CFD Forwards Explained: What They Are and How They Work

Imagine locking in the price of oil, gold, or Bitcoin today, without ever physically owning a single barrel, ounce, or coin. That's what CFD Forwards, a leveraged instrument used by over 15 million traders worldwide to speculate on future prices with just a small amount of the capital, can accomplish.

The catch? Leverage cuts both ways. A 10:1 margin can turn a 5% move in the market into a 50% profit or loss. Yet with over $7.5 trillion traded annually in CFDs globally, demand is hardly in doubt. Ready for a closer look? Let's break down how CFD Forwards really work and whether they belong in your trading toolkit.

What Are CFD Forwards?

CFD Forwards, or Contract for Difference Forwards, are financial instruments that allow traders to speculate on the future price of an asset without ever actually taking ownership of the underlying asset. Unlike normal CFDs, which are usually derived from spot prices and settled daily, CFD Forwards are derived from a future price level and mimic the features of futures contracts, but without the set expiration date.

In that way, they sit somewhere between standard CFDs and Futures. Futures are contracts traded on exchanges that have strict expiry dates. CFD Forwards, on the other hand, are traded over-the-counter (OTC) and allow for more flexibility in terms of contract duration and trade size.

Key Features of CFD Forwards

Leverage

Leverage is possibly the strongest attraction. With CFD Forwards, you can trade on a margin of as little as 10%, meaning a $1,000 position would require only $100 of capital. This is a multiplier effect for both potential profits and losses

No Expiry Dates

Unlike futures, CFD Forwards have no expiry dates. You can hold a position as long as you want, provided you maintain the margin and pay any overnight fees.

OTC Trading and Risk

Because they are traded OTC, there is no central exchange. This opens the door to more trading hours and flexible contract terms, but also introduces counterparty risk. If your broker fails, your funds could be at risk too.

How Do CFD Forwards Work?

Fees and Charges

Speaking of costs, they matter. Brokers typically charge spreads (the difference between buy and sell prices), commissions, and overnight financing fees for positions held past the trading day. These fees can add up quickly, especially for longer-term trades.

Long vs. Short Positions

Understanding the price movement is key. When you go long (buy), you profit if the asset’s price increases. When you go short (sell), you profit if the price falls. A visual chart showing entry and exit points can help new traders grasp this dynamic better.

CFD Forwards vs. Futures

Key Differences

Here’s how CFD Forwards stack up against Futures contracts:

| Feature | CFD Forwards | Futures |

| Expiry | Flexible | Fixed |

| Market | Over-the-counter (OTC) | organized exchanges |

| Trading Hours | Extended | Exchange-bound |

| Costs | Factored into spread | Commissions + exchange fees |

CFD Forwards give you more flexibility, but with that comes increased exposure to broker-specific risks and a lack of standardized pricing.

Pros and Cons

Pros

There’s a reason so many traders use CFD Forwards. The benefits include:

- Leverage allows you to amplify potential returns.

- There's no physical delivery needed.

- You can trade a wide range of global markets, from forex and metals to indices and cryptocurrencies.

Cons

But there are risks, too.

- Leverage also amplifies losses.

- You can lose more than your initial deposit if you don’t manage your risk properly.

- Because they are OTC products, there’s always the risk that your broker fails to honor the contract.

- Plus, depending on your jurisdiction, CFD Forwards might be restricted or even banned.

Where Can I Trade CFD Forwards?

If you're new to trading CFD Forwards, you'll probably be wondering, where on earth do I start? The great news is, there are several tried-and-tested platforms offering access to these instruments, each with their own quirks, and standout features.

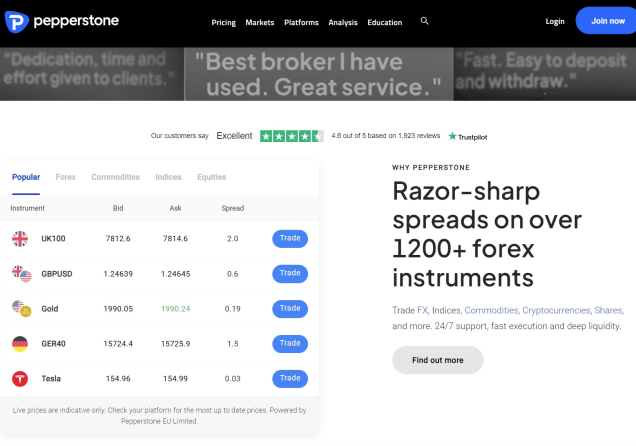

Pepperstone

Let's start with Pepperstone. This broker is a favourite among active traders for a reason. They offer CFD Forwards on a variety of products, including indices (such as AUS200, GER40, US500, NAS100) and commodities (such as gold and crude oil). And one of the best parts? Pepperstone has no explicit overnight charges associated with any trade on CFD forwards, this is factored into the price of the forward contract.

You can trade CFD forwards on Pepperstone’s MetaTrader 5 and cTrader platforms. All solid options, both for newcomers and for experienced ones.

CMC Markets

Next up is CMC Markets. These guys offer a massive selection of forward contracts, more than 220, covering everything from forex and commodities to indices and treasuries. Their forward FX contracts are especially useful for traders looking to hedge future currency exposures.

FP Markets

FP Markets is a strong choice for traders, offering access to over 10,000 CFD instruments, including a wide selection of forward contracts (subject to availability) —particularly in commodities and indices. The broker is regulated by top-tier authorities such as ASIC and CySEC, ensuring a high level of trust and compliance. Traders can use both MetaTrader and cTrader platforms, giving them flexibility and advanced trading tools.

VT Markets

VT Markets is another solid option, known for its fast execution speeds and broad range of CFD products, including forward contracts on commodities and indices. The broker supports both MT4 and MT5 platforms and is regulated in multiple jurisdictions, making it a suitable choice for international traders.

Conclusion

CFD Forwards offer a new way to speculate on or hedge future price movement without actually taking delivery of the underlying product. With no expiry dates, high leverage, and wide market access, they provide flexibility that traditional futures lack.

But flexibility comes with trade-offs. High risk, counterparty exposure, and regulatory issues mean CFD Forwards should be used with caution. If you're considering trading them, start with a demo account. Practice your strategies. Understand the costs and the risks.

Top-Tier Trusted Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.