Best Forex Brokers in Maldives

The Maldives is a chain of tropical islands famous for their stunning beaches and pristine weather. It is now emerging as a hub for financial services, including forex trading. This is contributed by the Maldivians exploring ways to diversify their investments and a growing number of international investors and traders attracted by this vacation destination. However, one of the key challenges for traders in the Maldives is identifying the best forex broker that is reliable, transparent and caters to their specific needs. In this review, we are going to take a look at some of the best forex brokers in Maldives. But first, it is important to understand the forex market in Maldives and the criteria we will use.

Understanding Forex Trading in the Maldives

Forex trading is generally legal in the Maldives and traders can access forex and other global markets through various online brokers. However, the regulatory environment in this region is lacklustre, to say the least. The Maldives Monetary Authority (MMA) is the primary regulator overseeing financial services, including forex trading. However, there are not any brokers that are under the regulation of this institution. As a result, people in Maldives who are interested in trading forex must rely on international brokers. The absence of local regulations will greatly affect how we make our selections for this article. Below are the criteria we will use to select the best forex brokers in Maldives.

Our Criteria For Choosing a Forex Broker in the Maldives

- Regulations - We will look out for regulations from organisations such as the UK’s FCA, the CySEC in Cyprus, or Australia’s ASIC, among others. Being regulated by top-tier regulators means that a broker operates under strict financial standards and with transparency. Nonetheless, always ensure you find out whether your local financial market regulator requires brokers operating in your country to be licensed locally.

- Trading Platforms - We will consider the trading platform as it is the gateway to the forex market. It should be user-friendly and efficient while providing all the necessary tools and features that traders need.

- Trading Costs and Fees - Forex trading costs include spreads, commissions, and other fees. It’s important to compare brokers to find the most competitive pricing structures. Additionally, watch out for hidden fees such as withdrawal charges, inactivity fees, and conversion costs.

- Selection of Market Products - A broker with a plethora of trading instruments allows its investors to diversify their portfolios as they see fit.

With that, it is time for us to now shift our focus to some of the best forex brokers in Maldives.

Exness

Exness is a globally recognized forex broker with regulations from a variety of organisations. This broker holds regulatory licenses from the CySEC in Cyprus, the FCA in the UK, the FSCA in South Africa, and the CMA in Kenya, among others. This multi-regulatory framework is one of the reasons that makes Exness a top choice for traders in the Maldives.

Moreover, this broker has a low minimum deposit of just $10 and offers a ton of market products. With this broker, traders gain access to over 250 different trading instruments including CFDs on forex, indices, stocks, commodities, and cryptocurrencies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, Exness trader app, and Exness terminal. These are powerful trading platforms with a variety of trading tools to support investors.

Further, this broker features some of the lowest spreads in the market today. Its standard account has a spread that starts from 0.2 pips for major currencies with no commission charged. Always ensure to also check the average and typical spreads offered by a broker as they are a better representation of the market. Nonetheless, there are three professional accounts on Exness that allow investors to trade with spreads from 0.0 pips with two charging a commission. Additionally, the broker provides its traders with a cent account for investors who want to trade with lower currency units. The cent account features spreads from 0.3 pips for major currencies with no commission.

Further, Exness charges swap fees to clients who want to maintain open positions overnight. These fees are paid every day except on weekends. Luckily for Maldivians, the company offers swap-free accounts for residents of countries where Islam is the dominant religion. Moreover, Arabic is one of the supported languages on this broker site alongside English and others.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

XM.com

XM is another popular broker with millions of clients worldwide. This broker is accessible in the Maldives and features plenty of investment opportunities for Maldivians to explore. In total, there are over 1,000 different market products on this broker site. This includes CFDs on forex, stocks, indices, cryptocurrencies, precious metals, and energies. These market products are accessible industry-standard platforms including MetaTrader 4, MetaTrader 5, and their very own XM Trading Point App.

On another note, this broker offers four main trading accounts that traders can use. These accounts include the standard, the micro, the XM Ultra low account, and the shares account. Both the Standard and Micro accounts feature spreads beginning at 1.0 pips on major currency pairs, with no commissions. In contrast, the XM Ultra Low account provides spreads starting from 0.6 pips, also without any commissions. The shares account charges a commission depending on the share and the size of the trade.

XM also charges swap fees on positions left open overnight. However, XM is aware of Sharia laws and offers traders of the Islamic faith an Islamic account that does not charge interest on overnight positions. This account includes no swaps on overnight positions, no spread widening, and positions that can be held with no time limit. The minimum deposit accepted by this broker is a low $5.

In terms of regulations, XM operates under the examination of several institutions. These include the CySEC in Cyprus, the ASIC in Australia, and the FSC in Belize. There are a variety of supported languages including Arabic and English that are spoken in Maldives.

Remember that forex and CFDs available at XM.com are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

FBS

Next up is FBS. FBS is regulated by a variety of institutions including the CySEC in Cyprus, the ASIC in Australia, and the FSCA in South Africa. Additionally, FBS provides a variety of trading instruments which is a welcomed feature by many traders. These include products from global markets such as forex, indices, metals, energies, stocks, and crypto. The trading platforms available include MetaTrader 4, MetaTrader 5, and mobile apps.

Further, FBS offers some of the lowest spreads in the market today. The standard account has spreads from as low as 0.7 pips for major currency pairs with no commissions charged. The minimum deposit to start trading with FBS is $5, which provides a low entry point for new clients. There are various supported languages but English is the best option for traders in Maldives.

Remember that forex and CFDs available at FBS are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

HFM

HFM gives traders in the Maldives a plethora of market products to trade. With this broker, investors can trade over 1,000 CFDs on forex, energies, stocks, metals, commodities, cryptocurrencies, indices, bonds, and ETFs. To trade these markets, investors can pick between five main accounts. These include the Premium, the Cent, the Zero, the Pro, and the Pro Plus accounts. In some regions, the broker also avails the Top-up bonus account.

The account that a trader uses determines the spreads they will pay. The Premium and Cent accounts feature spreads starting from 1.2 pips on major currency pairs, while the Top-up Bonus account offers spreads beginning at 1.4 pips. On the other hand, the Pro account offers tighter spreads starting from 0.5 pips. Meanwhile, the Pro Plus account boasts spreads as low as 0.2 pips on major currency pairs. Importantly, none of these five accounts charge commissions for forex trading. Finally, the Zero account stands out with spreads as low as 0.0 pips, but it comes with a small commission starting at $3 per side per lot.

Another fee that applies when trading on this broker site is swap fees charged to traders for holding positions overnight. This swap fee depends on the asset and the size of a trade. However, there are swap-free versions for each of the accounts on HF Markets. This means that even Muslim traders can trade on this broker site without worrying about breaking religious laws.

Further, the regulatory status of this broker is in good standing. It holds licenses from the FCA, the FSCA, the CMA, the CySEC, and the DFSA in the DIFC. Favourably, HFM does not have a minimum deposit requirement to start trading. While the broker does not support Maldivian, it supports both English and Arabic.

Remember that forex and CFDs available at HFM are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

XTB

XTB is a reputable online forex and CFD broker with a strong presence in Europe and a growing global reach. They offer a user-friendly platform and a variety of features that could be attractive to Maldivian traders. For starters, this broker offers a wide range of CFDs on forex, commodities, cryptocurrencies, indices, stocks, and ETFs. XTB offers its proprietary xStation platform, known for its user-friendliness and advanced charting tools. It's available in various languages, including English for traders in Maldives.

On another note, XTB offers competitive trading conditions. Its standard account comes with tight spreads starting from as low as 0.5 pips on major currency pairs without any commission charges. For Maldivian traders observing Islamic financial rules, XTB offers a swap-free account that allows traders to avoid interest on overnight positions. The Swap-Free account is available with slightly higher spreads starting at 0.7 pips

Further, this broker is regulated by top-tier institutions such as the FCA in the UK and the CySEC in Cyprus. It is also under the regulation of the FSC in Belize and the KNF in Poland. It does not have a minimum deposit, allowing traders to decide on what they want to invest.

Remember that forex and CFDs available at XTB are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

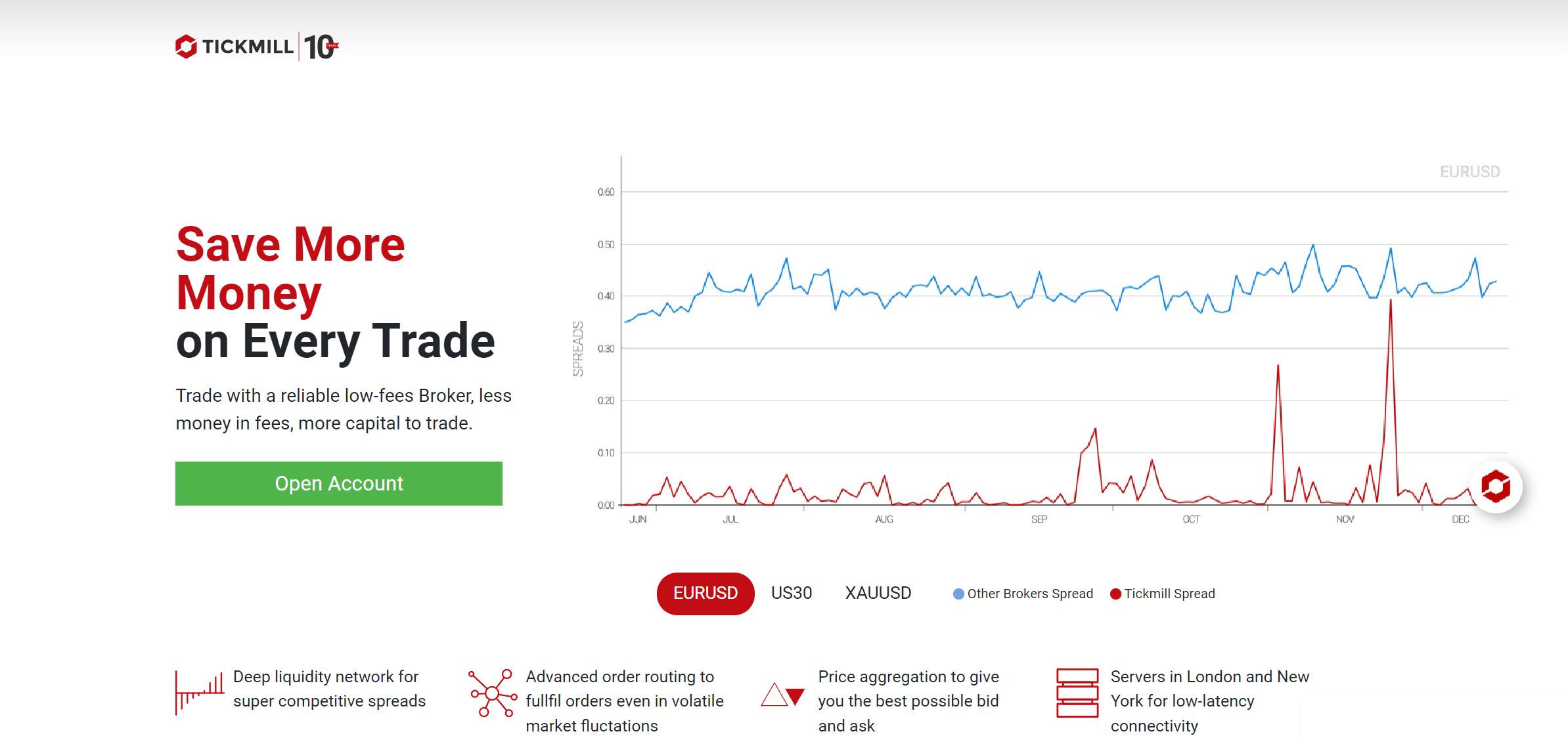

Tickmill

Tickmill is another excellent choice for forex traders in the Maldives. This broker is known for its strong regulatory standing, being licensed by authorities like the FCA, the CySEC, the ASIC, and the FSA in Seychelles. Such regulatory oversight means that Tickmill adheres to high standards of financial transparency and client protection.

Another one of Tickmill’s key strengths is its low trading costs. Traders benefit from some of the tightest spreads in the market. The Classic account provides spreads as low as 1.6 pips without additional commissions. The Pro account offers spreads from 0.0 pips but charges a commission of 2 currency units per side for every 100,000 traded. Finally, the VIP account also has spreads from 0.0 pips but with a lower commission 1 currency unit per side for every 100,000 traded.

Tickmill also offers a variety of market instruments, including forex, stock indices, metals, bonds, commodities, and cryptocurrencies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and mobile apps. With a minimum deposit of $100, traders can start investing with this multi-asset broker in the Maldives.

Tickmill supports a variety of languages but Maldivians may have to only use English as Maldivian and Arabic are not available. However, Tickmill provides Islamic accounts that are swap-free, ensuring compliance with Sharia law by eliminating overnight interest charges.

Remember that forex and CFDs available at Tickmill are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Our Conclusion on The Best Forex Brokers in Maldives

Forex trading in the Maldives is growing in popularity, but choosing a reliable broker is essential for a successful trading experience. While regulations in Maldives are lacklustre, traders can prioritise international brokers with strong regulations elsewhere.

The brokers we listed here not only have good regulations, but they also offer a variety of features and benefits, including competitive spreads and a wide range of tradable instruments. Additionally, user-friendly platforms and Islamic swap-free accounts. Nonetheless, please note that this article only provides a general overview of forex brokers in the Maldives. It is very crucial to conduct thorough research and due diligence before selecting a broker.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.