Does Pepperstone Have Nasdaq?

The Nasdaq 100 index is one of the most traded indices globally, comprising 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It features top-performing technology giants such as Apple, Microsoft, and Amazon, making it a favourite among traders seeking exposure to tech-heavy U.S. markets.

In this article, we’ll answer the question, "Does Pepperstone have Nasdaq?" in detail, exploring whether Pepperstone provides access to the Nasdaq 100, the trading conditions, available platforms, leverage, costs, and the advantages of trading this popular index with Pepperstone.

If you're looking to diversify your trading portfolio with index CFDs, you'll find everything you need to know right here.

Does Pepperstone Offer Nasdaq?

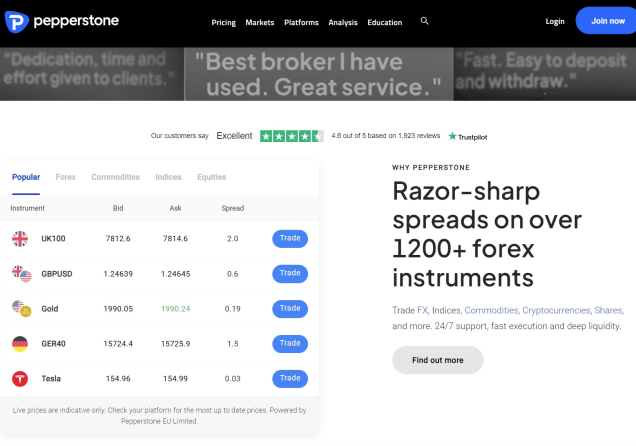

Yes, Pepperstone offers trading on the Nasdaq 100 index as a CFD (Contract for Difference). On the Pepperstone trading site, this index is listed under the symbol NAS100. Traders can speculate on the price movements of the Nasdaq 100 without owning the underlying stocks.

Pepperstone allows both long (buy) and short (sell) positions on the NAS100, making it ideal for traders who want to profit from both rising and falling markets. Since it's a CFD, you’re trading on margin, which can amplify both profits and losses.

75.3% of retail CFD accounts lose money

Key Features of Nasdaq on Pepperstone:

- Symbol: NAS100.

- Minimum Trade Size: 0.1 lots.

- Typical Spread: Variable, starting from 1.0 USD during liquid market hours.

- Trading Hours: 01:00 – 23:15 and 23:30 – 00:00 GMT+2 (Monday to Friday).

- Leverage: Pepperstone provides leveraged trading. However, it depends on the regulatory jurisdiction under which your account is held.

Please note that trading conditions, including leverage, may vary based on your location and the regulatory body governing your account. It's advisable to consult Pepperstone's official website or contact their support for the most accurate and personalised information.

Why Trade Nasdaq with Pepperstone?

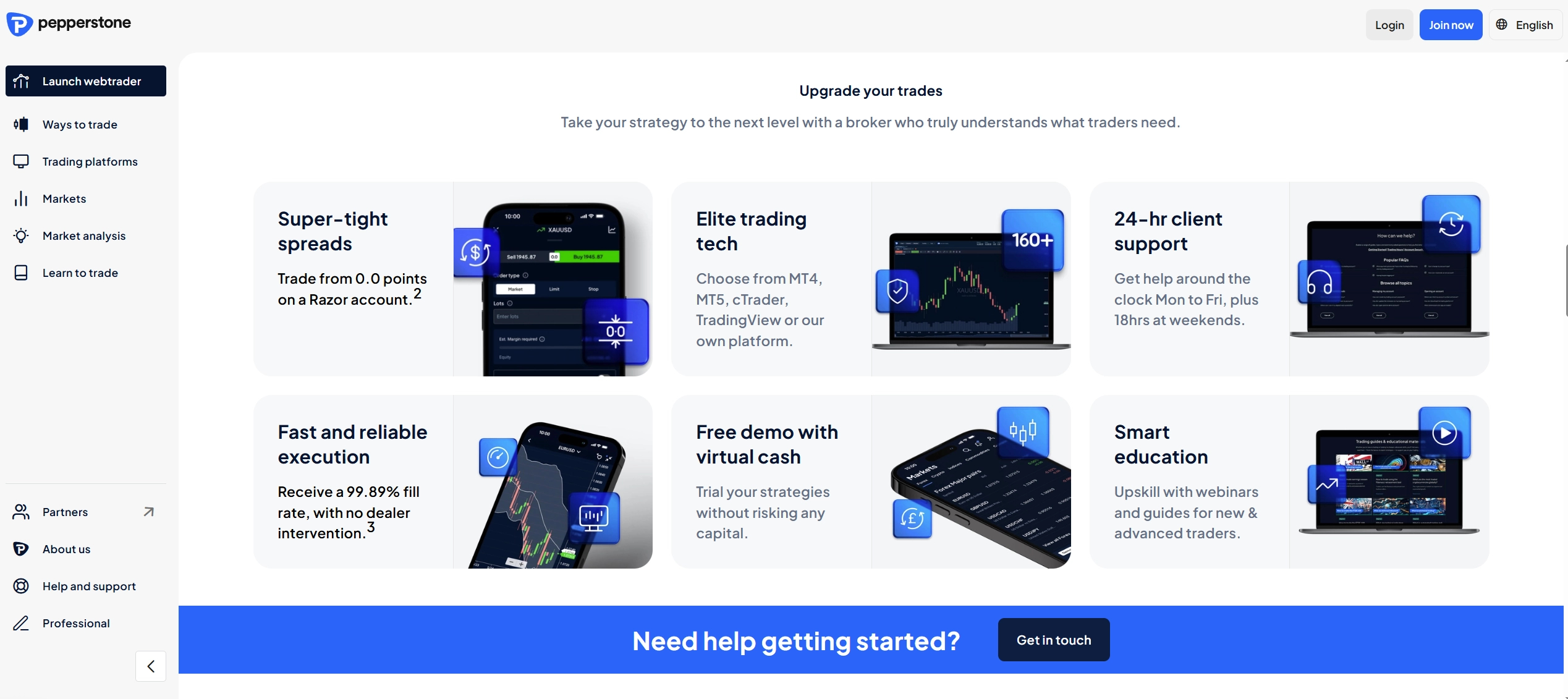

Tight Spreads and Low Trading Costs - Pepperstone is known for its low-cost trading environment. The broker offers tight spreads on the NAS100 on both its accounts. Both the Standard and the Razor accounts offer spreads as low as 1.0 for the NAS100 index. There are no commissions on index CFDs, which makes cost calculations more transparent for traders.

Fast Execution and Deep Liquidity - Pepperstone delivers ultra-fast execution powered by its state-of-the-art trading platforms and a direct market access (DMA) model. The DMA execution model especially reduces slippage and ensures near-instant order execution, which is crucial for trading volatile indices like the Nasdaq.

Multiple Trading Platforms - Pepperstone supports NAS100 trading across multiple platforms, including MetaTrader 4 (MT4) for reliable execution and custom indicators. MetaTrader 5 (MT5), offering enhanced features such as depth of market, is also available. Meanwhile, cTrader offers professional-grade charting tools and superior order execution, and TradingView offers advanced charting capabilities with integrated CFD trading functionality. Each platform supports fast order execution, a range of charting tools, and compatibility with Expert Advisors (EAs) for automated trading.

No Dealing Desk (NDD) Execution - Pepperstone uses a Straight Through Processing (STP) model, ensuring that all trades are routed directly to liquidity providers. This means no dealing desk intervention, reducing the risk of requotes and enhancing transparency.

24/5 Market Access with News Updates - The NAS100 market is available almost around the clock during weekdays, offering ample opportunities to trade. Pepperstone complements this with real-time news updates, analysis, and an economic calendar to help you stay informed.

Trading Conditions for Nasdaq on Pepperstone

Margin requirements are directly tied to your chosen leverage level and account size. Pepperstone provides convenient tools, including an in-platform calculator and website resources, to help traders determine exact margin needs before entering positions.

As mentioned, spreads on NAS100 CFDs are competitively low with no additional commissions. The average spread for this asset is 1.2 pips on both the Standard and Razor accounts. Traders will typically observe the tightest spreads during major U.S. trading sessions, making these periods particularly cost-effective for active trading.

Overnight positions in NAS100 CFDs may incur swap fees, which are calculated based on prevailing market interest rates and Pepperstone's published swap schedule. These details are readily available in the product specifications section of the trading platform, allowing traders to anticipate and account for holding costs.

Who Should Trade NAS100 CFDs?

Tech lovers and long-term investors will like trading the NAS100 because it includes all the big tech companies like Apple, Microsoft, Nvidia, and Tesla in one trade. Instead of picking single stocks, you get a piece of the entire tech sector. This is great for people who believe technology will keep growing but don't want the risk of betting on just one company.

Day traders and active investors enjoy trading the NAS100 because it moves a lot during the day, creating many opportunities to profit. The index trades almost 24 hours during weekdays, so you can trade when it works for you. Pepperstone's fast trading systems help you get in and out of trades quickly at good prices.

Traders who understand leverage can use Pepperstone's margin trading to control larger positions with less money. This can increase profits when you're right about the market's direction, but remember it also increases risk. Always use stop losses to protect yourself.

No matter what kind of trader you are, Pepperstone gives you the tools to trade the NAS100 effectively. You can check charts, set alerts, and practice with a demo account before using real money. The NAS100 is a simple and effective way to trade an index made up of 100 big and popular companies on the NASDAQ, offering chances for both short-term and long-term trading.

What Other Market Products Are Available on Pepperstone?

While the NAS100 index features a great diversified collection of individual stocks, it is always a great option to have access to other market products to trade. Luckily, Pepperstone provides its traders with a deep collection of over 1,400 instruments, which include:

- Forex - Pepperstone provides access to CFDs on more than 90 currency pairs, featuring competitive spreads, making it an appealing option for forex traders.

- Other Indices - Traders can speculate on a wide range of other global indices through CFDs with Pepperstone. Available options include the DAX 30, CAC 40, ASX 200, Russell 2000, FTSE 100, S&P 500, and Hong Kong's Hang Seng Index, among others.

- Commodities - Pepperstone enables CFD trading on a variety of commodities, including precious metals like gold and silver, energy products such as natural gas and crude oil, as well as agricultural goods like wheat, corn, and soybeans. Livestock trading, including cattle and goats, is also available.

- Cryptocurrencies - Traders can speculate on several major cryptocurrencies through CFDs, including Bitcoin, Ethereum, XRP, Solana, and Litecoin.

- Shares - Through CFD trading, Pepperstone offers access to a broad range of shares. Traders can invest in major stocks from markets in the US, Canada, Germany, Australia, and the UK, with prominent companies like Apple, Tesla, JPMorgan, Coca-Cola, and Walmart available.

- ETFs - Pepperstone also offers over 100 CFD ETFs, including the iShares China Large Cap ETF, SPDR S&P Bank ETF, and iShares MSCI Australia ETF.

Pepperstone Regulation and Credibility

The most crucial factor to consider on a broker site is its regulatory standing and overall credibility. Founded in 2010, Pepperstone has grown into a leading online broker, serving traders in over 150 countries.

The firm is strictly regulated by several authorities, including the UK’s FCA, Australia’s ASIC, the DFSA in Dubai, the Securities Commission of the Bahamas, and Kenya’s CMA. These stringent regulations ensure full transparency, client fund protection, and ethical trading practices.

To safeguard investor assets, Pepperstone holds client funds in segregated accounts with major banks, ensuring they remain separate from company funds. With ultra-fast execution, competitive pricing, and advanced trading tools, Pepperstone remains a preferred choice for traders all over the world.

On another note, Pepperstone holds a strong reputation in online reviews. On TrustPilot, the broker boasts an average rating of 4.4 out of 5 stars from more than 2,900 user reviews. This is another strong indication that the broker has a high level of credibility among traders.

Conclusion

Pepperstone provides seamless access to the Nasdaq 100 via its NAS100 CFD, featuring tight spreads, ultra-fast execution, and cutting-edge platforms. This index provides a powerful way to diversify one’s portfolio, capitalise on tech sector trends, and trade a top-tier global index.

While Pepperstone’s low-cost structure and advanced tools enhance trading potential, always manage risk wisely, especially with leveraged products. New traders should practice first on a demo account to build confidence. With strong regulation and competitive trading conditions, Pepperstone stands out as a top broker for Nasdaq 100 trading.

75.3% of retail CFD accounts lose money

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.