pricing and fast fills they need to maximise efficiency.

High-Frequency Traders (HFTs): Individuals or institutions who place dozens or even hundreds of trades per day benefit from the Razor Account's raw spreads and low-latency infrastructure. The minimal spread cost is crucial for maintaining profitability at high volumes.

Algorithmic Traders: Those who use automated trading strategies, such as Expert Advisors (EAs) on MetaTrader or custom trading bots on cTrader, require stable, low-cost execution. The Razor Account supports seamless algorithmic trading with fast execution and no dealing desk intervention.

Professional and Institutional Traders: Experienced traders managing larger portfolios or trading for clients benefit from institutional-grade pricing. With access to deep liquidity and advanced trading platforms, the Razor Account meets the demands of professionals looking for optimal market conditions.

75.3% of retail CFD accounts lose money

Pepperstone Standard Account

The Pepperstone Standard Account offers a more straightforward approach to pricing. It has no separate commission charges (it is commission-free). Instead, Pepperstone's compensation is included in the spread. This makes it a simpler and more transparent option, particularly for newer and casual traders.

Key Features and Benefits

- Spread-Based: The Standard Account offers slightly wider spreads than those on the Razor Account. These spreads include Pepperstone's markup, with no other hidden charges. For major currency pairs, spreads typically start from around 1.0 pips.

- Commission-Free: The primary advantage of the Standard Account is its simplicity. Traders know the cost of a trade upfront, as it's all included in the spread. There are no separate commission calculations to worry about.

- Suitable for New Traders: This account is well-suited for new traders who may find the commission structure of the Razor Account more complex. It provides a more predictable and straightforward cost structure.

- Platforms and Tools: Like the Razor Account, the Standard Account is available on MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, Pepperstone Trading Platform, and TradingView, providing access to a wide range of trading tools and features.

- Simplicity: The all-inclusive spread makes it easy to calculate the cost of a trade.

Who is the Standard Account Suitable For?

New Traders: For trading newcomers, the Standard Account offers a straightforward pricing model with no commission charges. All trading costs are built into the spread, making it easier to understand and calculate potential profits and losses.

Casual Traders: For those who trade infrequently or as a part-time activity, the Standard Account provides a hassle-free trading experience. With competitive all-inclusive spreads, you won’t need to factor in separate commission costs for each trade.

Swing Traders: Traders who hold positions for several days or even weeks tend to place fewer trades over longer timeframes. In this case, the slightly wider spreads are not a significant concern, making the Standard Account a suitable and cost-effective option.

This account type is also great for traders who prioritise ease of use over ultra-tight spreads, while still benefiting from Pepperstone’s fast execution, top-tier platforms, and wide range of instruments.

75.3% of retail CFD accounts lose money

Factors to Consider When Choosing Account Type

When choosing between Pepperstone's Razor and Standard accounts, several key factors should be considered. Spreads are a primary difference. The Razor Account offers raw spreads that are generally lower, particularly during high-liquidity periods. In contrast, the Standard Account features wider spreads that include the broker’s markup.

In terms of commission, the Razor Account charges a separate fee per trade, which can increase overall costs for frequent traders. On the other hand, the Standard Account has no commission, making it more straightforward.

Lastly, trading volume plays a role; high-volume traders often benefit from the Razor Account’s tighter spreads despite the commission, while low-volume or casual traders may prefer the simplicity and predictability of the Standard Account’s pricing model.

Trading Platforms and Tools on Pepperstone

Both the Razor and Standard accounts offer access to a range of powerful trading platforms to cater to different trader preferences and strategies.

MetaTrader 4 (MT4) is one of the most popular trading platforms globally. It’s known for its user-friendly interface, making it a great choice for traders of all experience levels. MT4 also provides a variety of charting tools and supports automated trading through Expert Advisors (EAs), allowing traders to automate their strategies and manage trades efficiently.

MetaTrader 5 (MT5) is the successor to MT4 and offers several advanced features to enhance trading. It provides more order types and additional timeframes, which give traders greater flexibility in executing their strategies. MT5 also comes with an integrated economic calendar, helping traders stay informed about important financial events and make more data-driven decisions.

cTrader is another powerful platform that Pepperstone offers. It’s especially favoured by experienced traders due to its advanced order types and depth of market display. The depth-of-market feature provides deeper insight into market conditions. With fast execution speeds, cTrader is designed to meet the needs of high-frequency traders and those looking for a seamless trading experience.

Further, TradingView is a platform that stands out for its excellent charting capabilities and interactive features. Traders can take advantage of social networking features, allowing them to share ideas and collaborate with other traders. TradingView also integrates well with other platforms, making it a versatile option for traders who value collaboration and in-depth chart analysis.

The in-house built Pepperstone Trading Platform offers a variety of charting tools and analytical features for in-depth market insights, along with technical indicators and built-in risk management tools to support well-informed trading decisions. Traders can easily switch between charts using the Quick Switch function and public watchlists for new trading ideas.

Traders can choose the platform that best suits their trading style and preferences, regardless of the account type.

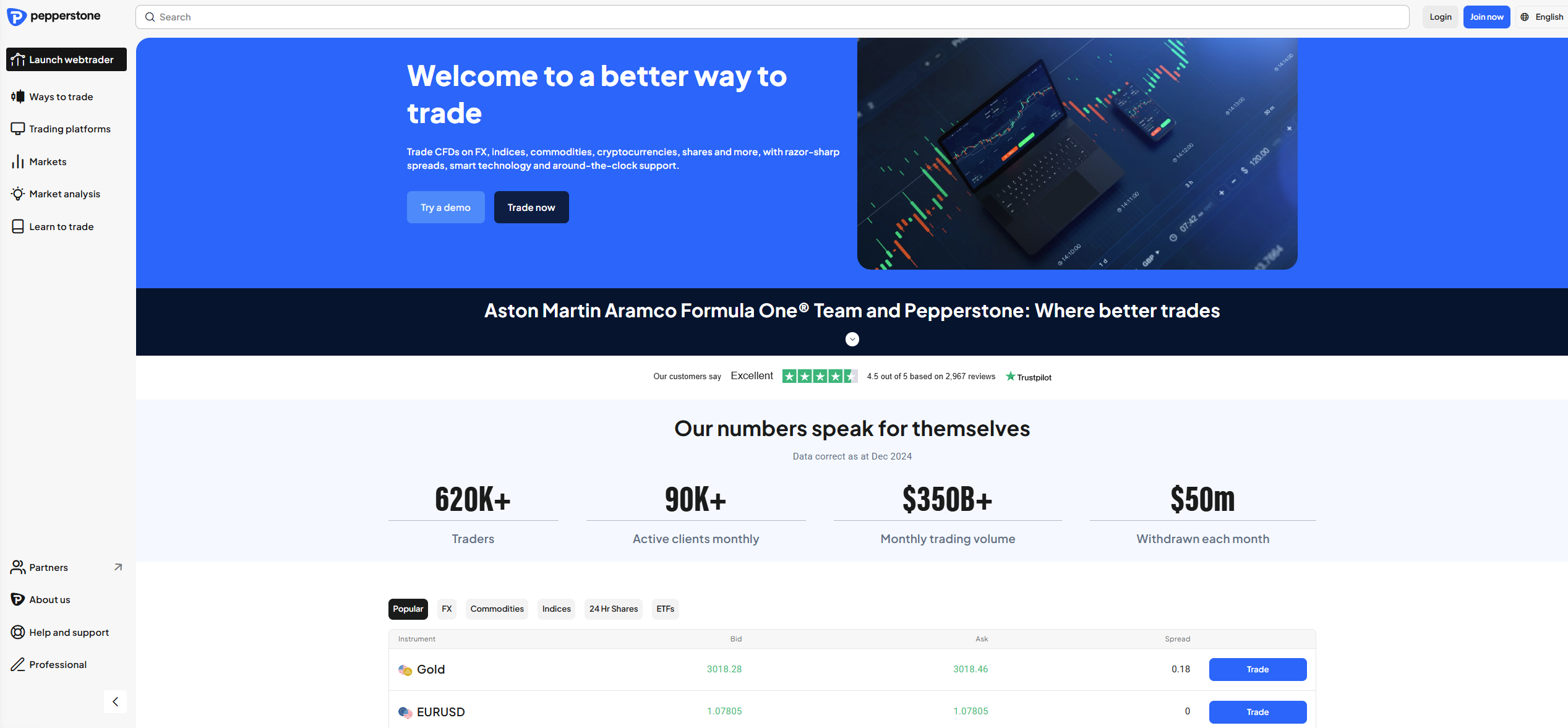

Instruments available on Pepperstone

Pepperstone gives traders access to an extensive selection of over 1,200 CFDs trading instruments across various global markets. This broker delivers diverse opportunities with tight spreads and fast execution, all without a dealing desk intervention. Here's a closer look at the instruments you can trade on Pepperstone.

- Forex Currency Pairs: Pepperstone allows investors to trade over 90 pairs, including major pairs like EUR/USD, minor pairs such as CAD/JPY, and exotic options like EUR/TRY.

- Commodities: On the Pepperstone broker site, traders can take positions on popular commodities including gold, silver, crude oil, and natural gas for portfolio diversification.

- Global Indices: Pepperstone offers access to major indices from around the world, such as the Nasdaq 100 (US Tech 100), US Wall Street 30, US 2000, and Canada 60.

- Shares: Here, people can trade CFDs on leading company stocks from the US, UK, Australia, and Germany, all with competitive pricing and deep liquidity.

- ETFs: Pepperstone clients can invest in a broad range of Exchange-Traded Funds via CFDs from key markets across Asia-Pacific, North America, Africa, and various emerging economies.

- Cryptocurrencies: Further, traders can explore the cryptocurrency space with 21 different crypto CFDs, covering major coins and trending altcoins.

With this wide variety of instruments, Pepperstone empowers traders to diversify their strategies and seize opportunities across major global financial markets.

Pepperstone's Reputation and Regulation

Pepperstone is a globally recognised forex and CFD broker regulated by multiple top-tier financial authorities, ensuring a high level of trust and client protection. The broker holds licenses from the ASIC, the FCA in the UK, the CySEC in Cyprus, and the DFSA in Dubai. Additionally, Pepperstone is regulated by the BaFin in Germany, the SCB, and the CMA in Kenya. This multi-jurisdictional regulatory framework not only enforces strict compliance standards but also reinforces Pepperstone’s commitment to transparency, client fund security, and fair trading practices.

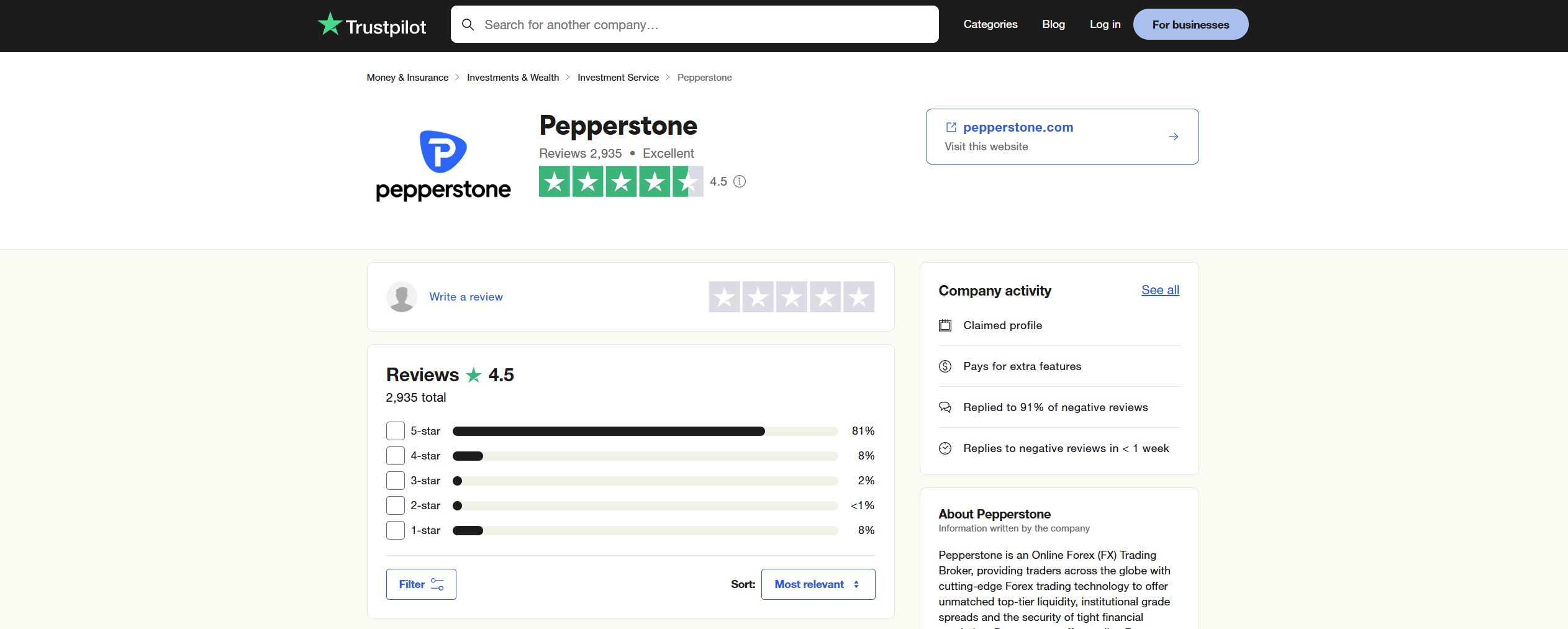

Moreover, Pepperstone has a large customer base from around the world. The broker serves over 750,000 traders from over 170 different countries. The ability to attract such a large, diverse group of traders speaks volumes to the broker’s quality of service. Furthermore, the broker has received great reviews online. It enjoys an overall rating of 4.5 stars out of 5 on Trustpilot after over 2,900 reviews, which is impressive.

Final Verdict: Razor vs Standard Account

Choosing between the Pepperstone Razor and Standard accounts ultimately comes down to your trading style, experience level, and cost preferences. The Razor Account is ideal for active, professional, and algorithmic traders who prioritise ultra-tight spreads and are comfortable paying a separate commission. Its raw pricing model, fast execution, and support for advanced trading platforms make it well-suited for scalping and high-frequency strategies.

On the other hand, the Standard Account is a better fit for new traders and casual traders who prefer a simpler, all-inclusive pricing model. With no separate commission and competitive spreads, it offers a more straightforward trading experience, particularly for those who trade less frequently or hold positions over longer periods.

Regardless of which account you choose, both options provide access to Pepperstone’s award-winning trading infrastructure, top-tier platforms, and strong regulatory oversight. This ensures that traders of all types can enjoy a secure, reliable, and high-performance trading environment with one of the most trusted brokers in the industry.

75.3% of retail CFD accounts lose money

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.