Pepperstone Leverage : An In-Depth Guide

Leverage is a crucial feature in forex and CFD trading. It allows traders to open larger positions with a relatively small amount of capital. Pepperstone, a globally recognised online broker, offers competitive leverage across a variety of trading instruments. The leverage level on this broker site changes depending on the market product and the region a client is trading in. However, understanding how leverage works at Pepperstone, the associated risks, and the regulatory framework is essential before taking full advantage of it.

This guide provides an in-depth analysis of Pepperstone’s leverage offering, including how it varies by region, asset class, and trader profile. Having a clear understanding of how to use Pepperstone’s leverage is crucial for traders to make informed decisions about how they trade with the broker.

What Is Leverage in Trading?

Leverage in forex trading is a tool that allows traders to control a larger position size with a relatively small amount of capital (margin). It’s expressed as a ratio, such as 1:100. While leverage magnifies profits, it also amplifies losses, making risk management crucial.

Pepperstone, a globally recognised online broker, offers varying levels of leverage depending on several factors. These include:

- Regulatory Variations - Different regulatory bodies impose varying restrictions on the maximum leverage brokers can offer to retail clients. Different regulators implement leverage caps on different assets to protect traders from excessive risk. As a global broker operating in various jurisdictions, Pepperstone has to comply with the different leverage levels set by different regulators.

- Asset-Specific Leverage - The level of leverage offered by Pepperstone also varies depending on the asset class being traded. Major currency pairs (e.g., EUR/USD, GBP/USD) typically have higher maximum leverage compared to more volatile or less liquid assets like indices, commodities, or cryptocurrencies.

- Professional Client Status - Pepperstone offers higher leverage to professional traders on its platform, as one of the perks. Becoming a professional trader on Pepperstone is a self-certification process that involves completing a short quiz to demonstrate that you meet the eligibility criteria. You will need to self-certify that you meet at least two of the following three criteria:

1. You have experience in trading leveraged trading (financial derivative or OTC) products.

2. Your cash deposits and trading portfolio exceed $500,000.

3. You have professional experience working in the financial services sector.

With these various factors in mind, let’s take a look at the leverage offering on Pepperstone.

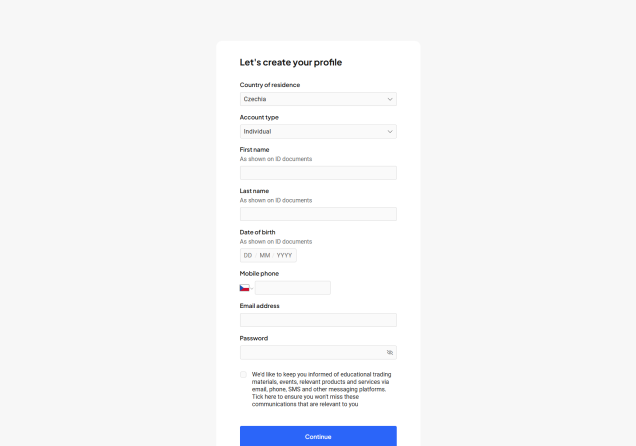

Interesting fact: When you visit Pepperstone’s official website, you’ll be automatically redirected to the most suitable entity based on your location. If not, a message saying "We’re licensed in another region which may be better suited for you, based on your location" will appear at the top, offering to redirect you to the appropriate regulated entity with the correct leverage limits.

75.3% of retail CFD accounts lose money

Pepperstone Leverage by Region/Regulation

Cyprus/Europe (CySEC)

Pepperstone EU Limited is regulated by the CySEC in Cyprus with the license number 388/20. While it operates from 195, Makarios III Avenue, Neocleous House, 3030, Limassol, Cyprus, the CySEC license allows it to operate in the greater European Economic Area (EEA). The CySEC restricts maximum leverage levels to 1:30 for retail traders. Here is the breakdown per asset class:

| Asset Class | Maximum Leverage |

| Forex |

|

| |

| Indices |

|

| |

| Commodities |

|

| |

| Equities |

|

| Cryptocurrencies |

|

Professional clients can access higher leverage through this branch of up to 1:500.

Australia (ASIC)

Pepperstone Group Limited is regulated by the ASIC in Australia with the license number with the ACN number ACN 147 055 703. It has a physical address in this country at Level 16, Tower One, 727 Collins Street, Melbourne VIC 3008, Australia. Under ASIC regulation, leverage is limited for retail clients to a maximum of 1:30. Here is a breakdown of the various leverage levels per asset class:

| Asset Class | Maximum Leverage |

| Forex |

|

| |

| Indices |

|

| |

| Commodities |

|

| |

| Equities |

|

| Cryptocurrencies |

|

Notably, professional clients can access leverage of up to 1:500.

UK (FCA)

Pepperstone Limited operates from 70 Gracechurch St, London EC3V 0XL, United Kingdom and is regulated by the FCA with the registration number 684312. Similar to the ASIC’s regulations, the FCA restricts the maximum leverage to 1:30 for retail traders. As such, the same leverage levels per asset class for UK clients are similar to those of traders in Australia. Here is a reminder:

| Asset Class | Maximum Leverage |

| Forex |

|

| |

| Indices |

|

| |

| Commodities |

|

| |

| Equities |

|

| Cryptocurrencies |

|

Just like in Australia, professional clients in the UK can access leverage of up to 1:500.

Kenya (CMA)

Pepperstone Markets Kenya Limited is regulated by the Capital Markets Authority (CMA) of Kenya under license number 128. It operates locally with a registered office at 2nd Floor, The Oval, Ring Road Parklands, PO Box 2905-00606, Nairobi. The CMA is Kenya’s chief financial markets regulator, and its framework seeks to promote investor protection. The maximum leverage in this jurisdiction is more flexible than in stricter jurisdictions like the UK or the EU. However, it still promotes responsible trading by limiting the maximum leverage to 1:400.

| Asset Class | Maximum Leverage |

| Forex |

|

| Indices |

|

| |

| Shares |

|

| Metals and Oil |

|

| |

| Energies |

|

| Commodities |

|

The maximum leverage for professional traders on the Kenyan branch of Pepperstone is also 1:400.

Dubai (DFSA)

Pepperstone operates in Dubai under the regulatory oversight of the DFSA with the license number F004356, which governs financial activities within the Dubai International Financial Centre (DIFC). The company operates from Al Fattan Currency House, Tower 2, Level 15 - Office 1502A, DIFC Dubai, United Arab Emirates.

The DFSA imposes strict leverage limits to protect retail traders while allowing more flexibility for professional clients. Under DFSA regulation, Pepperstone offers leverage of up to 1:30 for retail clients. Here’s a breakdown of the leverage offered by Pepperstone under the DFSA:

| Asset Class | Maximum Leverage |

| Forex |

|

| Cryptocurrencies |

|

For other asset classes, traders can check the leverage details on their trading platforms. Professional traders in Dubai have access to much higher leverage, up to 1:500.

Germany (BaFin)

Pepperstone GmbH operates within Germany and is subject to the regulatory oversight of the Bundesanstalt für Finanzdienstleistungsaufsicht (BaFin) under the register number 151148. The broker has a physical office in Germany at Neubrückstr. 1, 40213 Düsseldorf, Germany.

As Germany is within the European Economic Area (EEA), the leverage restrictions applicable to European clients, as outlined by ESMA, also apply to retail clients in this country. The maximum leverage available to traders in this country is 1:30, and here is a breakdown for the various asset classes:

| Asset Class | Maximum Leverage |

| Forex |

|

| |

| Indices |

|

| |

| Commodities |

|

| |

| Equities |

|

| Cryptocurrencies |

|

Similar to the UK, Europe, under the CySEC, Australia, and Dubai, Pepperstone professional traders also have access to a higher leverage of 1:500.

Bahamas (SCB)

Pepperstone Markets Limited is licensed and regulated by the Securities Commission of the Bahamas (SCB) under license number SIA-F217. Their registered office is located at #1 Pineapple House, Old Fort Bay, Nassau, New Providence, The Bahamas. The SCB offers more flexible leverage limits compared to stricter jurisdictions like the EU or UK, while still maintaining oversight to protect traders.

This entity is ideal for international traders who are not covered by the other regional branches. Retail traders under the SCB-regulated entity can access leverage of up to 1:200, depending on the instrument being traded. Here’s a breakdown of the maximum leverage offered under SCB regulation:

| Asset Class | Maximum Leverage |

| Forex |

|

| Indices |

|

| Currency Indices |

|

| Commodities |

|

| Shares |

|

| Cryptocurrencies |

|

For professional clients, the Bahamas office of Pepperstone offers leverage as high as 1:500, similar to some other Pepperstone entities catering to professionals.

Pepperstone Spreads and Commissions

Alongside the leverage, the trading fees that a broker offers are a crucial consideration for traders. On Pepperstone, there are two trading accounts with distinct fee structures. The Standard account offers spreads from as low as 1.0 pips for major currency pairs, with no commission charged. On the other hand, the Razor account features raw spreads that start from 0.0 pips plus a commission that depends on the trading platform a trader uses.

The commission on MetaTrader 4 and MetaTrader sits at $3.50, €2.60, £2.25, or CHF 3.30 per side per lot, depending on the account currency. TradingView and Pepperstone Trading Platform users also pay a commission of $3.5 per side per lot. Meanwhile, cTrader charges traders a commission of $3.0 per side per lot. The commission for TradingView, cTrader, and Pepperstone Trading platform accounts in currencies other than USD is converted to the account currency at the spot exchange rate.

Pepperstone also charges swap fees for holding positions overnight. The swap rate depends on the market product and the size of the trade. Traders can confirm the actual swap rates on the broker’s website or contact customer support for the exact numbers.

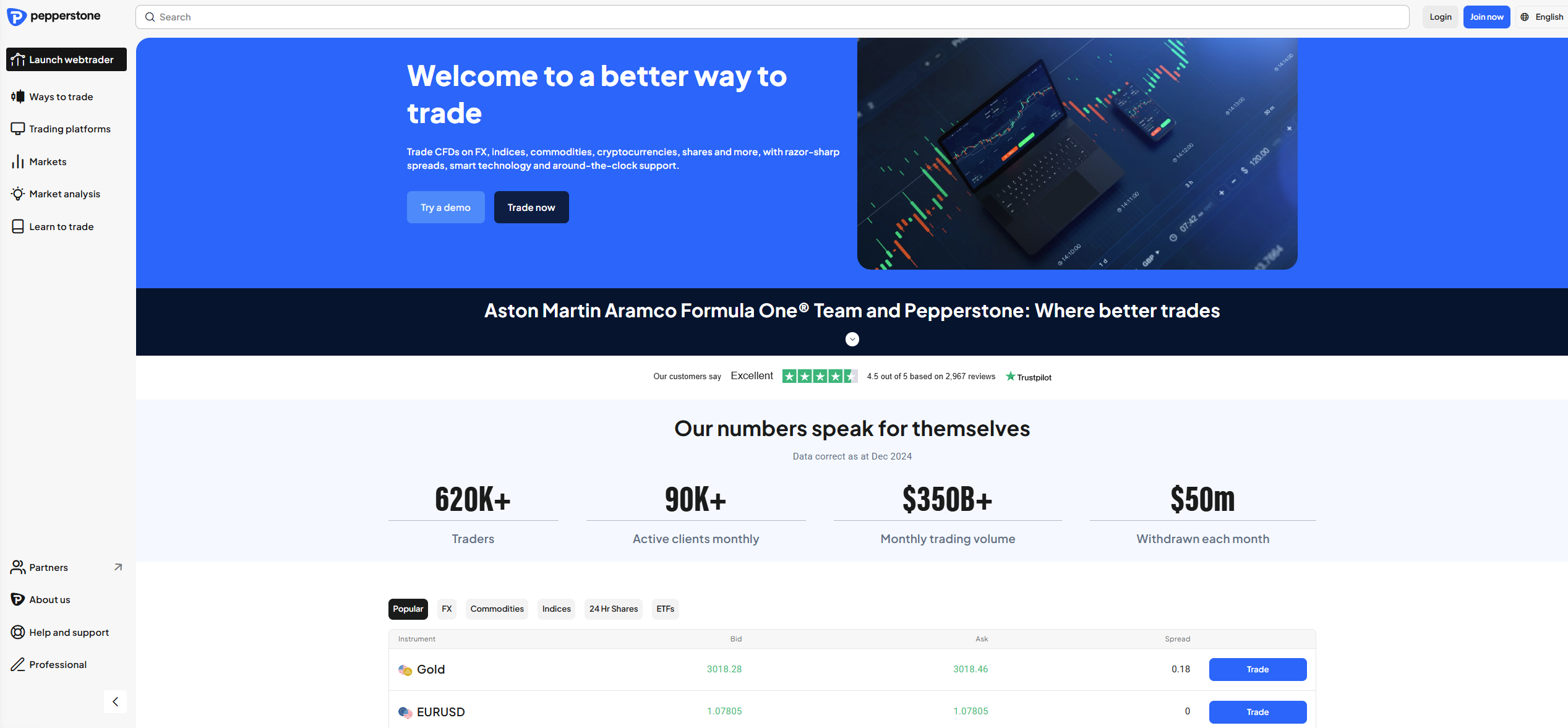

Pepperstone’s Credibility

For peace of mind in trading, it is highly advisable to choose brokers that operate under strict regulatory oversight. Regulated brokers are held to high standards by financial authorities, ensuring fair and transparent trading practices. Pepperstone is a prime example of such a broker, boasting licenses from several top-tier regulatory bodies.

The broker is regulated by the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, the BaFin in Germany, the CMA in Kenya, and the DFSA in Dubai, among others, as detailed above. This extensive compliance demonstrates Pepperstone’s dedication to transparency and ethical business conduct.

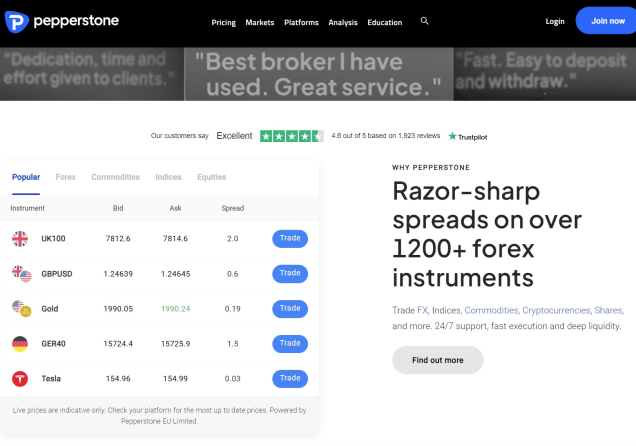

Beyond regulation, Pepperstone enjoys a strong reputation within the trading community. On Trustpilot, the broker enjoys a rating of 4.4 out of 5 stars, based on feedback from over 2,900 users. The combination of robust regulation and high client satisfaction positions Pepperstone as a popular choice for many traders.

Closing Remarks

Leverage is a powerful tool in forex and CFD trading, enabling traders to amplify their positions with relatively small amounts of capital. However, it comes with significant risks, making it essential to understand how leverage works.

Pepperstone offers competitive leverage levels that differ depending on the trader’s location, asset class, and client status (retail vs. professional). While some jurisdictions adhere to stricter leverage caps of 1:30 for retail clients, other regions offer more flexible options. Professional traders, on the other hand, can access higher leverage levels in most regions.

Beyond leverage, Pepperstone stands out as a credible broker with multiple top-tier licenses, tight spreads, and transparent fee structures. Its strong reputation among traders further reinforces its reliability. Remember, leverage is a double-edged sword that can amplify gains, but it can also magnify losses. Therefore, responsible use of leverage with solid risk management strategies is essential.

75.3% of retail CFD accounts lose money

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.