Forex Trading Sessions in South Africa (in local time)

The forex market is highly dynamic and complex, influenced by numerous factors that impact trading activity and market sentiment. For serious traders, understanding these factors is essential. One of the most critical aspects to grasp is the timing of forex trading sessions in their local time zone.

South Africa, with its active forex trading scene regulated by the Financial Sector Conduct Authority (FSCA), is no exception. To refine trading strategies and maximise trading opportunities, South African traders must understand forex market hours in their local time.

In this guide, we will explore the forex market hours in South African time (SAST) and discuss potentially the best trading times for South African traders.

What Time Does the Forex Market Open/Close in South Africa?

The forex market operates 24 hours a day, five days a week, due to its decentralised nature. Trading occurs across four major sessions, each corresponding to the business hours of key financial centers globally. The four trading sessions include the Sydney, Tokyo, London, and New York sessions. These sessions overlap at certain times, ensuring continuous trading throughout the week.

The forex market opens in South Africa on Mondays at 12:00 AM SAST (South African Standard Time).

The forex market closes in South Africa on Saturdays at 12:00 AM SAST.

These timings correspond to the start of the Sydney session on Monday and the close of the New York session on Saturday (Friday in New York). Let’s take a look at the four major trading sessions in South African Standard Time.

Forex Trading Sessions in South Africa

The four major forex trading sessions are the Sydney, Tokyo, London, and New York sessions. Each session has its unique characteristics, and understanding these can help South African traders identify the best times to trade.

The Sydney Session in South African Time

The Sydney session marks the beginning of the forex trading day. In South Africa, the Sydney session opens at 12:00 AM (midnight) and closes at 9:00 AM SAST. It is generally less volatile compared to later sessions. Nonetheless, it is significant for trading the Australian dollar (AUD) and New Zealand dollar (NZD). South African traders can use this session to trade AUD/USD, NZD/USD, and other AUD or NZD-related pairs. Economic data releases from Australia and New Zealand, such as interest rate decisions and GDP figures, can influence market movements during this session.

The Tokyo Session in South African Time

The Tokyo session overlaps with the Sydney session for a couple of hours, increasing market activity slightly. In South Africa, this session starts at 2:00 AM and ends at 11:00 AM SAST. This session is crucial for trading Asian currencies like the Japanese yen (JPY) and the Chinese yuan (CNY). Economic data releases from Japan and China can significantly impact currency movements.

The London Session in South African Time

The London session is the most active period of the trading day, featuring high volatility and strong price movements. It accounts for a significant portion of global forex trading volume. In South Africa, this session runs from 10:00 AM to 7:00 PM SAST.

Many major forex pairs see increased trading volume during this session. Economic data releases from the UK and Europe, such as inflation reports and interest rate decisions, often lead to significant price movements. The overlap between the London and New York sessions is particularly the most volatile and active forex trading period of the day.

The New York Session in South African Time

The New York session is the final major session of the trading day. As mentioned, it overlaps with the London session to create the most active period of the forex trading day. The New York session begins at 3:00 PM and ends at 12:00 AM in South African Standard Time.

This session is highly volatile, especially for USD-based currency pairs. The release of key economic data from the United States, such as Non-Farm Payrolls, and GDP figures, can cause significant currency movements.

Impact of Daylight Saving Time (DST)

Daylight Saving Time (DST) has a notable impact on forex market hours. When DST is in effect (typically from March to November), some countries adjust their clocks forward by one hour, leading to a change in the timing of trading sessions. For South African traders, it’s essential to note these changes to align trading activities accordingly. Below is a summary of how DST impacts trading session timings in SAST:

| Trading Session | Opening Time (No DST) | Closing Time (No DST) | Opening Time (DST) | Closing Time (DST) |

| Sydney Session | 12:00 AM | 9:00 AM | 11:00 PM | 8:00 AM |

| Tokyo Session | 2:00 AM | 11:00 AM | 2:00 AM | 11:00 AM |

| London Session | 10:00 AM | 7:00 PM | 9:00 AM | 6:00 PM |

| New York Session | 3:00 PM | 12:00 AM | 2:00 PM | 11:00 PM |

What is Potentially the Best Time to Trade in South Africa

The best time to trade forex in South Africa depends on a trader's strategy, preferred currency pairs, and availability. However, certain periods offer more significant opportunities due to higher liquidity and volatility. Below are some of the best trading times for South African traders:

The London Session

This session aligns well with South African business hours, making it convenient for local traders. This session is highly active and offers excellent trading opportunities for South African traders. Traders can focus on major currency pairs like EUR/USD, GBP/USD, and USD/CHF during this session. South African traders trading during this session should keep an eye on the economic data releases from the UK and Europe in general.

The London-New York Overlap

The London-New York overlap runs from 3:00 PM to 7:00 PM SAST and offers the most market activity to traders. Since this period occurs during convenient hours, traders in South Africa can take advantage of the volatility and liquidity that arises.

It's a good time to trade major currency pairs like EUR/USD, GBP/USD, USD/JPY, and even AUDUSD. Economic news and events from both the US and Europe have a significant influence on market sentiment. As such, South African traders looking to invest during this period should ensure they stay updated on such events.

The New York Session

For traders who prefer to trade in the evenings to late nights, the New York session is a perfect time. This session is also known for immense trading opportunities and market activity. The opening of the New York Stock Exchange aligns with this session, sparking substantial market movement. This session holds great importance because of the impact of the US dollar, which is involved in nearly 90% of all Forex trades.

Tips for Navigating Forex Market Hours in South Africa

- Align Trading with Your Schedule - Choose sessions that fit your availability. The London session is particularly convenient for South African traders and it occurs during business hours.

- Assess Your Risk Tolerance - Understanding how much risk you are willing to endure in the market is crucial to plan your trading. For example, your risk appetite may be aligned with less active trading sessions like the Sydney session. However, some traders prefer more active markets with immense liquidity.

- Monitor Economic Events - Stay updated on economic news releases and central bank announcements, as they can cause significant market movements. Ensure you check the events of the economies associated with the sessions you wish to trade.

- Use Risk Management Tools - Risk management should be at the core of every trader’s strategy. Implement stop-loss and take-profit orders to protect your capital during volatile periods.

- Choose a Reliable Broker - Select a broker regulated by the FSCA with competitive spreads and reliable execution.

- Utilise Trading Tools - Use trading tools like economic calendars, trading journals, and market sentiment indicators to enhance decision-making.

Final Thoughts

Understanding forex market hours in SAST is essential for South African traders. It can greatly help traders fine-tune their strategies to maximise trading efficiency. For South African traders, the London session and the London-New York overlap are particularly advantageous due to their alignment with local business hours and high liquidity.

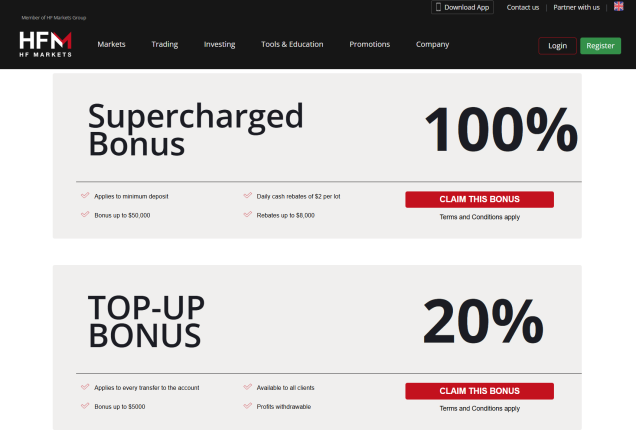

Additionally, choosing a broker that offers a 100% deposit bonus and supports ZAR accounts can provide South African traders with extra flexibility and capital to enhance their trading opportunities.

By combining this knowledge with diligent risk management, South African traders can navigate the forex market effectively and enhance their trading performance. Remember, always conduct thorough research and choose a reliable broker to optimize your forex trading experience.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.