Top 10 Copy Trading Platforms

The rise of copy trading has significantly transformed the world of online trading. This innovative approach simplifies the trading process by allowing users to automatically replicate the trades of other investors of their choosing. This makes trading accessible to a wide range of traders, regardless of their expertise or time constraints.

For those new to the markets or with limited knowledge, copy trading provides an opportunity to benefit from the expertise of seasoned traders. Similarly, busy individuals who lack the time to analyse market trends can still participate in trading by leveraging the skills of others.

With numerous Forex and CFDs brokers now supporting copy trading, the options are vast. In this guide, we will look at probably the top 10 copy trading platforms in the world, exploring their features, benefits, and what makes them stand out.

How Does Copy Trading Work?

Before we list our top picks for the best copy trading platforms, let’s first understand how this process works. Copy trading is a modern investment strategy that allows individuals to automatically replicate the trades of experienced traders. Essentially, it bridges the gap between those with limited trading knowledge and the complexities of financial markets.

In this system, investors choose traders to follow based on their performance and trading strategies. The copy trading platform then automatically replicates the chosen trader's trades in the follower's account in real time.

Copy trading is facilitated through brokerage platforms that offer this feature, either as an in-built service or through third-party integrations. For the best copy trading experience, traders should choose quality brokers with seamless copy trading integration.

How To Select a Broker For Copy Trading

Selecting a broker for copy trading involves evaluating several key factors to ensure reliability and ease of use. Here are the main aspects to consider when choosing a copy trading broker:

- Regulation - Ensure the broker is regulated by a reputable financial authority, such as the FCA (UK), CySEC (Cyprus), ASIC (Australia), or FSCA (South Africa). Regulation provides a layer of security and ensures the broker adheres to strict financial standards.

- Copy Trading Platform - Ensure the broker offers built-in copy trading features or supports third-party platforms like ZuluTrade, Myfxbook AutoTrade, DupliTrade, or MetaTrader’s Signal Service, among others.

- Fees and Costs - Compare the fees charged by different brokers, including spreads, commissions, and any additional costs for using copy trading services. Make sure the fee structure is transparent and aligns with your budget.

- Range of Tradable Assets - Consider the variety of assets available for trading, such as forex, stocks, commodities, and cryptocurrencies. A broker with a diverse range of assets allows you to copy trades across different markets

With these factors in consideration, let’s take a look at some of the best copy trading forex brokers.

Exness

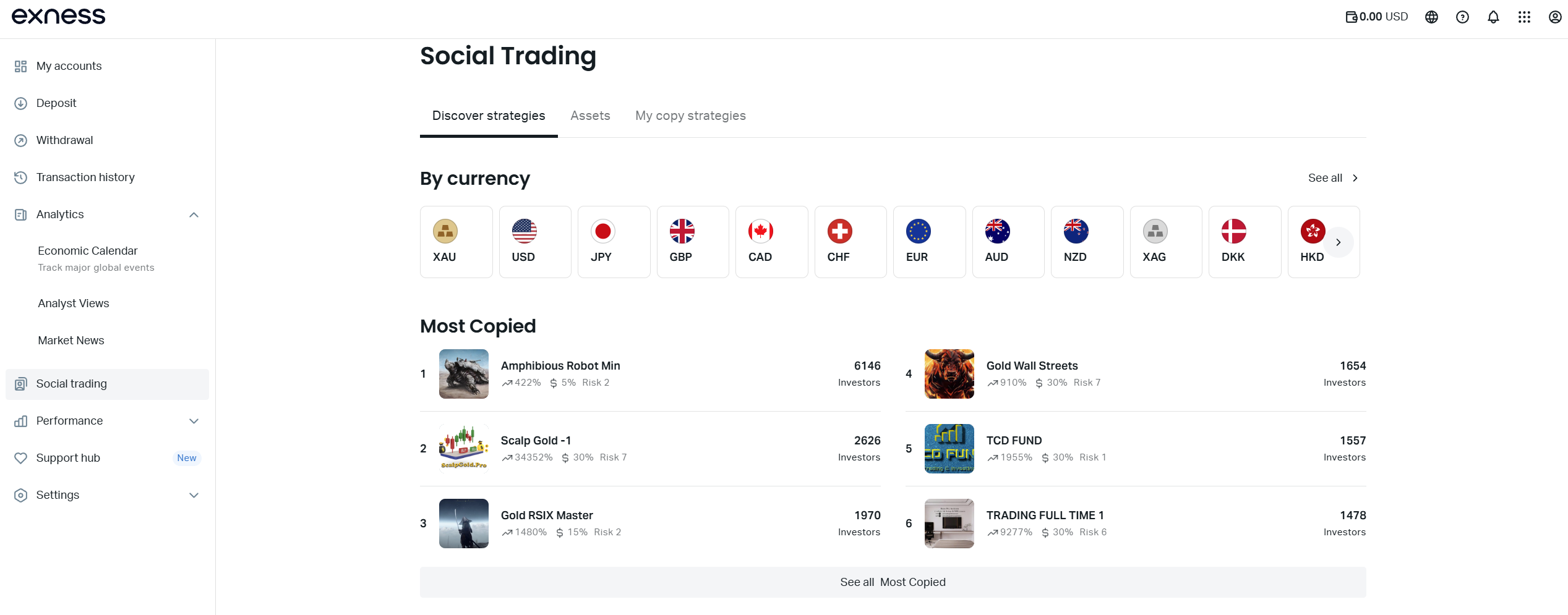

Exness is one of the top brokers that offers a copy trading platform to its clients. Its Social Trading feature allows investors to participate in the market by copying the trades of other investors. To make the process seamless, Exness provides a leaderboard feature that showcases the performance of various strategy providers on the platform. Here, people can access the track record, risk levels, and profitability of strategy providers to help them determine who to follow.

Strategy providers have something to gain from Exness Social Trading. Exness' social trading platform enables them to monetise their expertise and set their own commission rates that can go all the way up to 50%. As such, they can earn an extra income which they can channel back into trading or withdraw.

There are three different accounts that Strategy Providers can use to participate in Exness Social Trading. These include the Social Standard, the Social Pro, and the Pro accounts. The Social Standard account has a minimum deposit of $200* and has a spread from as low as 1.0 pips for major currency pairs plus no commission charged. In contrast, the Social Pro account requires a minimum deposit of $2,000 and has a spread from as low as 0.6 pips for major currency pairs with no commission charged.

The minimum deposit for these accounts can be different depending on a trader’s country of residence. Meanwhile, the Pro has a spread from as low as 0.4 pips with no commission charged. The minimum deposit for this account fully depends on the country in which a trader resides.

All three of these accounts have swap-free versions to accommodate Muslim traders who cannot pay overnight fees. For the Social Standard and the Social Pro accounts, there are only three markets available to trade, which include forex, metals, and cryptocurrencies. In contrast, the Pro account offers five different market classes including forex, metals, cryptocurrencies, energies, stocks, and indices. All instruments on Exness are CFDs.

For followers (investors), they need to create an account by filling in their personal information using the Social Trading app or the Social Investor Web Investor terminal. If you already have an Exness account, select Sign in and log in using your registered email and Personal Area password.

Exness’ Key Features

We have looked at the accounts that Exness offers for Social Trading. However, this broker has several other accounts to accommodate traders with a wide range of strategies and backgrounds. There are two Standard accounts and three different Professional accounts. These accounts have highly competitive spreads with the standard account having spreads from as low as 0.2 pips with no commissions. The professional accounts have even lower spreads starting from 0.0 pips with two of the accounts charging commissions.

There are three main trading platforms on Exness including MetaTrader 4, MetaTrader 5, and Exness Terminal. On another positive note, Exness is a regulated broker in several jurisdictions. These include in the UK by the FCA, in Cyprus by the CySEC, in South Africa by the FSCA, and in Kenya by the CMA, among others.

While Exness accepts traders from most countries around the world, they do not accept retail clients from the UK and European Economic Area countries, among others.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Pepperstone

Pepperstone is another leading broker that has gained popularity for its robust copy trading capabilities. It has recently partnered with Pelican Exchange Ltd to bring its clients CopyTrading by Pepperstone, which offers a refined copy trading experience.

To participate in copy trading on Pepperstone, you first need to have an MT4 or MT5 account. From there, you need to download the CopyTrading by Pepperstone app which is available on both the App Store and Google Play. Once you download the app, you need to create a copy trading account on the app and link it to your MT4 or MT5 account through the settings.

From the Discover tab of the app, you can explore various signal providers or search for a specific one. Once you find a signal provider you wish to follow, simply click on copy. From there, read all the details, adjust your trade size settings, and click on Agree and Copy when you’re ready. Unfortunately, this is only available on mobile.

However, Pepperstone also offers copy trading through two third-party integrations accessible via all kinds of devices, including PCs and the Web. First, it has partnered with Signal Start. This is a professional, forex-signals service that allows providers to send, and followers to receive trading signals conveniently and transparently. To use this platform, traders need to have an MT4 or MT5 Pepperstone trading account.

Further, Pepperstone offers copy trading through cTrader Copy. This integration gives traders access to the strategies of seasoned traders and allows them to start copying their actions. cTrader ensures that strategy providers have a proven track record and lists them according to their performance stats and track record.

Pepperstone’s Key Features

Pepperstone excels in many areas which makes it one of the top platforms for copy trading. This broker offers competitive trading conditions on its two accounts. Its standard account has a spread as low as 1.0 pips for major currency pairs with no commission charged.

It also offers a razor account with a commission as low as 0.0 pips plus a commission that depends on the trading platform that a trader uses. This broker offers five different trading platforms, which include MT4, MT5, cTrader, TradingView, and the Pepperstone Trading Platform.

On market products, this broker gives access to a diverse collection of instruments. These include CFDs on forex, shares, commodities, cryptocurrencies, ETFs, and indices. On another note, Pepperstone is a regulated broker with licenses from various institutions. These include the FCA in the UK, the DFSA in the DIFC, the ASIC in Australia, the CySEC in Cyprus, and the BaFin in Germany, among others.

75.3% of retail CFD accounts lose money

eToro

eToro is one of the most well-known and widely used copy trading platforms in the world. Founded in 2007, eToro was one of the pioneers of social trading by introducing its CopyTrader feature. This feature allows users to automatically replicate the trades of top-performing investors. CopyTrader is built to be simple and intuitive.

On this platform, traders can find thousands of investors on the Copy Discover page, each with a unique strategy, risk level and transparent track record. Once you find a trader to follow, hit the copy button and choose how much you want to allocate to the trader. You can choose one or multiple traders to follow. The platform allows traders to follow up to 100 different investors.

Moreover, this platform offers one of the largest collaborative communities of traders in the world. This offers a place to connect, share, and learn from other investors. You can chat with them, discuss strategies and benefit from each other.

Moreover, this platform offers one of the largest collaborative communities of traders in the world. This offers a place to connect, share, and learn from other investors. You can chat with them, discuss strategies and benefit from each other.

eToro’s Key Features

eToro offers a deep collection of market products from a variety of global markets. In total, this broker allows its investors to access more than 7,000 different instruments which include CFDs on forex pairs, commodities, indices, stocks, ETFs, and cryptocurrencies. On top of that, the broker supports the trading of real stocks and cryptocurrencies. The spreads are fairly low, with major currency pairs having spreads that start from 1.0 pips. The only trading platform available is the broker’s proprietary eToro platform.

Further, this broker is also under the regulation of various institutions. These include the FCA, the CySEC, the ASIC, and the MFSA in Malta, among others. With such regulations, eToro remains one of the best choices for copy trading.

61% of retail investor accounts lose money when trading CFDs with this provider.

HFM

HFM is a globally recognised broker that offers a robust copy trading platform through its HFcopy feature. HFcopy is HFM’s proprietary copy trading platform that allows users to automatically replicate the trades of other investors. Users can browse through a list of strategy providers, view their performance metrics, and choose to copy their trades with ease.

To participate in HFM’s copy trading, traders must first have an account with HFM. They then need to have a copy trading account. There are three different accounts available to both followers and strategy providers, which include a copy cent, a copy premium, and a copy pro account. Followers can only copy strategy providers with the same account to them. For example, followers with copy cent accounts can only follow strategy providers with copy cent accounts.

A copy cent account requires a minimum deposit of $25 for strategy providers and $10 for followers. It features spreads from 1.2 pips with no commission and only offers access to CFDs on forex and gold. Meanwhile, a copy premium account requires a minimum deposit of $100 for strategy providers and $25 for followers.

It has spreads from 1.2 pips with no commission and offers access to CFDs on forex, indices spot, gold, energies spot, and silver. Finally, the copy pro account has a minimum deposit of $100 for both followers and strategy providers. It offers spreads from 0.6 pips with no commission charged and offers access to CFDs on forex, indices spot, gold, energies spot, and silver.

Additionally, strategy providers have two different trading account categories, which include the Copy Standard and the Copy Plus accounts. Both the copy standard and the copy plus accounts have a minimum deposit of $100.

The Copy Standard account is not visible on the strategy provider list and has a funds-under-management limit of $300,000. On the other hand, the Copy Plus account allows investors to choose between public or private visibility and has no limit on funds under management. Additionally, opening a Copy Plus account requires proof of trading history, whereas this is not necessary for a Copy Standard account.

HFM’s Key Features

HFM offers a wide range of tradable assets, including CFDs on forex currency pairs, indices, stocks, metals, energies, commodities, bonds, ETFs, and cryptocurrencies. The broker supports a variety of trading platforms including MetaTrader 4, MetaTrader 5, and the HFM Platform. There are a variety of accounts for traders to use, which determine the spreads that traders enjoy.

The spreads are as low as 0.2 pips on the pro-plus account. Additionally, the broker also offers a zero spread account with spreads from 0.0 pips plus a commission of $3 per side per lot. In terms of regulations, this broker is under the supervision of the FCA, the CySEC, the FSC, the FSCA in South Africa, and the FSA in Seychelles, among others.

While HFM accepts traders from the UK and European Economic Area countries, they do not provide copy trading services in these regions.

68% of retail investor accounts lose money when trading CFDs with this provider.

Octa

Octa offers a robust copy trading platform that is designed to accommodate traders with diverse backgrounds and expertise. In this system, there are two types of traders, Copiers and Master Traders. Master Traders are the investors who serve as strategy providers within the system. In contrast, Copiers are the traders who replicate the trading moves of Master Traders.

Octa simplifies the process for Copiers to monitor and evaluate which Master Traders they want to follow. The Master Trader’s rating system ranks the traders by past performance and provides other details like risk tolerance and commissions they charge. Copiers can also filter Master Traders by performance over specific timeframes, risk score, minimum investment, and required expertise.

Additionally, Copiers have full control over the copy trading system. They can decide how many Master Traders to copy, adjust trade sizes, and manually close any copied trade at any time. Importantly, their trading statistics remain private and are only visible to them.

For Master Traders, the system offers an opportunity to earn extra income by charging Copiers a commission for their strategies. Master Traders have complete control over the commission amount they set. However, Octa deducts a 12% commission from the earnings of Master Traders for providing this service.

It’s worth noting that Octa Copy Trading is exclusively available on the MetaTrader 4 (MT4) platform. Both Copiers and Master Traders must have an MT4 trading account with Octa to participate in the system.

Octa’s Key Features

Octa provides traders with a wide range of market products, enabling them to diversify their investments. Traders can speculate on CFDs across various asset classes, including forex, cryptocurrencies, commodities, indices, and stocks. Other than MetaTrader 4, traders can also trade using MetaTrader 5 and OctaTrader.

The broker offers two account types, both featuring spreads starting from 0.6 pips for major currency pairs with no additional commission charged. Additionally, Octa is a regulated broker. It operates under the regulation of the FSCA in South Africa and the MISA in Mwali.

While Octa accepts traders from most countries around the world, they do not accept retail clients from the UK and EEA countries, among others.

Remember that forex and CFDs available at Octa are leveraged products and can result in the loss of your entire capital.

XM

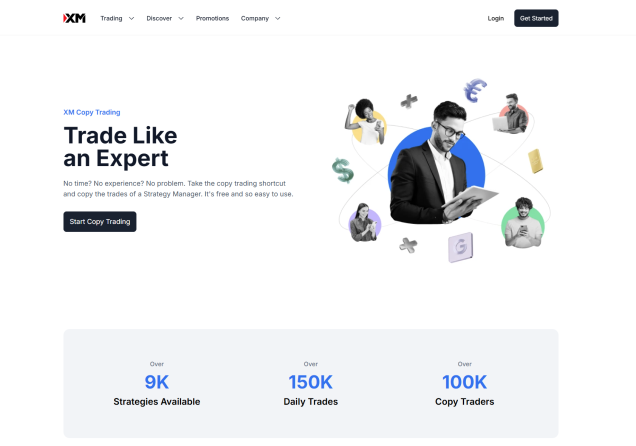

XM is another well-established broker that offers copy trading services through its XM Copy Trading feature. This feature allows traders to browse through a list of investors, view their performance metrics, and choose to copy their trades with just a few clicks.

XM also provides detailed statistics on each trader, including their win ratio, number of investor followers, total amount invested, and even return percentage. One of the standout features of XM’s copy trading platform is its flexibility. Users can allocate a specific amount of their capital to copy trades.

With over 9,000 different options, XM has no shortage of strategies to follow. Strategy Providers on the XM Copy Trading platform can earn up to 50% in profit share. To participate in copy trading on XM.com, a trader first needs to have an account with XM. They then should sign up to XM Copy Trading as an investor or a strategy provider.

XM’s Key Features

XM stands out as a quality broker offering investors a ton of market products. With this broker, traders gain access to 1,400 assets including CFDs on forex, equity indices, shares, cryptocurrencies, commodities, metals, stocks, and energies. To trade these market products, XM offers MetaTrader 4 and MetaTrader 5 trading platforms alongside its own XM Trading app.

The spreads offered by this broker are competitively low starting from 1.6 pips on the standard account and 0.8 pips on the XM Ultra Low account. Both of these accounts allow investors to trade with no commissions charged. In terms of regulation, XM is licensed by several financial authorities. These include the CySEC, the ASIC, the FSC in Belize, and the DFSA.

While XM accepts traders from the UK and European Economic Area countries, they do not provide copy trading services in these regions.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Tickmill

Tickmill is a well-regarded forex and CFD broker that offers a competitive copy trading experience. It offers this through an integrated platform that allows traders to connect to other accounts and copy their trades or to become Strategy Providers. The leaderboard here provides a ranking of strategy providers with the top performers at the top. The Rating system is simply an aggregated value calculated by Tickmill using various weighted return and volatility characteristics.

One of the standout features of Tickmill’s copy trading platform is its flexibility. Users can allocate a specific amount of their capital to copy trades, allowing them to manage their risk effectively. To participate in copy trading on Tickmill, traders first need to have a live trading account, and then they should sign up as followers or as strategy providers. To become a Strategy Provider, traders need to have a Tickmill account with a balance of at least $250 or equivalent in other currencies.

Both MT4 and MT5 are eligible for Tickmill Social Trading. Please note, however, that if you have an MT4 account and the Strategy Provider you follow is trading CFD Stocks, you will not be able to copy those trades as Stocks are only available on MT5.

Tickmill’s Key Features

Tickmill offers a wide range of tradable assets, including CFDs on forex, indices, stocks, commodities, bonds, metals, and cryptocurrencies. The broker offers a suite of trading platforms, including MetaTrader 4, MetaTrader 5, and Tickmill Trader. Clients have a choice of three account types, each offering different spreads and commission structures.

The spreads are from as low as 1.6 pips on the Classic account with no commission charged. They are even lower on Tickmill’s two Raw Spread accounts from 0.0 pips plus a commission depending on the platform. Additionally, Tickmill is regulated by several financial authorities such as the FCA, the CySEC, the ASIC, and the FSCA, among others.

While Tickmill accepts traders from the UK and European Economic Area countries, they do not provide copy trading services in these regions.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

FP Markets

FP Markets is a highly respected forex and CFD broker that supports social trading. Notably, FP Markets provides flexible copy trading options. First, users can directly utilise the built-in copy trading features within MetaTrader 4 and 5 to automatically replicate the moves of other investors of their choice. The built-in copy trading features of MT4 and MT5 enable seamless trade replication.

Additionally, investors can opt for Signal Start, a comprehensive solution designed for both signal providers and followers. Accessing Signal Start’s basic features requires a $25 monthly subscription fee. This includes a list of professional signal providers with a breakdown of their percentage gain, drawdown, and profits. Additionally, individual signal providers charge their own subscription fees typically ranging from $30 to $100. This allows you to choose a signal provider that aligns with your budget and trading goals.

FP Markets’ Key Features

FP Markets offers competitive spreads starting from 1.0 pips on Standard accounts with no commission, making it an attractive choice for copy traders. It also features a Raw account with spreads from 0.0 pips plus a commission of $3 per side per lot. On another note, FP Markets offers one of the deepest collections of market products exceeding 10,000 different products.

Aside from MT4 and MT5, FP Markets also supports the powerful TradingView and cTrader platforms. On regulations, this broker operates under the supervision of the ASIC, the CySEC, and the FSCA, among other organisations.

72.44% of retail CFD accounts lose money

AvaTrade

AvaTrade is a well-established forex and CFD broker that offers a comprehensive copy trading experience. Primarily, AvaTrade offers two different platforms for copy trading. It provides access to both its own proprietary social trading platform, AvaSocial, as well as integration with the popular third-party platform, DupliTrade.

AvaTrade’s AvaSocial platform allows users to automatically replicate the trades of other investors within the AvaTrade community. The platform provides real-time insights, rankings of strategy providers, and a community-driven approach to trading.

On the other hand, DupliTrade is a leading third-party copy trading service that focuses on duplicating the strategies of select professional traders with proven track records. The platform provides detailed performance statistics and risk management tools to help users make informed decisions. To use DupliTrade with AvaTrade, users need to open a live MT4 or MT5 account and meet the minimum deposit requirement of $2,000.

AvaTrade’s Key Features

AvaTrade offers a diverse range of tradable instruments. In total, the broker offers over 1,250 different assets which include CFDs on forex, stocks, commodities, indices, cryptocurrencies, ETFs, and bonds. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and its own AvaTrade app.

Spreads for trading on the AvaTrade trading site are competitive, starting from as low as 0.9 pips on major currency pairs with no commission charged. Finally, AvaTrade has regulations from a variety of authorities. These include the Central Bank of Ireland, the ASIC, the FSCA, the FSA in Japan, and the ADGM in the UAE, among others.

IC Markets

IC Markets offers copy trading functionalities through two major implementations. First, the broker offers its own IC Social trading app that is available to download from Google Play and the App Store. This app allows traders to replicate/copy the strategies of signal providers or become signal providers themselves.

Once you download this app, you can connect your IC Markets MetaTrader 4 account. To copy a trader, simply select the account you would like to copy, and click Copy. You may have to complete a suitability form before pressing confirm. You have full control of the trade size and even when to start or stop copying a trader.

The second way that IC Markets delivers copy trading to its traders is through cTrader copy trading. This platform provides a list of strategy profiles showcasing the top performers to follow alongside other metrics.

Additionally, traders have full control over the position sizes and when to start or stop copying a trader. On another note, the cTrader copy trading platform can act as a social media platform where investors can share market analytics and insights.

IC Markets’ Key Features

IC Markets offers its clients a deep collection of market products totalling over 2,100 instruments. These include CFDs on forex, cryptocurrencies, stocks, indices, commodities, and futures. The trading platforms available on this broker site include MT4, MT5, WebTrader, and cTrader.

In terms of spreads, the broker provides three main account options to its traders. The Standard Account features spreads starting at 0.8 pips on major currency pairs and does not charge any commissions. In contrast, the Raw Spread Account offers spreads beginning at 0.0 pips but includes a commission that varies by the trading platform. The Raw Spread Account on cTrader and TradingView has a commission of $3 per $100,000 traded, while the Raw Spread Account on MetaTrader platforms has a commission of $3.5 per side per lot.

Finally, this broker operates under the regulation of the ASIC, the CySEC, the FSCA, and the SCB in the Bahamas. While IC Markets accepts traders from the UK and European Economic Area countries, they do not provide copy trading services in these regions.

Who is Copy Trading Best Suited For?

- Aspiring Traders - Copy trading makes market participation easy for trading newcomers, even without extensive prior experience. Its straightforward nature lets them learn by mirroring seasoned traders' strategies, saving time and effort.

- Busy Individuals - Copy trading provides a hands-free option for investing in financial markets. It is particularly suited for those seeking a more passive investment strategy, allowing them to potentially earn returns without actively managing their trades.

- Experienced Traders - Skilled traders can utilise the platform by becoming Strategy Providers, generating extra income via commissions. Their earnings potential increases with their success and the number of copiers they attract.

Closing Remarks

Copy trading has revolutionized the way individuals engage with financial markets, making trading accessible to individuals with varying experience levels. By allowing users to replicate the strategies of seasoned traders, it offers a simplified and time-efficient approach to investing. The top 10 copy trading platforms highlighted in this guide provide diverse features, competitive fees, and robust regulatory oversight.

Whether you're a novice looking to learn, a busy professional seeking passive income, or an expert aiming to monetise your skills, copy trading offers a versatile solution. However, it’s crucial to choose a reliable broker and platform that aligns with your goals and risk tolerance.

Brokers like Exness, eToro, Pepperstone, and others, offer comprehensive copy trading platforms to cater to a wide range of trading needs. With the right approach, copy trading can be a powerful tool to enhance your trading journey. Nonetheless, remember that trading still carries a lot of risk and you should approach it with caution, regardless of the strategy used.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.