Best Brokers In The United Kingdom

UK residents have a plethora of options when it comes to Forex and Stock brokers. The majority of them operate via more than one legal entity, but the main regulator is called the Financial Conduct Authority in this country. The company is not dependent on the government, and it is financed by the members of the financial services industry. So, every UK brokerage firm operating under the license of the FCA is overwatched by the regulatory body. However, you need to look for other crucial aspects as well before opting for certain options.

It is essential to take into account what kind of financial instruments are provided and what is the average spread for them. Also, you have to check the available number of account types and whether brokers include the industry’s leading trading softwares. In this guide, we would like to provide an in-depth review of the top brokers in the United Kingdom.

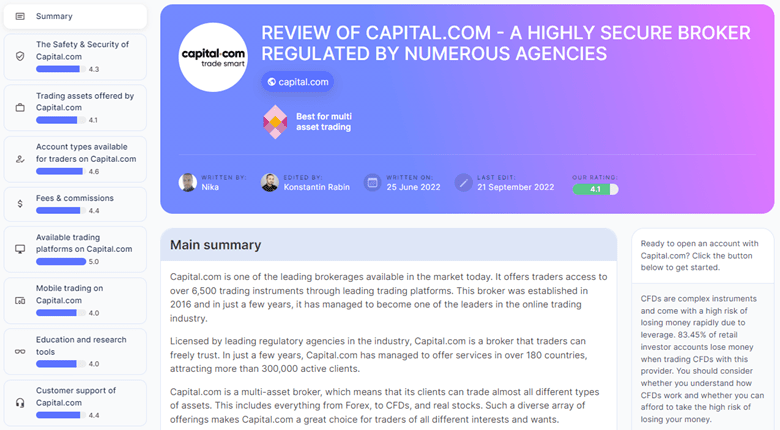

Capital.com

Capital.com is a relatively new broker in the Forex market, established in 2016. However, it has quickly gained tremendous popularity and became one of the leaders in the industry with the help of high-quality features. It is licensed by four regulatory agencies such as Australia, Cyprus, the UK, and Belarus. The broker offers traders more than 6,500 financial instruments starting from currency pairs, cryptocurrencies, stocks, shares, indices, and commodities. What’s more, Capital.com provides a wide range of account types in order to suit your needs and preferences. Hence, you will come across demo, standard, plus, premiere, invest, and Islamic accounts on this website.

Capital.com is a relatively new broker in the Forex market, established in 2016. However, it has quickly gained tremendous popularity and became one of the leaders in the industry with the help of high-quality features. It is licensed by four regulatory agencies such as Australia, Cyprus, the UK, and Belarus. The broker offers traders more than 6,500 financial instruments starting from currency pairs, cryptocurrencies, stocks, shares, indices, and commodities. What’s more, Capital.com provides a wide range of account types in order to suit your needs and preferences. Hence, you will come across demo, standard, plus, premiere, invest, and Islamic accounts on this website.

When it comes to fees and commissions, it is worth noting that Capital.com does not require you to pay extra money for deposits and withdrawals, nor for being inactive. Spreads are very low and competitive as well as they start from zero for major currency pairs and there is no commission charged for real stock trading. As for trading platforms, the broker contains the industry’s leading software MetaTrader 4 as well as its own custom trading platform in order to provide a user-friendly experience. Lastly, Capital.com offers a substantial database of educational content including simple guides as well as comprehensive and detailed reviews.

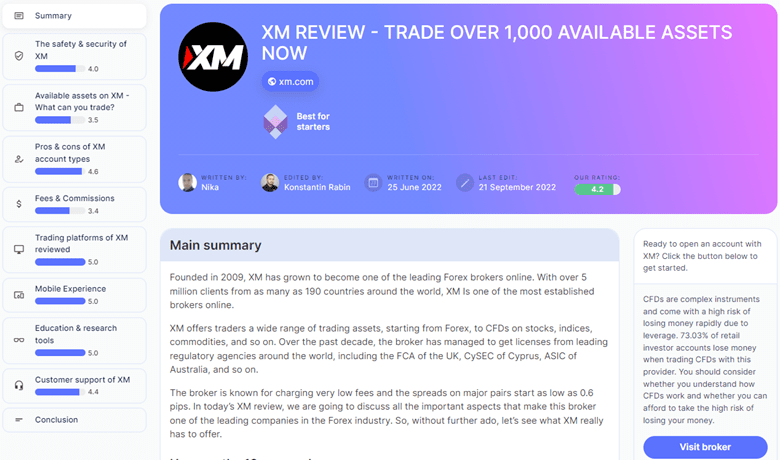

XM

XM was created in 2009 and has offered a wide range of high-quality features to every trader ever since. This broker is regulated by some of the most prominent companies such as FCA of the UK, CySEC of Cyprus, ASIC of Australia, and so on. The most appealing attribute of XM is that it offers over 1,200 financial assets, including Forex, indices, shares, commodities, and cryptocurrencies. Moreover, the broker contains an array of account types - demo, micro, standard, ultra low, shares, and Islamic accounts, so it is impossible not to find the most convenient one for your requirements.

In terms of fees and commissions, you have to pay them based on several factors such as account types and financial assets you are using. Spreads start as low as 0.6 on XM and you are required to pay an inactivity fee every month. You will find the most popular trading platforms here such as MetaTrader 4 and MetaTrader 5 as well as the custom-made trading platform of XM. You just need to deposit at least $5 to open an account, and you are ready to go.

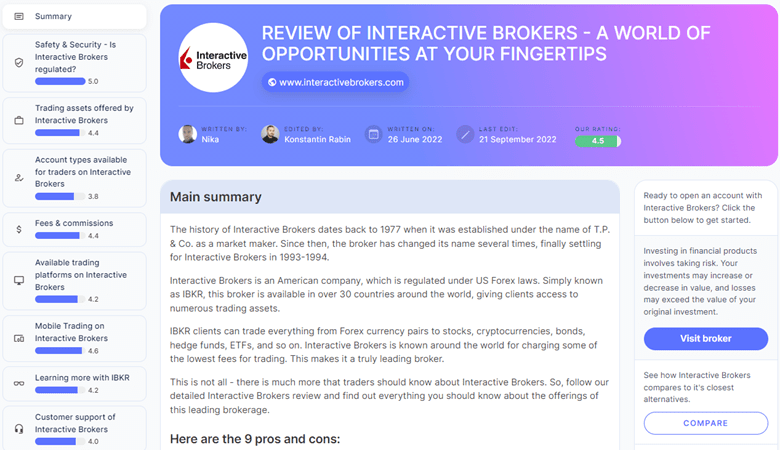

Interactive Brokers

Interactive Brokers is one of the oldest companies launched back in 1977 and today, it is available in more than 30 countries. Being established in the USA, Interactive Brokers is licensed under US Forex Laws. It provides access to a wide range of markets, and you have the possibility to trade pretty much everything here, including Forex currency pairs to stocks, cryptocurrencies, bonds, hedge funds, ETFs, and so on. The number of total assets exceeds 20,000.

Interactive Brokers is one of the oldest companies launched back in 1977 and today, it is available in more than 30 countries. Being established in the USA, Interactive Brokers is licensed under US Forex Laws. It provides access to a wide range of markets, and you have the possibility to trade pretty much everything here, including Forex currency pairs to stocks, cryptocurrencies, bonds, hedge funds, ETFs, and so on. The number of total assets exceeds 20,000.

Interactive Brokers provides accounts for both novice and experienced traders starting from a demo account to pro, lite, Islamic, and other account types. One slight downside might be the fact that it takes several days to open a live account. As the investfox.com review says, there are a lot of available payment methods on this broker, and what’s more, it charges a $0 fee for real-life stock trading, which is a great feature. As for trading softwares, we have to note that Interactive Brokers does not offer access to MT4 or MT5 since you can only take advantage of customer trading platforms established by the broker. However, it does provide the IBKR Mobile trading app for both iOS and Android users.

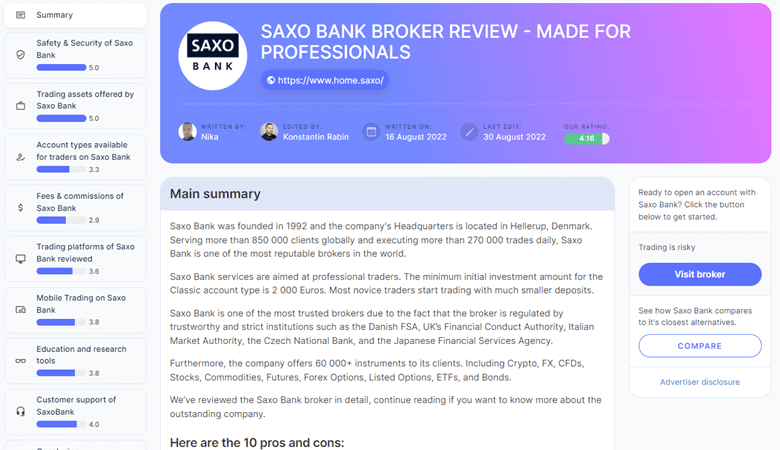

Saxo Bank

Saxo Bank is another pioneer in the financial industry since it has operated successfully since 1992. As of today, it has accumulated nearly 850,000 customers in all parts of the world and the daily trading volume exceeds 270,000 billion. Given the fact that Saxo Bank is regulated via various jurisdictions such as the UK’s Financial Conduct Authority, the Czech National Bank, the Danish FSA, Italian Market Authority, and the Japanese Financial Services Agency. The broker offers access to more than 60,000 financial instruments such as cryptos, Forex, Commodities, CFDs, stocks, Forex Options, Futures, ETFs, Listed Options, and Bonds.

When it comes to account types, you will come across Classic, Platinum, and VIP options with a wide range of features. Lack of Islamic and Demo accounts is a slight drawback of Saxo Bank. Spreads start as low as 0.6 here and there are no fees for deposits. However, keep in mind that you have to pay $100 every month after being inactive for 6 months. In terms of trading softwares, you will come across two options - SaxoTraderGo and SaxoTraderPro, which can be accessed with all types of devices. Lastly, we have to point out that Saxo Bank offers an extensive database of educational material in terms of courses, video guides, and risk management tools in order to facilitate the trading process for newbies.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.