How to Trade Gold (XAUUSD) on MT5

Gold (XAUUSD) is one of the most popular assets among traders in the world. Thanks to its safe-haven appeal, gold continues to attract traders who want to hedge against inflation, economic uncertainty, and currency fluctuations.

To trade gold effectively, many turn to the MetaTrader 5 (MT5) platform, a powerful and versatile trading platform that offers advanced tools for analysis and execution. As a result, trading gold (XAUUSD) on MT5 has become increasingly popular among both novice and experienced traders seeking a reliable and feature-rich platform.

In this article, we’ll explore how to trade gold (XAUUSD) on MT5, including how to set up your account, analyse the market, place orders, and manage risk. Whether you're just getting started or looking to refine your approach, this article will provide the basic knowledge needed to navigate the XAUUSD market confidently.

Why Trade Gold (XAUUSD)?

Gold is one of the oldest and most valued assets in the financial world. Its value is influenced by global economic events, central bank policies, interest rates, inflation levels, and the strength of the US Dollar. XAUUSD represents the price of gold quoted in US dollars, and it's one of the most traded commodity pairs in the forex market. Trading gold can offer both short-term opportunities through intraday price movements and long-term hedging benefits against currency devaluation and market volatility.

XAUUSD trading on MT5 allows for the use of advanced trading tools like Expert Advisors (EAs), custom indicators, and technical analysis. This makes it a powerful option for traders looking to diversify their portfolio with a high-liquidity asset.

How to Set Up MT5 to Trade Gold

To start trading gold on MT5, the following steps are vital.

1. Select a reliable broker that offers access to XAUUSD

Needless to say, the broker has to offer MT5 as a trading platform. Prioritise a broker that is well-regulated, offers low spreads on gold, and provides fast execution. Fortunately, there are several well-regarded gold brokers that offer low spreads on gold (XAUUSD).

2. Register and Fund Your Account

Once you've registered, deposit funds into your account using any of the supported payment methods. This is, of course, if you wish to trade with real funds. If not, open a practice demo account.

3. Verify Your Identity (KYC)

Before you can start trading, regulated brokers will require you to verify your identity. This usually involves uploading a government-issued ID (like a passport or national ID card) and proof of residence (such as a recent utility bill or bank statement dated within the last 3 months).

4. Download and Install MT5

Download and install the MT5 platform on your desktop or mobile device. This is a very compressed look at the process of setting up a real account on MetaTrader 5. However, this is a very straightforward process that most traders can follow intuitively.

5. Add XAUUSD to Your Market Watch

On the MT5 platform, open the "Market Watch" window and search for “XAUUSD.” If it’s not visible, right-click on the Market Watch window and select “Symbols.” Navigate to the Metals category and enable XAUUSD. Once added, you can right-click on XAUUSD and select “Chart Window” to open a live gold chart.

6. Open a Gold Chart

Once XAUUSD is visible in the Market Watch window, right-click on it and select “Chart Window” to open a live price chart. This will display the current market movements of the gold pair (XAUUSD) on MetaTrader 5. MT5 offers a comprehensive suite of built-in technical analysis tools you can use to study price action and identify trade setups. These include:

- Moving Averages (SMA, EMA): These indicators smooth out price data over time and show you the general trend. Are gold prices trending up, down, or sideways? Moving averages give you the answer. They can also act as dynamic support and resistance, signalling when a price might bounce or reverse.

- Relative Strength Index (RSI): The RSI tells you if gold is overbought or oversold. An overbought reading means gold may have climbed too fast and could drop. An oversold reading suggests it may rebound soon. It’s perfect for spotting possible turning points in the market.

- MACD (Moving Average Convergence Divergence): MACD helps confirm trend strength and momentum shifts. It’s a go-to tool for identifying when a trend is picking up or slowing down. It often provides early warnings of reversals.

- Bollinger Bands: These measure how volatile the market is. When the bands squeeze together, it might mean a breakout is coming. When they widen, it shows the market is more active. Bollinger Bands are great for finding those breakout moments when gold may move sharply.

By using these tools on MT5, you can better understand gold’s price behaviour, improve your trading strategy, and make smarter decisions

6. Place a Trade on XAUUSD in MT5

You’re now ready to begin analysing and trading the XAUUSD pair. To place a trade on XAUUSD in MT5, begin by opening the XAUUSD chart on your platform. Conduct your market analysis to determine whether you want to buy or sell. Once ready, right-click on the chart, go to “Trading,” and select “New Order.” In the order window, enter your desired lot size, remember that 1 lot of gold equals 100 ounces, so adjust accordingly.

Next, set your Stop Loss and Take Profit levels in line with your risk management strategy. Choose “Market Execution” if you want the order to execute immediately, or select “Pending Order” if you plan to enter the trade at a specific price level. Then, click either “Buy” or “Sell” depending on your outlook.

After your trade is live, you can monitor and manage it from the “Terminal” window, where you’ll be able to adjust orders, set alerts, or close the position manually.

Factors That Influence XAUUSD Price Behaviour

Before placing trades, it’s important to understand what drives gold prices. The primary factors influencing XAUUSD include:

- US Dollar Strength - Since gold is commonly priced in USD for the XAUUSD pair, movements in the dollar often influence gold prices. A weaker dollar usually leads to higher gold prices, while a stronger dollar tends to push them lower. This relationship is especially relevant when trading XAUUSD, though other variations like XAUEUR also exist, where gold is quoted against different currencies.

- Interest Rates - When major economies like the US, China, and Australia raise their interest rates, other investments such as bonds become more appealing. This can draw investors away from gold, potentially lowering its demand and price.

- Inflation - Gold is widely viewed as a hedge against inflation. During periods of high inflation, investors often turn to gold to protect their purchasing power. This demand leads to higher prices.

- Central Bank Policies - Decisions by central banks to buy or sell gold reserves can significantly affect the price.

- Geopolitical Events - Periods of global instability, including wars, political turmoil, or economic sanctions, tend to increase uncertainty. This drives up demand for gold, as it's considered a safe haven during such times.

- Supply and Demand - Like any commodity, gold's price is subject to the forces of supply and demand. Fluctuations in mining output, purchases by central banks, and industrial use can all impact its value.

Keeping an eye on economic calendars, news headlines, and macroeconomic trends can help you anticipate major price moves in XAUUSD.

Risk Management for XAUUSD Traders

Gold is a volatile asset, which makes risk management essential. Here are key tips to protect your capital:

- Use a stop-loss on every trade. A stop-loss order automatically closes your trade if the market moves against you by a set amount, preventing large losses.

- Keep your risk per trade between 1 and 2% of your total account balance. This ensures that even if you encounter a losing streak, your losses remain small and manageable, preventing your account from being wiped out.

- Use leverage responsibly. While MT5 brokers often offer high leverage, avoid using full leverage to reduce risk exposure.

- Diversify your trades. Don’t risk your entire account on one XAUUSD position. Consider spreading your risk across multiple gold trades or exploring other instruments available on MT5..

- Backtest and forward test your strategy before going live. Use MT5's built-in strategy tester to backtest your plan on historical data, assessing its past performance. Follow this with forward testing using a demo account or small live trades. This process confirms your strategy's strength and builds confidence in its effectiveness under real-time market conditions.

Advantages of Trading XAUUSD on MT5

- Multi-Asset Capability: One of the main benefits of MT5 is its multi-asset capability. This means you're not limited to just gold. You can seamlessly trade XAUUSD alongside a diverse range of other financial instruments. This includes forex pairs, global indices, individual stocks, and even cryptocurrencies, all managed from a single trading account.

- Advanced Charting Tools: MT5 boasts a collection of advanced charting tools that are crucial for in-depth technical analysis. Traders get access to highly customisable charts, allowing them to tailor them to their specific analytical needs. MT5 offers a wide array of timeframes, from minute-by-minute (M1) for scalpers to monthly (MN) for long-term investors, giving traders granular control over their market analysis.

- Expert Advisors (EAs): For traders looking to automate their strategies, MT5's robust support for Expert Advisors (EAs) is a significant advantage. These powerful trading bots and algorithms can be programmed to execute trades automatically based on your predefined criteria. This allows for systematic and disciplined gold trading without the need for constant manual intervention.

- Depth of Market (DOM): The Depth of Market (DOM) feature provides real-time, transparent insights into market liquidity for XAUUSD. This essential tool displays the volume of buy and sell orders at different price levels, offering a clear view of market depth. Understanding the DOM can give you a significant edge by revealing potential short-term supply and demand zones.

- Strategy Tester: Finally, MT5's integrated strategy tester is an invaluable tool for any serious gold trader. It allows you to rigorously backtest your trading strategies on historical XAUUSD data. By simulating how your strategy would have performed under various past market conditions, you can accurately assess its viability, fine-tune its parameters for optimal performance, and gain confidence before applying it to live trading. This significantly reduces the inherent risks associated with implementing new strategies.

Top Gold Brokers on the MT5 Platform

The following is a brief example of reputable brokers that offer gold trading on the MT5 platform.

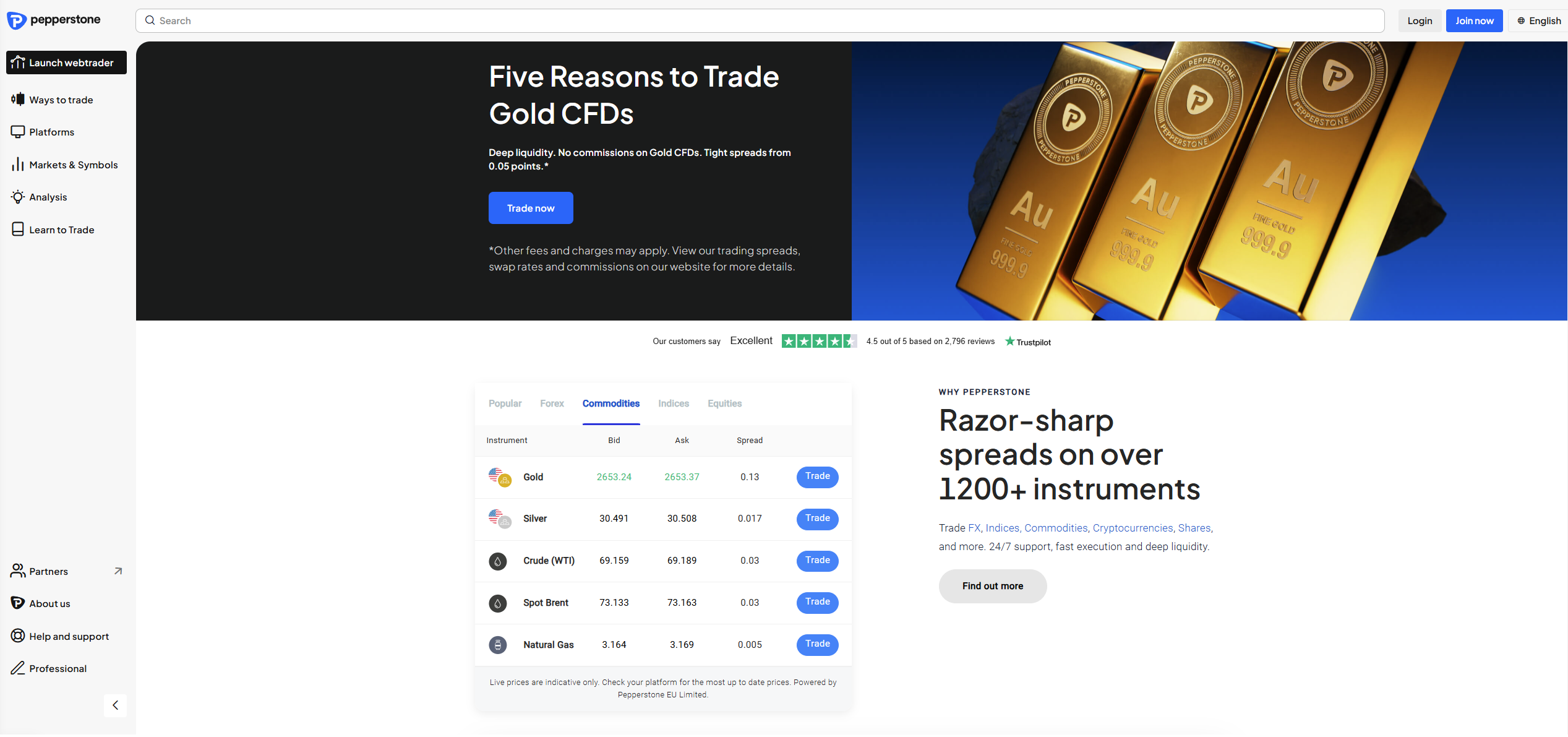

Pepperstone

Pepperstone supports gold CFD trading with institutional-grade conditions on multiple platforms, including MT5, MT4, cTrader, TradingView and Pepperstone’s proprietary mobile platform. The broker offers minimum spreads on XAUUSD starting from just $0.05, with average spreads around $0.19. These conditions apply to both Standard and Razor accounts.

Prices and spreads are subject to change. Check your platform for the most up to date data.

The minimum trade size is 0.01 lots (equivalent to 1 ounce of gold). Swap-free accounts are available for Islamic traders. Pepperstone also offers fast execution, deep liquidity, and a wide range of CFD markets including forex, indices, cryptocurrencies, and commodities. It is regulated by leading authorities such as ASIC, FCA, CySEC, DFSA, and CMA.

75.3% of retail CFD accounts lose money

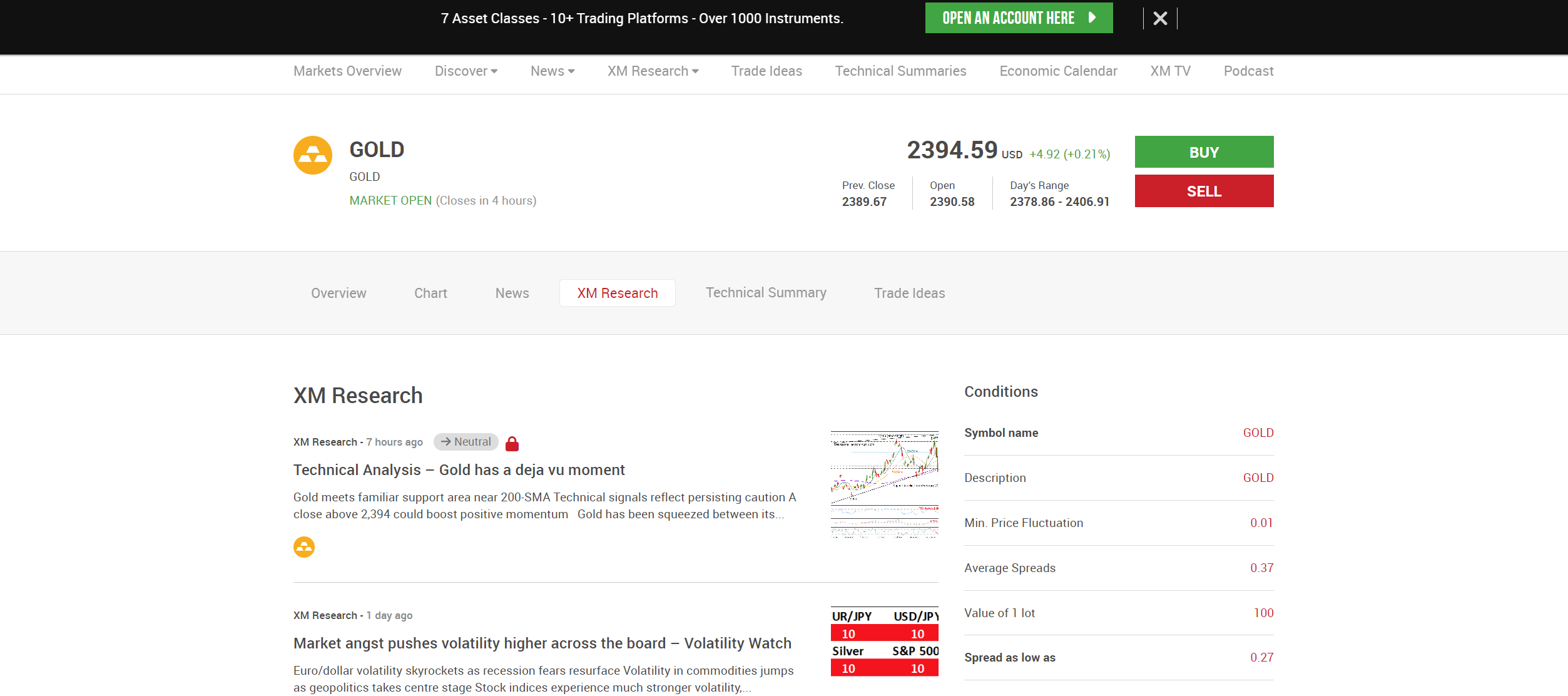

XM

XM offers gold CFD trading on both MT5 and MT4 platforms across desktop, web, and mobile, making it a flexible option for traders of all levels. With a minimum deposit of just $5, traders can access both standard and micro lot sizes. Spreads on XAUUSD start from $0.16 and average at $0.2 (so 1.6 and 2.0 pips) on the Ultra-Low account with no commission, while the Standard account features slightly wider spreads (typically $0.27 to $0.37).

Prices and spreads are subject to change. Check your platform for the most up to date data.

Gold trading is available 24/5, and XM also provides access to other CFD assets such as forex, stock indices, energies, and shares. The broker is licensed and regulated by ASIC, CySEC, and the FSC of Belize, and is known for its reliable execution, negative balance protection, and strong educational resources.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Exness

Exness is a top choice for gold CFD trading, offering tight spreads, flexible conditions, and swap-free gold trading by default across all account types. However, swap-free status may be revoked depending on trading activity. Gold (XAUUSD) is available on both MT4 and MT5 platforms, as well as through Exness Terminal (web-based), Exness Trade (mobile app), and the proprietary Exness WebTerminal.

Gold can be traded as a CFD against the USD on two standard and three professional account types. Spreads and commission fees vary depending on the account type, with more competitive conditions offered on the professional accounts. Trading is available 24/5 with a short daily break, and the minimum trade size is 0.01 lots. Exness supports market execution with ultra-fast order processing and deep liquidity.

The broker is regulated by multiple authorities, including the FCA (UK), FSCA (South Africa), CMA (Kenya), and offshore regulators such as the FSA (Seychelles) and FSC (Mauritius). Beyond gold, traders can access a broad range of assets, including forex, indices, stocks, cryptocurrencies, and energies.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Final Thoughts

Trading gold on MT5 offers a powerful combination of high liquidity, volatility, and technical clarity. Regardless of the trading approach you take, XAUUSD can be a valuable addition to your trading portfolio when approached with discipline and preparation. Luckily, MetaTrader 5 comes packed with a ton of trading tools that make analysing and trading the gold market seamless.

For the best gold trading experience, focus on building a solid foundation in both technical and fundamental analysis, follow a tested trading plan, and prioritise risk management. Make use of MT5’s robust features and continuously refine your skills through education and practice. Above all, ensure you trade with a regulated broker offering competitive spreads.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.