Best ECN Brokers with Low Minimum Deposit

Forex brokers with no or low minimum deposits are ideal for beginning traders. They are also ideal for clients who do not have a large capital to invest. Brokers can attract such clients and potentially retain them as long-term customers by offering a low minimum deposit. They encourage investors to trade in smaller increments, which can benefit both the investor and the broker.

Smaller trades may be less risky for the investor and may result in more frequent trading activity, which may result in more commissions for the broker. They lower entry barriers and improve access to financial markets.

In this review, we are going to look at some of the best ECN brokers with low minimum deposit. let’s jump in.

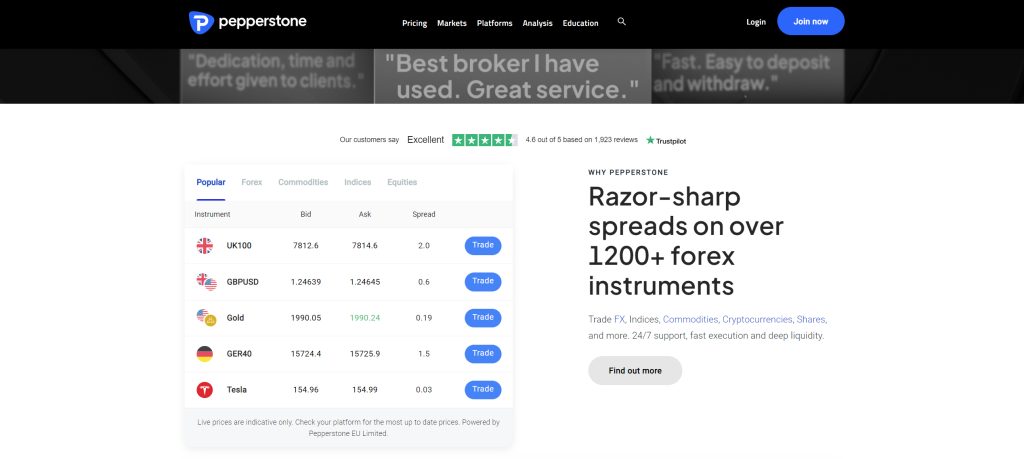

Pepperstone

Pepperstone is an ECN broker because it does not maintain a proprietary trading book. There is no minimum deposit set by the broker, but Pepperstone recommends a minimum deposit of AUD$200 or equivalent. Clients can deposit using different methods such as Visa, Mastercard, Bank transfers, MPESA, and PayPal.

Pepperstone offers CFDs trading in over 1,200 trading instruments. These include trading instruments from the forex, shares, indices, ETFs, commodities, cryptocurrencies, and currency indices markets. These instruments are available to trade on various industry-standard platforms. Clients can choose between TradingView, MetaTrader 4, MetaTrader 5, and cTrader. Regardless of the platform, Pepperstone has one of the fastest order execution times in the market. Most orders are executed in less than 30 milliseconds (Pepperstone Group Limited) and 60ms (Pepperstone Limited).

Further, the fees for trading on this broker site are fairly low with spreads as low as 1.0 pips on the standard account. However, clients can trade with even lower fees on the razor account with spreads as low as 0.0 pips and a commission from €2.60 per side per lot on forex. In terms of regulation, Pepperstone operates under the watchful eyes of the FCA, the ASIC, the BaFin, and the CMA.

75.5% of retail CFD accounts lose money

FP Markets

As an ECN broker, FP Markets receives price feeds directly from their liquidity providers. It provides an environment for investors to trade forex and CFDs on Forex, Indices, Shares, Commodities, Metals, crypto, Bonds, and ETFs. It has two account types which are standard and raw. Both of these require a minimum deposit of $100 AUD or equivalent.

Depositing funds is possible through various payment methods. These include credit cards, debit cards, e-wallets such as Neteller and Skrill, and bank wire transfers, among others. Better yet, FP Markets supports instant deposits on many of these payment options. Additionally, FP Markets has no deposit fees and will cover all internal bank fees for all international deposits.

FP Markets takes pride in being one of the forex brokers providing ECN pricing with some of the lowest spreads. The spreads start as low as 0.0 pips on its Raw account and a commission of $3 per side per lot. on the other hand, clients can trade on spreads starting from 1.0 pips on the standard account with no commissions paid.

The various trading instruments provided by FP Markets are traded on a great lineup of platforms. These include MetaTrader 4, MetaTrader 5, IRESS, cTrader, WebTrader, and mobile apps for iPhone and Android devices. These platforms are industry standard and fast enough to land FP Markets among the fastest execution brokers in the world.

Finally, FP Markets is regulated by the CySEC in Cyprus, the ASIC in Australia, and the FSCA in South Africa.

71.23% of retail CFD accounts lose money

Forex.com

Forex.com is another broker with ECN services that accepts a low minimum deposit. The initial deposit accepted by Forex.com is $50. However, Forex.com recommends that clients deposit at least $1,000 in order to have greater flexibility and risk management when trading. The broker supports credit cards, debit cards, Skrill and Neteller e-wallets, as well as wire transfers. Forex.com does not charge any deposit fees. Note that PayPal deposits are not available for corporate accounts and are only available in certain countries.

Notably, Forex.com provides over 5,500 trading instruments which are all CFDs. Clients from most countries can trade forex pairs alongside CFDs on stocks, commodities, cryptocurrencies, and indices. On the other hand, clients from the US can trade over 80 currency pairs, Gold and Silver, Futures and Futures Options. There are four main trading platforms that clients can choose from. These include MT4, MT5, TradingView, and Forex.com Trader.

Further, Forex.com has three accounts: a standard account, a commission account, and a direct market access account. ECN services are offered on the Direct Market Access account. This account charges clients a commission depending on the trading volume of a client. For example, a trader with a trading volume of $0M – $100M per month would pay a commission of $60 per $1 million traded. The commission account features spreads starting from 0.2 pips and charges a commission of $5 per 100k traded. Traders who do not want to pay commissions can trade on the standard account that features spreads starting from 0.8 pips for major currency pairs.

Lastly, Forex.com is regulated by the FCA, the ASIC, the IIROC, the CySEC, the CFTC and the NFA. These are some of the best financial regulators in the world.

77.7% of retail investor accounts lose money when trading CFDs with this provider.

Axi

Axi is another ECN broker that accepts a low minimum deposit. Axi has a minimum deposit of $0 which means that you can start trading with any amount, no matter how little. It supports several funding methods including credit/debit cards, bank transfers, Neteller, Skrill, Sofort, GiroPay, iDeal, Polish Internet Banking, Global Collect, and China Union Pay.

Clients have several trading instruments to invest in from various asset groups. Clients can trade in the forex, crypto, commodities, shares, and indices markets. It has three trading accounts to choose from; standard, pro, and elite.

The spreads on Axi depend on the account clients choose. On the standard account, the spreads start from 0.4 pips and 0.0 pips on the Pro account. The pro account, however, charges a commission of $7 per round trip. The elite account also features spreads as low as 0.0 pips and a low commission of $3.50 per round trip.

Several international regulators have granted permission for Axi to operate within their jurisdictions. These include two top-tier regulators in the FCA in the UK and the ASIC in Australia. Companies with tier-one regulations always have a better reputation in the market than unregulated ones.

FXTM

FXTM is another ECN broker with MT4 that offers its clients a good amount of forex pairs and CFDs for trading. Here, there are various accounts to choose from. The various ECN accounts include the Stocks Account, ECN Account, ECN Zero Account, and FXTM Pro Account. Among these, the ECN zero account has the lowest minimum deposit at $200. This is fairly low compared to other ECN brokers on the market.

Nonetheless, clients can trade on the Micro account without ECN services with a small investment of $10. FXTM supports various ways of payment methods including credit cards, debit cards, e-Wallets, crypto, Bank Wire transfers and local payment solutions.

Further, clients can trade a variety of global markets including forex, indices, stocks, metals, commodities, and cryptocurrencies. The spreads can go as low as 1.3 pips for major currency pairs on the standard account. The popular trading platforms MetaTrader 4 and MetaTrader 5 are available on the FXTM broker site alongside the FXTM Trader.

Finally, FXTM is a regulated company in two of the most heavily regulated forex markets. The company is regulated by the FCA in the UK and the CySEC in Cyprus. These are two vital regulations for a broker to have in order to operate in the UK and Europe at large.

InstaForex

InstaForex considers itself one of the most popular ECN brokers in the world. InstaForex clients have 24-hour access to ECN trading due to high internal liquidity rates and reliable counteractors. The minimum deposit supported by this broker sits at a mere $1. Clients can start trading with this small investment on an ECN broker that offers a variety of instruments.

Here, clients can trade CFDs on forex, shares, indices, metals, oil and gas, commodity futures, cryptocurrencies, and instafutures. There are four main accounts which include Insta.Standard, the Insta.Eurica, the Cent.Standard, and the Cent.Eurica accounts. Additionally, clients have several trading platforms to choose from including MT4, MT5, Multiterminal, WebTrader, and InstaTick Trader. Diversity is greatly supported on this broker site.

The spreads on InstaForex depend on the account a user is on. There are two main spread-based accounts, the Insta.Standard and the Cent.Standard accounts. The spreads on these accounts range from 3 to 7 pips. The Cent.Standard account is best suited for traders who want to invest small amounts at a time. There are a number of reputable forex brokers that offer cent accounts to their clients and InstaForex is one of them.

Lastly, we look at the regulation of this company as reliable regulations are a top requirement for any broker that appears in our articles. Luckily, InstaForex is regulated by the CySEC which has strict rules and laws to follow. It is also regulated by the BVIFSC and the FSC.

Fusion Markets

Another ECN broker that accepts a low minimum deposit is Fusion Markets. It offers several products from a variety of markets including forex, energy, precious metals, Equity indices, shares, and commodities. It has two main accounts to choose from; the Zero account and the Classic account. The Zero account has low spreads starting from 0 pips and a $2.25 per lot commission. The Classic account, on the other hand, features spreads from 0.9 pips and zero commissions.

Interestingly, Fusion Market’s minimum deposit is $0, meaning that clients can deposit any amount and start trading. It accepts credit/debit cards, PayPal, Skrill, Neteller, Fasapay, Jeton Wallet, Perfect Money, Online Naira, Doku, Cryptos, and bank wire. Clients have access to both MT4 and MT5 on this broker site.

Finally, Fusion Markets is regulated primarily by the Australian Securities and Investment Commission (ASIC). Regulators keep companies in check ensuring they maintain fair trading conditions for investors.

Roboforex

Roboforex closes out our list of some of the best ECN brokers with low minimum deposits. This broker offers two accounts to traders, the ECN account and the Prime account. These accounts allow clients to trade with ultra-low spreads starting from 0.0 pips. As expected, both of these accounts require clients to pay a commission when trading. The ECN account requires a commission of $20 while the Prime account charges a commission of $10 and above.

The minimum deposit for the ECN accounts on this broker site is $10. There are several methods of deposit which include Bank Transfers, e-wallets such as Skrill, Neteller and Perfect Money, AdvCash, and Bank cards.

The trading platforms available to clients include the R WebTrader and R MobileTrader, R StocksTrader, MetaTrader 4, and MetaTrader 5. Some of the markets traders can invest in on RoboForex include forex, stocks, indices, ETFs, commodities, metals, energy commodities, and cryptocurrencies.

This wide range of trading instruments is a characteristic of brokers who cater to diverse investors. RoboForex has over 12 yeast of experience serving forex traders and has regulatory licenses from the CySEC and the FSC. While the FSC might be a more relaxed regulator, the CySEC is one of the best watchdogs in the market. It ensures that brokers follow strict policies before handing them a license and authorization.

Final Thoughts

A small minimum deposit allows clients to start investing without needing to invest large sums of money. This greatly reduces the entry barrier to trading financial markets. Additionally, traders can take advantage of low minimum deposits to practice their trading strategies. There is a clear need for low minim deposit ECN brokers in the market.

Needless to say, even with small minimum deposits, you should still exercise extreme caution and always conduct thorough due diligence on a broker before investing. It is critical to pay attention to the regulatory status, availability of assets, fees, and trading platforms offered by a broker.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.