eToro Islamic Account Review

eToro is a global broker, renowned for its social trading and multi-asset brokerage platform. This broker has attracted traders from around the world, thanks to its user-friendly interface, innovative copy trading features, and a wide range of financial instruments.

Among its diverse clientele are Muslim traders who seek to trade in compliance with Islamic financial principles. To cater to this demographic, eToro offers an Islamic account, also known as a swap-free account. In this review, we will explore the features, pros, and cons of the eToro Islamic account to see what it has to offer to traders.

What is an Islamic Trading Account?

Islamic finance is governed by Sharia law, which prohibits certain practices. Specifically, Islamic finance principles prohibit the earning or paying of interest (riba) and engaging in transactions that involve excessive uncertainty (Gharar) or gambling (Maysir).

To ensure compliance, Islamic accounts remove swap fees charged for holding positions overnight. eToro’s Islamic account is designed to provide this swap-free feature while maintaining competitive trading conditions. Let’s take a look at some of its key features.

61% of retail investor accounts lose money when trading CFDs with this provider.

eToro Islamic Account

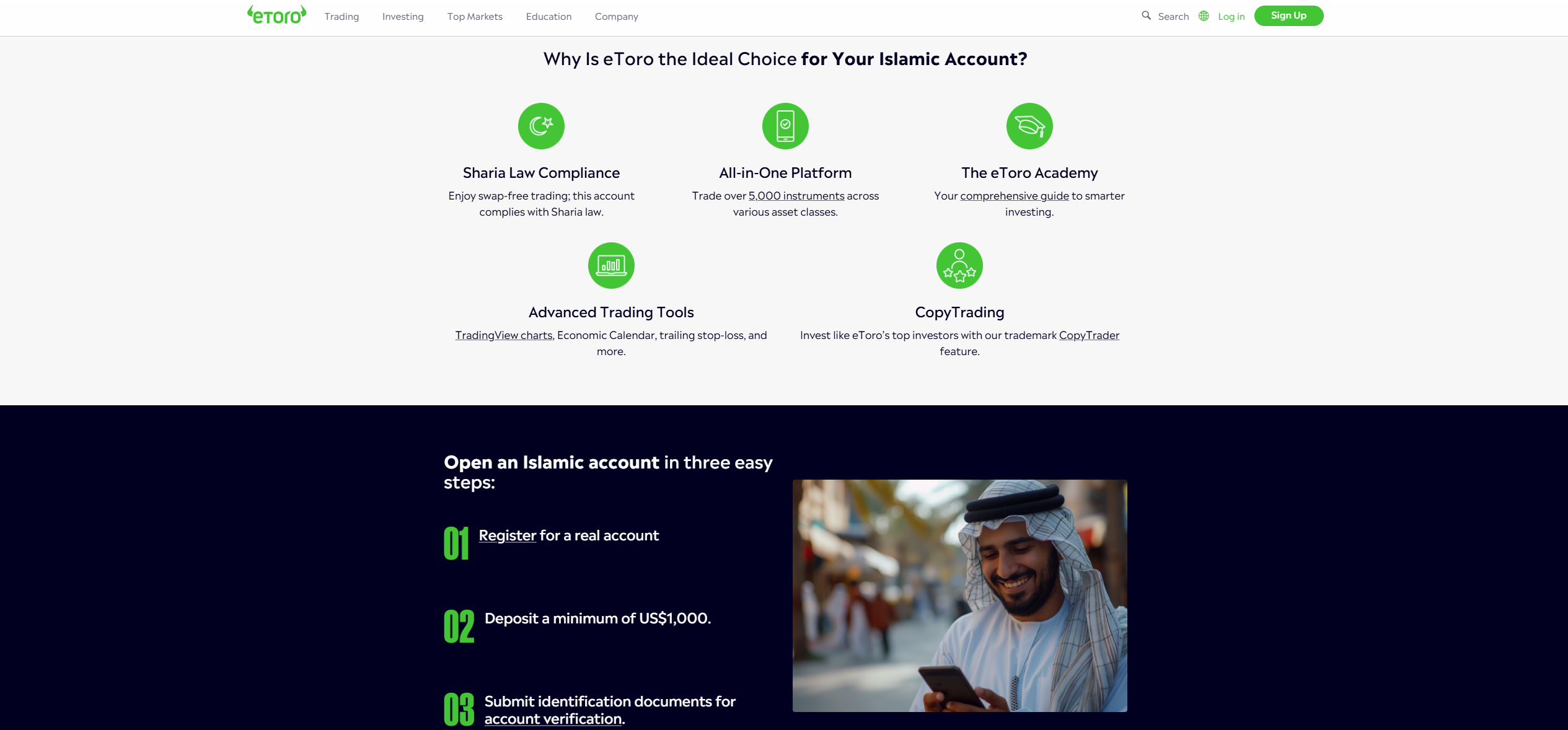

eToro's Islamic account mirrors its regular trading account but removes swap fees. This account allows Muslim traders to trade all assets available on the eToro platform. eToro has structured all assets and any potential fees associated with them to align with Sharia law.

In particular, eToro allows Muslim traders to access over 5,000 different products including CFDs on forex, indices, commodities, ETFs, stocks, and cryptocurrencies. The broker also supports the trading of real stocks and cryptocurrencies.

Notably, eToro charges administrative fees on the Islamic account. These fees vary depending on the CFD instrument and apply daily to positions held past 22:00 GMT. The administrative fee is not linked to interest rates or any interest-related charges.

Moreover, eToro offers a seven-day grace period, after which the administration fees are applied. The administrative fee does not apply to real stocks, ETFs, or cryptos. For Spot Commodity positions, Islamic Accounts, like other eToro accounts, are subject to spot price adjustment on a daily basis.

Further, the eToro Islamic account offers traders several other perks. For starters, traders have access to several advanced trading tools including TradingView charts, an economic calendar, trailing stop-loss, and more. Additionally, traders on this account gain access to the eToro Academy which hosts a collection of comprehensive guides for smarter investing.

Better yet, this account also has the revolutionary CopyTrader feature that allows investors to automatically replicate the trades of other traders. This can be particularly appealing for those new to trading or seeking to learn from others.

One major point to note is that the Islamic account requires a minimum deposit. To open this account, traders need to make a minimum deposit of at least $1,000. Additionally, traders need to submit identification documents for review during the account verification process.

Pros of the eToro Islamic Account

- Sharia Compliance - The primary advantage of the eToro Islamic account is adherence to Islamic financial principles. This allows Muslim traders to trade without paying or receiving interest.

- Wide Range of Assets - eToro provides access to all its diverse range of assets on the Islamic account. This allows investors to diversify their portfolios as they see fit.

- Copy Trading - The ability to use eToro’s innovative CopyTrader feature on the Islamic account is a significant benefit for traders. Traders can follow the strategies of other investors in just a few clicks using this feature.

- User-Friendly Platform - eToro's platform is known for its intuitive interface, making it accessible to retail traders with varying experience levels.

- Transparency -eToro provides transparent pricing, ensuring that traders understand the fees associated with their Islamic account.

Cons of the eToro Islamic Account

- High Minimum Deposit - The eToro Islamic account requires traders to make a deposit of at least $1,000, which may be expensive for some traders.

- Administrative Fees - eToro charges administrative fees on positions held beyond 7 days. Some traders may find this disadvantageous.

eToro’s Credibility

It is always important to consider a broker’s credibility before committing to investing with them. Above everything, it is crucial to assess the regulatory background of a broker across various jurisdictions. Fortunately, eToro is a highly reputable broker with a strong track record in the industry.

It operates under the regulation of multiple financial authorities, including the FSRA in Abu Dhabi, the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, and the FSAS in Seychelles, among others. These regulatory bodies ensure that eToro adheres to strict financial standards, providing traders with a fair and transparent trading environment.

Additionally, eToro has a strong presence in the trading community, with millions of active users worldwide. Customer reviews highlight its user-friendly platform, extensive asset selection, and innovative copy trading feature. eToro has an impressive 4.1-star rating on Trustpilot based on over 26,000 reviews.

How to Open an eToro Islamic Account

Opening an Islamic account on eToro is a straightforward process. It involves three main steps:

- Registration - The first step is to visit eToro’s site and register for a real trading account. You will complete a registration form by providing accurate personal information, including your name, email, and phone number.

- Deposit Funds - You will then need to fund your account using one of the available payment methods. eToro supports a wide variety of payment options including PayPal, Skrill, Neteller, bank transfer, and credit/debit cards, among others. The minimum deposit for the eToro Islamic account is $1,000.

- Account Verification - The next step is to submit your documents for account verification. Here, you will need to provide proof of identity and proof of address documents. You will also need to verify your phone number to trade on this account.

Final Verdict

The eToro Islamic Account is an excellent option for Muslim traders who want to participate in the financial markets while adhering to Sharia principles. The account’s alignment with Islamic principles, combined with eToro’s strong regulatory credibility and global reputation offers a compelling solution for swap-free trading. Further, its wide range of assets, innovative Copy Trading feature, and user-friendly platform enhances its appeal.

However, the $1,000 minimum deposit and administrative fees may present minor drawbacks for some traders. As with any trading decision, it's essential to conduct thorough research and understand the fee structure before committing to an account. Ultimately, the suitability of eToro's Islamic account depends on individual preferences and investment goals.

61% of retail investor accounts lose money when trading CFDs with this provider.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.