Pepperstone Gold Trading - Spreads, Leverage & Trading Hours

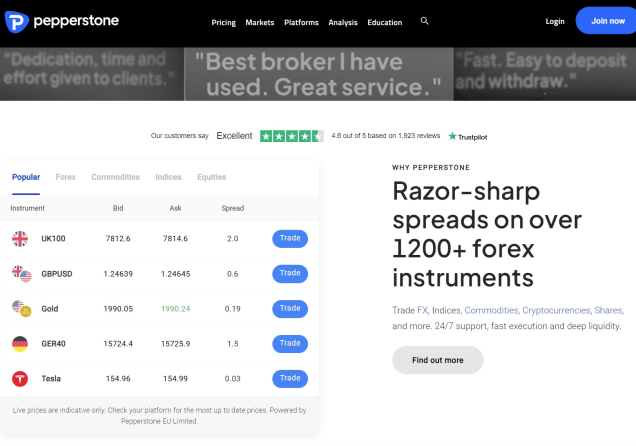

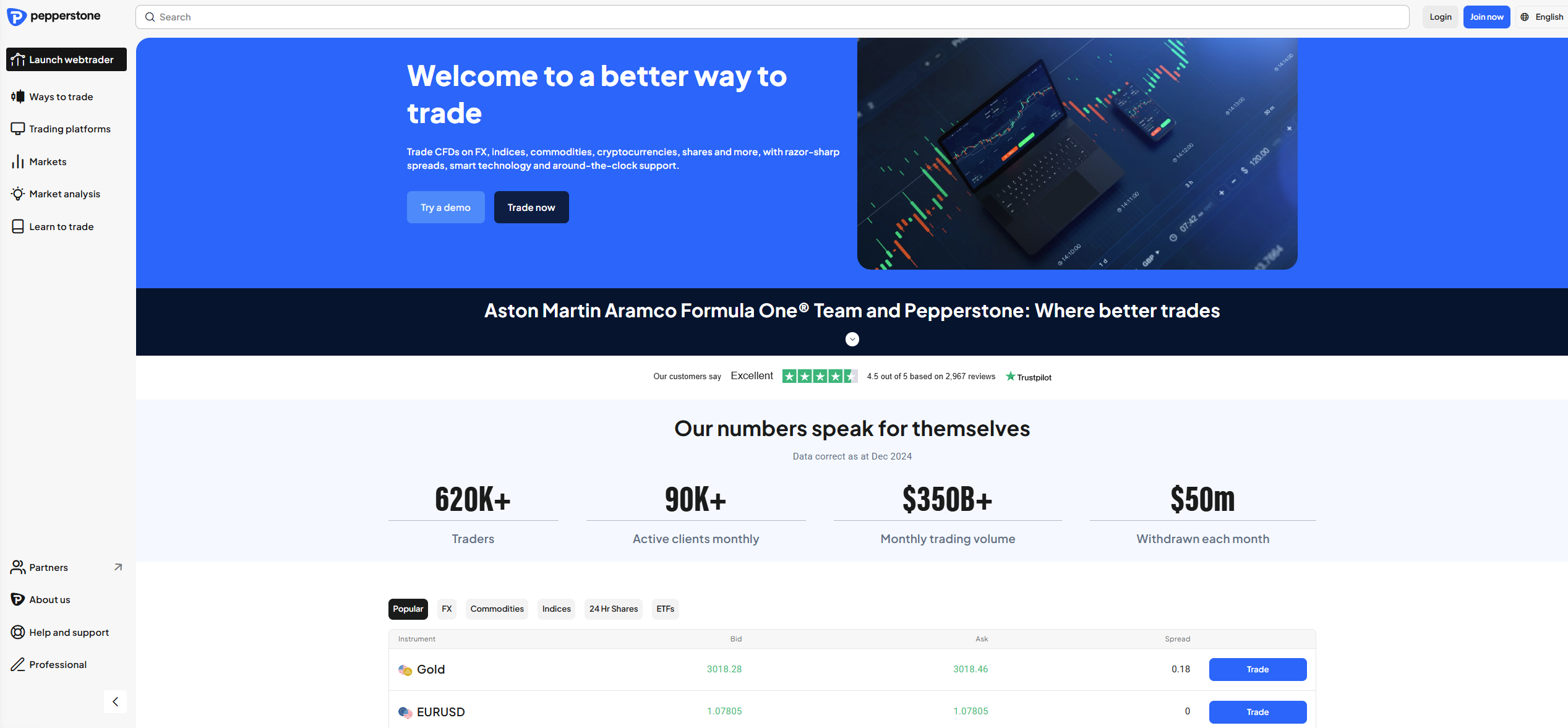

Gold (XAUUSD) is a highly valued asset in global financial markets, prized for its safe-haven status and exceptional liquidity. As a global CFD and forex broker, Pepperstone provides a competitive and professional-grade environment for trading gold. It offers institutional-grade spreads, rapid execution, and access to advanced trading platforms. As such, Pepperstone is a top choice to consider for traders focusing on XAUUSD.

However, understanding Pepperstone’s trading conditions for XAUUSD is essential for maximising trading efficiency. In this guide, we’ll explore Pepperstone’s Gold (XAUUSD) trading, including spreads, commissions, leverage, and trading hours. By the end, you’ll have a clear understanding of how to trade gold effectively on Pepperstone.

Gold Spreads on Pepperstone

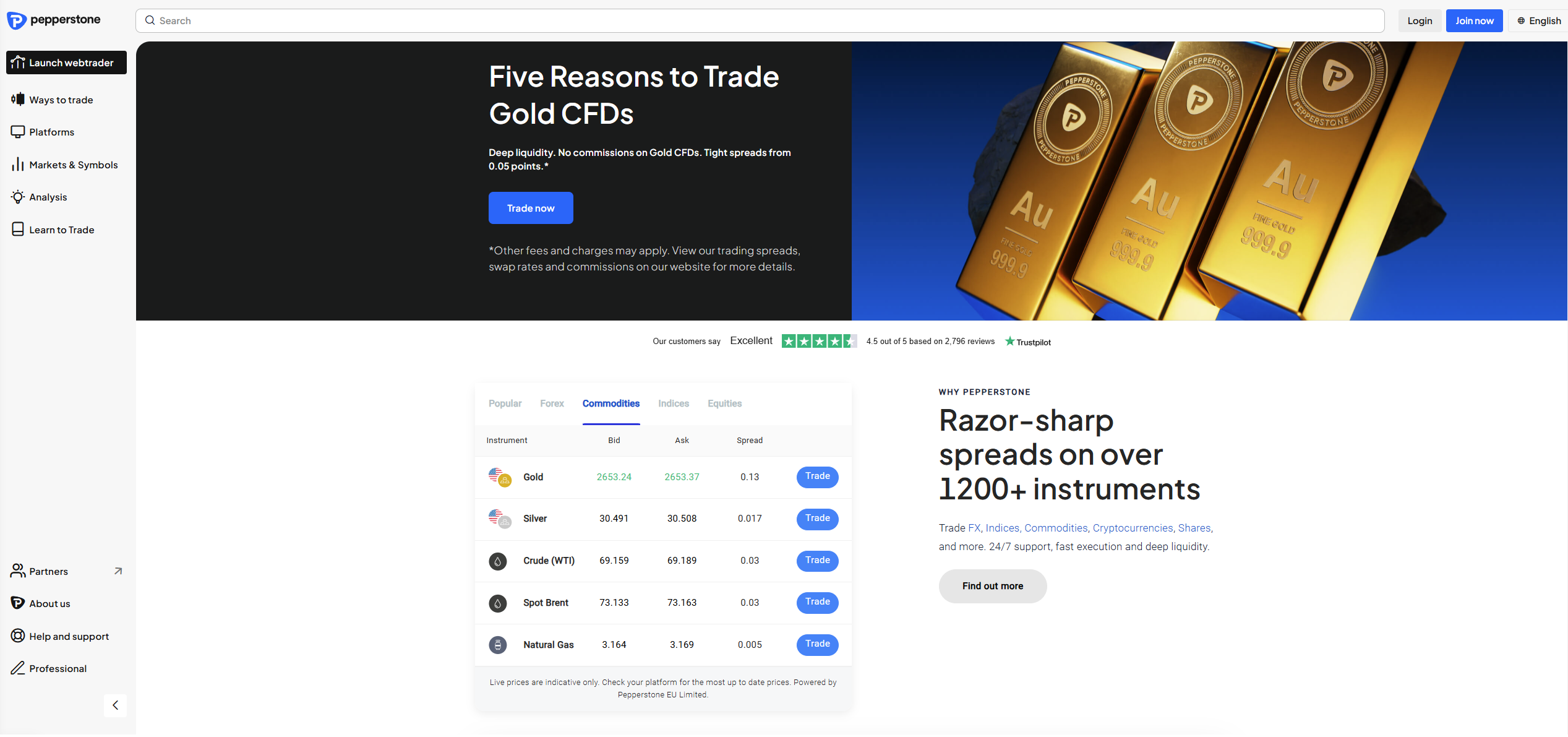

Pepperstone provides gold trading through CFDs, meaning traders speculate on price movements without owning the physical asset. While XAUUSD (Gold against the US Dollar) is the most popular pair, Pepperstone also offers gold trading against other major currencies. These include the British Pound (XAUGBP), Euro (XAUEUR), Australian Dollar (XAUAUD), Swiss Franc (XAUCHF), and Japanese Yen (XAUJPY).

Traders can access gold CFDs through MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, TradingView, and Pepperstone Trading Platform. These platforms offer advanced charting tools, automated trading capabilities, and user-friendly interfaces. They are available across a variety of devices, including PCs, Tablets, and Mobile Phones. They are also available as web platforms.

75.3% of retail CFD accounts lose money

Gold Trading Spreads on Pepperstone

Spreads are a crucial factor in gold trading, as they directly impact trading costs. Pepperstone offers tight spreads on XAUUSD across its two accounts, which include the Standard and the Razor accounts. When gold is traded against the USD (XAUUSD), it features a minimum spread of $0.05 and an average spread of $0.18 on both accounts.

Spreads are subject to change. Check your platform for the most up to date data.

Spreads are subject to change. Check your platform for the most up to date data.

Notably, the broker does not charge commissions on gold positions. Additionally, all commodity CFDs on Pepperstone are spot markets with no expiry and no rollover charges. However, please note that other charges may apply when trading.

Further, it's crucial to remember that these spreads are floating and can widen during periods of low liquidity, high volatility, or significant news events. Pepperstone typically publishes average historical spreads. Always check the live spreads on your trading platform for the latest figures on spreads.

Leverage for Gold (XAUUSD) on Pepperstone

Pepperstone provides flexible leverage for XAUUSD, allowing traders to amplify their exposure. The maximum leverage available can vary based on the specific Pepperstone entity a client is registered under, due to differing regulatory requirements. Here is a breakdown of the maximum leverage for different regions:

| Country/Region | Maximum Leverage for Gold |

|---|---|

| Cyprus / European Economic Area | 1:20 |

| Australia | 1:20 |

| UK | 1:20 |

| Kenya | 1:400 |

| Germany | 1:20 |

| Bahamas (International Clients) | 1:50 |

Please note that professional clients on Pepperstone may have access to higher leverage levels depending on their location. Additionally, it is crucial for traders to understand that while leverage can amplify profits, it also equally magnifies losses. As such, it should be used cautiously.

Gold XAUUSD Trading Hours on Pepperstone

Understanding the trading hours for XAUUSD is vital for effective trade planning and risk management. The gold market generally operates almost 24 hours a day, five days a week, with some minor breaks. On Pepperstone, the standard trading hours for XAUUSD (and other gold pairs) are typically from Monday morning to Friday evening, with a short daily break. Below is a look at the general trading hours for XAUUSD on Pepperstone:

Trading Hours: Gold (XAUUSD) trading is available virtually 24 hours a day, five days a week, from Monday at 1:01 AM to Friday at 23:55 PM. There are short daily breaks in gold trading between 11:59 PM and 1:01 AM.

Server Time: Pepperstone’s server time is set to GMT+2 when the US is not under daylight saving and GMT +3 while the US daylight saving is in place.

Weekend Closures: Trading for XAUUSD is closed over the weekend. The gold market typically closes on Friday at 23:55 and reopens on Monday at 1:01 AM.

The best time to trade gold largely depends on a trader’s risk tolerance and chosen strategy, given the distinct characteristics of each trading session. For XAUUSD, peak trading activity typically occurs during the overlap between the London and New York sessions, from 3:00 PM to 7:00 PM GMT+2. This window is favoured by most gold traders due to the surge in market liquidity, which results in tighter spreads and more efficient trade execution.

Pepperstone Trading Platforms

Pepperstone provides a comprehensive suite of trading platforms, catering to various trading styles and preferences. Traders can access XAUUSD and other instruments through MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Pepperstone Trading Platform.

MetaTrader 4 (MT4) remains the most widely used trading platform in the industry. It is renowned for its intuitive interface, powerful charting capabilities, and strong support for automated trading via Expert Advisors (EAs). Its familiarity makes it a preferred choice among seasoned forex and spread betting traders.

MetaTrader 5 (MT5), the successor to MT4, builds on its predecessor with expanded features. This includes more timeframes, additional analytical tools, and access to a wider range of markets. MT5 also boasts an improved user interface, faster processing, an integrated economic calendar, and a Depth of Market tool.

cTrader, developed by Spotware, stands out with its sleek, user-friendly design and advanced charting capabilities. Traders benefit from in-depth trade analysis, educational resources, and lightning-fast execution speeds, making it a preferred platform for scalpers and experienced traders alike.

Pepperstone also integrates with TradingView, a highly popular charting platform. This is a widely used charting platform valued for its advanced analysis tools, intuitive interface, and social trading features. This integration allows Pepperstone clients to execute orders directly from TradingView charts using their Pepperstone account.

Finally, Pepperstone provides its proprietary trading platform, the Pepperstone Trading Platform. This platform includes multiple charting options, in-depth market analysis tools, technical indicators, and built-in risk management features to support informed trading decisions.

The Credibility of Pepperstone

The credibility of a broker is paramount to consider when considering them for your trading activities. Fortunately, Pepperstone operates under the regulation of several reputable financial authorities globally. In particular, Pepperstone is supervised and authorised by the FCA in the UK, the CySEC in Cyprus, the DFSA in the DIFC (Dubai), the CMA in Kenya, and the BaFin in Germany, among others. This multi-jurisdictional oversight ensures client fund safety and adherence to strict financial standards.

Moreover, Pepperstone has garnered a positive reputation among online reviewers and is recognised as a major player in the gold and CFD brokerage industry. On Trustpilot, the broker has a rating of 4.4 out of 5 stars, after over 3,000 reviews. Many users highlight the fast deposit and withdrawal processes. This further highlights the broker’s reliability and client satisfaction.

Final Comments

Pepperstone provides a comprehensive and competitive platform for gold (XAUUSD) trading. It offers a blend of tight spreads, deep liquidity, and fast execution on various advanced trading platforms. Its strong regulatory framework further enhances its appeal as a reliable broker.

By understanding the spreads, leverage structures, and market hours available through Pepperstone, traders can time their entries and manage risk more effectively. As always, disciplined risk management is key to long-term success in trading gold and other financial instruments.

75.3% of retail CFD accounts lose money

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.