How to trade CFDs on Options

I found out that there are many guides that compare options trading to CFD trading. No article, however, explains how does work trading CFDs on options. Guess what I will cover in today's article? Well, everything there is to know about trading CFD Options. We will start with an explanation of what this investment instrument is and how it works in practice, then I will give you an example of a broker that supports CFDs on Options.

How CFDs on Options work

Options CFDs work exactly the same as any other CFD instrument. That means, we physically don't own any options as we are just speculating on the price fluctuations. On the real market, there are "Call" and "Put" options and because when we trade CFDs we can also speculate on the price decrease of an asset, it is possible to open short as well as long positions on both call and put options. CFDs on Options is possible to trade at regulated brokers with 1:5 leverage.

How is determined the price of an Option

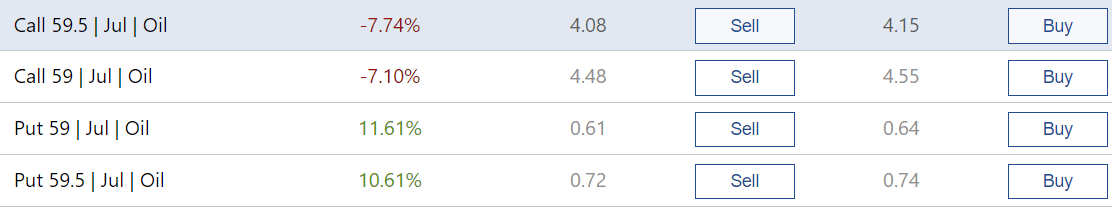

If you look at a trading platform of any CFD broker, you will see a similarly looking list of options:

[caption id="attachment_9139" align="aligncenter" width="1112"] Options CFDs on the Plus500 platform (Illustrative prices)[/caption]

Options CFDs on the Plus500 platform (Illustrative prices)[/caption]

When looking at the screenshot above, you can see that each option has a different sell and buy price (even though the number of options/contracts is for both displayed Call options - 50 and for both Put options 500). That is because these options all exist on the real market and there is their price determined by the number of buy and sell orders (supply and demand), which in itself is determined by the strike price and the price of the underlying asset.

How is calculated profit from CFD Options

- A buy position is a position that profits, when the sell rate of the instrument increases above its opening, buy rate. Vice versa, If the sell rate falls below the opening buy rate, the buy position will be in loss.

- A sell position is a position that profits when the buy rate of the instrument falls below its opening sell rate. Vice versa, if the buy rate rises above the opening sell rate, the sell position will be in loss.

In case of a buy position: (Close 'sell' rate - Open 'buy' rate) X amount of contracts

In case of a sell position: (Open 'sell' rate - Close 'buy' rate) X amount of contracts

For example, if you open a buy position on the option Call 63 | Jun | Oil at a sell rate of 2.59 for the amount of 100 options. In order for this position to be on a profit, the sell rate of the option should increase above its opening buy rate. For example, if the sell rate becomes 3.10 your position will have the following P/L = (3.10 - 2.59) * 100 = 51 USD (minus any fees).

Expiration of OptionsUnlike CFDs on other asset types, Options CFDs have their expiration time. Once this expiration time has been reached, your trade automatically closes. The reason being is that CFDs Options mirror Options that are on the real market and once they end so does the CFD trade placed on them. You can, of course, exit the trade yourself at any time, but if you don't bother yourself with doing that, there is the expiration time.

Options CFDs brokers

The market features hundreds of regulated and thousand of unregulated CFD brokers. For instance, in Europe, the most popular regulators are the CySEC and FCA and the leading European forex brokers have at least one of these licenses. Most brokers support on their trading platforms only CFDs on forex, stocks, indices and commodities. So the selection of brokers that offers CFDs on options is a little bit limited. I am not an expert on Options CFDs trading, but I know that Plus500 features them and that they have very good trading conditions for them (Very tight spreads). I regard this company very highly and I think it is safe to say that they are one of the best CFD brokers on the market.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.