Best Spread Betting MT4 Brokers

Spread betting is a type of trading that involves taking a bet on the future price movement of assets instead of taking ownership of the assets themselves. Brokers set a spread that includes the bid and the ask, hoping to get equal action on both sides of a game. On the other hand., traders bet on whether the price will go lower than the bid price or higher than the asking price.

Today, we are going to look at some of the best spread betting MT4 brokers that exist. But first, let’s look at a brief explanation of what spread betting is.

What is Spread Betting?

Spread betting is a type of derivative trading that allows investors to speculate on the price of an asset without owning the underlying asset. As the name suggests, this type of trading involves traders predicting whether the market will rise or fall. They do not need to own an asset to speculate on its price. However, keep in mind that all forms of trading carry risk and spread betting is no exception, especially with its use of leverage. Note that speculating on the financial market is hard thus making spread betting very risky. Let’s look at some advantages and disadvantages of spread bet trading.

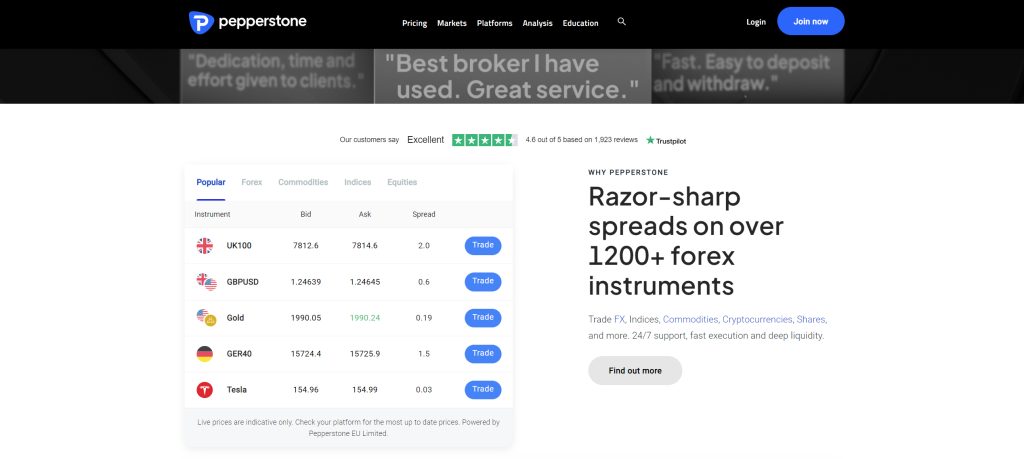

Pepperstone

Pepperstone is another broker that offers spread betting on MetaTrader 4. Traders have access to low latency, fast execution, and no-dealing desk execution. What's more, clients have access to various markets to invest in. The markets available for spread betting on Pepperstone include indices, forex, commodities, and stocks. These market assets are also tradeable on cTrader, MetaTrader 5, and TradingView. Also, Pepperstone has a wide range of trading tools that will help a client manage trading risk and improve strategy. these include Capitalise.ai, smart trader, Algorithmic trading, and many more.

Pepperstone has multiple liquidity providers from tier-1 banks and institutions. With this clients can have access to some of the tightest spreads in the market. The spreads are as low as 1.0 pips on the standard account. However, clients can trade with even lower fees on the razor account with spreads as low as 0.0 pips and a commission from $3.50 per lot per side per lot. Further, traders inside the EEA have access to leverage of up to 1:30 offered by Pepperstone while outside it can go up to 1:500.

Pepperstone has multiple liquidity providers from tier-1 banks and institutions. With this clients can have access to some of the tightest spreads in the market. The spreads are as low as 1.0 pips on the standard account. However, clients can trade with even lower fees on the razor account with spreads as low as 0.0 pips and a commission from $3.50 per lot per side per lot. Further, traders inside the EEA have access to leverage of up to 1:30 offered by Pepperstone while outside it can go up to 1:500.

Regarding licenses and authorization, Pepperstone has regulations in various jurisdictions. The company has licenses from CySEC in Cyprus, the ASIC in Australia, the FCA in the UK, and Bafin in Germany. With such regulations, Pepperstone has a good standing among traders. This is because brokers with quality regulations offer the best services in the market.

75.5% of retail CFD accounts lose money

IG

IG gives traders access to forex, shares, indices, and commodities for spread betting. This means that clients can spread bet on key assets like the FTSE100 with no commission. These assets are available to spread bet on the revolutionary MetaTrader 4 which comes with a number of tools to support investors while trading. Apart from the MT4 platform traders can also trade with other platforms including ProgressiveWebApp, Prorealtime, and L2 Dealer which are state-of-the-art platforms.

Arguably, IG is one of the top brokers that offer spread betting on the MT4 platform. When spread betting on IG, traders can take advantage of the direction in which an asset's price will move. They trade on IG with some of the tightest spreads in the market which are as low as 0.6 pips for major currency pairs. The leverage for trading on this broker site varies depending on where a trader is located. For clients in the EEA, the maximum leverage sits at 1:30 while outside it is at 1:200.

In terms of regulations, the broker is regulated by the FINMA in Switzerland, the ASIC in Australia, and the FCA which are quality regulators. While regulations alone are never enough, it is definitely a good sign to be regulated in multiple jurisdictions.

AvaTrade

AvaTrade is one of the brokers that offer spread betting and the MetaTrader 4 platform. This offering is specifically available to traders based in the UK and Ireland. Such traders can expect tax-free profit and bet on more than 1,000 financial instruments. With the diversity of the financial market, clients can spread bet on forex, metals, energies, commodities, indices, bonds, equities, and ETFs.

Spread betting requires a trader to have a good understanding of the market. Other than MetaTrader 4, clients also have access to MetaTrader 5 and AvaTradeGO. The MetaTrader platforms come with a plethora of tools including Strategy Tester that is used in the backtesting of strategies.

Trading with AvaTrade does not require clients to pay hefty fees. AvaTrade offers some of the lowest spreads in the market that go as low as 0.9 pips for major currency pairs. Further, AvaTrade traders can trade with a maximum leverage of 1:400 which varies depending on the jurisdiction as well as the asset class you are dealing with. For example, the maximum leverage for clients within the EEA sits at 1:30 in accordance with regulations.

Trading with AvaTrade does not require clients to pay hefty fees. AvaTrade offers some of the lowest spreads in the market that go as low as 0.9 pips for major currency pairs. Further, AvaTrade traders can trade with a maximum leverage of 1:400 which varies depending on the jurisdiction as well as the asset class you are dealing with. For example, the maximum leverage for clients within the EEA sits at 1:30 in accordance with regulations.

We only mention brokers that are regulated by reputable organizations. Luckily, AvaTrade is regulated by the CySEC in Cyprus, the Central Bank of Ireland, the FSCA in South Africa, and the KNF in Poland. These regulators are well respected and ensure the broker maintains a fair trading environment.

76% of retail CFD accounts lose money

Vantage Markets

Vantage Markets is yet another broker that offers spread-betting on MT4. This broker allows traders to speculate on the price of several instruments including share prices, indices, currencies, and other financial assets. Apart from MT4, Vantage Markets traders can have access to other market standard platforms which include MetaTrader 5, ProTrader, and WebTrader.

In terms of spreads, they start at 1.4 pips on the Standard STP account for major currency pairs. On top of that, Vantage Markets offers spreads as low as 0.0 pips on Raw ECN accounts. Traders pay a commission of $3 per side per lot on this account. The leverage offered by this broker site varies depending on the jurisdiction. With a leverage of up to 1:1000 offered by the Vantage Markets, clients outside the EEA can control large positions in the market than they would while using their capital only. Within the EEA and the UK, clients have leverage of only up to 1:30.

Finally, Vantage Markets is regulated by two reputable organizations. The company has regulations from CySEC in Cyprus and ASIC in Australia, two of the best regulators in the market. It is also authorised and licensed in the Cayman Islands by the CIMA and in Vanuatu by the VFSC.

ActivTrades

ActivTrades offers market-standard service and execution for spread betting. With this broker site, traders trade using top-tier platforms that are easy to use for both beginner and experienced traders. These include MetaTrader 4, MetaTrader 5, TradingView, and its own platform ActivTrader. These platforms give clients access to a wide range of markets available for spread betting. These include forex, shares, indices, commodities, bonds, and ETFs.

On top of the huge collection of trading instruments, ActivTrades is regulated by a reputable organization. It has regulations from FCA in the UK. Traders on ActivTrades can trade with some of the lowest spreads starting from 0.5 pips for major currency pairs. They also have access to leverage up to 1:400 for clients outside the EEA. Inside the EEA, the maximum leverage remains at 1:30.

City Index

City Index is another broker that offers spread betting on MT4. The broker is regulated by some of the best regulators in the market. With licenses from the CySEC in Cyprus, the ASIC in Australia, and the FCA in the UK, City Index is undoubtedly well-regulated.

When spread betting it's crucial to maintain appropriate risk management and City Index does not disappoint. Investors can also spread bet on shares, forex, and commodities. In total, there are over 4,000 spread betting markets to choose from. Such a collection of instruments allows clients to diversify their portfolios and spread their risk of investment across various markets. The spreads on this broker site can go as low as 0.6 pips for major currency pairs. While in the EEA the maximum leverage is 1:30, outside it can go up to 1:200.

City Index offers an award-winning trading platform that clients can choose from. Other than MT4, clients can also use WebTrader and Tradingview. These are powerful platforms that feature powerful tools to assist clients in trading and analysis. Furthermore, investors have access to Trading Central, one of the best analytical software in existence.

CMC Markets

The last broker on our list that offers spread betting on MT4 is the CMC Markets. Traders on the platform can spread bet on various markets that include forex, commodities, shares, ETFs, share baskets, and treasuries.

Positively, the company promises the best pricing when trading these instruments. CMC Markets charges variable spreads to clients when trading. For instance, the spreads on the EURUSD and the USDJPY can go as low as 0.7 pips. Many traders would find this attractive as it is very competitive compared to other brokers. While the spreads are variable, it is refreshing to know they can drop this low.

Finally, CMC Markets has licenses and regulations from well-known regulators. The company is licensed and regulated by the FCA in the UK and BaFin in Germany. Investors should only invest in regulated brokers as such brokers operate under the oversight of strict organizations.

Final Thoughts

We have gone through some of the best brokers that offer spread betting on MT4. Since this is not the full coverage of such brokers, we advise clients to do their own investigation to choose a broker that best suits their needs. We have seen that spread betting has both advantages and disadvantages. Understanding the risks involved in spread betting is key before trading.

Regulations from reputable organizations are essential for a broker. Ensure the broker you choose is regulated by reputable organizations regardless of whether they are on this list or not. Other key qualities to look at include the availability of various trading instruments, low spreads, and the availability of market standard trading platforms.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.