Penny Stocks 101: Introduction to Penny Stock Trading

Prior definitions of penny stocks pegged them as stocks trading for $1, or less. However, the Securities and Exchange Commission (SEC) has revised the definition as follows, ‘… penny stocks refer to stocks trading under $5 per share.’ The $5 penny stock threshold is an important level, particularly in the US. In the United Kingdom, penny stocks trade for £1, or less.

The SEC goes on to explain that penny stocks by definition are, ‘…

Low-priced shares of small companies. Penny stocks may trade infrequently – which means that it may be difficult to sell penny stock shares once you have them.’

Why are Penny Stocks Risky & How Can You Mitigate Against Risk?

This rudimentary introduction to penny stocks provides a window into these oft-prized financial instruments, which day traders are highly attracted to. It is worthwhile taking a step back to understand the attendant risks of trading, or investing in penny stocks. Brokers, advisors, and fund managers tend to caution against penny stocks by dint of their volatile nature, lack of media exposure, and low levels of liquidity. Combined, these features of penny stocks can serve as a deterrent to traders across the spectrum.

It is worth pointing out that no trade or investment is without risk. Risk is a function of multiple factors. These include an individual's appetite for risk, the value of the trade, the percentage of the portfolio being subjected to risk, and the nature of the underlying financial instrument itself. As a case in point, assume that Trader A is prepared to risk $500 on penny stocks. Barring margin and leverage, the maximum potential loss is $500. That risk of loss may be acceptable to Trader A, in a worst-case scenario.

The risk factor is further mitigated by way of portfolio management. Assuming that a conservative investor allocates 50% of a portfolio towards high performing blue-chip stocks, 25% of the portfolio towards gold ETF's, gold shares, and gold bullion, 20% of the portfolio towards fixed-interest-bearing assets (certificates of deposit, bank accounts, and bonds), and 5% towards alternative investments such as cryptocurrency, forex, and penny stocks. In this scenario, the maximum exposure to risk vis-a-vis penny stocks is < 5%. Portfolio management is therefore critical to risk mitigation.

The risk factor is further mitigated by way of portfolio management. Assuming that a conservative investor allocates 50% of a portfolio towards high performing blue-chip stocks, 25% of the portfolio towards gold ETF's, gold shares, and gold bullion, 20% of the portfolio towards fixed-interest-bearing assets (certificates of deposit, bank accounts, and bonds), and 5% towards alternative investments such as cryptocurrency, forex, and penny stocks. In this scenario, the maximum exposure to risk vis-a-vis penny stocks is < 5%. Portfolio management is therefore critical to risk mitigation.The Most Effective Hedge Against Risky Penny Stocks Investments

Perhaps the most important factor to consider when assessing risk is the specific type of penny stock selected. To this end, education is sacrosanct. A sound understanding of market dynamics is critical to picking the right stocks. Successful penny stocks traders have learned to negotiate the intricacies of the financial markets. It takes years of experience to improve the percentage of winning trades over losing trades. A penny stocks education for a beginner is not necessarily a Master’s Degree in Finance, or a Wall Street Trading Education; it is a function of patience, perseverance, and professionalism.

The 5 Pillars of Success for Penny Stocks Trading Include

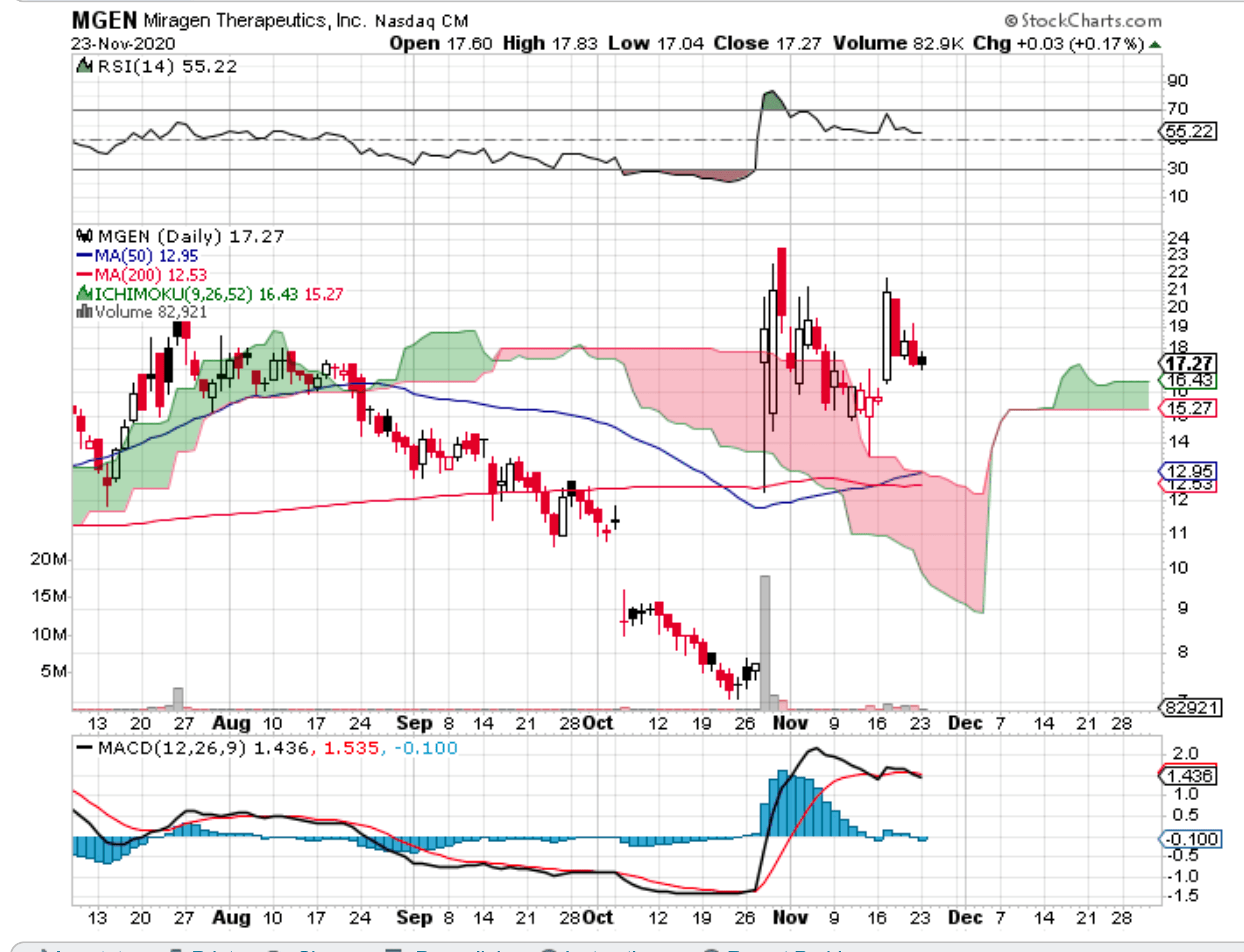

Source: StockCharts.com Miragen Therapeutics Inc (NASDAQ: MGEN)

Source: StockCharts.com Miragen Therapeutics Inc (NASDAQ: MGEN)Education

Education as it pertains to penny stocks trading is defined as ongoing learning, especially for beginners. Experienced traders understand market dynamics. They know how to read charts, spot patterns, pick stocks, and work with the attendant technology to successfully trade stocks. Education entails knowing what to look for in regards to the penny stocks you are interested in. This includes financial reports, mergers, acquisitions, buyouts, complimentary products and services, alternative products and services, et al. While many traders regard profit as the overarching objective of penny stocks trading, the true goal is the acquisition of knowledge. Profit is merely a byproduct of a job well done.

Persistence

Like anything in life, it is easy to get derailed by failure. Successful penny stocks traders have all failed miserably, often close to the point of no return. Persistence – the dogged determination to succeed – is the difference between success and failure. Rather than banging your head against the wall every time you fail, learn from your mistakes. Write down the results of every trade you make. What went right? What went wrong? What tactics and strategies were employed? Is there room for improvement? This is the type of persistence that is needed in order to generate the results that you desire.

Stock Selection

Everybody wants to pick winners when it comes to penny stocks trading. Your choice of stocks a.k.a. stock selection, will mean the difference between success and failure. Careful, methodical, and deliberate research will help you to choose the right stocks more often than not. A little research goes a long way when it comes to stock selection. For example, it's better to pick a rising stock than a falling stock if you're looking to benefit from price appreciation. By the same token, if you can spot a falling stock before it craters, you can short the stock and cash in on the back end. There is no substitute for meticulous stock screening, prior to selection.Budget Management

A budget is necessary for penny stocks trading. It is easy to get distracted from your budget because penny stocks are generally low-cost options. However, a penny stock priced at $2.50 per share, with 1000 shares purchased is already $2500 into your budget. Manage your budget in such a way that you do not expose yourself to too much risk per trade. Some analysts recommend allocating no more than 1% of your budget towards any individual trade. If you have a $1000 budget, that means you should limit trades to $10 per penny stock. If you increase that to 5% per trade, your maximum exposure per penny stock should be $50. Fortunately, if penny stocks are priced at under $1 per share, you can get plenty of penny stocks for that price. The objective in all instances is to maximize your yield, while minimizing your risk.

Logical Decision Making

Perhaps the most difficult element to master when trading penny stocks is the use of logic over emotion. It's easy to get caught up in the trade, by acting emotionally. For example, if you go against your better judgment when a stock is falling, and decide to stay invested in trade, you could lose everything. By the same token, if a stock is rising, and you get greedy, you could abandon your 10% take profit objective and end up ruining your decision when a sudden reversal takes place.

Naturally, there are other approaches, in addition to the aforementioned pillars of success, which can be implemented during your penny stocks trading endeavors. Foremost among them is your choice of a trading platform and/or broker. Too many traders don't pay enough attention to the pros and cons of the trading platform. For example, Robinhood has the auspicious honor of being the most downloaded trading app in 2020. However, it is not ideal for penny stocks traders since it doesn't necessarily allow penny stocks to trade on the platform.

While Robinhood is a low-cost trading platform, traders with under $25,000 invested are subject to limitations which can impinge upon your trading success. Another factor which could affect your success is the accuracy of trade executions. If a broker’s platform fails to execute at your pre-set price points, it could literally blow your trade out of the water. For example, if you buy penny stock ABCD for $1 and you have a take profit order at $1.20, the trade should execute at your price point. If penny stock ABCD is falling, and you have a stop loss order add $0.80, and the trade executes at $0.50, you can see how quickly your success gets eroded with inaccurate executions of trades.

Fortunately, there are plenty of worthwhile trading platforms to consider. These include Stocks to Trade (STT), Interactive Brokers (IB), Fidelity, E*TRADE, and TD Ameritrade by Charles Schwab. Stocks to Trade features prominently with beginners since it runs a stock screening tool known as Oracle. This helps you to select the top performing penny stocks at any given time. The costs of trading must carefully be assessed to ensure that you don't end up paying exorbitant fees (trading fees, commissions, hidden costs, account management fees, brokerage fees, et cetera).

Picking Tiered Penny Stocks & Reading Penny Stock Charts

It's really important to understand the data before you place a trade. Penny stocks are typically traded OTC (over-the-counter), or as pink sheets. If you've seen the movie, ‘The Wolf of Wall Street’, you have a behind-the-scenes glimpse into how penny stocks are traded, albeit from a nefarious perspective. There are penny stocks of companies which have nothing more than a well-crafted prospectus to offer unsuspecting traders. Then, they are legitimate small cap companies (microcap companies or nanocap companies) which have viable products or services in the pipeline. It is your job as an informed trader to make these decisions based upon your research.

If a stock does not trade on the NASDAQ, or the New York Stock Exchange, it is not subject to SEC reporting guidelines. This makes it a questionable investment at the very least. However, there are different tiers of penny stocks to trade. Ideally, you want Tier 1 and Tier 2 penny stocks. A Tier 1 stock is listed on the exchange, and trades below $5 per share. A Tier 2 penny stock trades at less than $1. The others trade at fractions of a dollar, and while they may yield significant profit potential, they typically fly well under the radar. What many first-time traders don't understand is that there are scores of blue-chip stocks today that traded as penny stocks. Amazon and Facebook are cases in point.

Stock performance – penny stocks and traditional stocks – can be plotted on a graph. When patterns are exhibited, such as rising or falling stock prices, or repeating patterns, traders can seize upon these movements to drive profit potential. A stock that shoots up in price is often followed by a dramatic collapse as traders take profit and sell their holdings. But, on the way down, there is plenty of buying opportunity, known as buying the dip. If the stock has value, plenty of traders will buy the dip, hoping for the inevitable price rise. Various technical indicators serve as barometers of a stock's likely trajectory. A good point of departure is the 50- day moving average (the short-term moving average), and the 200-day moving average (the long-term moving average). By assessing the current value of the stock relative to its moving averages, you can determine performance.

Bollinger Bands (20, 2) are particularly useful as technical indicators for the possible performance of stocks. If the upper Bollinger Band is breached, it indicates overbought territory and a likely reversal. If the lower Bollinger Band is breached, it indicates oversold territory, and a likely reversal. There are scores of technical indicators to consider when trading penny stocks. These include Moving Average Convergence Divergence (MACD), stochastic indicators, oscillators, SMA's, EMAs, Ichimoku Cloud, and pivot points among others. These indicators are worth studying, insofar as they can provide valuable guidance on how best to trade a stock.

This introductory guide to trading penny stocks can be used irrespective of the stocks you are interested in trading. It is designed as a keepsake for reference purposes. Feel free to consult this guide, and the information contained within to better improve your win/loss ratio when trading penny stocks online.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.