Pepperstone Islamic Account Review

One of the hallmarks of top-tier brokers is the ability to accommodate a diverse range of traders. Pepperstone is a globally recognised forex and CFD broker known for its competitive trading conditions, advanced platforms, and strong regulatory compliance.

Among its diverse client base are Muslim traders who seek to trade in accordance with Islamic financial principles. To cater to this demographic, Pepperstone offers an Islamic account, also known as a swap-free account. In this review, we will explore the features, the pros, and the cons of the Pepperstone Islamic account.

Understanding Islamic Trading Accounts

As a reminder, Islamic finance prohibits charging or paying interest (riba). In traditional trading, holding positions overnight incurs swap fees, which are essentially interest charges. Leaving positions open overnight on these accounts by Muslim traders would lead to a compromise on their religious beliefs.

Islamic accounts eliminate these swap fees, allowing Muslim traders to participate in the markets without violating their religious beliefs. Pepperstone’s Islamic accounts are designed to provide this swap-free feature while maintaining competitive trading conditions. Let's see how Pepperstone achieves this.

75.3% of retail CFD accounts lose money

Pepperstone Islamic Account

Pepperstone's Islamic account mirrors the features of its Standard account, excluding swap fees. This account features market-standard spreads with no commission charged. As an example, the EURUSD currency pair has an average spread of 1.1 pips.

While there is no commission, there is an admin fee charged to positions held for 5 days and above. The admin charge is $100 per standard lot for forex and metals. CFDs on forex and metals are the only financial instruments available to trade. Additionally, this account does not grant access to exotic currency pairs.

While Pepperstone does not have a minimum deposit requirement on other accounts, the Islamic account requires traders to deposit at least $200 or equivalent in other currencies. There are four account currencies supported by Pepperstone which include AUD, EUR, GBP, and USD.

This account supports various trading strategies including scalping, hedging, and even the use of AIs. However, it’s important to note that Pepperstone only offers Islamic accounts to traders from a select number of countries. Pepperstone offers swap-free accounts only to the following countries:

- Albania

- Bangladesh

- Burkina Faso

- Bahrain

- Brunei

- Brunei Darussalam

- Algeria

- Egypt

- Indonesia

- Jordan

- Kyrgyzstan

- Kuwait

- Morocco

- Mauritania

- Maldives

- Malaysia

- Niger

- Oman

- Pakistan

- Qatar

- Sierra Leona

- Turkey

- Uzbekistan

- Kosovo

Residing in a country other than the one listed above may make you ineligible for an Islamic account. In such cases, you can contact Pepperstone's customer support to check if a swap-free account is available.

Alternatively, consider other top-tier brokers that offer Islamic accounts in more countries. You can read the Exness Islamic account review and the XM Islamic account review to explore your options.

Pros of the Pepperstone Islamic Account

- Sharia Compliance - The primary advantage of Pepperstone’s Islamic account is its adherence to Islamic financial principles. This allows Muslim investors to trade without paying any overnight interest.

- Competitive Trading Conditions - Pepperstone is known for its tight spreads, fast execution speeds, and low trading costs, even on its Islamic account. This account features an average spread of 1.0 pips to 1.2 pips on the EURUSD pair which is similar to that of the standard account.

- Advanced Trading Platforms - Pepperstone provides access to industry-leading platforms like MT4, MT5, TradingView, and cTrader. These are equipped with powerful tools for analysis, automation, and execution.

- Transparent Pricing - Pepperstone reveals all the fees involved when trading on this account. This means that traders know exactly what they will be paying, upfront.

Cons of the Pepperstone Islamic Account

- Country Restrictions - The Islamic account is not universally available. Traders from certain countries may be ineligible.

- Asset Limitations - While Pepperstone offers swap-free trading, it is only available for CFDs on forex and metals.

- Administrative Fees - Positions held beyond 5 days incur administrative fees, which some traders may find disadvantageous.

Pepperstone’s Credibility

While Pepperstone caters to Muslim traders by offering an Islamic account to trade with, it is important to assess its credibility before investing. To check the credibility of a broker, people usually consider two things. These include the Regulation of the broker and the reviews of traders who have used the broker.

On regulations, Pepperstone excels well. It has regulations from the FCA in the UK, the DFSA in Dubai, the CySEC in Cyprus, the ASIC in Australia, and the BaFin in Germany, among others. Remember that regulations alone are never enough. However, regulations from multiple well-regarded organisations are a good sign for a broker.

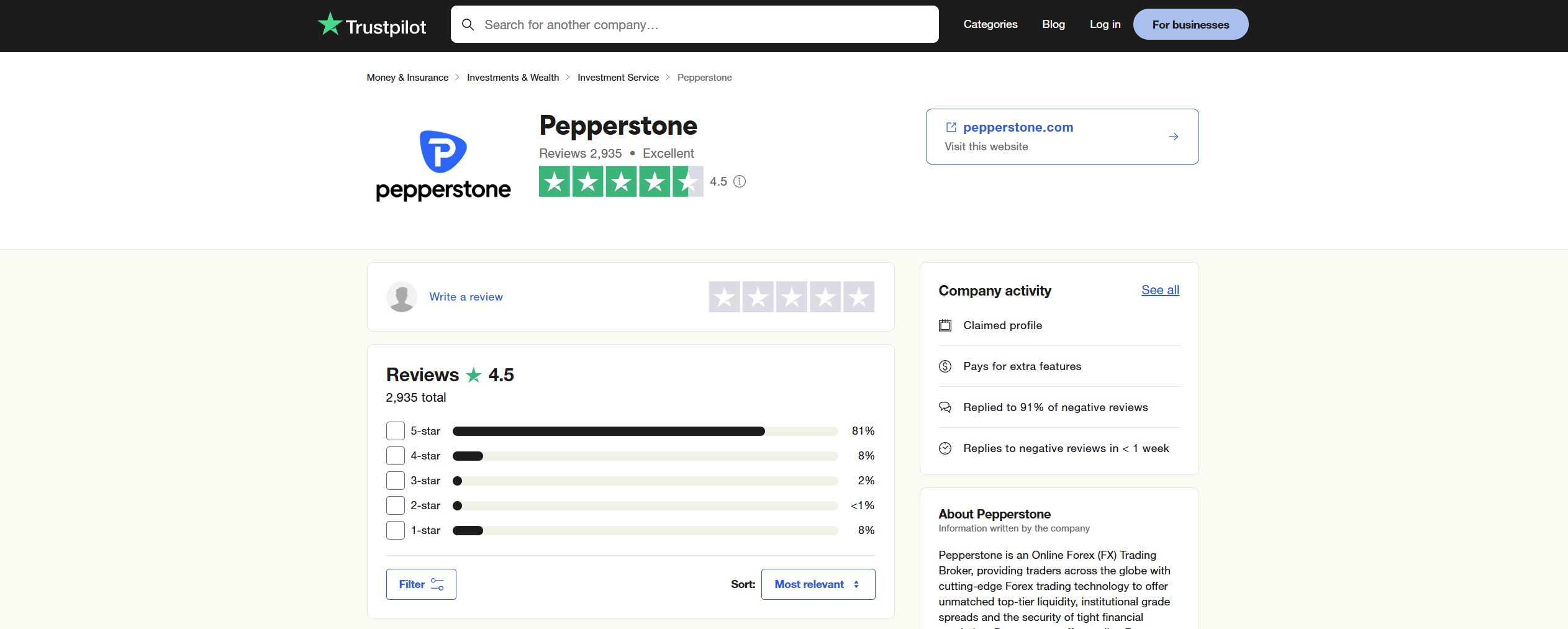

On another note, Pepperstone enjoys great reviews online from its customers. It boasts a solid 4.5 star rating out of 5 stars on Trustpilot after 2,900 different reviews. This reflects a general satisfaction with the services that Pepperstone offers. Moreover, this broker has received many awards over the years, including TradingView Broker of the Year 2022 by TradingView.

How to Open a Pepperstone Swap-free Account

To open a Pepperstone Islamic account, follow these steps:

- Registration - Visit the Pepperstone website and sign up for a live trading account by providing the necessary personal information.Account Verification - Submit the required identification documents to verify your identity and residency. This includes two valid government-issued ID documents and two proof of address documents.

- Islamic Account Request - Once the account is verified, contact Pepperstone’s customer support to request an Islamic account. You may need to provide more documents that Pepperstone may deem necessary in this process.

- Approval and Activation - Pepperstone will review your request and, upon approval, convert your account into an Islamic trading account. This process typically takes 24-48 hours. It may take longer depending on each individual situation.

- Deposit Funds - Fund your account using the available payment methods, such as bank transfers, credit/debit cards, or e-wallets like PayRedeem, Neteller, and Skrill. The minimum deposit requirement is $200 for a Pepperstone Swap-free account.

Please note that once you open a Pepperstone Swap-free Account, you will not be able to trade on a standard or a razor account.

75.3% of retail CFD accounts lose money

Final Verdict

The Pepperstone Islamic Account is an excellent option for Muslim traders who want to participate in the financial markets while adhering to Sharia law. With its competitive spreads, advanced trading platforms, and regulatory oversight, Pepperstone offers a well-structured solution for Muslim traders.

However, the account does come with certain limitations. For starters, this swap-free account is only available in a select few countries. On top of that, traders can only trade instruments from two global markets on this account.

Other accounts on Pepperstone offer significantly more trading instruments. Overall, Pepperstone’s Islamic account strikes a balance between religious compliance and modern trading efficiency. For those eligible and willing to meet the requirements, the Pepperstone Islamic Account is a solid option for swap-free trading.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.