How to Paper Trade on TradingView

TradingView has emerged as a powerhouse for traders of all levels. It offers a comprehensive suite of charting tools, analysis features, and a vibrant community of traders who share trading ideas and analyses. Among its most valuable offerings is the paper trading feature, which allows users to practice trading strategies and hone their skills without risking real capital.

This makes it an invaluable tool for aspiring traders to learn the ropes and for experienced traders to test new strategies. In this comprehensive guide, we will explore how to paper trade on TradingView, walking through the process from setting up your paper trading account to analysing your performance.

What is Paper Trading?

TradingView Paper Trading is a built-in feature that allows users to practice trading in a risk-free environment using virtual funds. It is an ideal tool for all kinds of traders who want to refine their strategies without risking real money. This feature provides a realistic experience by mimicking actual market conditions, tracking orders, and monitoring profit and loss, just as in a live trading account.

The Paper Trading account provides a default virtual balance of $100,000, which can be reset anytime, enabling users to experiment with different trading approaches. One of the key advantages of TradingView Paper Trading is its accessibility across multiple asset classes, including forex, stocks, cryptocurrencies, indices, and commodities.

This flexibility allows traders to practice on different financial instruments and develop strategies tailored to specific markets. As such, TradingView Paper Trading is a valuable resource for building confidence and competence before transitioning to live trading. So how does one go about Paper Trading on TradingView? Let’s find out.

How to Paper Trade on TradingView

Setting Up Your Paper Trading Account

Before you start paper trading, you’ll need to set up your account. If you don’t have a TradingView account, you’ll need to create one to proceed with setting up your account. Here are a few steps to get that done:

1. Go to TradingView’s website and click on the Get Started button on the top right corner. From there, click on Sign Up and complete the registration process by providing accurate information about yourself.

2. Once your account is created, log in using the credentials you provided during the registration process.

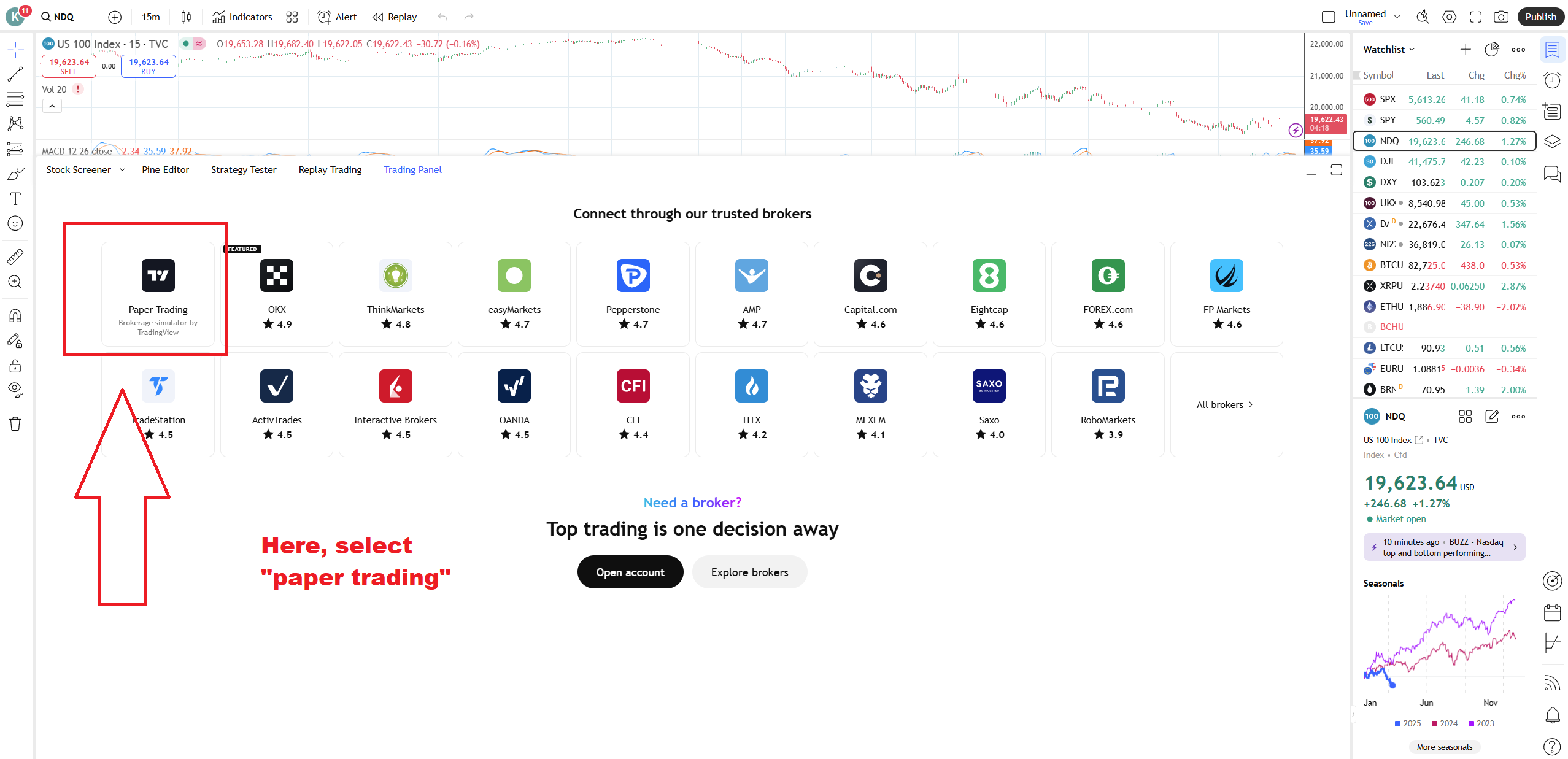

3. Once logged in, navigate to the charting section and open a chart by selecting any asset pair. At the bottom of the chart, you’ll see a horizontal panel labeled Trading Panel. Click on it to expand it.

4. In the Trading Panel, you will see the Paper Trading option alongside some popular brokers. Click on it to activate the feature. By simply clicking on Connect, you'll have access to a virtual account with simulated funds.

Placing Orders in Paper Trading

Now that your paper trading account is set up, let’s dive into the step-by-step process of placing trades.

- Choose an Asset - To choose the asset you want to trade, use the search bar at the top of the screen. There are a ton of market products to practice on including forex, stocks, indices, bonds, cryptocurrencies, and precious metals, among others.

- Analyse the Market - Once you’ve selected the asset you want to trade, open its chart and analyse the asset’s price movements using various charting tools available. You can also apply various technical indicators to identify potential entry and exit points.

- Place a Trade - Once you’re ready to place an order, open the Trading Panel and click on Trade to select your order type and configure the trade parameters.

Managing Open Positions

Once you have open positions, you can manage them within the Trading Panel. In the Positions tab, you will be able to see your open positions, including the symbol, quantity, entry price, current price, and profit/loss. You can make adjustments to your trade if necessary. This includes moving take-profit and stop-loss levels or closing the trade manually.

Analysing Your Paper Trading Performance

Paper trading is only effective if you analyse your results and learn from your performance. Positively, TradingView provides tools to help you track and analyse your performance. The Order History tab displays a record of all your executed orders, including the symbol, order type, price, quantity, and time.

Additionally, the Account History tab shows your account balance, deposits, withdrawals, and profit/loss over time. Further, TradingView provides a performance summary that includes key metrics such as total profit and loss, win rate, and maximum drawdown, among others.

Maintaining a trading journal can further help you to analyse your performance over time. Here, you will record your trades, including your entry and exit reasons, emotions, and lessons learned. This will help you identify patterns and improve your decision-making.

Advantages of Paper Trading on TradingView

- Risk-Free Learning - Paper trading allows you to learn and practice without the fear of losing real money. Here, traders can experiment with different strategies with more comfort. Moreover, traders can reset their balances at any time.

- Real-Time Market Conditions - TradingView’s paper trading feature uses real-time data, providing an accurate simulation of live markets.

- Access to Advanced Tools - You can use TradingView’s extensive charting tools and indicators to analyse markets and test strategies.

- Flexibility - TradingView offers access to a variety of global markets ranging from stocks, forex, cryptocurrencies, to indices, and more.

- Community Support - TradingView has a large community of traders where people share trading ideas and learn from other traders.

Limitations of Paper Trading

While paper trading is an invaluable tool, it has some limitations:

- False Emotional Impact - Since you’re not using real money, you may not experience the emotional highs and lows of real trading. This can translate into impulsive decision-making in the real market.

- Execution Differences - In real trading, factors like slippage and order execution speed can affect outcomes, which may not be fully replicated in paper trading.

- Overconfidence - Winning in Paper Trading may lead to a trader overestimating their trading skills. This can result in variance in results. Remember, success in paper trading doesn’t always translate to success in real trading, as the stakes are different.

TradingView Demo Accounts

It is important to know that Paper Trading is not the only way to practice trading using TradingView. There are plenty of brokers that support TradingView as a trading platform. These brokers integrate with the platform, allowing users to place orders straight from TradingView charts. Some of these brokers offer free TradingView demo accounts to their traders. Here, you can practice trading on TradingView under the broker’s trading conditions and order execution speeds.

Transitioning from Paper Trading to Live Trading

Once you’ve gained confidence and consistency in paper trading, you may be ready to transition to live trading. Here’s how to make the switch:

- Use a Reliable Broker - TradingView is only a charting and trading platform. It cannot hold customer funds, execute trades, or provide brokerage services. For that, traders need to choose a broker that integrates with TradingView for a seamless trading experience. Among these, there are several brokers that offer free TradingView paid plans, saving their customers on subscription fees.

- Start Small - When transitioning from a Paper Account to a Live Acount, it is wise to begin with a small amount. From there, you can develop confidence in your trading strategies and slowly grow your account.

- Stick to Your Strategy - Use the strategies and risk management techniques you practiced during paper trading. If you wish to experiment with other trading strategies, you can test them out in the Papper Account before transitioning them to the Live Account.

- Manage Emotions - Be prepared for the psychological challenges of real trading. When real money is involved, the stakes are much higher and impulsive decisions may develop.

One of the top TradingView brokers is now offering free TradingView subscriptions. Learn more here.

Closing Remarks

Paper trading on TradingView is a powerful tool for learning, practicing, and refining your trading skills with no financial risk. By simulating real market conditions, it provides a realistic platform for learning and experimentation. However, it’s important to remember that paper trading does not fully replicate the emotional and execution challenges of real trading.

Therefore, when moving to a live account, traders should start small, stick to their strategies, and manage risk effectively. With disciplined practice and continuous learning, paper trading on TradingView can be a powerful stepping stone to long-term trading success.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.