Best Forex Brokers for Algo Trading

Algo trading, also known as algorithmic trading, involves placing orders using a computer program. These programs use different types of algo trading strategies to identify and take advantage of trade opportunities. Some of the different strategy types in algo trading include arbitrage, scalping, swing trading, market timing, and trend following, among others. The trading programs adhere to a predetermined set of rules known as algorithms to execute these different strategies. Notably, the programs can place trades at a speed that traders cannot match. Moreover, they take away the emotions of traders from the equation.

Besides providing the trader with prospects for profit, algo trading increases market liquidity. Today, we want to look at some of the best forex brokers for algo trading. But before that, we are going to look at the different types of algo trading software. Buckle up and let’s jump in.

Different Types of Algo Trading Strategies

High-Frequency Trading

High-frequency trading is a type of algorithmic trading that uses computer programs to place a large number of orders in mere seconds. The goal of this trading strategy is to take advantage of small price movements to earn tiny profits that are large when compounded. There are two main types of high-frequency trading strategies that include market-making and arbitrage.

Trend Following

Under this strategy, computer programs monitor the market 24 hours a day to identify price trends. When the programs identify an upward trend, they place buy orders. Conversely, when they identify downward price trends, they place sell orders.

Mean Reversion

This algo trading strategy is based on one main concept. The concept is that the prices of assets always tend to return to their historic mean after deviation. As such, programs that use this strategy look out for assets whose prices have deviated significantly from the mean for a period of time. They then place an order banking on the expectation that the prices will reverse towards the mean.

Momentum

This trading strategy is somewhat similar to trend-following strategies. However, this strategy mainly looks for large-volume price movements of an asset. Programs using this strategy follow the momentum to enter and exit trades.

Sentiment Analysis

The programs using this trading strategy gather data from the trades that investors are making. They also source information from articles, social media and other news sources. After gathering the information, the programs use it to predict price movements and place orders.

Factor-Based Trading

Under this strategy, the programs base the orders they place on a range of factors. These factors can include the value of an asset, inflation in the market, liquidity, and more. This is one of the most prevalent trading strategies among algo trading programs.

Index Rebalancing

Index funds regularly require rebalancing for optimal market operation. Programs running an index rebalancing strategy look for such opportunities to place orders. The programs place a large number of orders within short periods of time.

Best Forex Brokers for Algo Trading

Now let’s take a look at some of the best forex brokers for Algo Trading. First up is Peppestone.

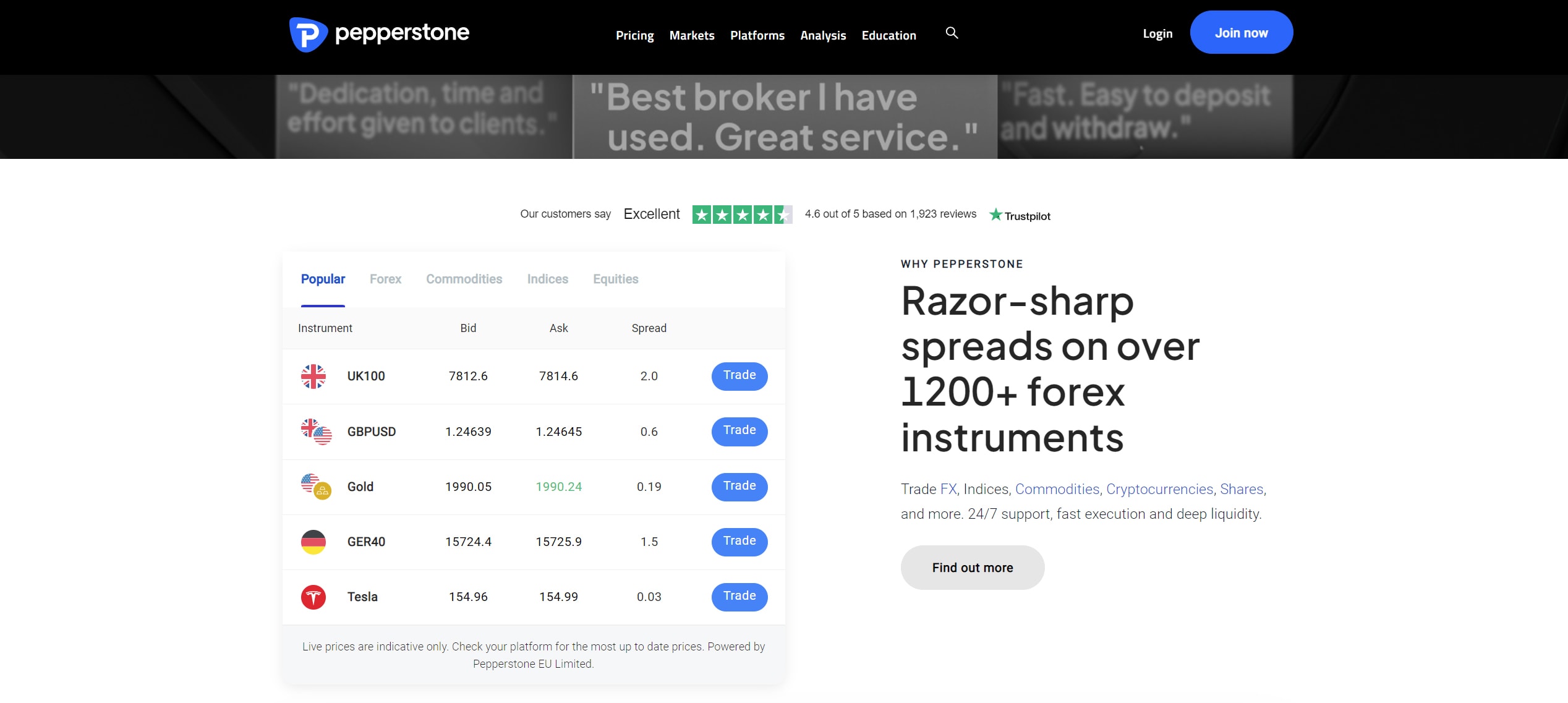

Pepperstone

Pepperstone offers trading instruments across the Forex, indices, equities, cryptos, energy and commodities markets. There are two trading accounts to choose from. These include the Standard account and the Razor account. The spreads are different depending on the account. The standard account features spreads from as low as 1.0 pips with no commissions.

On the other hand, the razor account has spreads from 0.0 pips and a commission that depends on the trading platform that a trader uses. When using either MetaTrader 4 or MetaTrader 5, traders pay a commission of $3.5 per side per lot. The commission is a little cheaper when using either cTrader or TradingView at $3 per side per lot.

Algo trading on Pepperstone is possible through the use of Expert Advisors. Traders can integrate expert advisors into their MT4, MT5 & cTrader accounts. Notably, the broker also allows those with the technical know-how to code their own automated trading solutions and use them. Most automated trading strategies are permitted on Pepperstone. However, the broker does not allow traders to use latency arbitrage when trading.

As we always mention the regulations of each broker we feature, let's see how Pepperstone is supervised. Well, this broker has regulatory licenses from the CySEC, the FCA, and the ASIC, among others.

75.5% of retail CFD accounts lose money

FP Markets

FP Markets also offers algo trading to its clients. There are several strategies that the broker supports under algorithmic trading. These include statistical strategies, arbitrage, hedging strategies, sentiment-based strategies, and momentum strategies, among others. FP Markets also offers traders education resources on the various algo trading strategies traders can use.

There are several markets traders can invest in on this broker site. They can trade forex and CFDs on stocks, cryptocurrencies, shares, ETFs, and indices. The trading platforms available for use include MetaTrader 4, MetaTrader 5, Iress, and cTrader. Further, the fees on this site are some of the lowest in the market. The standard account features spreads that start from 1.0 pips on the standard account. However, on the raw account, the spreads are as low as 0.0 pips with a commission of $3 per side per lot.

on regulations, this broker does not disappoint, This is because it has regulations from the ASIC, the CySEC, and the FSCA. The ASIC and the CySEC are two of the most reputable regulators in the market, giving the broker a boost in reputation.

72.5% of retail CFD accounts lose money

FOREX.com

FOREX.com is a well-known broker with some of the heaviest regulations in the market. It is a registered FCM and RFED with the CFTC and a member of the NFA. Additionally, it is regulated by the CySEC, the FCA, and the ASIC.

There are three main trading accounts to choose from. These include the Standard Account, the Raw Spread Account, and the Direct Market Access Account for traders outside the US. These accounts allow traders to trade CFDs on forex, shares, indices, precious metals, commodities, and cryptocurrencies if they are outside the USA. In comparison, clients from the US can only trade forex, stocks, gold and silver, and futures and futures options.

The spreads and commissions on these accounts differ depending on the account. The spreads on the standard account start from as low as 0.8 pips with no commission. On the other hand, the raw spread account has spreads as low as 0.0 pips with a commission of $5 commission per 100K traded.

In comparison, the DMA account charges variable commissions depending on the trading volume of a client. Clients with a trading volume of between $0M - $100M would pay a commission of $60 per $1 million traded. This account charges commissions only and hence there are no spreads charged.

Forex.com offers algo trading by allowing traders to connect Expert Advisors to their accounts. On Forex.com, you will be using MT4 as your algorithmic trading platform. This gives traders professional-grade control and flexibility over their trading strategy. Moreover, it allows traders to use trading strategies such as high-frequency trading. Traders can code their algorithms into a trading system, but they can also use off-the-shelf Expert Advisors created by other users or companies.

77.7% of retail investor accounts lose money when trading CFDs with this provider.

XM

XM is another broker that offers algo trading services. Like some other brokers on this list, this is possible through the use of expert advisors. The expert advisors can be accessed on both the MT4 and MT5. However, the full functionality of expert advisors is available on the MT4 platform. Traders can use these Expert Advisors to automate their trading and take away the need to constantly analyse the market. They can use trading strategies such as hedging and scalping.

XM offers four accounts which are the Micro Account, Standard Account, XM Ultra Low Account and Shares Account. The spreads start from as low as low as 1.0 pips on the standard and micro account. on the XM ultra-low account, the spreads are even lower starting from 0.6 pips. The shares account primarily charges a commission depending on the asset and the trade size. As a client, you have a wide range of instruments to trade including CFDs on Forex, Cryptocurrencies, Stocks, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, and Shares.

Trading with a regulated broker is the safest bet for a trader in the market. Luckily, XM is regulated by the CySEC, the ASIC and the FCA, three reputable organizations in financial regulations.

71.61% of retail investor accounts lose money when trading CFDs with this provider.

Exness

Established in 2008, Exness is a forex broker licensed and regulated by the FCA, the CySEC, and the FSCA. Regulations from top-tier organizations show that a broker is willing to follow strict financial laws.

With Exness, traders have access to a variety of market instruments. These include CFDs on forex, cryptocurrencies, indices, stocks, and energies. These assets are available on five different accounts. These include a standard account, a standard cent account, a pro account, a zero account, and a zero spread account.

Notably, Exness offers some of the lowest spreads traders can find in the market. on the standard account, the spreads start from as low as 0.3 pips with no commissions paid. However, the spreads can go lower on the zero account and the raw spread account starting from 0.0 pips. These accounts both feature commissions. The commission is $3.5 per side per lot on the Raw Spread account and $0.2 and higher on the zero account.

Exness offers access to algo trading through Expert Advisors. Exness allows traders to connect ready-made third-party Expert Advisors or program their own. Traders with the technical know-how can use either MetaQuotes Language 4 (MQL4) to write programs which work with MT4. They can also use MetaQuotes Language 5 (MQL5) for MT5 automated trading platforms.

Notably, Exness allows traders to use any trading strategy they see fit. The broker does not limit any algo trading strategies meaning traders can use hedging, arbitrage, trend-following strategies, momentum strategies, and others. However, Exness prohibits any strategies that are unethical, fraudulent, market manipulating, or illegal in nature.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

AvaTrade

AvaTrade offers many types of algo trading through the use of Expert Advisors and other trading programs. The broker informs traders that they require a trading platform that allows algorithmic trading, like MT5 which the broker provides. Using this platform in combination with automated trading systems, traders can use a variety of algo trading strategies on the AvaTrade trading site. These include mean reversal strategies, mathematical model-based strategies, arbitrage, and trend-following strategies, among others. The broker offers some educational material for traders to better educate themselves on these different strategies.

On the AvaTrade site, investors have access to a variety of markets. They can trade CFDs on forex, commodities, Stocks, ETFs, bonds, cryptos, and indices. Spreads start from as low as 0.9 pips for major currency pairs. The platforms available to trade these various markets include MT4, MT5, and its mobile app AvaTradeGo.

Closing out on this broker, let’s look at its regulatory status. Well, this broker has regulatory licenses from the Central Bank of Ireland, the ASIC, the CySEC, the BVIFSC, and the FSCA, among others. While regulations alone are not enough, licenses from reputable organizations are always a good sign.

Final thoughts

Algo trading is one of the most used trading strategies in the world today. Some traders who are new to the market rely on this type of trading because they lack the experience to analyse the market and place trades on their own. As such, they prefer to automate the process. Additionally, some traders simply lack the time to continuously monitor the market on their own. So they leave the heavy-lifting work to the different trading programs.

It is critical to understand that algorithmic trading carries the same risks and uncertainties just like other types of trading. Even using an algorithmic trading system, traders may still incur losses. Furthermore, the development and installation of an algorithmic trading system is fairly expensive. Keeping it out of reach for the majority of ordinary traders. They may also require traders to pay recurring fees. These recurring fees may be for software and data feeds. Before making any investment decisions, it is critical to thoroughly investigate and comprehend the potential risks and rewards.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.