Does Exness Allow Hedging? Key Facts

Hedging is a widely used risk management strategy in forex and CFD trading, helping traders protect their positions against adverse market movements. By opening offsetting trades, traders can minimize potential losses during periods of high volatility. If you're searching for a broker that supports this strategy, you might be asking: Does Exness allow hedging?

In this article, we’ll take a closer look at Exness hedging policies, explain how the hedging strategy works on the platform, and outline the key benefits and possible restrictions. Whether you’re a beginner or a seasoned trader, understanding how hedging functions on Exness can give you a strategic edge in volatile markets.

Is Hedging Allowed on Exness?

Yes, Exness allows traders to engage in hedging.

However, certain conditions affect its usage: For certain instruments, such as commodities, the hedged margin is 0%, meaning no additional margin is required for hedged positions; however, this can vary depending on the instrument. Exness supports hedging across a variety of account types.

Traders can open opposite positions on the same instrument without restrictions in all account types. This offers traders great flexibility, solidifying Exness’ reputation as one of the best brokers for hedging in the market. However, for serious hedging, Exness recommends using accounts like the Pro, Raw Spread, or Zero accounts, which offer more advanced features suited for hedging strategies.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Types of Hedging

Traders can use several hedging methods depending on their strategy, risk tolerance, and market conditions. Here are the primary types of hedging:

Direct Hedging - Direct hedging involves taking both a long and a short position on the same currency pair at the same time. This strategy helps to offset potential losses by balancing both positions. Traders generally use this when they anticipate market volatility but are uncertain about the direction of price movement.

Cross Hedging - Cross hedging involves using correlated but different instruments or commodities to hedge a position. For instance, a trader could hedge a position on EUR/USD with a position on EUR/GBP. Other examples include using related commodities, like beef cattle and feeder cattle. Cross hedging is a strategy employed when the trader cannot directly hedge a position but can use related instruments with similar price movements.

Partial Hedging - In partial hedging, traders hedge only a portion of their position rather than the entire position. This strategy allows traders to manage risk while still maintaining some exposure to market movements. For example, a trader might buy 10 lots of EUR/USD and sell 5 lots, leaving part of the position unhedged and thus exposing it to market fluctuations.

Advantages of Hedging

Hedging offers several advantages:

- Effective Risk Control

It provides a means of mitigating risks, especially during periods of high market volatility. Sudden reversals in market trends can catch traders off guard, but hedging helps cushion these shocks by offsetting losses in one position with gains in another. - Strategic Flexibility

Hedging offers traders the flexibility to hold multiple conflicting positions simultaneously. This allows them to spread risk across different instruments without needing to close existing trades. Traders can continue managing their positions while protecting themselves from adverse price movements.

- Neutral Market Exposure It enables traders to avoid taking a directional risk in the market. By maintaining both long and short positions, traders can stay neutral and not bet on a specific market direction. This becomes especially valuable in uncertain or sideways markets.

Hedging and Margin on Exness

Margin is the amount required to open and maintain trading positions. Margin requirements can vary depending on leverage, market environment, and the instruments of trade.

Fully Hedged Orders

A 0% margin is applied, and traders open equal buy and sell positions in the same instrument. For example, they might sell 10 lots of EUR/USD and buy 10 lots of EUR/USD. Exness does not require margins for fully hedged positions across most account types. This makes fully hedged orders a popular choice for traders who wish to eliminate or minimize exposure to market risks without risking their capital.

Partially Hedged Orders

Partially hedged orders involve opening buy and sell positions of differing sizes. For instance, a trader might buy 10 lots of EUR/USD and sell 5 lots of the same pair. In this case, the trader would hold the margin for the unmatched position. This strategy allows traders to limit exposure while still maintaining flexibility in managing their positions.

Note that Exness may implement high margin requirements (HMR)in periods of high market volatility.

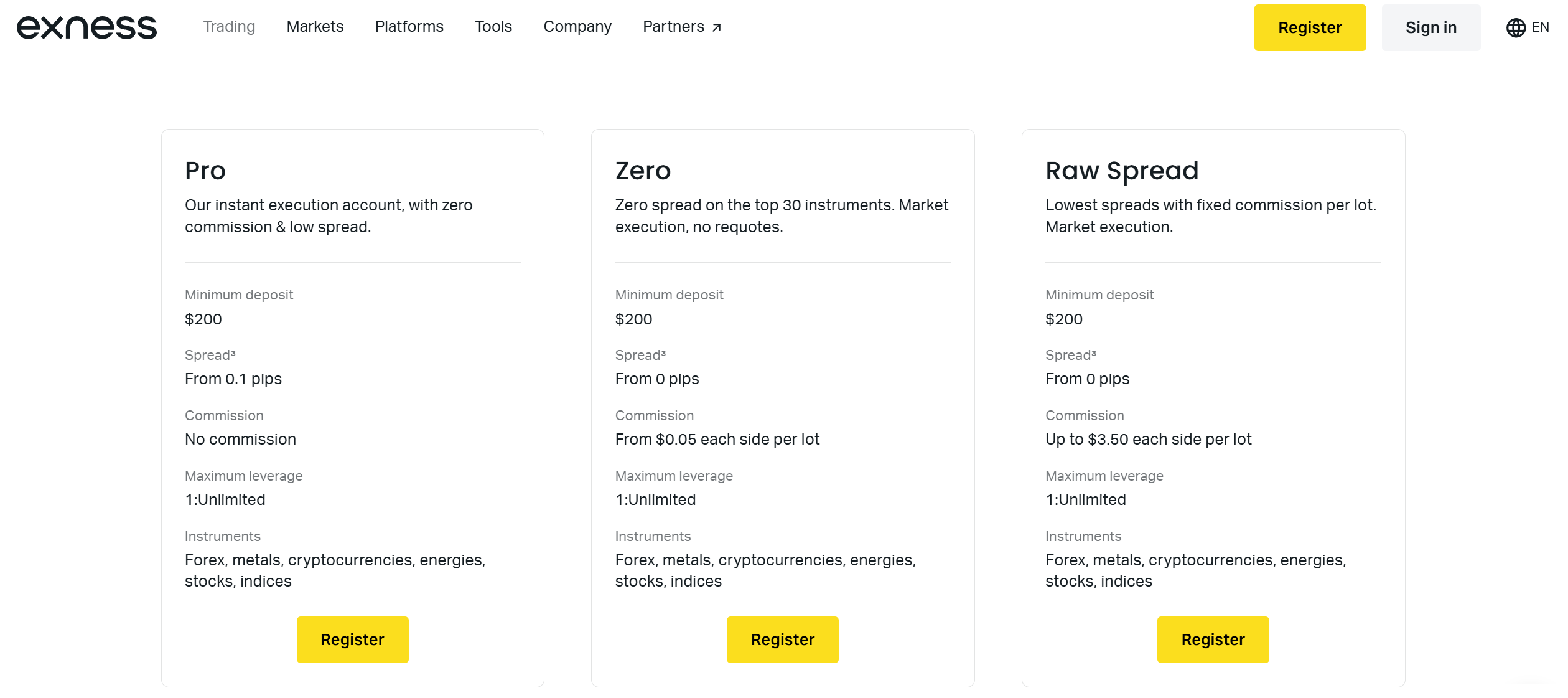

Best Exness Accounts for Hedging

Exness provides a variety of accounts suitable for hedging. These accounts cater to different types of traders, from beginners to professional investors. The most suitable accounts for hedging include:

- Standard Account

Ideal for new traders, the Standard account offers flexibility with a low minimum deposit requirement of just $10. It allows traders to hedge without restrictions and does not enforce FIFO (First In, First Out) rules, meaning traders are not forced to liquidate their positions. This account is suitable for both short-term and long-term trading strategies.

- Raw Spread Account

The Raw Spread account is well-suited for active traders and scalpers. It offers tight spreads starting from 0.0 pips, making it perfect for traders who frequently enter and exit the market. The account charges a commission of $3.5 per lot, which makes it cost-effective for active traders. However, traders should be mindful of the higher capital risk and the cumulative impact of commissions.

- Zero Account

The Zero account provides ultra-tight spreads starting from 0.0 pips, offering fast execution and low commissions. This account is ideal for professional traders and those who rely on precise market timing. However, due to the need for strict risk management, this may not be suitable for novice traders.

- Pro Account

The Pro account is designed for experienced traders. It offers better pricing than the Standard account, along with higher leverage options and instant execution. However, it requires a higher minimum deposit of $200+, making it more suitable for professional traders who can manage larger capital.

- Swap-Free (Islamic) Account

The Swap-Free account caters to traders seeking Sharia-compliant trading conditions. It does not involve swap fees, ensuring compliance with Islamic finance principles. However, not all assets are available in this account, and traders may experience wider spreads as a result of the lack of overnight swaps.

Which Exness Account is Best for Hedging?

When selecting the best Exness account for hedging, traders should consider their trading style and specific needs. The Standard account is an excellent choice for newcomers due to its low costs, ease of access, and protection from forced liquidation under FIFO rules, making it a user-friendly option for those just starting.

Scalpers and active hedgers will benefit most from the Raw Spread or Zero account, which offers ultra-tight spreads and fast execution speeds, allowing for efficient position management in volatile market conditions.

The Pro account is well-suited for experienced traders who require near-instant execution and lower trading costs. With no commission fees and competitive spreads, it provides a more cost-effective solution for those who frequently hedge while maintaining greater control over their trades.

By selecting the most appropriate account type, traders can optimize their hedging strategy while keeping trading costs manageable.

Exness Credibility

Exness, established in 2008, has quickly risen to become one of the largest and most reputable retail brokers in the world. With a monthly trading volume surpassing $4 trillion, Exness holds a dominant position in the forex and CFD markets.

The broker offers an extensive range of trading instruments, including CFDs on forex currency pairs, commodities, energies, stocks, and cryptocurrencies. Exness operates under strict regulations and holds licenses from prominent regulatory bodies, including the CMA, FSCA, and others, ensuring that traders receive a secure and trustworthy trading environment.

Conclusion

Hedging is an essential strategy for experienced traders, and Exness provides a great environment for practicing it. By offering a variety of account types tailored to different needs, Exness allows traders to hedge effectively while managing risk.

Whether you are new to trading or an experienced investor, hedging can help improve risk management and overall trading performance, and Exness is among the top brokers to trade with. Always ensure that you start with smaller positions and scale up as you gain more experience and knowledge of the markets.

Before you start trading, verify the local regulatory conditions in your region to understand any restrictions that might impact your hedging strategies.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.