Dangers of Bitcoin

Whenever discussions about cryptocurrency arise, Benjamin Graham's quote comes to mind: "The individual investor should act consistently as an investor and not as a speculator."

The significant volatility of Bitcoin and other cryptocurrencies suggests high speculative interest. Before investing (yes, we are talking about investing in this article, not trading), it is crucial to approach them rationally and understand the risks.

To start, let's establish some common ground. First and foremost, cryptocurrencies, especially Bitcoin, are high-risk assets. No matter how we measure risk, be it volatility or regulatory uncertainty, Bitcoin and other cryptocurrencies, by extension, undeniably fall into the high-risk category.

For example, in 2017, Bitcoin's price surged from around $1,000 at the start of the year to nearly $20,000 by December, only to crash to below $4,000 by the end of 2018. Such drastic fluctuations highlight the speculative nature of this asset.

Bitcoin’s risky nature is worth exploring because some people think that Bitcoin is the future of currency as an absolute certainty. However, nothing is certain in the world of finance, with the possible exception of taxes :)

Before we go any further, let us distinguish between Bitcoin and blockchain. Although often perceived as complex, we can decompose blockchain technology into its three core components:

Distributed Ledger

Imagine a digital notebook shared across a vast network of computers. This "notebook" is the distributed ledger, which permanently records every blockchain transaction. Each network participant (or node) maintains an identical copy of this ledger. This ensures transparency and reduces the risk of a single point of failure. Importantly, this ledger is immutable – once a transaction is recorded and added to a block, it cannot be altered or deleted, making the history of transactions secure and trustworthy. While public blockchains (like Bitcoin) allow anyone to participate, private or permissioned blockchains restrict access to a select group of participants.

Protocol (Consensus Mechanism)

The network uses a set of rules known as a consensus mechanism to keep everyone's copy of the ledger consistent. This protocol ensures that all participants agree on the validity of transactions and that the ledger is updated correctly across the network. The most well-known example is Bitcoin's PoW (Proof-of-Work, not Prisoner-of-War ????), where miners solve complex cryptographic puzzles to validate transactions. However, other blockchains use different mechanisms like Proof-of-Stake (PoS), where participants, known as validators, are chosen based on the amount of cryptocurrency they hold and "stake." The choice of consensus mechanism influences a blockchain's characteristics, such as its energy consumption (PoW is energy-intensive) and transaction speed. Both systems aim to maintain the accuracy and security of the distributed ledger, though they function differently.

Tokens

Tokens are the incentives that keep the blockchain running smoothly. In Bitcoin, miners are rewarded with tokens for successfully validating transactions and adding them to the ledger. This process, which uses PoW, requires substantial computational effort. On blockchains using PoS, validators are rewarded based on the amount of cryptocurrency they have "staked" as collateral. These incentive systems ensure participants remain engaged, securing the network and maintaining its operations. In addition to their role in transaction validation, tokens often have other uses, such as governance (allowing token holders to vote on proposed changes), acting as collateral in decentralized finance (DeFi) platforms, or representing ownership of an asset, further illustrating their versatility.

Blockchain is the method, while Bitcoin is a product using that method. Other examples of blockchain applications include supply chain management, where blockchain helps track goods from origin to destination. Digital identity verification is another notable application that provides secure and efficient ways to confirm identities.

Walmart uses blockchain to track the origin of its produce. If there's a food-borne illness outbreak, they can quickly identify the source and remove contaminated products from shelves, improving consumer safety and minimizing waste. (Source)

Think of blockchain as an operating system, like Windows or iOS, and Bitcoin as an application running on it, like a web browser. Just because a computer has value does not mean every program will have value. The CHF (swiss franc) or USD could easily use blockchain; it is not exclusive to Bitcoin. The point is that Bitcoin is not synonymous with blockchain.

Finally, buying Bitcoin is more akin to speculation than traditional investing. Traditional investments often include assets that generate income, such as dividend-paying stocks or rental properties, which provide a more stable return. The difference between speculating and investing can sometimes be subtle. Still, it boils down to this: when investing, one buys something that generates income (like dividends) or increases in intrinsic value over time, often backed by some underlying asset. Bitcoin does not have that. It does not generate income, physical assets, or cash flows that back it. Its value depends entirely on what people are willing to pay for it, making it speculative.

One helpful way to understand this is by comparing market and intrinsic values. Market value is what people are willing to pay. While intrinsic value is what something is fundamentally worth. For example, when a new Xbox is released, it might sell for $800 on launch day, but the price drops to $400 a year later. Initially, the market value was driven by hype, but it eventually fell closer to its intrinsic value. Bitcoin and other cryptocurrencies are often driven by similar hype. People buy it not because of what it fundamentally does. People buy it because they believe the price will keep rising. This is what speculation looks like, pure and simple.

Having established these fundamental concepts, let's delve into some of the more contentious aspects of Bitcoin.

Although Bitcoin operates independently of any central authority, banks and governments can still exert significant influence. If banks control interest rates, they can indirectly impact Bitcoin's value by shifting how attractive it is as an asset. For example, rising interest rates can make traditional savings accounts more appealing than riskier assets like Bitcoin.

Additionally, governments can regulate how people use Bitcoin through taxation, KYC (Know Your Customer), and AML (Anti-Money Laundering) regulations on exchanges or even restrict access altogether. This introduces risk for Bitcoin owners, and some governments may never fully accept it, especially considering its use for illegal activities.

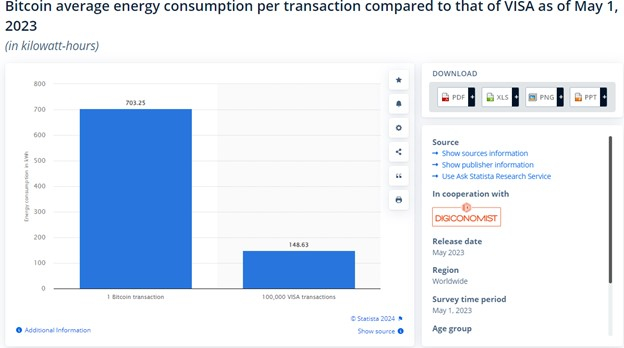

Proponents often highlight Bitcoin's convenience, particularly for cross-border transactions, as it bypasses traditional intermediaries like banks. However, this apparent convenience comes with significant drawbacks. For example, Bitcoin uses significantly more electricity per transaction than credit cards—estimated to be around 703 kWh per Bitcoin transaction compared to 148.63 kWh per 100,000 Visa transactions (source: Statista).

This is costly, both financially and environmentally. Moreover, Bitcoin's network can handle about seven transactions per second, compared to Visa's 24,000 transactions per second. Scalability remains a significant issue, though solutions like the Lightning Network aim to address this.

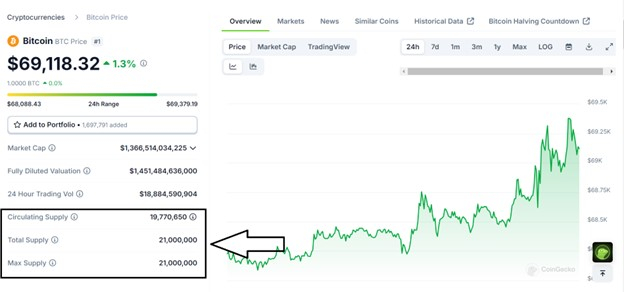

People also point to Bitcoin's limited supply because the price will always increase. However, demand for Bitcoin may decrease at any point in the future, potentially negating the effect of limited supply. About 19.7 million Bitcoins are in circulation, with a cap of 21 million, as shown in the screenshot below.

Source: https://www.coingecko.com/en/coins/bitcoin

If demand keeps increasing and supply is fixed, the price will rise. But here is where the catch comes in: if the price always increases, why would anyone spend their Bitcoin? If holding on to Bitcoin today means it will be worth more tomorrow, paying it feels like a loss. This behavior makes Bitcoin less effective as a currency because it discourages spending and promotes hoarding.

On the other hand, fiat currencies, like the USD, EUR, JPY, etc., typically have some level of inflation, which encourages spending rather than hoarding.

Fiat currency is a type of money that is not backed by a physical asset like gold or silver. Its value is derived from the government that issued it and the people's faith in that government.

If Bitcoin’s value keeps rising, it functions more like an appreciating asset than a medium of exchange.

Some enthusiasts say Bitcoin cannot be compared to fiat currency, but this is inaccurate. Both serve as forms of money. The comparison is valid—similar to comparing oil to wind energy. They may differ in form but ultimately serve the same purpose. In the same way, Bitcoin and traditional currencies need to be compared because they serve the same end goal.

Another argument frequently raised is that Bitcoin is "digital gold" or a "safe haven." However, even gold is not a perfect safe haven. During financial crises, like in 2008, gold's price also fell, though it did recover more quickly than many other assets. Gold has intrinsic utility—it can be used in manufacturing or jewelry—while Bitcoin's value is based entirely on belief. Gold also has thousands of years of history as a store of value, whereas Bitcoin is relatively new and largely untested in major global crises.

Another hotly debated point is whether Bitcoin is a bubble. While this cannot be definitively stated, there are similarities to past bubbles, like tulip mania in the 1600s, the South Sea Bubble in the 1700s, and the dot-com bubble in the early 2000s. In these cases, hype drove prices up, and when the bubble burst, people were left holding assets without real value.

The widespread belief that everyone could make easy profits led to a market crash. Today, similar enthusiasm is seen in Bitcoin, with many newcomers buying in, believing it’s their ticket to riches.

The cryptocurrency space also has significant potential for misinformation and biased advice. Many Bitcoin cheerleaders have much to gain from others' buying in, but only some will take responsibility if things go wrong. When Bitcoin's value peaked at $20,000, many investors had to endure massive losses as it dropped. Now, it is even higher at $69,000. Those buying based on hype may not be seeing the whole picture—and if things go wrong, there won't be anyone to take the blame.

So far, we have focused on investing in Bitcoin and other cryptocurrencies, dedicating this article primarily to that aspect. However, we’d also like to address day trading and some tools commonly associated with it, particularly technical analysis. For decades, day traders in stock and forex markets have relied heavily on technical analysis. But can it be effectively used for day trading cryptocurrencies? There isn’t a clear-cut yes or no answer. From a scientific perspective, the ability of technical analysis to outperform markets consistently is “mixed” at best. For a more detailed analysis of this, check out Finansified’s website.

So, where does this leave things? Bitcoin may continue to increase in value, and we hope it stabilizes enough for reliable use. However, it remains a high-risk, speculative instrument. If you have been considering adding this asset to your investment portfolio, think twice or consult a qualified and licensed financial advisor in your country. Paradoxically, its rising value makes it even riskier. The higher its market value climbs without underlying support, the further it has to fall.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.