How to Open a Real Forex Account on MetaTrader 5

MetaTrader 5 (MT5) is one of the world's most popular trading platforms, providing advanced tools for trading Forex, stocks, commodities, and other financial instruments. On one hand, its intuitive interface makes it accessible to traders of all experience levels.

On the other hand, its robust and feature-rich design caters to a broad spectrum of trading needs, making it a preferred choice for many forex traders. Fortunately, numerous reputable forex and CFD brokers offer MT5 to their clients.

But how does one go about opening a real trading account on MetaTrader 5?

In this guide, we aim to answer exactly that. Here is a step-by-step guide on how to open a real forex account on MetaTrader 5. Let’s Begin.

Steps To Opening A Real MetaTrader 5 Account

Step 1: Choose a Reliable Broker

The first step in opening a real trading account on MT5 is selecting a broker. You cannot trade on MT5 without linking your account to a broker that supports the platform. However, not all brokers offer MT5, so you'll need to choose one that does. Additionally, not all brokers that support MetaTrader 5 are credible. To find a credible broker, there are a few key factors that traders must consider. These include:

- Regulation - This is the most critical factor to consider. Ensure the broker you choose is regulated by a reputable financial authority like the FCA in the UK, the ASIC in Australia, or the CySEC in Cyprus, among others. Regulation provides a degree of security and protection for your funds.

- Trading Costs - Another crucial factor to consider is the spreads and fees charged by a broker as they can directly affect profitability. It's important to compare spreads, commissions, and swap rates and pick the most cost-effective broker for your needs.

- Trading Instruments - Ensure the broker offers the currency pairs and other assets you want to trade. Most top-tier forex and CFD brokers offer a variety of market products to allow their traders to diversify their portfolios.

These are the three key features to consider when choosing a broker with MetaTrader 5. Traders can also consider other factors like deposit and withdrawal methods, the minimum deposit accepted by the broker, customer support, and account types available. Let us pick Pepperstone, one of the Top MT5 Brokers, for our demonstration in this article.

Step 2: Registration and Account Application

To open a real trading account with Pepperstone, you will need to head to its website and register for an account. This is a straightforward process that involves the following steps:

- Go to Pepperstone’s official website and locate the Join Now button on the top-right corner.

- Complete a registration form by providing accurate personal information, including your name, email, and phone number.

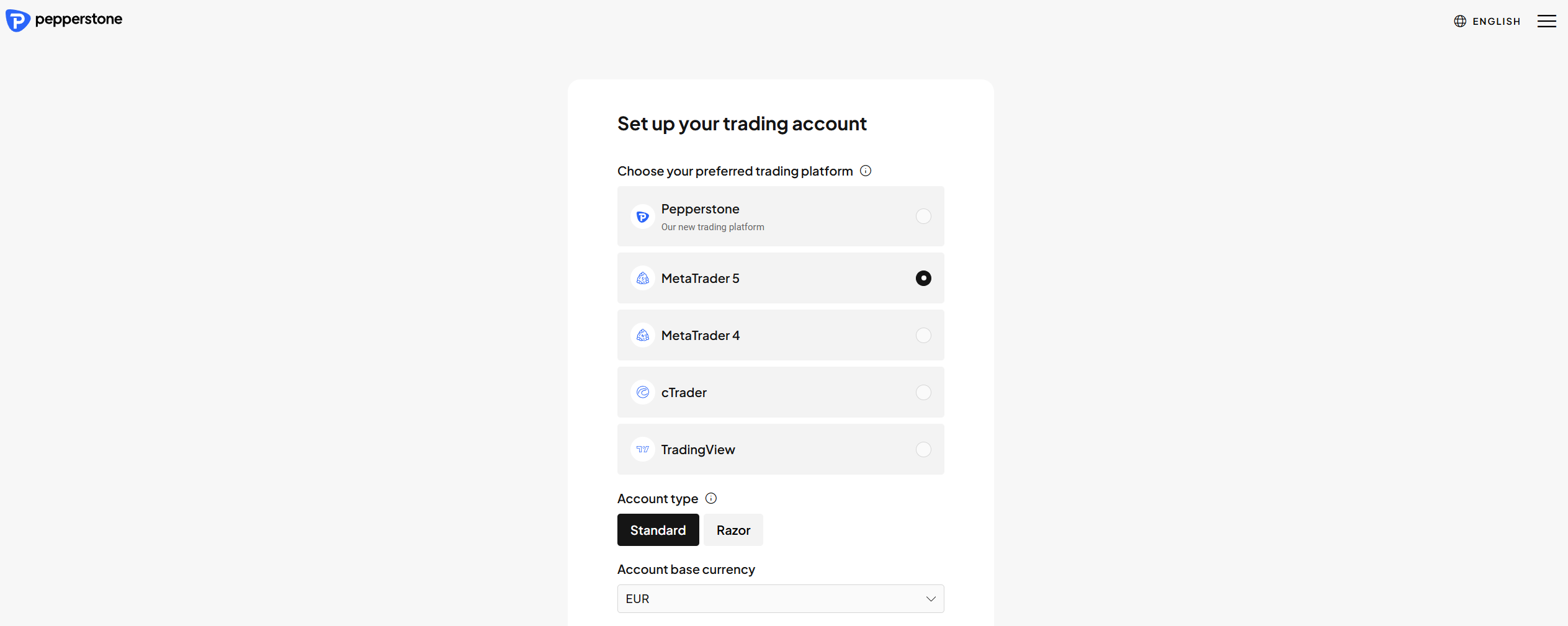

- Select MetaTrader 5 as your trading platform, select your account type, and specify the account base currency. There are two account types to select from which include the Standard and the Razor accounts.

75.3% of retail CFD accounts lose money

Step #3 (1a): Start Your Application

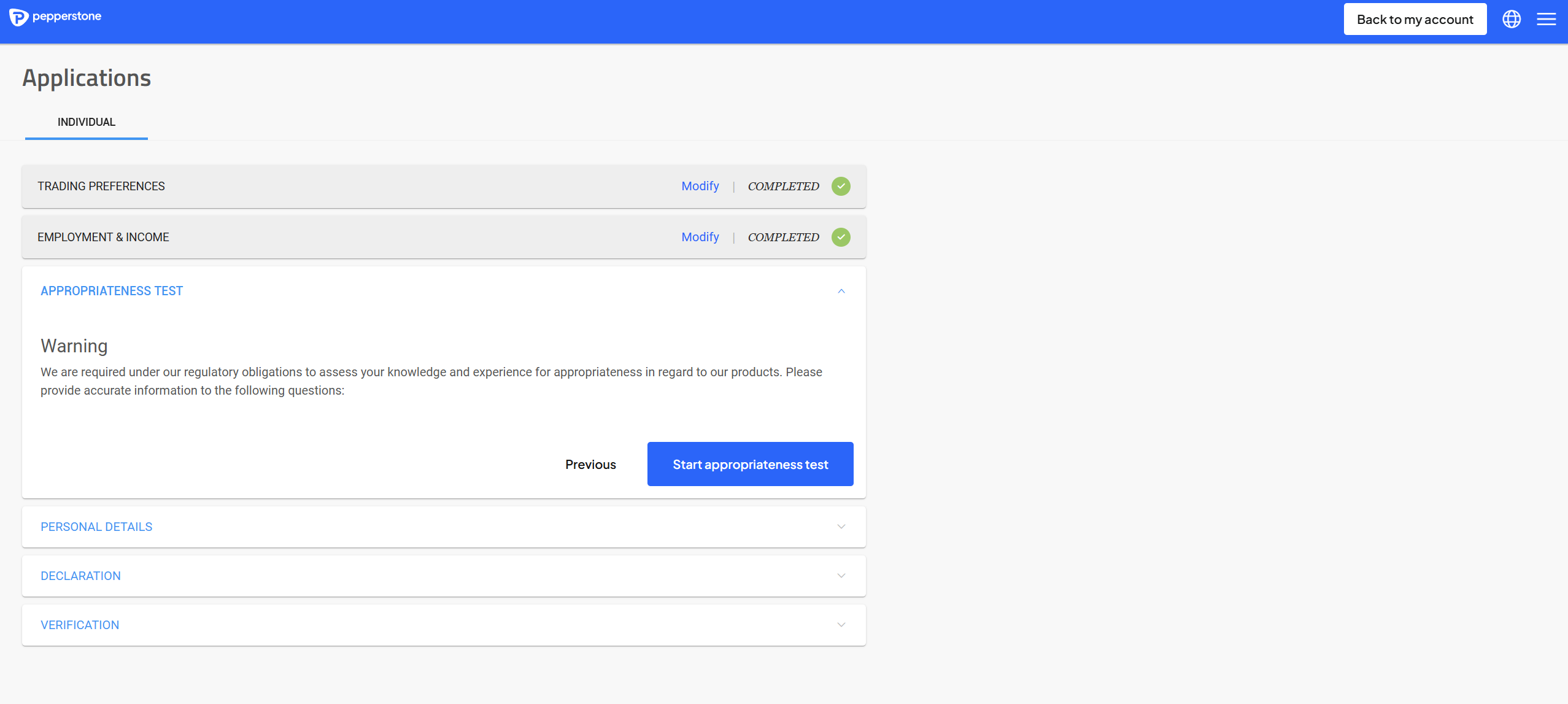

Pepperstone gives you a questionnaire that helps them determine your suitability to trade derivative products. There are only a few questions regarding your income, trading experience, and trading preferences. These questions help the broker assess your suitability for trading and ensure that their services align with your financial situation and level of experience.

Step #3 (1b): Proceed With Your Application

After completing the suitability test, Pepperstone will direct you to the Application page. Here, you will enter details about your employment status, and income, while also reviewing and confirming your personal information. You will then need to carefully review the terms and conditions and agree to them in order to proceed.

Step #3 (1c): Account Verification

In the final step of your application process, you must verify your identity. As a regulated broker, Pepperstone is required to comply with anti-money laundering (AML) regulations by verifying your identity. The Know Your Customer (KYC) process at Pepperstone includes:

- Providing two forms of valid government-issued ID (passport, birth certificate, or national ID card). You will upload photos ensuring the documents are clear and all information is visible.

- You'll also need to provide two proof of your address documents, such as a utility bill or bank statement. The document should be recent, issued within the last 3 months.

Please note that Pepperstone does not accept black-and-white images or scanned copies of your ID and, depending on where you’re from, they may require additional documentation. Pepperstone will notify you when your account is verified or if there is any issue with your application.

Step #4: Download and Install MetaTrader 5

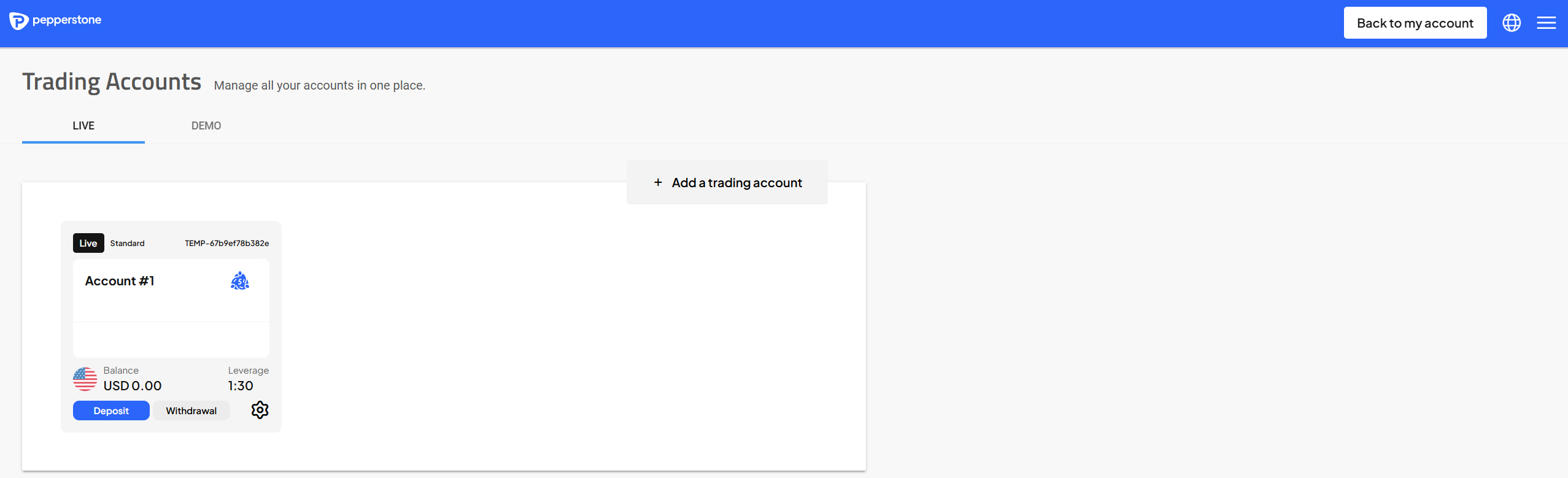

After the account verification process, you’ll need to download and install the MT5 platform. To begin, log in to your Secure Client Area using your credentials and request a live MetaTrader 5 account. The broker will send you an email with credentials that you will need to log into your MT5. From there, click the Downloads tab in your Secure Client Area and click on MetaTrader 5. Make sure to select the version that is compatible with your operating system, whether it’s Windows or macOS.

After downloading, double-click on the downloaded file and follow the installation steps. Once the installation is complete, you will need to connect your broker’s account. To do this, click on File, and then click on Login to Trade Account. You will then use the credentials that Pepperstone sent to you via email to link your Pepperstone account to MetaTrader 5.

Step #5: Fund Your Account

Before you can start trading with real funds on MT5, you’ll need to deposit funds into your account. You’ll start by logging into your Secure Client Area using the credentials provided during registration.

Once logged in, navigate to the Funds tab and click on Add Funds. You will then need to select the account you wish to fund You’ll then need to select a payment method from the available options. Pepperstone supports various deposit and withdrawal methods including wire transfers, credit and debit cards, PayRedeem, Neteller, Skrill, Fasapay, Mobile Money systems like M-Pesa, and cryptocurrencies.

After choosing your preferred payment method, enter the amount you wish to deposit. Positively, Pepperstone does not have a minimum deposit requirement. This means that traders can deposit whatever amount they wish. Once the details are entered, confirm the transaction by following the provided payment instructions.

Some methods, such as credit card payments, may require additional authentication steps, like entering a one-time password (OTP) for verification. Once the deposit is processed, check your trading account balance to confirm the funds have been credited. The processing time will depend on the payment method used.

Step #6: Start Trading

After following the steps above, you now have a real MetaTrader 5 forex account on Pepperstone that is funded. You are now ready to place orders from your MT5 account. Make sure to fully familiarise yourself with the platform’s functionality before jumping into trading. You can do this by first practising on a demo MetaTrader 5 account.

What Markets Does Pepperstone Offer?

Pepperstone provides a wide range of investment opportunities, offering access to over 1,200 market products. Traders can engage in CFD trading across various asset classes, including forex, cryptocurrencies, indices, currency indices, commodities, and shares.

When it comes to trading costs, Pepperstone’s spreads are competitive. On the standard account, spreads start from 1.0 pips for major currency pairs with no commission. On the razor account, the spreads are from 0.0 pips plus a commission depending on the trading platform. MetaTrader 5 traders pay a commission of $3.5 per side per lot (or €2.60 if your account base currency is in EUR).

Further, Pepperstone operates under the supervision of several top-tier financial regulators. These regulatory bodies include the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the BaFin in Germany, and others.

Why Choose MetaTrader 5?

MetaTrader 5 (MT5) is a highly advanced and versatile trading platform developed by MetaQuotes Software. It offers a wide range of tools and features for both aspiring traders and experienced traders. Some of its key features include:

MetaTrader 5’s Key Features

- Multi-Asset Trading: MT5 supports trading in various financial instruments, including forex, stocks, commodities, and cryptocurrencies.

- Advanced Charting Tools - The platform provides numerous technical indicators, analytical objects, and timeframes. This allows for detailed market analysis.

- Algorithmic Trading - MT5 supports automated trading through Expert Advisors (EAs) and allows for the creation of custom indicators and scripts using the MQL5 programming language.

- Market Depth - The platform offers a Depth of Market (DOM) feature, providing insights into liquidity and order book dynamics.

- Economic Calendar - The integrated economic calendar on MT5 helps traders stay updated with important financial events and news.

- Multi-Threaded Strategy Tester - This feature allows for faster and more efficient backtesting of trading strategies.

- Mobile and Web Versions - MT5 is available on multiple devices, including desktop, mobile, and web, ensuring accessibility and flexibility.

Pros of MetaTrader 5

- User-Friendly Interface - Intuitive and customisable interface suitable for all levels of traders.

- Comprehensive Analysis Tools - Extensive tools for technical and fundamental analysis.

- Community and Support - Large user community and extensive support resources.

Cons of MetaTrader 5

- Complexity for Aspiring Traders - The platform's advanced features can be overwhelming for novice traders.

- Limited Broker Support - Not all brokers support MT5, as many still prefer its predecessor, MetaTrader 4 (MT4).

What Other Brokers Support MetaTrader 5?

There are many other reliable forex brokers that support MetaTrader 5. Let’s highlight just a few here:

Exness

Exness is a globally known broker with a diverse range of trading accounts to accommodate different trader profiles. This broker supports MetaTrader 5 alongside MetaTrader 4 and its own Exness Trader. Exness spreads vary by account type. The Standard account offers spreads from 0.2 pips while the Standard Cent account starts at 0.3 pips, both with no commissions.

The Pro account features spreads from 0.1 pips with no commission. Meanwhile, the Zero account offers 0.0 pips on the top 30 instruments, with a commission from $0.05 per side per lot. Lastly, the Raw Spread account provides 0.0 pips spreads with a commission of up to $3.5 per side per lot.

Regarding market products, Exness grants its traders access to over 250 different market products. These include CFDs on forex, indices, commodities, cryptocurrencies, and stocks. It operates under the regulation of several institutions including the FCA, the CySEC, the CMA in Kenya, and the JSC in Jordan, among others.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

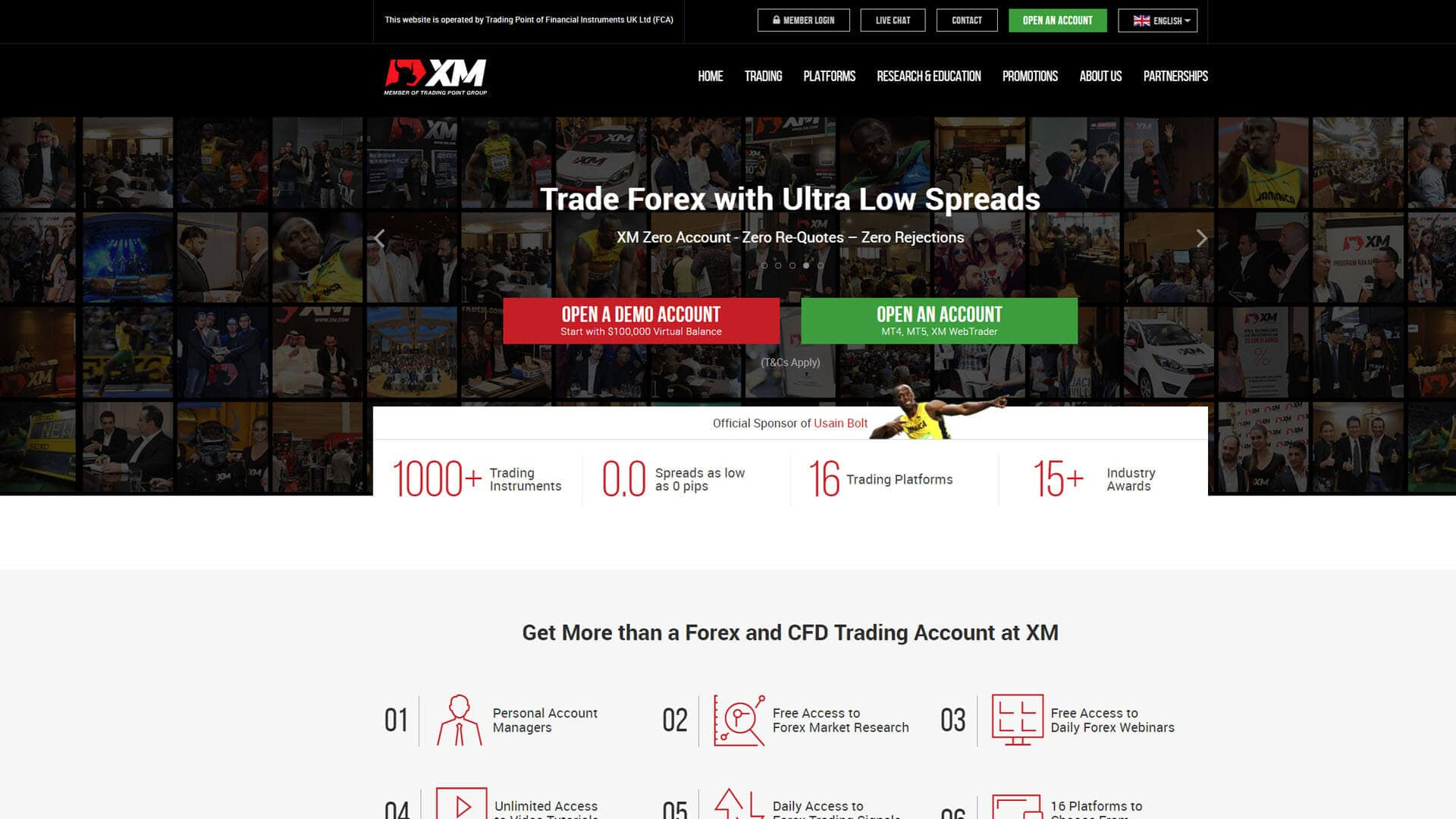

XM

XM is another well-regarded broker that supports MetaTrader 5, alongside MetaTrader 4. The broker offers a range of account types, including the Standard, XM Ultra Low, and Shares accounts. Spreads start from 0.8 pips on the Ultra Low account with no commission, while the Standard account offers spreads from 1.6 pips, also commission-free.

With XM, traders can access a broad selection of over 1,000 instruments, including forex, stocks, indices, commodities, metals, and energies. The broker is regulated by top-tier authorities which include the CySEC and the ASIC. It is also regulated by other organisations like the FSC in Belize and the DFSA in Dubai.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Tickmill

Tickmill is a globally recognised forex and CFD broker that provides access to MetaTrader 5, alongside other platforms. This broker provides tight spreads across its accounts. The Standard account offers spreads from 1.6 pips on major currency pairs with no commission. For lower spreads, Tickmill provides two Raw Spread accounts, both starting from 0.0 pips. The Raw account charges a $3 commission per side per lot, while the Tickmill Trader Raw account has a $3.5 commission per side per lot.

The financial instruments available to trade on Tickmill include CFDs on forex, stock indices, metals, bonds, commodities, and cryptocurrencies. This broker is regulated by multiple authorities, including the FCA, the CySEC, the FSCA in South Africa, and the DFSA, among others.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

Final Comments

Opening a real Forex account on MetaTrader 5 is a straightforward process that begins with selecting a reliable and regulated broker. Whichever broker you choose, the process steps are very similar and include completing registration, verifying your identity, funding your account, and finally, starting to trade. With its advanced tools and advanced capabilities, MetaTrader 5 remains a top choice for traders seeking comprehensive and professional trading experience.

Brokers like Pepperstone, Exness, and XM offer excellent MT5 trading conditions, catering to different trader preferences. Nonetheless, they are not the only brokers that support MetaTrader 5. There are several other quality brokers like FP Markets, HFM, Forex.com, and others that traders can also consider. Remember to thoroughly research brokers and compare their offerings to find the one that best suits your needs.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.