5 Richest & Most Successful Forex Traders in the UK

The United Kingdom has long been a global hub for financial markets, particularly forex trading. The UK plays such a significant role in forex trading, to the extent that one of the major forex trading sessions is centred around its economy. Moreover, the UK has one of the most robust regulatory frameworks, overseen by the Financial Conduct Authority.

Understandably, this has promoted a thriving forex trading scene in the country. As such, it’s no surprise that some of the richest and most successful forex traders have emerged from the UK. In this article, we will highlight the 5 richest and most successful forex traders in the UK. We will focus on their journeys, strategies, and contributions to the trading world.

Disclaimer About Our Selections

For lists like this, it is important to know that pinpointing the absolute richest or most successful traders in any region is very challenging. This is because the forex industry is notoriously secretive. Many traders elect not to reveal their wealth and strategies. As such, we will base our selections for this list on publicly available data and the overall recognition of traders in the trading community.

Additionally, it is important to stress the risks involved in forex trading. While the individuals we will list here have enjoyed great success, this is not the case for everyone. Most people who trade financial markets end up losing their money. It is important to approach the market with caution and realistic expectations. Most importantly, prioritise risk management strategies to protect your capital.

With that said, let’s now take a look at the 5 richest and most successful forex traders in the UK.

5 Richest and Most Successful Forex Traders in The UK

Joe Lewis

Joe Lewis is one of the most prominent and successful traders to emerge from the UK. While his investments span various sectors, forex trading has played a significant role in his wealth accumulation. Lewis began his career working for his family’s catering business but later turned to trading currencies. Today, he is one of the richest individuals in the UK, with a net worth estimated at several billion dollars.

Lewis gained fame for his involvement in the 1992 Black Wednesday crisis. Alongside George Soros, Lewis speculated against the British pound and made significant profits. Lewis is known for his long-term investment approach and his ability to identify and capitalise on long-term market trends.

Lewis’ trading strategy revolves around identifying macroeconomic trends. He then leverages them through large-scale speculative trades. He is popular for his contrarian investment style and his ability to identify undervalued assets. Lewis also emphasises diversification across different markets and industries. Today, he has diversified his investments into various sectors, including real estate and sports, owning the Tottenham Hotspur football club. Despite his success, Lewis maintains a low public profile.

Illustrative picture. Not Joe Lewis.

Michael Platt

Michael Platt is one of the UK’s most successful traders and the co-founder of BlueCrest Capital Management, a prominent hedge fund. Platt’s expertise in forex trading has played a crucial role in the fund’s success. Under his leadership, BlueCrest grew to manage billions of dollars in assets.

Platt’s trading strategy emphasises a disciplined approach to risk management and a focus on macroeconomic trends. He is known for his ability to identify high-probability trades and execute them with precision. Platt’s success is also attributed to his adaptability. He has consistently evolved his strategies to align with changing market conditions.

In recent years, Michael Platt has shifted his focus toward private investments. His achievements continue to inspire traders looking to make their mark in the forex market.

Chris Hohn

Chris Hohn is a billionaire hedge fund manager and the founder of The Children’s Investment Fund Management (TCI). While Hohn is primarily known for his investments in equities, his early career included significant success in forex trading. His ability to analyse global economic trends and implement effective trading strategies has been a hallmark of his career.

Hohn’s approach to trading is rooted in rigorous research and a focus on long-term sustainability. He combines fundamental analysis with a keen understanding of macroeconomic factors. Risk management is at the core of Hohn’s trading strategy. His trading philosophy prioritises capital preservation and consistent returns over high-risk, high-reward trades.

In addition to his financial success, Chris Hohn is known for his philanthropic efforts. Through TCI’s foundation, he has donated billions to many charitable causes.

Alan Howard

Alan Howard is a renowned hedge fund manager and co-founder of Brevan Howard Asset Management. Known for his exceptional skill in macroeconomic trading, Howard has achieved remarkable success in the forex market. His ability to predict currency movements and manage risk has been instrumental in his career.

Howard’s trading philosophy is rooted in a deep understanding of global economic trends and a disciplined approach to risk. Under his leadership, Brevan Howard has delivered impressive returns, solidifying his reputation as one of the UK’s top traders. Beyond his trading success, Alan Howard is also involved in philanthropic activities, supporting various causes through his charitable foundation.

Michael Hintze

Michael Hintze is the founder of CQS, a UK-based asset management firm with a focus on multi-strategy investments. Hintze’s ability to combine macroeconomic analysis with a keen eye for market trends has been a key factor in his success.

Hintze’s trading strategy emphasises diversification and adaptability. He is known for his meticulous research and strategic decision-making. This has helped CQS become one of the most respected asset management firms in the industry. In addition to his financial achievements, Michael Hintze is a prominent philanthropist. He supports educational, cultural, and scientific initiatives worldwide.

Top Traders in the UK on Etoro

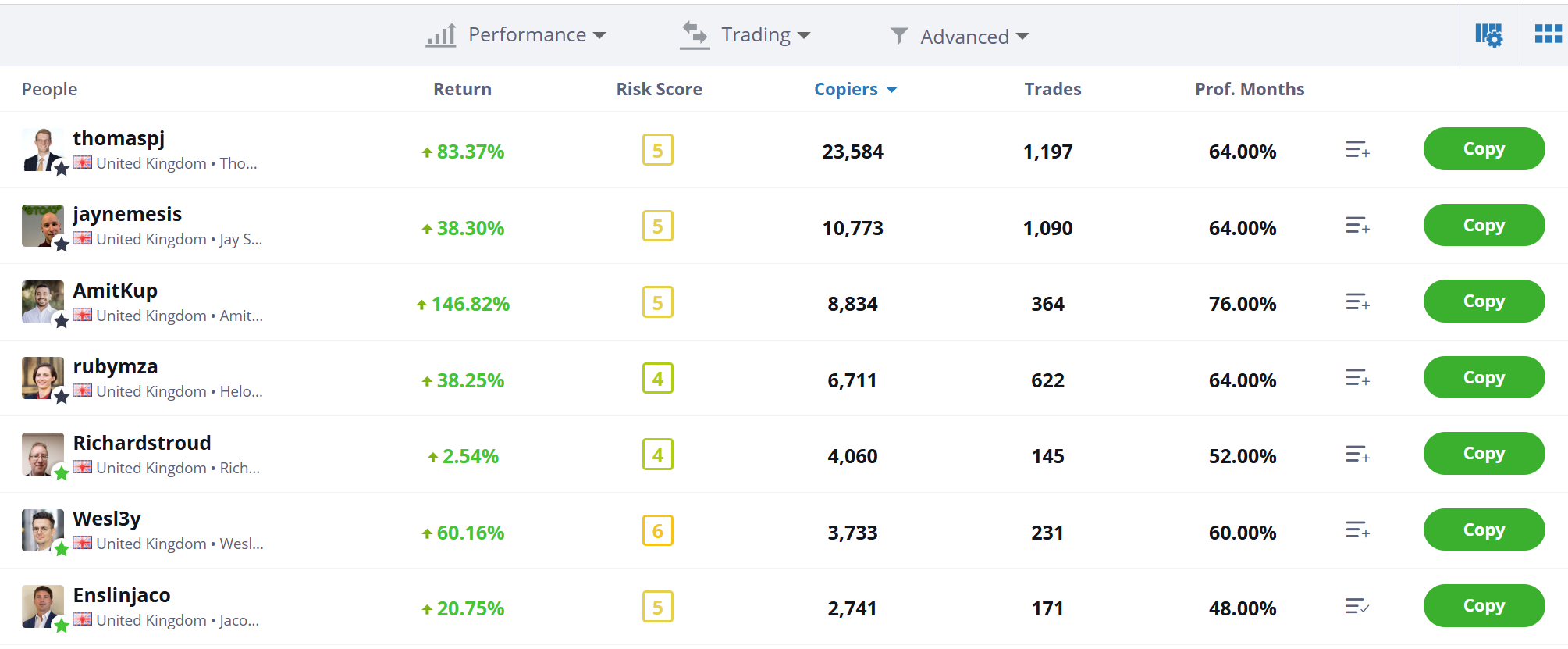

eToro, a globally renowned copy trading platform, is home to a significant number of top traders from the UK. Below are the performance statistics of some of the highest-achieving traders in the UK on eToro.

Top 3 Traders in the UK on eToro:

- thomaspj (Thomas Parry Jones): +83.37% profit, risk score 5, 23,583 copiers, 1,197 trades, 64.00% profitable months.

- jaynemesis (Jay Smith): +38.30% profit, risk score 5, 10,773 copiers, 1,090 trades, 64.00% profitable months.

- AmitKup (Amit Kupfer): +146.82% profit, risk score 5, 8,835 copiers, 364 trades, 76.00% profitable months.

61% of retail investor accounts lose money when trading CFDs with this provider.

Past performance is no guarantee of future results.

Lessons from the UK’s Top Forex Traders

The journeys of these traders offer valuable lessons for aspiring forex traders:

- Knowledge is power - Successful trading requires a deep understanding of market dynamics. It is crucial to stay informed about global economic trends, market developments, and trading strategies.

- Risk Management - Effective risk management is crucial for long-term success. Successful traders emphasize risk control, ensuring they can weather market volatility. Use stop-loss orders, diversify your trades, and avoid over-leveraging.

- Long-Term Vision - Several of these individuals have achieved success through long-term investment strategies. Stick to your strategy and avoid impulsive decisions driven by fear or greed.

- Innovation and Adaptability - The forex market’s dynamic nature necessitates constant innovation and adaptability. Successful traders often embrace new technologies and trading strategies to stay ahead of the curve.

Closing Remarks

The UK boasts a thriving forex trading ecosystem. It has a strong regulatory framework and a thriving economy. These are two ingredients that promote the growth in success stories. Today, the UK boasts a rich history of successful forex traders who have achieved remarkable wealth and influence. The individuals highlighted in this article represent the best-case scenario in forex trading.

Their stories demonstrate that with deep market knowledge, discipline, and a long-term approach, traders can achieve remarkable success. However, it's crucial to remember that forex trading involves significant risk. Most traders who participate in this market lose money. It is important to approach the market with caution, prioritise education and risk management, and strive for consistent and sustainable growth.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.