Trade247 Review – What to Expect From the Broker

Trade247 is a rising online broker offering Contracts for Difference (CFDs) across a diverse selection of financial instruments. While still relatively new, the broker has captured attention for its round-the-clock trading model, user-friendly interface, and commitment to commission-free pricing.

With features designed to appeal to both aspiring and experienced traders, Trade247 presents itself as an accessible and straightforward brokerage solution. In this review, we provide an in-depth analysis of what Trade247 has to offer, including its platforms, trading instruments, regulatory status, account types, fees, and customer support experience.

| Risk Warning: Trading in financial instruments is a risky activity and can bring not only profits, but also losses. The amount of possible losses is limited by the amount of the deposit. |

Basic Information About Trade247

- Website Address: www.trade247.com

- Instruments: CFDs on forex, commodities, indices, stocks, metals and energies, Crypto

- Minimum Deposit: $100 (Standard Account), $500 (Pro Account)

- Demo Account: Yes, available for free

- Trading Platforms: MetaTrader 5 (MT5) and Trade247 WebTrader, and Mobile App

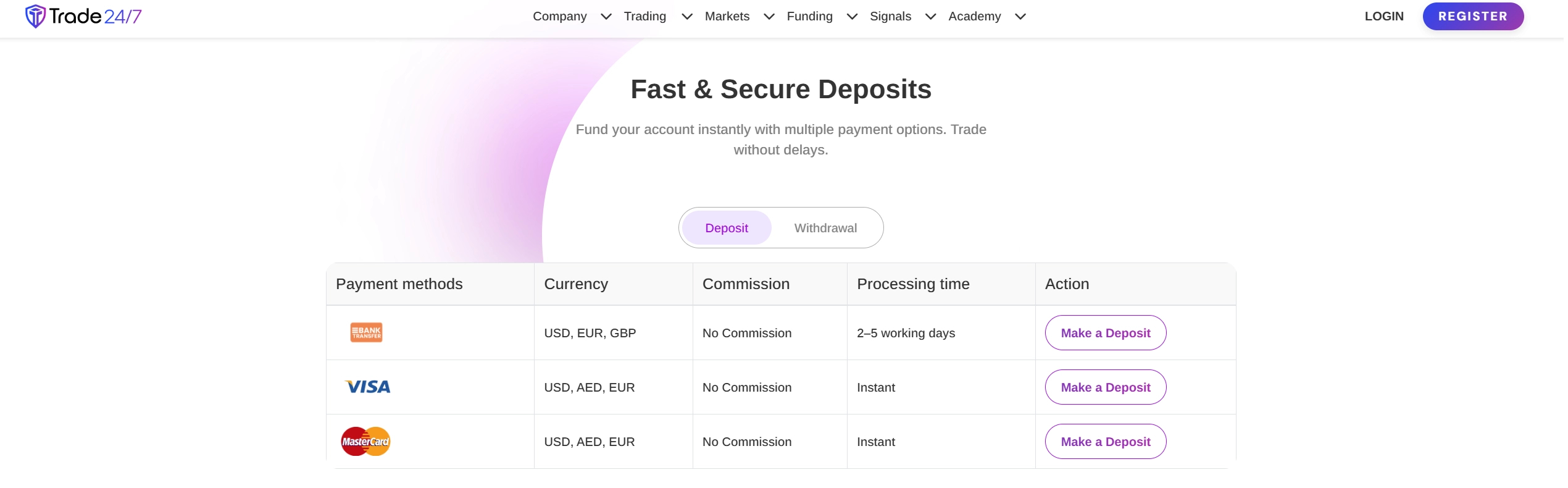

- Funding Methods: Visa, MasterCard, and Bank Transfer

Trading Platforms on Trade247

Trade247 offers the highly acclaimed MetaTrader 5 (MT5) platform to all its clients. MT5 is the successor to MetaTrader 4 and brings enhanced charting tools, faster execution, and broader market access. The platform supports multiple order types, technical indicators, drawing tools, and customisable layouts. Traders who prefer desktop or web-based interfaces can choose between the downloadable MT5 or Trade247’s WebTrader version. Both versions deliver real-time data feeds, one-click trading, and access to various timeframes.

For mobile traders, Trade247 also provides a dedicated mobile trading app, available for Android and iOS devices. The mobile app mirrors many of MT5’s features, allowing users to place trades, analyse charts, and manage accounts on the go. While the mobile experience is simplified, it remains powerful enough to satisfy casual and serious traders alike.

Trading Instruments Available on Trade247

Trade247 enables clients to trade a wide selection of CFDs across multiple markets. These include major asset classes such as forex, commodities, indices, cryptocurrencies, metals & energy and stocks. Here is a breakdown of the products traders can access on this broker site:

- Forex - In the forex market, traders can choose from over 50 currency pairs, including major pairs like EURUSD, GBPUSD, and USD/PY, as well as several minor and exotic pairs. Forex trading is available 24/7, giving traders flexibility and access to global price movements any day of the week.

- Commodities - On the Trade247 site, people can access commodities, which include popular instruments like gold, silver, crude oil, and natural gas. These are popular among traders seeking to diversify their portfolios or hedge against inflation.

- Indices - Another asset class that traders can engage with on this site is Indices. They include international benchmarks such as the S&P 500, Dow Jones, FTSE 100, and NASDAQ. These allow traders to speculate on broader market trends without selecting individual stocks. Like forex pairs, most indices are available to trade on this broker site 24/7.

- Stocks - Stock CFDs are also available and include major U.S. and U.K. companies such as Amazon, Apple, Tesla, and HSBC. These assets allow for leveraged trading without the need to purchase actual shares.

- Cryptocurrencies - Trade the most popular digital assets including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Ripple (XRP). Crypto trading is available 24/7, offering dynamic opportunities in one of the world’s most volatile markets.

- Metals & Energy - Trade247 offers CFDs on popular metals like gold, silver, platinum, and palladium, along with key energy assets such as crude oil, Brent oil, and natural gas.

Account Types on Trade247

Trade247 provides three main types of accounts to meet the needs of different trading profiles: the Standard Account and the Pro Account. The Standard Account requires a minimum deposit of $100 and is designed for new to intermediate traders. It features commission-free trading, access to all available instruments, and includes basic tools such as market analysis and a dedicated account manager.

The Pro Account is aimed at more experienced traders who want enhanced support and potentially tighter spreads. This account type requires a minimum deposit of $500 and offers similar benefits to the Standard Account with improvements in execution speed and support features.

Spreads, Commissions, and Costs

Trade247 operates on a commission-free model. Instead, the broker incorporates its costs into the spread, which is the difference between the buy and sell price of an asset. This model is preferred by many new traders as it simplifies the cost structure.

The broker claims some of the lowest spreads in the industry, starting from as low as 0.3 pips. Please note that this is the minimum spread offered by the broker. Typical spreads may be higher depending on market conditions. Always verify the spreads involved in a trade before placing an order.

Overnight positions attract swap fees, which vary based on the asset class. Swap rates are transparently listed in the broker's platform and help compensate for holding positions past the end of the trading day. Notably, Trade247 does not charge deposit fees or withdrawal fees, which helps reduce the overall cost of trading. However, Trade247 does reserve the right to charge up to 5% of a withdrawal if no trading activity has occurred.

Trade247 also offers an Islamic (swap‑free) account, available upon request, which eliminates all overnight interest charges, making it fully Shariah‑compliant.

Leverage Offered by Trade247

Leverage is one of Trade247’s key offerings and allows traders to control larger positions with a smaller amount of capital. The leverage offered on forex pairs starts from as low as 1:10. However, the broker does not specify the maximum leverage on various instruments. Typically, higher leverage is available for forex and commodities, while stocks and indices have lower leverage caps.

Please note that the maximum leverage a trader can access will depend on regulatory restrictions in their region. Moreover, understand that trading with leverage amplifies potential losses just like it amplifies potential profits. As such, traders should always be cautious when using leverage and only apply levels that fit their risk tolerances.

Deposit and Withdrawal Methods

Trade247 supports a range of secure deposit and withdrawal methods. These include traditional options such as Visa, MasterCard, and bank wire transfers. The broker does not support third-party payments and insists that deposits and withdrawals be made using accounts registered in the same name as the trading account holder.

Deposits are typically processed quickly, while withdrawals may take one to two business days. Trade247 does not charge internal fees on these transactions, but traders should confirm whether their bank or payment provider applies any charges. Deposits and withdrawals are handled during the broker’s business hours, which are Monday to Friday, 10 am to 7 pm GMT+4. This may limit transaction speed outside business hours, but overall, the process is streamlined and secure.

Trade247 Demo Account and Educational Resources

The Trade247 demo account is a helpful feature for traders of all experience levels. New users can use the demo account to get familiar with the trading interface, test various tools, and understand how the markets function. Experienced traders often use the demo to back-test strategies or evaluate the broker’s execution speed and pricing models. The demo account mirrors live trading conditions, including real-time spreads, margin levels, and order execution speeds.

On another note, Trade247 offers a growing suite of educational resources to support trader development. The broker’s Academy section includes blog posts, webinars, trading tutorials, and eBooks. These materials cover essential topics such as CFD trading, technical analysis, risk management, and platform navigation.

Video tutorials are available via Trade247’s official YouTube channel, which walks users through platform setup, placing trades, and using indicators. While the educational offering may not be as deep as larger brokers, it is actively expanding and covers the core areas most new traders need.

Trade247 also provides basic market analysis, including daily insights, news updates, and trade ideas. These are aimed at helping traders identify market trends and plan their strategies.

Regulation and Licensing

Trade247 operates under two primary entities. Trade Twenty Four 7 Markets Limited is authorised and regulated by the Financial Services Commission (FSC) of Mauritius under License No. GB24203587. The company’s registered office is located at Office 1201, Premier Business Centre, Sterling Tower, Port Louis, Mauritius.

In addition, Trade Everyday Financial Advisors LLC is regulated by the Securities and Commodities Authority (SCA) of the United Arab Emirates. It has a registered office at Al Attar Building, M Floor, Offices 13, 114, 115, Bank Street, Dubai, UAE, PO Box 121485. This dual regulatory structure increases the broker’s credibility and provides a layer of legal protection and oversight for traders in multiple jurisdictions.

The broker also boasts of having segregated bank accounts, ensuring that company capital and client deposits remain separate. This reduces the risk of misappropriation and aligns with standard financial safety practices. Trade247 also complies with KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols, further securing the trading environment.

Customer Support and User Experience

Trade247 delivers customer service via several channels, including live chat, email, phone, and a help desk. Live chat is the most efficient channel, offering relatively quick responses during business hours. Email support is also responsive, usually resolving queries within a few hours on working days. The email address to contact Trade247’s customer support is [email protected]. For clients who would like to speak on the phone with a representative, this option is also available through the line (04) 5587135.

Finally, this broker maintains a social media presence on various platforms. These include X, Facebook, and Instagram. Through these channels, traders can receive company updates and possibly engage with the team.

Final Verdict

Trade247 is a promising and regulated trading broker based in Dubai, UAE, offering a secure and seamless trading experience across multiple financial markets. With its commission-free pricing model, 24/7 trading on some assets, and support for MetaTrader 5, the broker provides an environment well-suited to traders of varying experience levels. Its regulated status in both Mauritius and the UAE adds to its credibility and safety profile.

While the platform may lack some advanced features like algorithmic trading, copy trading, or deep technical analytics, it excels in delivering a straightforward and reliable trading experience. As always, traders should take advantage of the demo account and explore all features before committing funds. Moreover, this is a fairly new broker that still has a lot to prove in the industry.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.