XM List of Supported & Banned Countries

XM is a globally recognised forex and CFD broker that has been serving millions of traders since its founding in 2009. The broker has built a strong reputation for its client-centric services, diverse product offerings, and multi-jurisdictional regulation. With over 15 million clients from more than 190 countries, XM is one of the largest brokers in the world today. However, due to regulatory obligations and internal policies, XM does not serve clients in certain regions.

In this article, we will explore a list of supported and banned countries by XM.com. We will also look at some alternatives for traders in restricted regions.

Not sure if XM supports traders from your country? Try opening an account, if this works, they welcome traders from your country

75.18% of retail investor accounts lose money when trading CFDs with this provider.

XM List of Supported Countries

XM operates under several regulatory licenses, allowing it to serve clients in different regions legally. Below is a breakdown of XM’s regulatory jurisdictions and the countries where it accepts clients:

CySEC

Cyprus - Trading Point of Financial Instruments Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC), License No. 120/10. This regulation allows XM to offer services within the European Economic Area (EEA) in compliance with MiFID II regulations. The countries supported under the CySEC license include:

- Austria

- Belgium

- Bulgaria

- Croatia

- Cyprus

- Czechia

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

DFSA

Dubai - Trading Point MENA Limited is regulated by the Dubai Financial Services Authority (DFSA), with the license number F003484. This enables XM to provide financial services within the Dubai International Financial Centre (DIFC) and to clients in the broader UAE region.

FSC

Belize - XM Global Limited is regulated by the Financial Services Commission (FSC) in Belize under license number 000261/27. This license allows XM to accept clients from many countries globally, excluding those in restricted jurisdictions.

FSC

Mauritius - XM International MU Limited operates under the regulation of the Financial Services Commission (FSC) of Mauritius with the license number GB23202700. This license also allows XM to provide its services to many countries around the globe, except those from restricted jurisdictions.

XM List of Banned or Restricted Countries

Despite its broad international reach, XM does not offer services to residents of certain countries. This is for a variety of reasons, including regulatory limitations, international sanctions, or internal policy decisions. So if you are from one of the restricted countries, you might get a notification “Unfortunately, the product or service you’re trying to access isn’t available in your country.”

As of now, XM does not accept clients from the United States of America, Canada, Israel, the Islamic Republic of Iran, and other sanctioned countries.

XM also does not accept traders from the UK. Instead, they are shown a pop-up promoting Trading.com/uk — a distinct entity that operates independently within the same corporate group.

This list can be subject to change as regulations and internal policies evolve. Therefore, the most reliable way to ascertain if XM accepts clients from a specific country is to visit their official website.

| Important Note: If your country doesn’t appear under either the supported or restricted regions, this typically indicates that the broker accepts clients from your location. To be certain, please visit XM’s official website and initiate the registration process by clicking on Get Started. On the page you land on, check whether your country is listed in the Country of Residence drop-down menu. If it’s there, you’re eligible to create an account. |

What XM Offers

XM offers its traders a diverse collection of trading instruments, totalling over 1,000 different assets. This broker allows its clients to trade CFDs on forex, shares, equity indices, commodities, stocks, metals, cryptocurrencies, and energies. This allows traders to diversify their portfolios as they see fit. To access these market products, the broker supports MetaTrader 4, MetaTrader 5, and XM’s trading app.

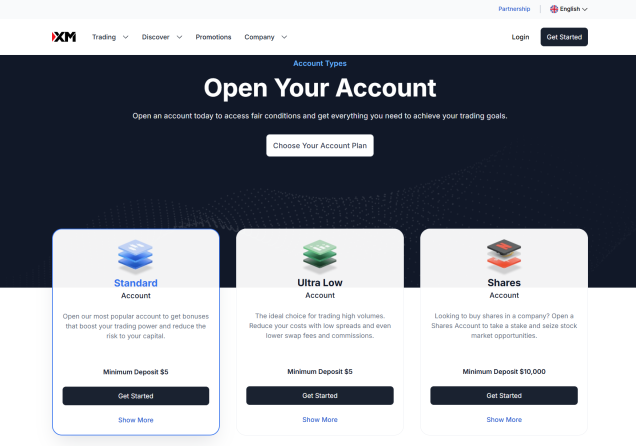

Additionally, this broker provides competitive spreads across its trading accounts. The Standard account features spreads from 1.6 pips on major currency pairs with no commission. For tighter spreads, the XM Ultra Low account provides spreads starting at just 0.8 pips, also without a commission. The Shares account charges a commission depending on the share and the size of the trade.

As detailed above, XM operates under the regulation of various financial institutions around the world. To recap, XM is licensed by the CySEC, the DFSA in the DIFC, and the FSC in Belize. This multi-regulatory framework is one of the reasons why XM has grown into one of the largest brokers in the world.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Alternatives to XM for Restricted Countries

For traders residing in countries restricted by XM, several alternative brokers offer similar trading conditions and a wide range of services. Some of these include:

Pepperstone (Alternative for UK and International Traders)

One of the top alternatives to XM is Pepperstone, which, like XM, offers a wide range of market instruments. With this broker, traders have access to over 1,200 CFDs on forex, indices, sector indices, equities, commodities, ETFs, and cryptocurrencies. To trade these market products, the broker offers several advanced trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, TradingView, and Pepperstone's proprietary platform.

Traders with Pepperstone can choose between two primary account types, each with a different fee structure. The Standard Account features spreads starting from 1.0 pips on major currency pairs and charges no commission. In contrast, the Razor Account offers raw spreads starting from 0.0 pips, with a commission that varies depending on the trading platform used.

When using MetaTrader 4 and MetaTrader 5, traders pay a commission of $3.50, €2.60, £2.25, or CHF 3.30 per side per lot, depending on the account's currency. TradingView and Pepperstone platform users also pay a $3.50 commission per side per lot. However, those trading via cTrader benefit from a slightly lower commission of $3.00 per side per lot. For non-USD accounts on TradingView, cTrader, and Pepperstone's platform, the commission is converted into the account currency at the current spot rate.

Pepperstone is well-regarded for its strong regulatory framework. The broker holds licenses from several financial authorities, including the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the BaFin in Germany, and the CMA in Kenya, among others. The combination of competitive pricing and strong regulatory oversight makes Pepperstone an attractive choice for traders of all experience levels.

75.3% of retail CFD accounts lose money

Exness (Alternative for African and Asian Traders)

Exness is a well-established global broker with a strong presence in African and Asian markets. Founded in 2008, Exness serves a vast number of traders worldwide. The broker operates under the regulation of several financial authorities across different jurisdictions. These include the FSCA in South Africa, the CMA in Kenya, and the FSC in Mauritius, among others.

Regarding market products, Exness supports the trading of over 250 different instruments. These include CFDs on forex, energies, cryptocurrencies, stocks, metals, and indices. The broker supports MetaTrader 4, MetaTrader 5, and Exness Trader as the trading platforms available. Traders can choose from five different trading accounts: two standard and three professional options.

The Standard account features spreads starting from 0.2 pips, while the Standard Cent account begins at 0.3 pips. For even tighter pricing, the Pro account offers spreads from as low as 0.1 pips. All three of these accounts (the Standard, the Standard Cent, and the Pro accounts) are commission-free. On the other hand, the Raw Spread account provides ultra-low spreads from 0.0 pips, accompanied by a commission of up to $3.50 per side per lot. Meanwhile, the Zero account also offers spreads from 0.0 pips on the top 30 instruments, with commissions starting as low as $0.05 per side per lot.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Forex.com (Alternative For US Traders)

Forex.com is a globally recognised broker with robust regulation in the US, EU, and other international markets. In particular, Forex.com’s parent company, StoneX, is under the regulation of the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the CIRO in Canada, and both the CFTC and NFA in the United States.

The market products that traders have access to on this broker site depend on the trader’s location. Forex.com provides U.S. clients with access to forex, futures, and futures options trading. These products can be traded through several platforms, including MetaTrader 4, MetaTrader 5, TradingView, and the broker’s proprietary Forex.com Trader platform.

In terms of pricing, Forex.com delivers competitive spreads across its account types. The Standard Account features spreads starting from 0.8 pips, while the MetaTrader Account begins at 1.0 pips. Neither of these accounts charges a commission. In comparison, the Raw Account provides tighter spreads, starting from 0.0 pips, with a commission of $7 per $100,000 traded for U.S. clients.

Online trading involves significant risk of loss and is not suitable for all investors.

Closing Remarks

XM stands as a globally respected broker, offering a wide array of trading instruments, competitive account types, and access to advanced platforms. It offers these features all under the watchful eye of multiple regulatory bodies. With its reach extending to over 190 countries, XM has become a trusted name among millions of traders worldwide. However, due to regulatory obligations and internal compliance policies, some countries remain restricted from accessing its services.

For traders located in these restricted regions, alternatives like Pepperstone, Forex.com, and Exness provide excellent options. Each of these brokers has unique strengths in regulation, pricing, and platform diversity. Ultimately, whether you choose XM or one of its alternatives, selecting a broker with strong regulatory backing and transparent policies is key to a secure and rewarding trading experience.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.