Is Exness Regulated in Kenya? Legal Status Breakdown

Exness is a globally recognised forex and CFD broker known for its competitive trading environment, fast execution, and low spreads. Exness is licensed and regulated by major regulatory bodies, ensuring the safety of traders’ funds. However, Kenyan traders may wonder: Is Exness regulated in Kenya?

Strong regulatory oversight is essential for protecting investor funds, ensuring fair market practices, and providing enforceable legal safeguards. This article explores Exness's regulatory compliance in Kenya, delving into the country's forex trading framework and its impact on local traders.

The Regulatory Landscape in Kenya

In Kenya, the Capital Markets Authority (CMA) stands as the primary regulator for forex and CFD trading, playing a critical role in safeguarding investors and maintaining market integrity. Established under the Capital Markets Act, the CMA licenses and rigorously supervises forex and CFD brokers, demanding adherence to stringent financial and operational standards.

This robust regulatory framework includes mandatory licensing for all operating brokers, the compulsory segregation of client funds for enhanced protection, enforced leverage limits to mitigate retail trading risks, and clear transparency rules regarding fees, spreads, and risks. The CMA actively enforces these regulations, imposing substantial penalties such as fines, suspensions, or bans on non-compliant and unlicensed brokers.

Furthermore, the authority actively cautions traders against the risks associated with unregulated offshore entities, emphasising the importance of verifying broker licenses before investing. By implementing these measures, the CMA ensures a secure and transparent trading environment for Kenyan investors.

Traders can confirm this by checking CMA’s official site for the full list of brokers authorized to operate in Kenya or check out our smaller hand-picked list of top CMA regulated brokers here.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Is Exness Regulated in Kenya?

Yes, Exness is regulated in Kenya and operates in the country under Capital Markets Authority (CMA) License number 162 as a registered non-dealing online foreign exchange broker, in compliance with local financial regulations. Exness maintains a dedicated Kenyan website, www.exness.ke.

Additionally, Exness holds the following legal licences from the following global financial authorities.

- Financial Services Commission (FSC) - Exness holds full authorization from the British Virgin Islands bearing registration number 2032226 and operating under investment business license SIBA/L/20/1133.

- Jordan Securities Commission (JSC) - Exness is officially registered in Jordan under registration number 51905

- Financial Sector Conduct Authority (FSCA) - Exness is authorized and regulated as a Financial Services Provider with FSP No. 51024.

- Cyprus Securities and Exchange Commission (CySEC) - Exness (Cy) Ltd is regulated by the CySEC under license number 178/12.

- Financial Services Authority (FSA) - Exness is licensed by the Financial Services Authority of Seychelles with authorization number SD025.

Why Choosing a Locally Regulated Broker in Kenya is Essential for Traders?

For Kenyan traders, trading with a locally regulated forex broker offers unmatched security, compliance, and peace of mind. Here’s why regulation matters:

Investor Protection – Safeguard your funds with brokers that follow strict Kenyan financial regulations, ensuring fair and ethical trading practices.

Legal Recourse – If disputes arise, you have direct access to Kenya’s legal system, protecting you from fraud or malpractice.

Full Compliance with Kenyan Laws – Locally regulated brokers adhere to AML (Anti-Money Laundering) and KYC (Know Your Customer) policies, keeping your transactions secure.

Transparent Trading – Regulatory oversight ensures brokers provide clear pricing, fair execution, and honest operations so you can trade with confidence.

By choosing a CMA-regulated broker in Kenya, you minimize risks and trade in a safer, more transparent financial environment.

Trading Instruments on Exness

Traders can trade the following instruments’ CFDs.

- Over 61 currency pairs, including major, minor, and exotic pairs.

- Precious metals such as gold, platinum, palladium and Silver.

- Stocks such as Nike, Meta, Netflix, Amazon and Tesla.

- Indices such as US Tech 100, US Wall Street 30, and EU Stocks 50.

- Cryptocurrency - This includes Bitcoin and Ethereum.

Deposit and Withdrawal Methods

Exness employs multiple layers of security to ensure the safety of funds. Deposits and withdrawals can be executed 24/7. In most cases, 95% of withdrawals are processed instantly, in under one minute. However, in case of any delays, they are processed within 24 hours.

Exness also pays third-party transaction fees for all its clients during withdrawal. Traders can use the following deposit and withdrawal methods.

- Bank or wire transfer.

- Debit/credit cards such as Visa and Mastercard.

- Mobile payments - These include M-Pesa, Airtel Money, Lipa na Bonga, Eazzy Pay, and eLipa.

Trading Accounts on Exness

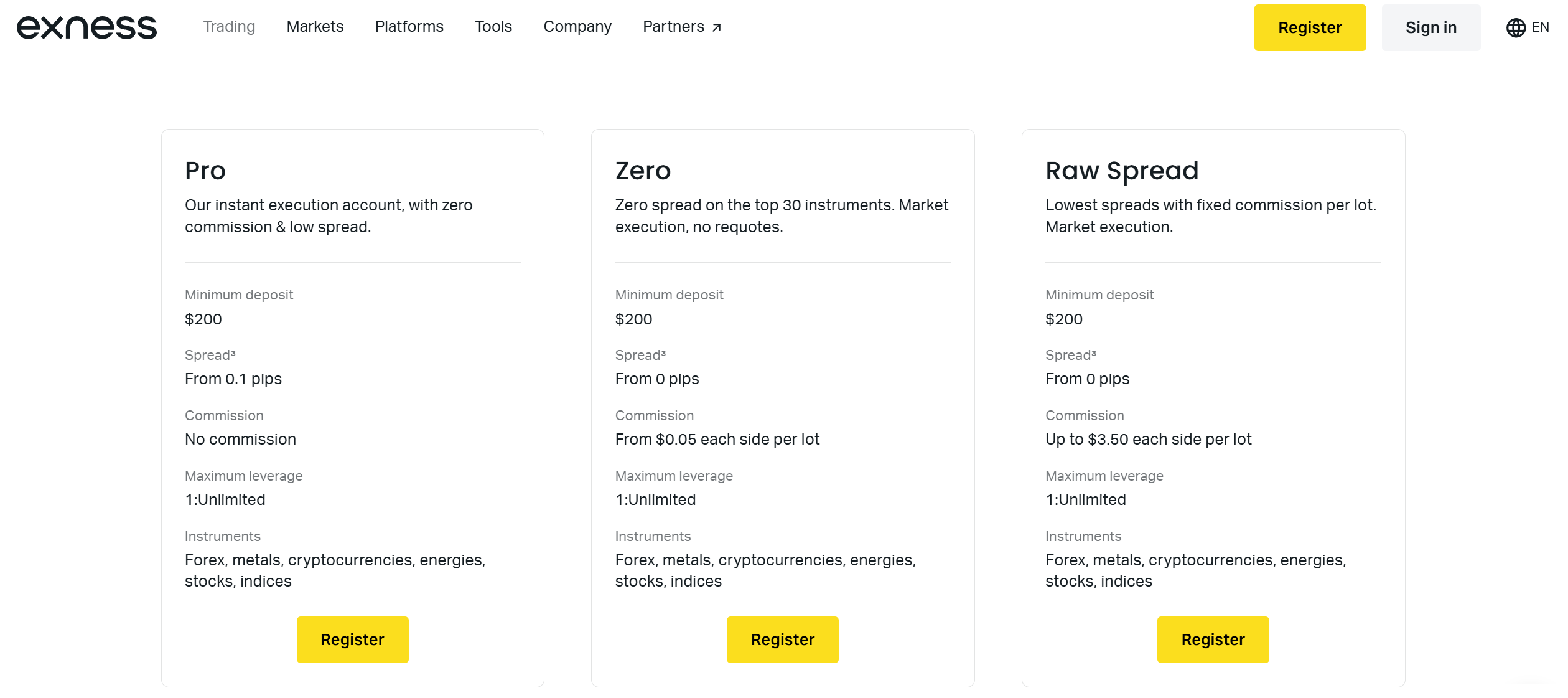

Exness offers diverse account types designed to suit various trading styles, each with its own fee system. Traders can select between two standard accounts and three professional options. For those seeking commission-free trading, the Standard Account and Standard Cent Account are a solid choice. The Standard Account features tight spreads from 0.2 pips on major forex pairs, while the Standard Cent Account starts at 0.3 pips. The Pro Account, also commission-free, provides even tighter spreads as low as 0.1 pips.

For traders prioritizing ultra-low spreads, Exness offers two professional accounts with competitive commissions: The Raw Spread Account offers spreads from 0.0 pips, charging commission of up to $3.5 per side per lot. The Exness Zero account offers spreads from 0.0 pips with commissions as low as $0.05 per side per lot on the top 30 traded instruments for 95% of the day and on other instruments for 50% of the day, depending on market volatility.

Trading Platforms On Exness

Exness offers a diverse and powerful suite of trading platforms tailored for Kenyan traders of all experience levels, from beginners to seasoned professionals. These include:

Exness provides seamless access to global markets through its suite of powerful trading platforms. Utilize the industry-leading MetaTrader 4 (MT4) and MetaTrader 5 (MT5), both available across desktop, web, and dedicated mobile applications. MT4 offers a robust environment, particularly known for its automated trading capabilities through Expert Advisors (EAs), thereby enhancing trading efficiency. Expanding beyond forex, MT5 provides access to a wider array of assets, including stocks and commodities, complemented by advanced analytical tools and an enhanced strategy tester.

For Kenyan traders seeking a streamlined, browser-based experience, the Exness Web Terminal delivers fast execution without requiring any software downloads. Furthermore, Exness ensures continuous connectivity for on-the-go trading with its optimized mobile apps for both iOS and Android, which offer full trading functionality, including convenient one-click trading and real-time alerts.

To further enhance the trading experience, Exness offers copy trading, allowing Kenyan traders to effortlessly mirror the strategies of successful peers. Underpinning these platforms are ultra-low latency servers, deep liquidity, and comprehensive multi-language support, all working together to ensure a smooth and efficient trading journey for all users.

Why Trade with Exness in Kenya?

Exness stands out as a highly favorable broker for Kenyan traders due to its strong regulatory framework, user-friendly features, and cost-effective trading conditions. One of its key advantages is that it is fully licensed and regulated by the Capital Markets Authority (CMA) of Kenya, ensuring a secure and trustworthy trading environment.

Additionally, Exness offers a free demo account, allowing both new and experienced traders to practice and refine their strategies without risking real money, an excellent feature for those looking to build confidence before transitioning to live trading. Another major benefit is its low minimum deposit requirement of just $10, making it accessible to a wide range of traders, including those with limited capital.

The broker also provides exceptionally high leverage of up to 1:400, enabling traders to maximize their market exposure with relatively small investments. Furthermore, Exness facilitates fast and seamless withdrawals while eliminating transaction fees for third-party withdrawals, enhancing convenience and cost efficiency for its users. These combined features make Exness a top-tier choice for traders in Kenya seeking reliability, flexibility, and competitive trading conditions.

Conclusion

While Kenya's forex market has been plagued by unregulated brokers and investment scams. Exness emerges as a trustworthy, CMA-regulated broker. This broker combines rigorous oversight with exceptional trading conditions. It offers Kenyan traders a secure environment. This environment features fast execution and competitive spreads. Furthermore, Exness provides seamless M-Pesa integration. Alongside these features are comprehensive educational resources. Dedicated local customer support is also available.

This powerful combination, including regulatory protection, makes Exness a very good choice for traders. With features like cutting-edge technology and market expertise positions Exness not just as a broker, but also as a true financial partner. This partnership empowers both new and experienced traders and allows them to navigate the forex and CFD markets with confidence. Simultaneously, Exness fosters disciplined trading practices and encourages sustainable growth within Kenya's dynamic financial landscape.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.