Best Brokers With Trailing Stop Loss

In trading, we can’t emphasize the importance of risk management enough. Towards this purpose, traders can use traditional stop loss and take profit features. Savvy traders, however, will also take advantage of the trailing stop loss which moves with the market price, allowing traders to lock in profits while still giving the trade room to grow. Today, we will take a look at some of the best forex and CFD brokers with trailing stop loss, but before we do, let’s take a closer look at how the traditional stop loss and trailing stop loss work to understand the difference between them.

Setting a Stop Loss

Instead of staying glued to the screen to exit the trade manually, you can always use a stop loss. A stop loss is an order that tells the broker to close the order at a predetermined price with a calculated loss if the trade goes south. While some believe it’s possible to trade without a stop loss, the old market adage — ‘If you don’t use a stop loss, you’ll eventually stop trading’ — serves as a strong reminder of how essential the stop loss feature really is.

However, the stop loss is static. Therefore, even if your trade is making money, a sudden market reversal can take away all your profits and leave you with a loss. It doesn’t matter how much profit you had — it can disappear quickly. This brings us to an important question:

Can you have a dynamic stop loss that changes according to how the price changes?

The answer is YES. This is what the trailing stop loss entails.

Understanding the Trailing Stop Loss

The difference between the conventional stop loss and trailing stop loss is that the latter moves. It trails the price movement to lock in profits. For example, if you set the trailing stop loss at 50 pips in an uptrend, your stop loss will move 50 pips below the highest price point. The close order is triggered when the price hits the trailing stop loss, effectively closing the order. However, the trailing stop is not affected if the market moves in the opposite direction.

Many brokers now offer the trailing stop-loss feature, which means it's important to consider also other factors like trading conditions (spreads, fees), regulation, and the variety of trading assets available. Popular platforms like MT4 and MT5 offer trailing stop orders as a built-in feature. However, it's worth noting that these are client-side functions, meaning they run on your device (computer, phone, or tablet) rather than on the broker's servers.

As a result, if you close the platform, turn off your device, or lose your internet connection, the trailing stop will stop adjusting until the platform is reconnected. So if you close your platform, your order will stop adjusting and remain at the same level it was at when you closed it. This is a standard feature on these platforms, and just something to keep in mind when planning your trades.

Below is a list of some of the top brokers that offer the trailing stop loss feature.

Best Brokers with Trailing Stop Loss

Exness

Exness, one of the largest forex retail brokers by trading volume in the world, offers traders the ability to use trailing stop-loss orders, along with other protective features. The broker allows trading in a wide range of CFD instruments, including forex, oil, digital currencies, stocks, metals, and indices.

Exness provides multiple account types, including two standard accounts and three professional accounts, each with different trading conditions to cater to various types of traders. The broker also supports a wide range of deposit and withdrawal methods, and according to the official Exness website, they process 95% of withdrawals instantly.

The broker provides access to two popular trading platforms: MT4 and MT5. Trailing stop-loss orders can be set on both platforms. To set a trailing stop, simply right-click on the open order in the “Trade” tab and select “Trailing Stop.” You can then choose from the available point options or enter a custom value—note that the minimum allowed is 15 points (1.5 pips).

The broker is regulated by several financial authorities, including the FSCA in South Africa, the CMA in Kenya, and the JSC in Jordan, among others.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Pepperstone

Pepperstone is a leading forex and CFD broker, regulated by top-tier financial authorities such as BaFin in Germany, the FCA in the UK, CySEC in Cyprus, and ASIC in Australia, among others. According to the broker's official website, Pepperstone offers advanced order types, including trailing stop-loss orders. The company provides access to over 1,250 CFDs across a wide range of asset classes, including forex, indices, commodities, stocks, and cryptocurrencies.

Traders can choose from four of the world’s leading retail platforms: MT4, MT5, cTrader, and TradingView. Pepperstone offers two account types: the Standard account and the Razor account. The Standard account features spreads starting at 1.0 pips on major currency pairs with no commission.

Meanwhile, the Razor account offers raw pricing, with spreads as low as 0.0 pips, accompanied by a low commission. Traders can select their account's base currency from options such as USD, EUR, GBP, or other available currencies.

75.3% of retail CFD accounts lose money

FP Markets

FP Markets is a prominent forex and CFD broker that supports trailing stop-loss orders. It’s highly regarded among traders for its competitive trading conditions and extensive range of tradable assets. The broker offers two account types: the Standard account and the Raw account, each with different trading conditions. The Standard account features zero commissions and low spreads starting from 1.0 pips, while the Raw account offers raw pricing with spreads from 0.0 pips and a low commission of 3 USD per side per lot.

FP Markets is regulated by several top-tier authorities, including the CySEC in Cyprus, the ASIC in Australia, and the FSCA in South Africa, ensuring a high level of oversight. Traders can access a wide range of CFDs, including forex, indices, metals, cryptocurrencies, and ETFs, and trade on platforms such as MT4, MT5, cTrader, and TradingView.

Traders can take advantage of auto trading and expert advisors (EAs) to enhance their trading results. The broker offers fast execution through its NY4 server facility and provides 24/7 multilingual customer support. Established in 2005, the broker also provides a 30-day demo account for traders to explore its platform and features.

72.44% of retail CFD accounts lose money.

XTB

XTB is another highly regarded broker that offers trailing stop-loss orders through its proprietary trading platform, xStation. Interestingly, the platform allows you to set a trailing stop either when placing a new order or after a position has been opened.

The broker provides access to a wide range of assets, with over 2,100 CFDs available across global markets, including indices, commodities, forex, stocks, cryptocurrencies, and ETFs. In addition to CFDs, XTB also enables the purchase of real stocks and ETFs, offering more than 4,300 instruments from the EU and US markets.

xStation is known for its fast execution speeds and high level of customization. It also features sentiment data, performance statistics, and an integrated trading calculator. These innovative tools and user-friendly features have helped XTB earn the trust of over 1,000,000 traders worldwide. The broker is regulated by several reputable authorities, including CySEC in Cyprus, KNF in Poland, and the FSC in Belize.

To set the trailing stop loss order while placing an order, check the Stop Loss field and expand the settings. Once you enter a Stop Loss value, the Trailing Stop option becomes available. Simply enter your preferred trailing value and proceed with placing the order.

To apply a trailing stop-loss to an existing position, right-click the open trade in the Terminal window and select Modify, or click the "+" icon in the SL column to adjust the stop parameters. It's worth mentioning that when you're using xStation, your Trailing Stops remain in place even if you log out.

75-78% of retail investor accounts lose money when trading CFDs with this provider.

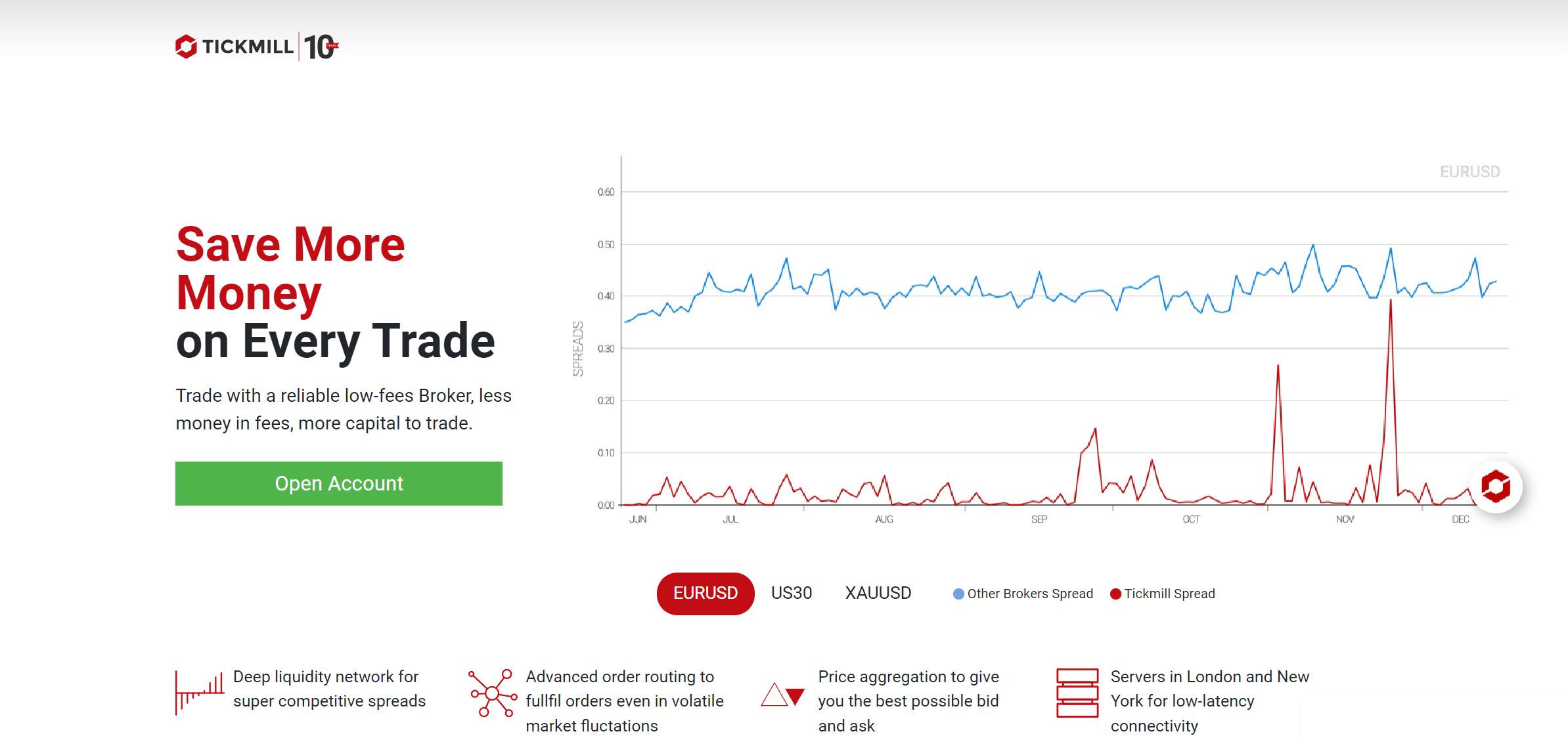

Tickmill

Tickmill is a well-known Forex and CFD broker serving clients in over 180 countries. It supports trailing stop-loss orders on its MetaTrader platforms, with a minimum trailing stop level of 1.5 pips (15 points). Traders can set one trailing stop per order. The broker is regulated by some of the most reputable financial authorities, including the CySEC in Cyprus, the FSCA in South Africa, and the FCA in the UK. Tickmill offers access to a diverse selection of CFD instruments, including forex, metals, indices, commodities, and cryptocurrencies.

In addition to the MetaTrader platforms (MT4 and MT5), Tickmill also provides access to the highly advanced charting platform TradingView and their proprietary mobile platform Tickmill Trader. The broker offers fast execution speeds, with an average order execution time of just 0.15 seconds. Tickmill offers three account types tailored to different trading styles, each with its own trading conditions.

The Classic account features spreads starting from 1.6 pips on major currency pairs and does not charge any commissions. The Raw account, on the other hand, provides raw spreads from 0.0 pips with a commission fee of $3 per side per lot. The third option is the Tickmill Trader Raw account, designed specifically for traders using Tickmill’s proprietary Tickmill Trader platform.

This account also offers raw spreads from 0.0 pips, with a slightly higher commission of $3.5 per side per lot. Both the Classic and Raw accounts can be held in various base currencies, including USD, EUR, GBP, and ZAR.

71-74% of retail investor accounts lose money when trading CFDs with this provider.

HFM

HFM, a leading forex and CFD broker, also supports trailing stop-loss orders. The company is heavily regulated by several top-tier financial authorities, including CySEC in Cyprus, the FCA in the UK, the DFSA in Dubai, the FSCA in South Africa, and the CMA in Kenya, among others. HFM offers a variety of account types designed to suit different trading needs and experience levels. These accounts differ in the trading conditions that apply to them, such as spreads and commission fees.

Traders with HFM gain access to over 500 CFD instruments across a broad range of asset classes, including forex, metals, energies, indices, stocks, commodities, bonds, and ETFs—making it one of the more diverse offerings in the industry. The broker also stands out for its strong focus on trader education, featuring a rich library of how-to guides and hosting live webinars multiple times a week in various languages.

Trading is available via the popular MT4 and MT5 platforms, as well as HFM’s own mobile trading app, the HFM Trading App, which offers convenient access to the markets on the go.

68% of retail investor accounts lose money when trading CFDs with this provider.

Closing remarks

Brokers offering trailing stop-loss orders provide significant advantages, including enhanced risk management and the ability to lock in profits as the market moves in your favor. The brokers listed above are some of the top choices in the industry, each offering unique benefits tailored to different trading strategies.

However, selecting the right broker depends on your individual trading preferences. Keep in mind that this is not an exhaustive list, and there are several other brokers offering trailing stop-loss orders that we have not mentioned here. It’s crucial to conduct thorough research before choosing a broker. Be sure to consider factors such as regulation, available platforms, spreads, and customer support, in addition to the trailing stop-loss feature.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.