HFM Islamic Account Review

HFM is a globally recognised broker celebrated for its extensive range of trading services and robust market offering. Serving a diverse international clientele, HFM has a significant number of Muslim traders who prioritise ethical participation in financial markets. Understanding this vital need, HFM offers dedicated Islamic accounts, designed to provide Sharia-compliant trading opportunities.

This comprehensive HFM Islamic account review will delve into the broker's offerings for Muslim traders, outlining the advantages and disadvantages of its swap-free accounts.

Understanding Islamic Trading Accounts

In traditional forex and CFD trading, overnight positions often incur swap fees, which are interest-based charges. However, Islamic finance strictly prohibits the paying or earning of interest (Riba). Consequently, Muslim traders cannot utilise traditional trading accounts as they directly conflict with Islamic principles. Islamic trading accounts are specifically created to address these religious requirements, enabling Muslim traders to engage in financial markets in a permissible manner.

Islamic accounts achieve this by eliminating swap fees, thereby creating a Sharia-compliant trading environment. Brokers typically implement swap-free conditions in various ways. Some brokers may introduce alternative charges, like administrative fees, to compensate for the absence of swaps. Let's explore how HFM approaches this.

How Islamic Accounts Work on HFM

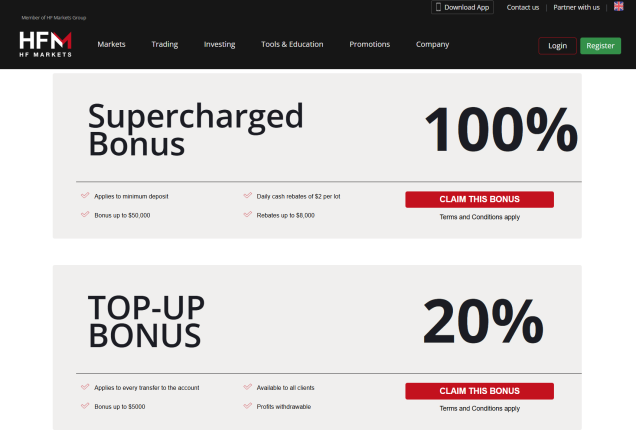

HFM offers swap-free trading on five of its trading accounts. These include the Cent, the Premium, the Zero, the Pro, and the Pro-plus accounts. The only account with no swap-free option is the Top-up Bonus account. The trading conditions that a trader will enjoy will depend on the account they are using.

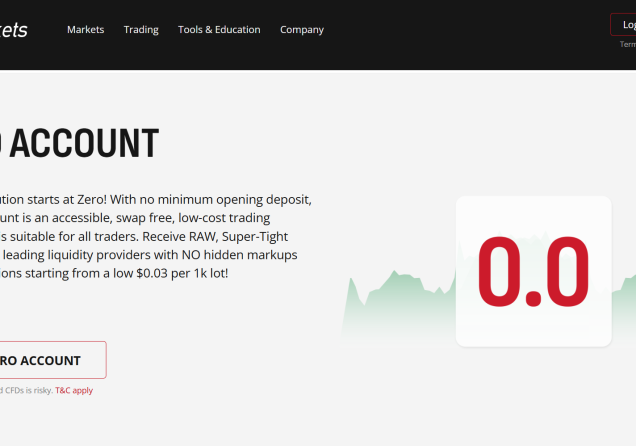

The Premium account features spreads starting at 1.2 pips, while the Cent account offers slightly tighter spreads from 1.0 pips. For traders seeking even lower spreads, the Pro account has spreads starting at 0.5 pips, and the Pro-Plus account offers spreads from 0.2 pips. None of these accounts charges a commission on forex pairs. However, the Zero Spread account offers spreads from 0.0 pips but charges a commission of $3 per side per lot.

Notably, several instruments may face Carry Charges after a position has been rolled over for a sequential period of days. The specific period depends on the market instrument involved in the trade.

Remember that Forex and CFDs available at HFM are leveraged products.

Their trading can result in the loss of your entire capital.

Swap-Free Trading for Non-Islamic Traders

On another note, swap-free trading conditions are also available for clients who do not observe Sharia law on specific instruments under a specific condition. The condition is that the client must trade mostly within the day and maintain a low number of overnight positions. The trading instruments where this applies include:

AUDNZD, EURNZD, GBPNZD, GBPJPY, USDCAD, AUDCHF, AUDJPY, CADCHF, CADJPY, CHFJPY, EURCHF, EURJPY, GBPCHF, NZDCHF, NZDJPY, USDCHF, USDJPY, AUDCAD, AUDUSD, EURAUD, EURCAD, EURGBP, EURUSD, GBPCAD, GBPUSD, NZDUSD, NZDCAD, XAUEUR, XAUUSD, AUS200, FRA40, GER40, HK50, JPN225, NETH25, SPA35, SUI20, UK100, USA100, USA30, USA500, USAIndex, USOIL.S

Please note that trading history on the above-mentioned instruments will be monitored to ensure correct use of the swap-free conditions. The Company reserves the right to revoke swap-free status at its absolute discretion.

Pros of HFM Islamic Accounts

- Full Sharia Compliance - HFM’s Islamic account eliminates swap fees, ensuring adherence to Islamic finance principles.

- Diverse Account Types - Islamic options are available across the Cent, the Premium, the Zero, the Pro, and the Pro-plus accounts, catering to different trading preferences and budgets.

- Competitive Trading Conditions - HFM's Islamic accounts maintain similar competitive spreads and execution speeds as their traditional counterparts, ensuring a high-performance trading experience.

- Wide Range of Instruments - Traders have access to HFM’s full suite of markets, including forex, stocks, and cryptocurrencies, among others

- Multiple Platforms - The Islamic accounts on HFM support MT4, MT5, and HFM’s proprietary platform. This offers flexibility and advanced trading tools across multiple devices.

- Low Minimum Deposit - Most trading accounts on HFM do not have a minimum deposit requirement. Specifically, the Cent, the Premium, and the Zero accounts do not have a minimum deposit requirement. However, the Pro account requires a minimum deposit of $100, and the Pro-plus account requires a minimum deposit of $250.

Cons of HFM Islamic Account

- Carry Charges on Some Instruments - While swap-free, some instruments may incur carry charges for positions held overnight, particularly for extended periods. Traders should be aware of these potential costs.

- Limited Grace Period Information - While HFM does not typically charge fees for overnight positions, the lack of a clearly defined grace period for all instruments may create uncertainty for some traders.

Setting Up an Islamic Account

Establishing an Islamic Account with HFM is generally a straightforward process. Traders typically need to:

- Open an Account - Register an account on the HFM website and choose your preferred account type (Cent, Premium, Zero, Pro, or Pro-plus).

- Verify your account - Provide the necessary identification and proof of residence documents as required by HFM's regulatory obligations.

- Request Islamic account conversion - Once your account is verified, you will need to contact HFM's customer support to request that your account be converted to an Islamic (swap-free) account. HFM may require specific documentation or confirmation of your adherence to Sharia law for this conversion.

Credibility of HFM

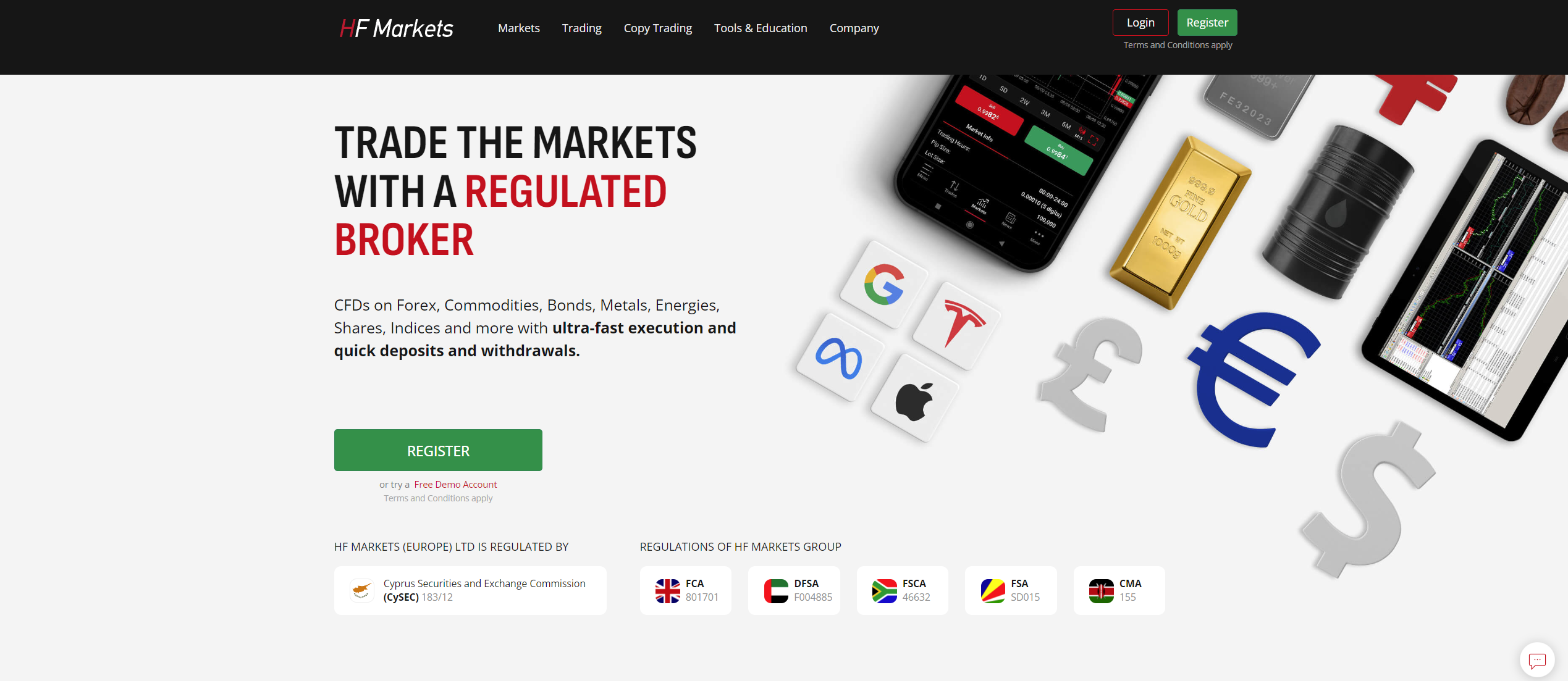

Before committing to any broker, it is important to consider their regulation and overall reputation. HFM has built a strong reputation as a reliable and credible broker since its founding in 2010. The broker operates under the regulation of numerous financial organisations globally. These include the DFSA in Dubai’s DIFC, the CMA in Kenya, the FSCA in South Africa, the FSA in Seychelles, the FCA in the UK, and the CySEC in Cyprus, among others.

Such extensive regulations are part of the reason why HFM stands out as one of the top brokers with Islamic accounts. However, please note that HFM does not offer services to retail clients in the UK and the EEA region. On another note, user ratings also reflect positively on HFM. On Trustpilot, the broker holds a solid 4.6-star rating out of 5 after over 1,900 reviews. This reflects high client satisfaction and trust in its services. Today, the broker hosts over 2.5 million live accounts globally.

Final Verdict

HFM provides a comprehensive and well-structured Sharia-compliant trading solution for Muslim traders. The availability of swap-free conditions across various account types gives traders the flexibility to pick an account that fits their preferences and budget. These accounts feature competitive trading conditions, access to a deep collection of market products, and several advanced trading platforms. This allows HFM to effectively balance religious adherence with high-performance trading capabilities.

However, prospective users should be aware of the potential for carry charges on certain instruments, especially for long-term positions. Still, HFM's strong regulatory oversight and commitment to Sharia compliance make HFM an appealing choice for Muslim traders seeking a halal trading experience.

Remember that Forex and CFDs available at HFM are leveraged products.

Their trading can result in the loss of your entire capital.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.