Exness Gold Trading - Spreads & Trading Hours

Gold has long been considered a safe-haven asset, a store of value, and a hedge against inflation and economic uncertainty. As such, gold trading is one of the most popular forms of investment, particularly in the forex market. For traders, gold offers a unique opportunity to diversify their portfolios and capitalise on market volatility.

Exness, a well-established online broker, offers access to gold trading, attracting a diverse range of investors. But what are the key aspects to consider when trading gold on Exness? In this article, we will dive into the specifics of trading gold on Exness, focusing on spreads, trading hours, and other essential aspects that traders need to know.

Gold Trading on Exness: The Basics

Gold trading on Exness is conducted through Contracts for Difference (CFDs). This means that you are not buying physical gold but rather speculating on the price movements of gold. Gold is available to trade against the US Dollar (USD), the British Pound (GBP), the Euro (EUR), and the Australian Dollar (AUD).

Exness provides access to gold trading through its MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, as well as its proprietary Exness Terminal. Let’s look at the trading hours for gold on Exness.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Gold Trading Hours on Exness

Understanding the trading hours for gold is crucial for effective trading. The gold market operates almost 24 hours a day, five days a week, with some minor breaks. On Exness, gold trading is open from Sunday 22:05 to Friday 20:58 GMT with daily breaks from 20:58 to 22:01 GMT.

The market is active across many global financial centers, including London, New York, Tokyo, and Australia. Meaning there are periods of very high activity when those markets are open. It is important to remember that changes in trading volume and liquidity can greatly affect the spread offered at that time. Speaking of spreads, let’s review the spread levels for gold trading on Exness.

Gold Trading Spreads on Exness

Spreads are a critical factor to consider when trading any asset, including gold. Exness is known for offering competitive spreads on gold across its various accounts. There are five different accounts available to choose from, including two standard accounts and three professional accounts. Let’s take the XAUUSD pair to demonstrate the spreads on each of the accounts.

The Standard account and the Standard Cent account both have an average spread of 16 pips with no commission charged. Further, the Pro account features a lower average spread of 11.2 pips with no commission. Meanwhile, the Zero account has an average spread of 0.0 pips but features a commission of $5.5 per side per lot. Finally, the Raw Spread account has an average spread of 3.7 pips plus a commission of $3.5 per side per lot.

Prices and spreads are subject to change. Check your platform for the most up to date data.

Prices and spreads are subject to change. Check your platform for the most up to date data.

Please keep in mind that these spreads are floating, and Exness usually publishes the previous day's average rates. For live spreads, ensure you check your trading platform. Additionally, note that spreads may widen when markets experience low liquidity. This may persist until liquidity levels are restored.

Exness offers an extended swap-free feature for XAUUSD under specific conditions. Swap-free status means that no swap fees are applied to orders held overnight for this instrument. This feature is particularly beneficial for traders who hold positions for extended periods.

The Credibility of Exness

The credibility of a broker is very crucial to consider alongside the other features regarding trading fees and market hours. Positively, Exness operates under the regulation of a variety of financial authorities around the world. These include the FSCA in South Africa, the CMA in Kenya, the FCA in the UK, the CySEC in Cyprus, and the JSC in Jordan, among others. While regulations alone are not enough, a multi-regulatory framework is always a good sign of a broker willing to operate within the laws.

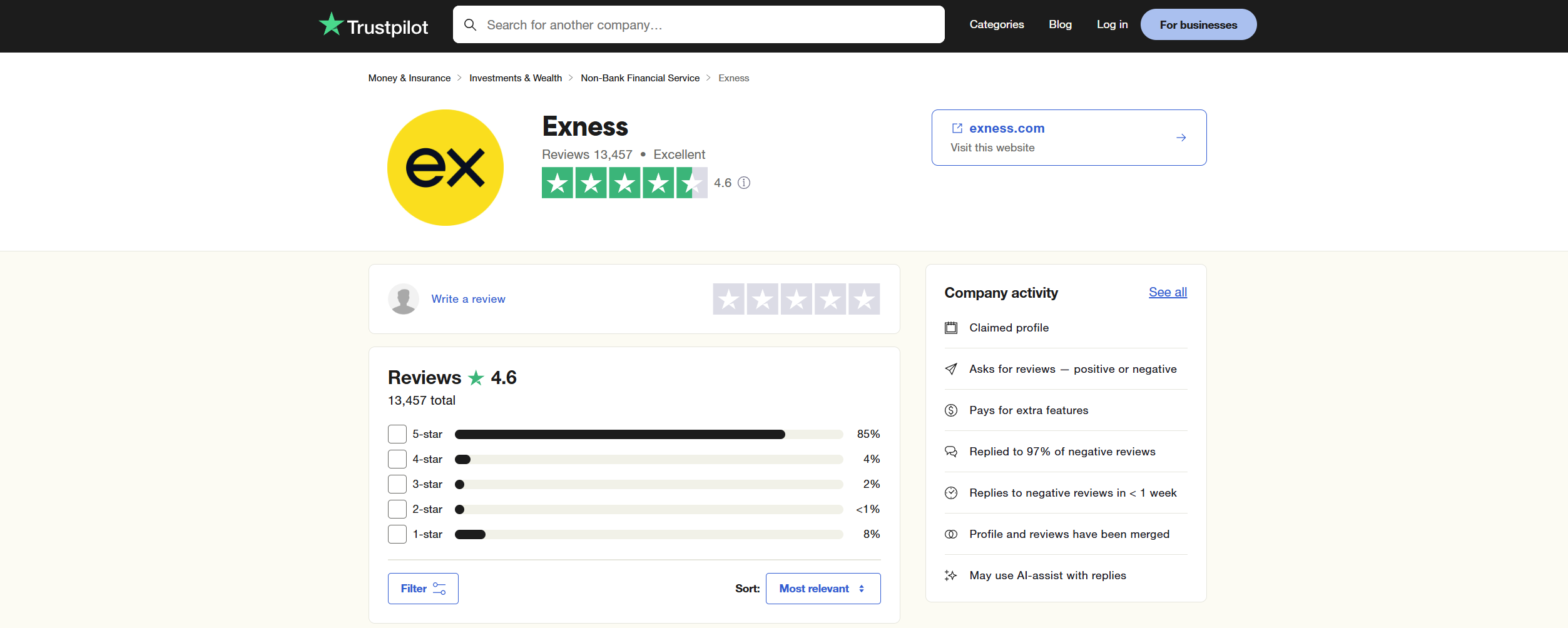

The broker has also garnered a great reputation among online reviewers. It has a rating of 4.6 stars out of 5 on Trustpilot after more than 13,400 reviews. Today, Exness stands out as one of the largest forex brokers in the world by trading volume, further emphasising its strong reputation.

Why Trade Gold with Exness?

After looking at the various aspects to consider when trading gold on Exness, let’s look at a summary of the key features that Exness provides.

- Regulation - Exness is regulated by multiple financial authorities, as highlighted above. The various regulators ensure that the broker maintains a fair and secure gold trading environment.

- Competitive Spreads - Exness offers some of the most competitive spreads in the industry, making it cost-effective to trade gold. Moreover, it offers several account types to fit different trader profiles.

- Advanced Trading Platforms - Exness offers a range of trading platforms, including MetaTrader 4, MetaTrader 5, and Exness Terminal. These platforms offer advanced charting tools, automated trading capabilities, and user-friendly interfaces.

- No Hidden Fees - Exness is transparent about its fees, with no hidden charges or commissions on most accounts.

Factors Influencing Gold Prices

Several factors can influence gold prices, and traders should be aware of these influences to make informed trading decisions. Key factors include:

- US Dollar Strength - Gold is usually priced in US dollars, so fluctuations in the dollar's value can significantly impact gold prices. A weaker dollar generally leads to higher gold prices, and vice versa.

- Interest Rates - Changes in interest rates of key economic countries like the US, China, and Australia, among others, can also affect gold prices. Higher interest rates can make other investments, such as bonds, more attractive, potentially reducing demand for gold.

- Inflation - Gold is often considered a hedge against inflation. When inflation is high, investors may turn to gold to preserve their purchasing power.

- Geopolitical Events - Geopolitical instability, such as wars, political unrest, and economic sanctions, can create uncertainty and increase demand for gold as a safe-haven asset.

- Supply and Demand - Like any other asset, gold prices are influenced by supply and demand dynamics. Changes in mining production, central bank purchases, and industrial demand can all affect gold prices.

Final Comments

Exness offers a robust platform for gold trading, with competitive spreads, flexible account options, and advanced trading platforms. It also offers a variety of trading accounts to suit different traders and strong regulatory oversight.

Understanding the intricacies of gold trading, including spreads, trading hours, and the factors that influence gold prices, is essential for efficient trading. Implementing robust risk management strategies is equally critical for protecting capital and navigating the volatile gold market. Always conduct thorough research before using any broker to invest in any financial product.

Remember that Forex and CFDs available at Exness are leveraged products.

Their trading can result in the loss of your entire capital.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.