How to Trade Gold (XAUUSD) on MT4

Gold is one of the most valued commodities on the planet, and it has a rich history in the financial world. Primarily, it's widely regarded as a safe-haven asset. This means its value tends to hold or even increase during times of economic uncertainty, geopolitical instability, or high inflation, when other assets like stocks and bonds may decline.

Meanwhile, MetaTrader 4 is one of the most popular trading platforms in the world, if not the most popular. It offers traders reliability, a user-friendly interface, and advanced technical analysis tools tailored for all experience levels. As such, trading gold (XAUUSD) on MetaTrader 4 (MT4) continues to be a favoured choice for both new and seasoned traders.

In this article, we’ll delve into how to trade gold (XAUUSD) on MT4. We’ll cover essential steps like setting up your account, analysing the market, executing trades, and implementing sound risk management strategies.

Why Trade Gold (XAUUSD)?

Gold is more than just a shiny metal. It is one of the oldest and most valued assets in the financial world. XAUUSD represents the price of gold quoted in US dollars and is among the most traded pairs in the commodities and forex markets. Its price is affected by a variety of factors, which contribute to immense trading opportunities for both short-term and long-term traders.

The XAUUSD pair is an attractive tool for portfolio diversification, helping traders hedge against market volatility and protect their capital. Online gold trading also offers high liquidity, allowing traders to enter and exit positions quickly with minimal price slippage. Trading XAUUSD on MT4 allows traders to use customisable technical tools, automated strategies, and leverage to enhance their trading performance. Here is a brief look at how to trade gold on MetaTrader 4.

How to Set Up MT4 for XAUUSD Trading

To begin your gold trading journey on MT4, you will need to follow a few steps:

Step 1: Choose a Broker That Offers Gold (XAUUSD) Trading

The first step is to select a reputable MT4 broker that provides access to XAUUSD. Choose a broker with top-tier regulations, low spreads on gold, and ensure swift trade execution. Fortunately, numerous well-regarded gold brokers offer competitive spreads on gold (XAUUSD). Some popular brokers that offer XAUUSD on MT4 include Pepperstone, Exness, XM and FP Markets.

Step 2: Open an Account With The Broker

Once you identify your broker of choice, you will need to create an account. Visit the broker's official website and look for a "Sign Up," "Open Live Account," or "Start Trading" option. Once you click on the link, you will be redirected to a registration form where you will need to fill in your details.

These include your full name, address, contact details (email, phone number), date of birth, and nationality, among other details. Although opening an account is generally straightforward, you can refer to our detailed guide on how to open a real account on MT4 if you need assistance.

Step 3: Verify Your Identity (KYC)

Regulated brokers are legally required to verify your identity. This typically involves submitting a government-issued ID such as a passport, national ID card, or driver's license. Additionally, you will need to provide proof of residence, such as a utility bill or bank statement with your address, dated within the last 3 months.

Step 4: Download and Install MT4

The next step is to download the MetaTrader 4 platform from the MetaQuotes website or through a link that the broker provides to you. Follow the setup wizard and complete the installation process. Upon successful installation, log in to your trading account using the credentials supplied by your broker. This will connect your trading account on your chosen broker site to MetaTrader 4.

Step 5: Add XAUUSD to Your Market Watch

Within the MT4 platform, open the "Market Watch" window. If “XAUUSD” is not immediately visible, right-click anywhere within the Market Watch window and select “Symbols.” From the list, navigate to the "Metals" category and enable XAUUSD. Now you’ll see XAUUSD in your Market Watch window, showing Bid and Ask prices.

Step 6: Open a Gold Chart

Once added, you can right-click on XAUUSD and select “Chart Window” to display a live gold chart. Here, you can analyse the price movement of the XAUUSD pair on MetaTrader 4. You can use a variety of technical analysis tools that are readily available on MT4. These tools include:

- Moving Averages (SMA, EMA) - These indicators smooth out price data over a specified period, revealing the underlying trend. Moving averages provide clarity on whether gold prices are trending upwards, downwards, or sideways.

- Relative Strength Index (RSI) - The RSI helps determine if gold is in an overbought or oversold condition. An overbought reading suggests that gold prices may have risen too rapidly and could be due for a correction, and vice versa.

- MACD (Moving Average Convergence Divergence) - MACD is highly effective in confirming trend strength and identifying shifts in momentum. It is a go-to tool for recognising when a trend is gaining or losing momentum.

- Bollinger Bands - These indicators measure market volatility. When the bands contract, it may signal an impending breakout. When they expand, it indicates increased market activity.

These are just a few of the popular technical analysis tools available on MT4. The platform is packed with many other features that traders can access as needed.

Step 7: Place a Trade on XAUUSD in MT4

After opening the XAUUSD chart and completing your analysis, right-click on the chart and select "Trading," followed by "New Order." In the order window, input your desired trade size in lots – remember, 1 standard lot of gold typically equals 100 ounces. Set your Stop Loss and Take Profit levels in accordance with your risk management strategy. Then, choose "Market Execution" for an immediate trade or "Pending Order" if you wish the trade to trigger at a specific price.

Finally, click "Buy" or "Sell" based on your market outlook. Once your trade is active, you can monitor and manage it from the "Terminal" window. MT4 also allows you to set alerts, adjust existing orders, or manually close trades.

Factors That Influence Gold Prices

Understanding what drives the price of gold is essential before making any trading decisions. Below are some of the main drivers of gold prices:

- Interest Rates - Interest rates also play a major role. When countries like the United States, China, or Australia raise interest rates, investors often shift their money to higher-yield assets like bonds. This can reduce demand for gold and lower its price.

- Central Bank Policies - When central banks buy large amounts of gold, it can reduce supply in the market and drive up prices. On the other hand, selling gold reserves can have the opposite effect.

- Inflation - Inflation is another key factor. Gold is seen as a safe hedge against inflation. When inflation rises, more investors buy gold to protect their purchasing power. This increased demand often pushes prices higher.

- Geopolitical Events - Geopolitical tensions and global instability tend to increase demand for gold as well. During events such as wars, political unrest, or economic sanctions, gold is viewed as a safe-haven asset. As uncertainty rises, so does gold buying, which can push prices up.

- Supply and Demand - Basic supply and demand also affect gold’s value. Changes in mining output, industrial demand, and central bank activity can all influence the availability and price of gold.

To stay ahead in XAUUSD trading, it's important to follow global news, monitor economic calendars, and keep track of major financial trends. These insights can help you better predict price movements and make more informed trading decisions.

Benefits of Trading XAUUSD on MT4

Trading XAUUSD (Gold) on the MetaTrader 4 (MT4) platform offers several key advantages for traders. Let's explore some of the most notable benefits:

- Multi-Asset Capability - MT4 isn't just for gold. Its multi-asset capability allows you to trade XAUUSD seamlessly alongside a wide variety of other financial instruments. This means you can manage other market products like forex, indices, stocks, and even cryptocurrencies, all from a single trading account.

- Advanced Charting Tools - For in-depth technical analysis, MT4 provides an impressive suite of advanced charting tools. You get highly customisable charts that you can tailor to your specific analytical needs.

- Automated Trading with Expert Advisors (EAs) - For those looking to automate their trading strategies, MT4's strong support for Expert Advisors (EAs) is a major plus. These powerful trading bots and algorithms can execute trades automatically based on a predefined set of rules.

- Depth of Market (DOM) - The Depth of Market (DOM) feature gives traders real-time, transparent insights into XAUUSD market liquidity. This essential tool displays the volume of buy and sell orders at different price levels, offering a clear view of market depth.

- Strategy Tester - MT4 includes an integrated strategy tester that enables you to backtest your XAUUSD strategies using historical data. This tool helps evaluate the effectiveness of your trading system in various market conditions, refine its parameters, and increase confidence before moving to live trading.

Some of The Best MT4 Gold Brokers

Exness

Exness is a top choice for gold trading on MT4, offering traders some of the best trading conditions. On this broker site, traders have access to a variety of account types, each catering to different trading styles and risk tolerances. The standard and the standard cent account both offer spreads averaging $0.16 for the XAUUSD pair with no commission charged. Meanwhile, the Pro account offers lower spreads, averaging $0.11 with no commission.

Prices and spreads are subject to change. Check your platform for the most up to date data.

In contrast, the Raw Spread account offers average gold spreads of $0.037, with a commission of $3.50 per side per standard lot. Finally, the Zero account provides spreads from $0.0, paired with a commission of $5.5 per side per standard lot. Keep in mind that on Exness, gold is only traded as a CFD and can be quoted against several major currencies, including USD, EUR, AUD, GBP, and SGD.

Exness stands out by offering swap-free gold trading on all its accounts. This is a significant advantage for investors who intend to hold their gold positions for longer durations, as they won't incur overnight financing charges. Please note that swap-free status may be revoked if a trader primarily holds large positions overnight outside regular trading hours.

Exness maintains a strong regulatory framework, operating under the oversight of several financial authorities worldwide. These include the FCA, CySEC, FSCA, CMA, and the FSA of Seychelles, among others.

Beyond gold, Exness provides a diverse selection of trading instruments. These include forex pairs, indices, commodities, stocks, and cryptocurrencies, all available as CFDs. Other than MetaTrader 4, traders can also use MT5, Exness Terminal and the Exness Trade app.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

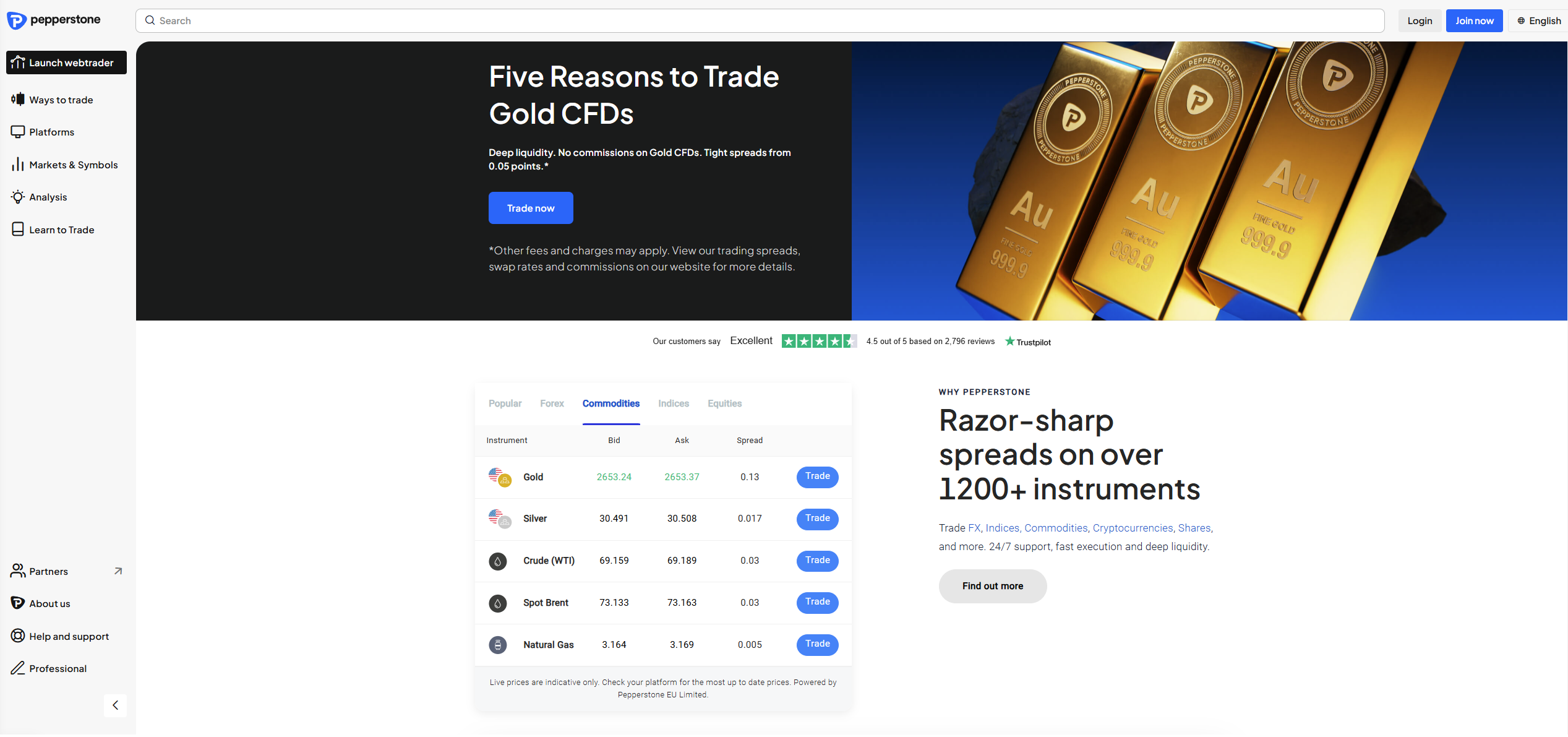

Pepperstone

Pepperstone supports gold CFD trading on MT4 with institutional-grade spreads and ultra-fast execution. For the XAUUSD pair, it features a minimum spread of $0.05 and an average spread of $0.18. Pepperstone provides multiple platforms for trading gold alongside MetaTrader 4. These include MetaTrader 5, cTrader, TradingView, and the Pepperstone Trading Platform. Aside from gold CFDs, investors can also access CFDs on forex, indices, commodities, cryptocurrencies, and ETFs. This allows investors to diversify their portfolios as they see fit.

Prices and spreads are subject to change. Check your platform for the most up to date data.

Pepperstone maintains strong regulatory oversight, holding licenses from some of the world's most respected financial authorities. These include the UK's FCA, Australia's ASIC, Cyprus' CySEC, Germany's BaFin, and the DFSA in Dubai's DIFC. This ensures compliance across multiple jurisdictions.

75.3% of retail CFD accounts lose money

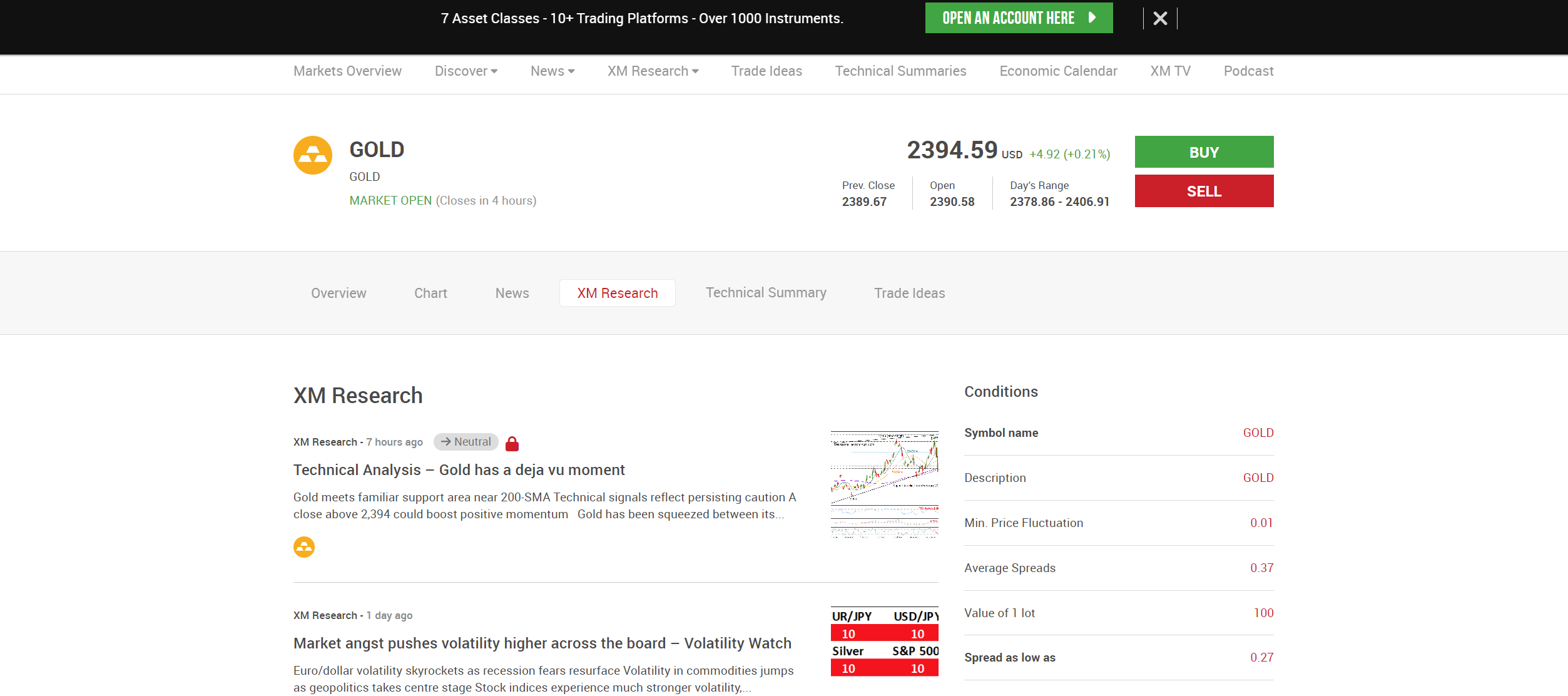

XM

XM is another top broker for trading gold on MT4. This broker provides highly competitive spreads for gold trading, ensuring traders can maximise their profitability. When trading gold against the USD (XAUUSD), the Standard account offers a minimum spread of $0.27 and an average spread of $0.37. For even tighter pricing, the Ultra Low account provides spreads starting from $0.16, with an average of 0.20 on XAUUSD.

Prices and spreads are subject to change. Check your platform for the most up to date data.

XM.com offers a diverse range of CFD instruments beyond gold. These include CFDs on forex, indices, energies, shares, cryptocurrencies, and other precious metals. Traders can execute orders using MetaTrader 4 and 5 and the XM Trading App.

Finally, XM has a strong regulatory standing. This broker operates under the regulation of the ASIC in Australia and the CySEC in Cyprus, among others.

75.18% of retail investor accounts lose money when trading CFDs with this provider.

Closing Remarks

Trading gold (XAUUSD) on MT4 gives you access to one of the most liquid and reliable markets in the world. With the platform’s robust features and customisable tools, MT4 allows traders to analyse and execute their gold trading strategies with confidence. Moreover, the support for Expert Advisors (EAs) allows traders to automate their trading, which is an added advantage.

By understanding the fundamentals of the gold market, you can improve your chances of success in the XAUUSD market. Remember to apply proper technical analysis and sound risk management strategies. Before going live, make sure to backtest and paper trade your strategies. Then, choose a reputable MT4 broker with competitive spreads on gold.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.