How to Open a Real Account on MetaTrader 4

MetaTrader 4 (MT4) has long held its position as one of the most widely used trading platforms in the forex industry. Known for its user-friendly design, powerful charting tools, and compatibility with automated strategies, MT4 remains the go-to platform for traders of all experience levels.

Its intuitive design makes it an accessible gateway for newcomers, while its robust features continue to satisfy the demands of seasoned traders. Consequently, a multitude of reputable Forex brokers extend the MT4 platform to their clientele. To start trading live on MT4, you’ll first need to open a real account through a broker that supports the platform.

But how does one actually set up a live trading account on the MetaTrader 4 platform?

In this guide, we’ll look at how to open a real account on MetaTrader 4, detailing the exact steps someone needs to follow to complete the process.

Steps to Open a Real MetaTrader 4 Trading Account

Step 1: Choose a Reliable Broker

The initial and arguably most crucial step in opening a live trading account on MT4 is choosing the right broker. You can trade on MT4 only if your account is linked to a broker that supports the MT4 trading platform. It's important to note that not all brokers offer MT4 support—your choice should be limited to those that do. Furthermore, the credibility of brokers offering MetaTrader 4 can vary significantly. To identify a dependable broker, traders should prioritise several key aspects:

- Regulation - This is paramount. Ensure the broker operates under the oversight of a well-respected financial regulatory body. Examples include the FCA in the UK, the ASIC in Australia, and the CySEC in Cyprus, among others. Regulation offers a layer of security and safeguards for your trading capital.

- Trading Costs - The spreads and commissions charged by a broker directly impact your trading profitability. It's wise to compare these costs, including spreads, commissions, and swap rates, to find a broker that aligns with your trading strategy and budget goals.

- Tradable Instruments - Verify that the broker offers the specific currency pairs and other financial instruments you intend to trade. Most leading Forex and CFD brokers provide a diverse array of market products, enabling traders to diversify their investment portfolios.

So, these three things are really the main foundation for choosing a MetaTrader 4 broker. In addition, traders often take into account aspects like deposit and withdrawal options, minimum deposit requirements, the efficiency of customer support, and the range of account types available. For the purpose of this guide, we will use Pepperstone, a highly regarded and respected MT4 Broker, as our illustrative example. But the process is similar across other MT4 brokers.

Step 2: Registration and Account Application

To open a live trading account with Pepperstone, you'll need to visit their website and complete the registration. This is a relatively straightforward procedure involving the following steps:

- Navigate to Pepperstone’s official website and locate the button labelled Join Now, usually found in the top-right corner of the page.

- Fill out the registration form with accurate personal details, including your full name, email address, and phone number.

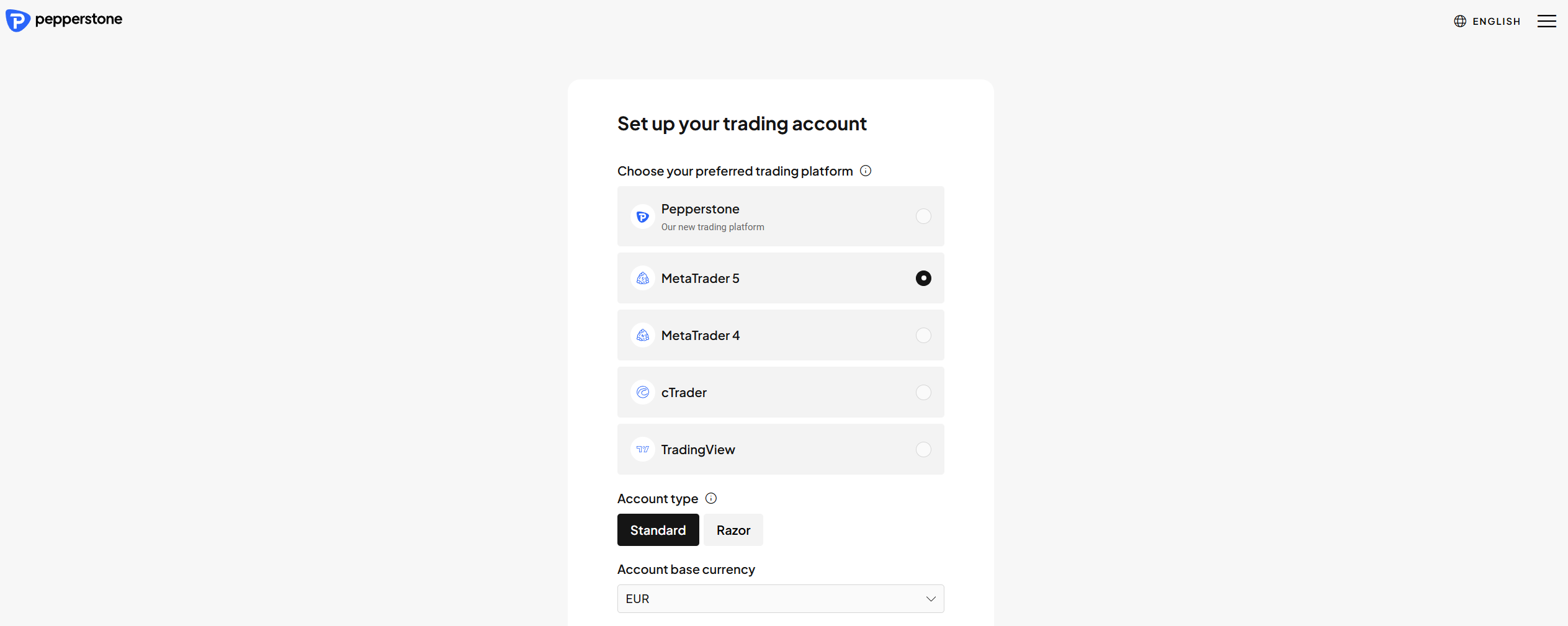

- Select MetaTrader 4 as your preferred trading platform, choose your desired account type, and select your account's base currency. Pepperstone offers a choice between two main accounts, which include the Standard and the Razor accounts.

75.3% of retail CFD accounts lose money

Step 3 (1a): Start Your Application

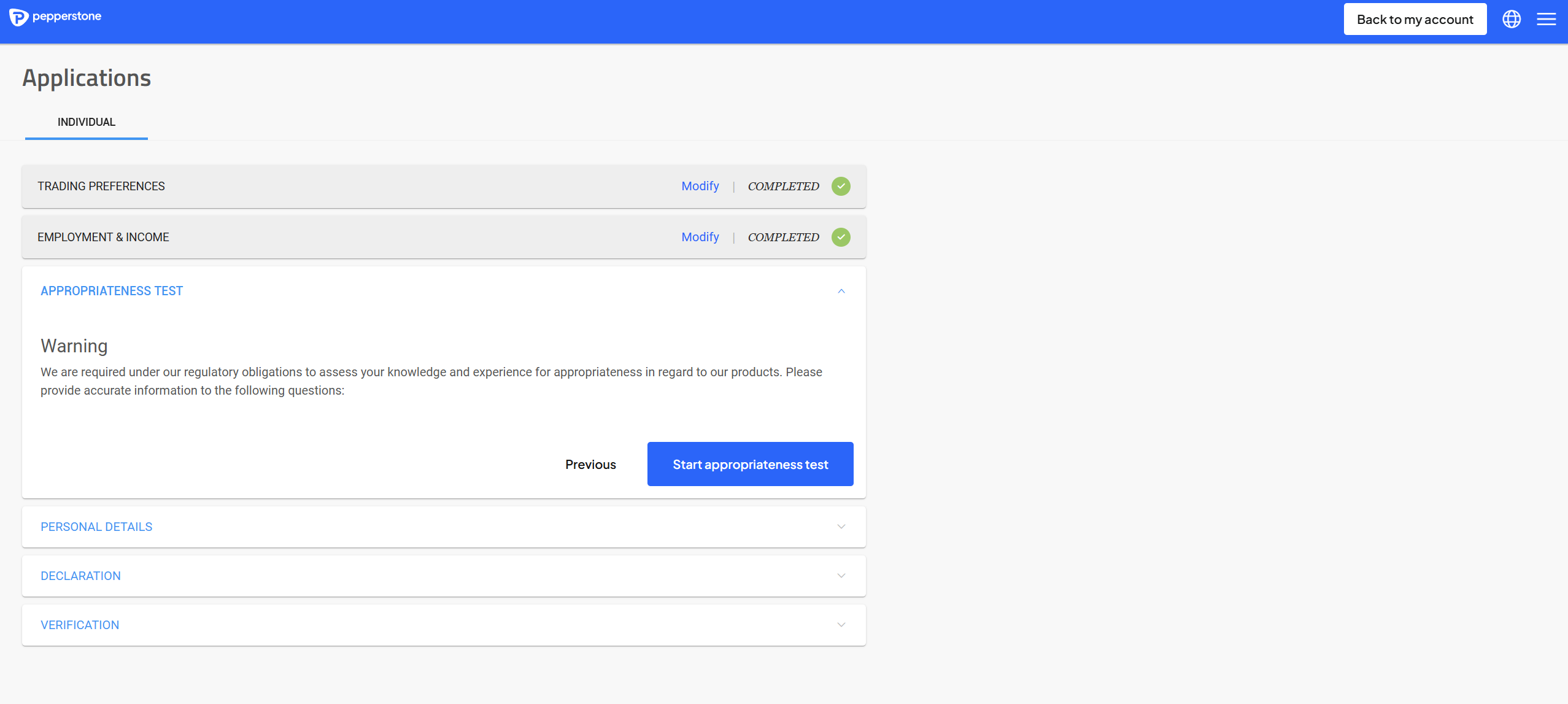

Pepperstone requires traders to complete a short questionnaire to assess their trading experience and risk tolerance. This helps the broker assess whether trading leveraged products is appropriate for you. You will need to answer the provided questions honestly, and Pepperstone will provide your assessment results immediately.

Step 3 (1b): Proceed With Your Application

Following the suitability test, Pepperstone will direct you to a page requesting further details. Here, you will need to confirm your personal information and provide additional details regarding your residential address. You will also need to agree to the broker’s terms and conditions before proceeding.

Step 3 (1c): Account Verification

As a regulated entity, Pepperstone is obligated to verify your identity to comply with anti-money laundering (AML) regulations. You’ll need to upload:

- Proof of Identity (POI) documents. These can include a Passport, national ID, or driver’s license.

- Proof of Address (POA) documents, which can include a recent utility bill or bank statement issued within the last three months.

Please note that Pepperstone usually does not accept black-and-white images or scanned copies of identification documents. Depending on your country of residence, they may also request additional documentation. Once approved, you’ll receive a confirmation from Pepperstone.

Step 4: Downloading and Installing MetaTrader 4

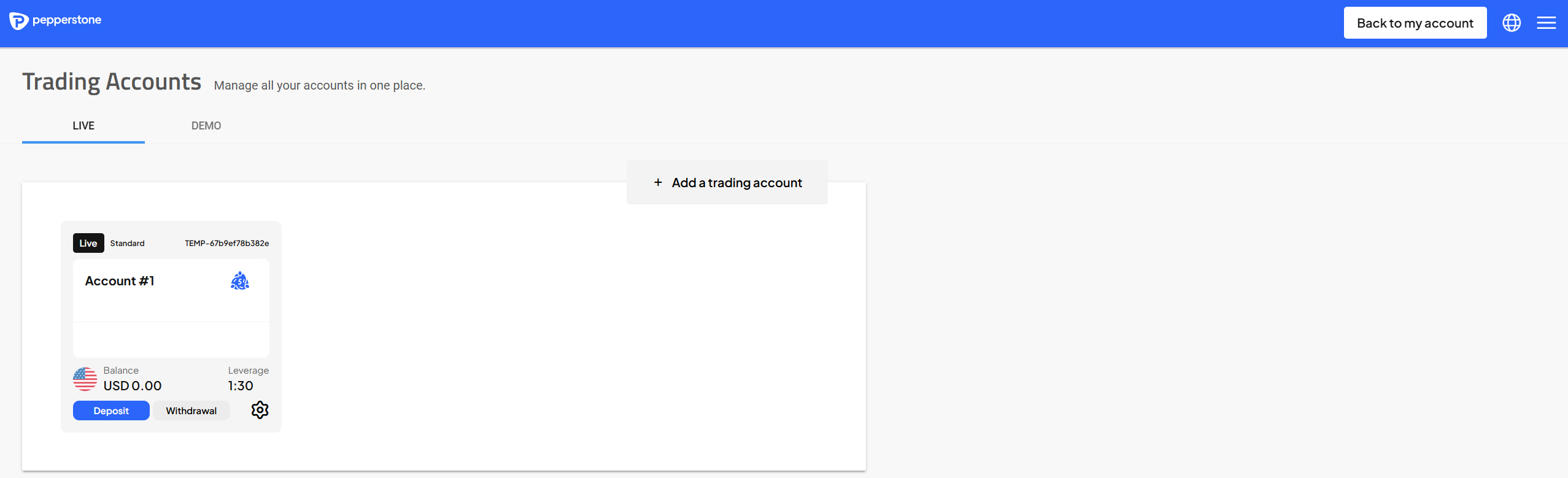

Once your account verification is complete, the next step is to download and install the MT4 platform. To begin, log in to your Secure Client Area on the Pepperstone website using your registration credentials and request a live MetaTrader 4 account. The broker will then send you an email containing the necessary login credentials for your MT4 account. From the client area, navigate to the Downloads section and select MetaTrader 4. Ensure you choose the version compatible with your computer's operating system.

After the download is finished, double-click the downloaded file and follow the on-screen installation instructions. Once installed, you'll need to connect it to your Pepperstone account. To do this, open the MetaTrader 4 platform, click on Menu, select Manage Accounts, and then click the Plus sign at the top. Choose to log in to an existing account and Pepperstone’s server. Enter the login credentials that Pepperstone sent to your email address to link your Pepperstone account with the MetaTrader 4 platform.

Step 5: Funding Your Trading Account

Before you start trading, you need to deposit funds into your newly opened account. Begin by logging into your Secure Client Area on the Pepperstone website using your registration details. Once logged in, navigate to the Funds tab and click on Add Funds.

You will then need to select the specific trading account you wish to fund and choose your preferred payment method from the available options. Pepperstone typically supports a variety of deposit and withdrawal methods, including bank wire transfers, credit and debit cards, and various e-wallet solutions like PayPal, Neteller, and Skrill.

After selecting your payment method, enter the amount you wish to deposit. Notably, Pepperstone has no minimum deposit requirement, giving traders the flexibility to start with any amount. Deposit times vary depending on the method used.

Some payment methods, such as credit card transactions, may require additional security steps, like entering a one-time password (OTP) for verification. Once the deposit is processed, check your trading account balance within your Secure Client Area or on the MetaTrader 4 platform to confirm the funds have been credited.

Step 6: Start Trading on MetaTrader 4

Now that you've gone through all those steps, you've got a real, funded MetaTrader 4 forex trading account with Pepperstone. You can begin placing trades directly through the MT4 platform. It's a good idea to get comfortable with how the platform works before you put a lot of money in. Using a MetaTrader 4 demo account for practice can be an excellent way to build confidence and skill.

What Markets Does Pepperstone Offer on MT4?

Pepperstone provides access to a diverse range of trading instruments on the MetaTrader 4 platform. This broker offers over 1,200 different CFDs on forex, cryptocurrencies, indices, currency indices, commodities, and shares.

In terms of trading costs, Pepperstone maintains competitive pricing. The Standard account features spreads starting from 1.0 pips on major currency pairs with zero commission. Meanwhile, the Razor account provides spreads from 0.0 pips, with commission rates that vary depending on the trading platform used. For MetaTrader 4 users, the commission is $3.50, €2.60, £2.25, or CHF 3.30 per side per lot, depending on the account currency.

Additionally, Pepperstone’s operations are watched over by some of the best financial regulators out there. These include the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the BaFin in Germany, and the CMA in Kenya.

Why Trade with MetaTrader 4?

MetaTrader 4 remains a top choice for traders worldwide due to its array of features and benefits. These include:

Key Features of MetaTrader 4

- User-Friendly Interface - MT4 is known for its intuitive and customizable interface, making it suitable for traders of all experience levels.

- Advanced Charting Tools - The platform offers a wide selection of technical indicators, drawing tools, and customisable charts to facilitate in-depth market analysis.

- Automated Trading (Expert Advisors) - MT4 supports algorithmic trading through the use of Expert Advisors (EAs), allowing for the automation of trading strategies. It also provides the MQL4 programming language for creating custom indicators and EAs.

- Security and Reliability - MT4 is a stable and secure platform, trusted by millions of traders worldwide.

- Mobile Trading - MT4 mobile applications for both iOS and Android devices enable traders to manage their accounts and trade on the go.

- Extensive Community and Resources - A large online community and abundant educational resources are available for MT4 users.

Pros of MetaTrader 4

- Well-established and widely supported platform.

- Large library of custom indicators and Expert Advisors.

- Relatively low system requirements.

Cons of MetaTrader 4

- The MQL4 programming language is less versatile than MQL5 on MT5.

- MT4 has a limited view of liquidity and order book compared to professional platforms.

What Other Brokers Support MetaTrader 4?

Beyond Pepperstone, numerous other reputable Forex and CFD brokers offer the MetaTrader 4 platform. Here are a few notable examples:

Exness

Exness is another prominent broker that supports MetaTrader 4. The broker also offers MetaTrader 5 and its proprietary Exness Terminal. The broker is popular for offering a variety of account types with different pricing structures. There are five different accounts available which include two standard accounts and three professional accounts.

The Standard account offers spreads from as low as 0.2 pips with no commissions charged. In contrast, the Standard Cent account features spreads from 0.3 pips, also without commissions. For lower spreads, traders can consider the Pro account with spreads from 0.1 pips and charges no commission. In contrast, the Raw Spread account offers spreads from 0.0 pips plus a commission of up to $3.5 per side per lot. Finally, the Zero account has spreads from 0.0 pips on the top 30 instruments, plus a commission that starts from $0.05 per side per lot.

The broker is regulated in multiple jurisdictions, including the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, the CMA in Kenya, and the FSC in Mauritius, among others. While Exness accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

FP Markets

FP Markets offers both MetaTrader 4 and MetaTrader 5, alongside cTrader and TradingView. These platforms offer traders advanced trading environments for trading a variety of market products. FP Markets features over 10,000 different instruments, including CFDs on forex, indices, metals, cryptocurrencies, commodities, stocks, bonds, and ETFs. The broker supports a variety of trading strategies, including scalping and hedging, among others.

Trading fees at FP Markets depend on the account type. The Standard account features spreads starting from 1.0 pips with zero commission. In contrast, the Raw account offers ultra-low spreads from 0.0 pips, accompanied by a $3 commission per side per lot.

From a regulatory standpoint, FP Markets is overseen by several respected financial authorities worldwide. These include the ASIC in Australia, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

72.44% of retail CFD accounts lose money

Tickmill

Tickmill is a well-regarded broker that provides access to MetaTrader 4, among other platforms. The other platforms available to use include MetaTrader 5 and Tickmill Trader. These platforms give traders access to a variety of market products, including CFDs on forex, stock indices, gold and other metals, bonds, commodities, and cryptocurrencies.

Tickmill provides three distinct account types tailored to different trading styles. The Classic Account features spreads starting from 1.6 pips on major currency pairs with no commission. For those who prefer raw spreads, Tickmill also offers two raw spread options. The Raw Account delivers spreads from 0.0 pips with a commission of $3 per side per lot. On the other hand, the Tickmill Trader Raw Account offers similar spreads with a slightly higher commission of $3.50 per side per lot.

Tickmill is regulated by several well-established financial authorities. These include the FCA, the CySEC, the FSCA, and the DFSA in the DIFC.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

Final Comments

Opening a live Forex account on MetaTrader 4 is a relatively simple process that begins with careful broker selection. Regardless of the broker you choose, the major steps involve registration, verification, funding your account, and finally, commencing your trading activities. With its established reputation and comprehensive trading tools, MetaTrader 4 remains a favoured platform for traders worldwide.

Brokers like Pepperstone, Exness, FP Markets and Tickmill provide robust MT4 trading environments. However, the landscape of brokers offering MetaTrader 4 is extensive. Remember to conduct thorough research and compare the offerings of different brokers to identify the one that aligns best with your individual trading needs and requirements.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.