The Basics of Natural Gas Hedging That You Need to Know

If natural gas is a significant underlying cost or a significant source of income for your business there is one term that you would have to live with and perhaps even sleep with – ‘VOLATILITY’. Natural gas is historically one of the most volatile commodities and the price fluctuations that take place can be very troublesome for both consumers and producers. Managing this risk is not always easy, but can be done through the use of a well laid out hedging strategy. Natural gas hedging is by no means a way a “profit center”, but rather is meant to mitigate the risks involved for your business due to unwanted price fluctuations. In this article, we take a look at some of the commodity trading basic principles when hedging natural gas.

What Is Hedging?

Hedging is the process of using energy derivatives (forwards, futures, options, swaps, etc.) to lock-in or protects against potentially harmful future price movements in the price of physical energy commodities.

For instance, the price of utility electricity that is generated using natural gas-fired generators is subject to significant fluctuations given the physical price of natural gas. By buying forward using natural gas futures or swaps the utility can “lock-in” the price of their gas at a given price. By fixing price the utility can then budget and plan accordingly should physical prices continue to rise or fall.

Use Statistical Models for Hedging

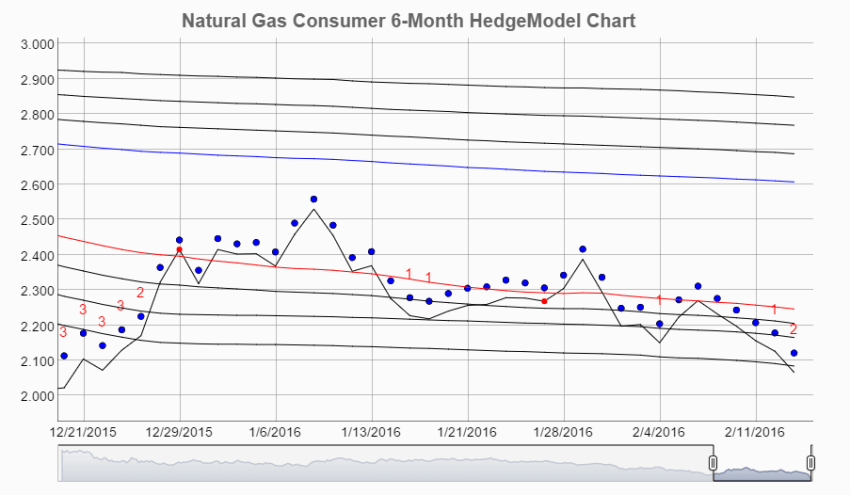

Now that you understand the theory behind hedging it is important to note that making the right decision in terms of FBS price of natural gas and the time to hedge will be a significant part in deciding your hedging program’s success. This is where you should incorporate a statistical model that would offer you scientifically analyzed data to understand the market’s price cycles. Using this type of model you will be able to make the right decision in terms of when to hedge, the right maturity to use, and the best derivates to meet your hedging goals and risk appetite.

If you are hedging for the long-term, a year or more, scaling into the hedges is equally important to minimize your risks. These statistical models will also guide you on the right path in terms of decision making. The biggest advantage of using these models is that they can be used to design a hedging strategy that meets your company’s unique risk management goals and risk appetite. No two companies have the same exposures to natural gas price risk, and therefore, no two hedging programs should be the same. Hedging is a way to cut down on your exposure to natural gas price risk. You need to choose the right statistical model tool for natural gas hedging to ensure success.

Don’t Rely On Speculative Hedging Strategies

Don’t Rely On Speculative Hedging Strategies

Many companies who do a lot of buying and selling of crude & natural gas on a regular basis, tend to depend on speculative hedging strategies, based on long-term forecasts, promoted by trading desks. It is not a good idea to ignorantly accept the exact trade that they recommend and is often an ineffective way of implementing natural gas hedging. The right way is to run rigorous statistical models to determine what a hedge will do under different market situations. Unfortunately, a lot of companies are taken by surprise when they are recommended to use statistical models. They do not understand that it is important to develop these models and that they are furthermore analyzed, before executing a hedge. Moreover, these models need to be updated and analyzed on a regular basis. The sad part is, many companies have tasted the bitter pill of going bankrupt because of excessively speculative trading, in the pretence of hedging. They are not aware of the repercussions of their hedging decisions.

When faced with conditions where natural gas prices increase or decrease significantly, the traders and investors should be alert about the following:

- Unproven hedge techniques can be fatal.

- Producers including consumers that need to buy or sell huge amounts of natural gas need to stress-test their hedge strategy. This will allow in identifying the financial ramifications of individual positions, and also the complete hedge portfolio, in varied market situations. This should include not just their exposure to price risk, rather also the credit and operations risks.

Need For an Effective Natural Gas Hedging Strategy

The exposure to price risk is unique for an individual company; however, companies that are involved in commodity transactions such as natural gas and crude oil can effectively mitigate risk by putting in place a hedging strategy that meets their goals and risk appetite. A statistically based hedging product that identifies when to hedge, which maturity to use, how to scale in, and when to restructure, can be effective for organizations who buy and sell energy commodities and want to diminish their risk exposure. Here, a seasoned energy market technician can help by coming up with a roadmap on hedging with options, futures, and other derivatives.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.