Best TradingView Brokers in South Africa

TradingView has revolutionised the trading landscape with its advanced charting tools, analysis tools, and vibrant social network. TradingView boasts a huge community of traders and investors where users can publish their trading ideas and get feedback from others. This platform also has an easy-to-use interface, making it a go-to platform for both novice and seasoned traders worldwide.

For South African traders looking to leverage TradingView's capabilities, choosing a broker that integrates seamlessly with TradingView is paramount. In this in-depth guide, we will review some of the best TradingView brokers in South Africa, focusing on their features and unique offerings to traders.

How To Select The Best TradingView Brokers in South Africa

To make the selections for this article, we will consider a few important factors. Below are the criteria we will consider while selecting the best brokers that offer TradingView in South Africa:

- TradingView Integration - It goes without saying that we will only consider brokers that integrate with TradingView. It is also important to consider the ease of integration and execution speed.

- Regulation - We will consider the regulatory status of the broker, prioritising those regulated in South Africa by the FSCA. Regulations from other top-tier organisations are an added bonus.

- Instrument Variety - The availability of a wide variety of market products allows investors to diversify their investments as they see fit.

- Spreads and Fees - The spreads and fees involved in trading directly impact profitability as they are the cost of each trade. Lower spreads and fees mean more of a trader’s capital is working for them, leading to potentially higher returns.

Now that we understand the key features we will consider, let’s look at some of the best TradingView brokers in South Africa.

Pepperstone

Pepperstone is one of the most respected international brokers and has a significant presence in South Africa. This broker integrates seamlessly with TradingView, allowing investors to place orders straight from the platforms’s charts. Apart from the advanced charting tools, TradingView allows South African investors to interact with over 30 million other traders. It is one of the largest social networks for traders. Moreover, this platform allows traders on Pepperstone to explore a vast range of indicators, both pre-built and customisable.

Interestingly, Pepperstone provides all its traders with a free auto-renewing TradingView Essential Subscription, allowing them to access premium charting free of charge. On another note, Pepperstone offers its traders a wide collection of market products to trade. This broker offers over 1,200 different trading instruments which include CFDs on forex, commodities, currency indices, ETFs, indices, and shares. Alongside TradingView, traders can also use MT4, MT5, cTrader, and the Pepperstone Trading Platform to place orders.

Further, Pepperstone provides competitive spreads to traders. Its standard account has spreads from as low as 1.0 pips on major currency pairs with no commissions. In contrast, the razor account features spreads from 0.0 pips plus a commission depending on the trading platform.Traders using TradingView and Pepperstone Trading Platform pay a commission of $3 per side per lot. MT4 and MT5 users pay a commission of $3.5 per side per lot. Lastly, cTrader users pay a commission of $3 per side per lot.

On a positive note, Pepperstone is regulated by several reputable financial authorities. While it is not overseen by the FSCA in South Africa, it is licensed by the CMA in Kenya, showcasing its regulatory presence in another African country. The broker further holds licenses from the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, and the BaFin in Germany, among others.

75.3% of retail CFD accounts lose money

Tickmill

Tickmill is another reputable online broker that offers TradingView integration to South African traders. Its compatibility with TradingView provides South African traders with an advanced charting tool with a plethora of indicators, drawing tools, and customisable features. TradingView gives access to an economic calendar and news features to keep up with key market moves.

Tickmill provides access to a wide array of financial instruments, including CFDs on forex, metals, stock indices, cryptocurrencies, bonds, and commodities. This diverse product offering allows traders to diversify their portfolios and strategies as they see fit. Alongside, TradingView, South African traders can also use MetaTrader 4, MetaTrader 5, and Tickmill Trader.

Tickmill is known for its competitive pricing, offering tight spreads and low commissions. Traders can choose from three account types: Classic, Raw, and Tickmill Trader Raw. The Classic Account features spreads starting at 1.6 pips on major currency pairs with no commission. The Raw Account offers tighter spreads from 0.0 pips on major pairs, with a $3 commission per lot per side. Similarly, the Tickmill Trader Raw Account provides spreads from 0.0 pips, with a $3.5 commission per lot per side.

Finally, Tickmill is regulated by several reputable financial authorities. These include the FSCA in South Africa, the FCA in the UK, the CySEC in Cyprus, and the ASIC in Australia. On top of that, it is authorised by the CONSOB to provide services in Italy.

Trading Forex and CFDs entail risk and could result in the loss of your capital.

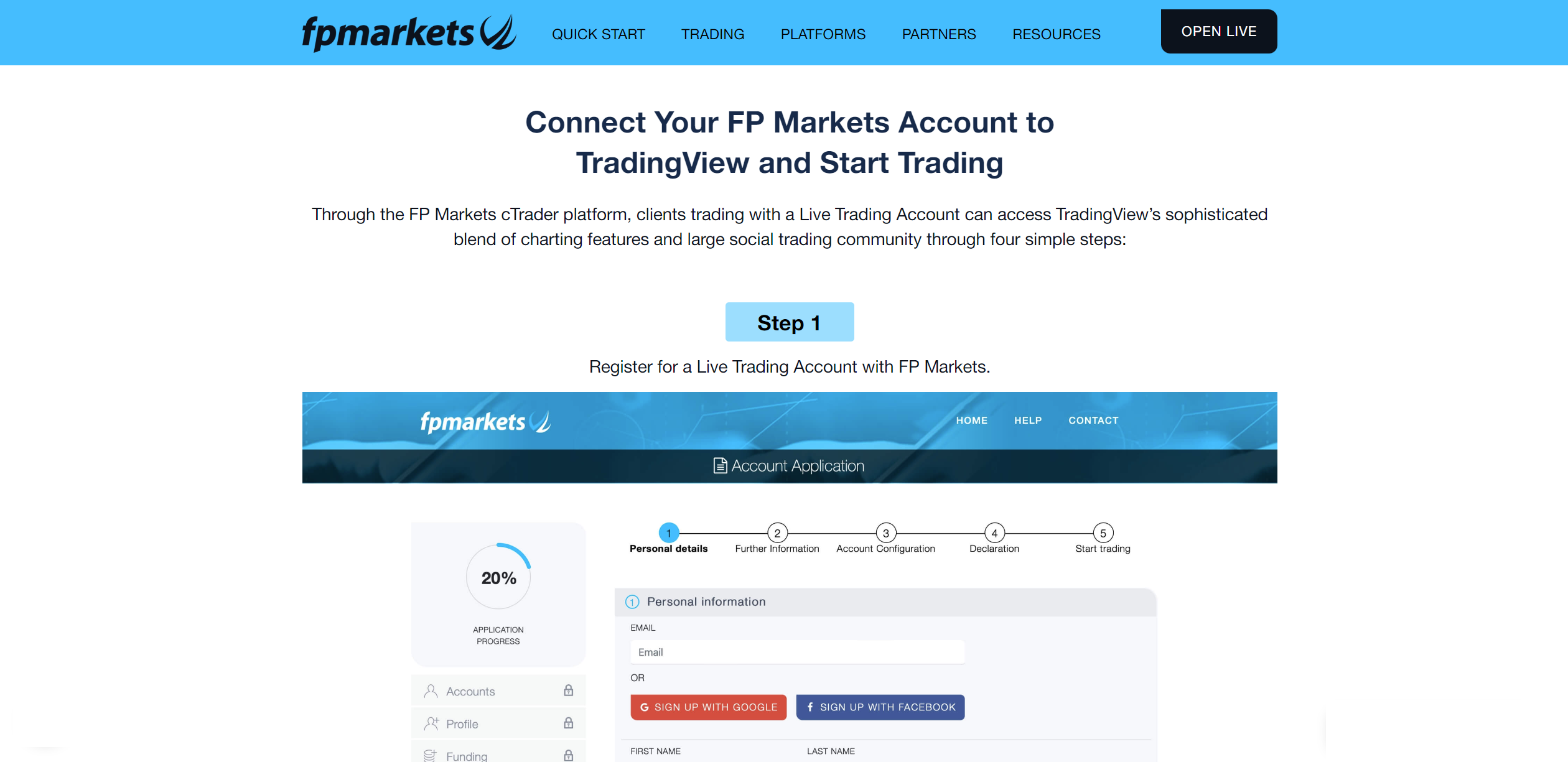

FP Markets

FP Markets is another notable addition to the list of best TradingView Brokers in South Africa. Its seamless integration with TradingView allows traders to leverage advanced charting tools, a wide range of indicators, and direct order execution from TradingView's charts. Additionally, the platform provides comprehensive real-time coverage for various global markets.

Speaking of global markets, FP Markets avails traders with one of the deepest collections of market products. It offers over 10,000 individual assets which include CFDs on forex, indices, metals, stocks, commodities, ETFs, cryptocurrencies, and bonds. In addition to TradingView, FP Markets also provides access to MetaTrader 4, MetaTrader 5, and cTrader trading platforms.

Further, FP Markets is known for its competitive pricing, offering tight spreads and low commissions. On its standard account, the spreads start from as low as 1.0 pips with no commission charged. In comparison, the raw account has a spread from as low as 0.0 pips with a commission of $3 per side per lot.

Finally, FP Markets holds regulatory licenses from various institutions. For starters, it is regulated in South Africa by the local regulator, the FSCA. Additionally, it holds regulatory licenses from the CySEC and the ASIC.

Trading Forex and CFDs entail risk and could result in the loss of your capital.

Forex.com

Forex.com is a well-established broker renowned for its robust trading platforms and global presence. For South African traders, Forex.com’s seamless integration with TradingView offers an advanced charting tool with direct order execution capabilities. It allows investors to trade directly from TradingView’s charts. TradingView’s rich feature set is fully supported by Forex.com. These include over 80 default indicators, access to a global community of traders, and access to live market data. These are great features for enhancing trading efficiency and convenience.

Forex.com offers a wide range of financial instruments which include CFDs on forex, stocks, indices, cryptocurrencies, commodities, and precious metals. In total, the broker avails over 5,500 different market products, enabling traders to diversify their portfolios. Traders can also access multiple trading platforms, such as MetaTrader 4, MetaTrader 5, and Forex.com Trader, alongside TradingView.

The spreads involved when trading depends on the account a trader uses. The Standard account offers spreads starting as low as 0.8 pips, while the MetaTrader account begins at 1.0 pips. Both of these accounts do not charge a commission. In comparison, the Raw account features spreads starting from 0.0 pips but charges a commission of $5 per $100,000 traded.

On regulations, this broker holds licenses from several organisations. While not regulated in South Africa by the FSCA, it has a strong regulatory framework. It holds regulatory licenses from the ASIC, the FCA, the CySEC, and the CFTC and the NFA in the US, among others.

Trading Forex and CFDs entail risk and could result in the loss of your capital.

BlackBull Markets

BlackBull Markets is a globally respected brokerage that offers seamless integration with TradingView. TradingView provides up to 25 indicators per chart, 8-chart layouts, and 400 price and technical alerts to South African traders on BlackBull Markets. Moreover, through this integration, traders can execute orders directly from TradingView’s sophisticated charting interface.

BlackBull Markets operates under the strict regulatory oversight of the FMA and FSPR in New Zealand, and the FSA in Seychelles. While not regulated by the FSCA, the regulations from the other organisations provide a degree of security and oversight.

BlackBull Markets provides access to a wide range of financial instruments from a variety of markets. The global markets that traders can trade when connecting TradingView to BlackBull Markets include CFDs on forex, commodities, indices, shares, and cryptocurrencies. In addition to TradingView, BlackBull Markets supports MetaTrader 4 and MetaTrader 5 platforms, ensuring flexibility.

When it comes to pricing, BlackBull Markets offers competitive spreads and account options to suit different trading styles. Traders can select from three ECN account types: Standard, Prime, and Institutional. The Standard account offers competitive spreads starting at 0.8 pips with no commissions. For tighter spreads, the Prime account provides spreads from 0.1 pips but charges a commission of $6 per lot. Finally, the Institutional account boasts the lowest spreads from 0.0 pips but includes a $4 commission per lot.

Eightcap

Eightcap is a highly regarded broker known for its robust trading infrastructure and excellent integration with TradingView. This compatibility allows South African traders to leverage TradingView’s advanced charting tools, over 100,000 community-built indicators, and a vibrant community of traders. Orders can be placed directly from TradingView’s charts, ensuring a seamless trading experience.

Eightcap provides access to an extensive range of financial instruments. In total, there are over 800 different instruments including CFDs on forex, commodities, indices, shares, and cryptocurrencies. Alongside TradingView, the broker supports MetaTrader 4 and MetaTrader 5. There are also a variety of trading tools available to use including Capitalise.ai and FlashTrader, among others.

Additionally, Eightcap offers competitive spreads and multiple account types tailored to different trading needs. The Standard and the TradingView accounts are commission-free, with spreads starting at 1.0 pips. In contrast, the Raw Account provides spreads from 0.0 pips with a commission of $3.5 per side per standard lot.

Regarding regulations, Eightcap operates under the supervision of a variety of organisations. These include the ASIC, the FCA, and the SCB in the Bahamas.

How To Connect TradingView With Your Trading Account

Integrating TradingView with a broker account is fairly straightforward. Here's a general guide on how to do it:

- Create Accounts - You will need to create an account with both TradingView and a broker of your choice that supports TradingView integration. If you already have an account with a broker, then make sure it is funded and active.

- Log Into TradingView - Go to the TradingView website or app and log in to your TradingView account. From here, open any chart on TradingView and navigate to Trading Panel at the bottom of the chart interface. Click on it to expand.

- Select Your Broker and Log In - Once you click on Trading Panel, you'll see a list of supported brokers within the Trading Panel. Find and click on your broker’s name from the list. A pop-up window will appear asking you to log in to your broker account. Once the login process is complete, your brokerage account should be connected to TradingView.

Benefits of Using TradingView

TradingView empowers traders with a comprehensive suite of tools and resources for in-depth market analysis. Its features include:

- Advanced Charting - TradingView provides access to over 50 drawing tools and hundreds of pre-built studies to facilitate detailed analysis of popular trading concepts.

- Fundamental Data - TradingView gives access to dozens of ratios, analytical data, financial statements, and valuation analyses directly within charts.

- Publishing Videos and Community - One standout feature is the ability to publish live videos of your trading activities or watch other traders. You can connect with a large and active community to discover insights and share investment strategies.

- Customisable Indicators - TradingView allows users to create and modify their own signals and indicators for personalised analysis.

- Customizable Alerts - TradingView also allows you to set custom alerts for market conditions that meet your specific criteria. With 12 alert types, including text messages, emails, audio signals, and visual pop-ups, you’re promptly notified of significant market movements.

Final Comments

Choosing the right broker is a crucial step for any trader, especially when using a powerful platform like TradingView. This platform has revolutionised the way traders analyse and interact with the markets. The south African brokers listed above offer seamless integration with TradingView, providing South African traders with access to advanced charting tools, diverse trading instruments, and competitive pricing.

When selecting a broker, it's essential to consider factors such as regulation, instrument variety, spreads and fees, and the overall trading experience. By carefully evaluating these factors, South African traders can choose a broker that aligns with their individual trading needs and goals. It is important to conduct thorough research and potentially test the platforms with demo accounts before committing to real capital.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.