Best Execution Only Brokers in the UK

Execution-only brokers only deal with the execution and reporting of orders placed by clients. Such brokers do not offer any financial advice to their clients or financial planning. Therefore, these types of brokers enable clients to have full financial control as they only deal with the final product of what the client decides. These sorts of brokers are fast and act within seconds delivering fast executions to clients.

In this review, we will look at some of the brokers that offer such services to clients. Let's take a look at some of the best execution-only brokers in the UK today.

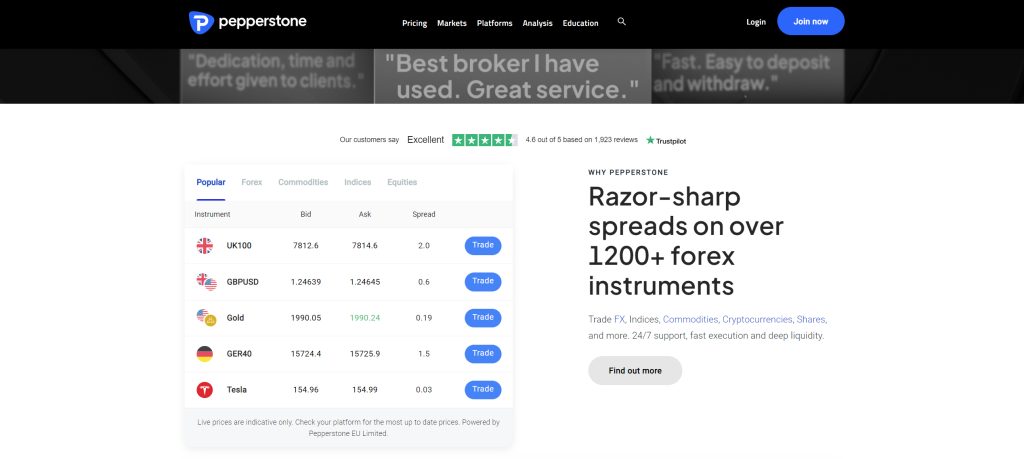

Pepperstone

Pepperstone is widely considered among the best Forex and CFD brokers in the UK. This broker is regulated by the FCA in the UK, the CySEC in Cyprus, the ASIC in Australia, the DFSA in Dubai, and the CMA in Kenya. While regulations alone are not enough, it is always a good sign to see a company with multiple regulatory licenses.

Pepperstone offers over 1,200 CFDs on forex, commodities, indices, shares and ETFs. These instruments are tradeable on four of the world’s leading platforms, MT4, MT5, cTrader and TradingView. Additionally, Pepperstone is one of the brokers that support Capitalise.ai, a tool that allows clients to automate their trading.

Pepperstione informs clients that they should seek independent financial advisors as the information on its website is general in nature. It should, therefore, not be considered financial advice. In this way, Pepperstone does not influence the trading decisions made by the trader. They only provide an execution-only service to clients making independent investment decisions.

Pepperstone offers fairly low spreads that start from 1.0 pips on major currency pairs on the standard account. However, clients can trade on even lower spreads on the Razor account. Specifically, the razor account has spreads as low as 0.0 pips and a commission paid. The commission on this account sits at €2.6 per side per lot on forex or $3.50 in US Dollars.

75.5% of retail CFD accounts lose money

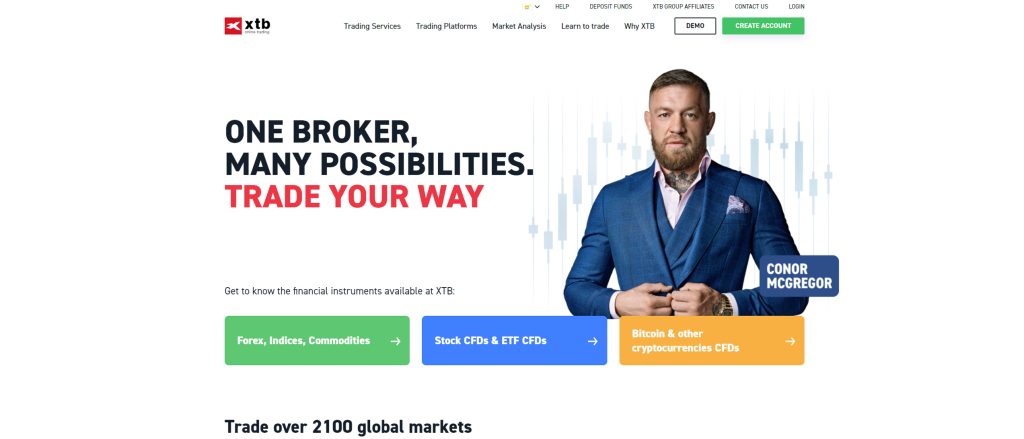

XTB

XTB is one of the brokers that focuses solely on the execution of orders placed by clients. This broker does not offer financial advice or planning. On its risk disclaimer, the company specifically states that the contents of its website are for informative purposes only and should not be construed as financial advice. However, the company does provide market analysis and educational material to assist clients in the decision-making process. The ultimate trading strategy and decisions are on the trader and XTB only executes their final decision.

On the XTB broker site, clients can trade a variety of assets. These include CFDs on Forex, Indices, Commodities and ETFs. These trading instruments are tradeable on XTB’s in-house-built platform, xStation 5. Typical spreads on this trading platform can fall as low as 0.5 pips for major currency pairs on the standard account.

On another positive note, XTB has regulations from various organizations across the world. XTB is licensed and regulated by the FCA in the UK, the CySEC in Cyprus, and the KNF in Poland. XTB also offers a full-time customer support system for its clients. These are some of the features that make XTB a tier-one broker in the market.

78% of retail investor accounts lose money when trading CFDs with this provider.

Libertex

Libertex is one of the world's leading CFDs brokers. It specializes in the trade of CFDs on forex, stocks, metals, oil and gas and ETFs. The broker focuses on the execution of orders with no secondary services provided. Nonetheless, Libertex provides clients with a variety of educational materials to support clients with information they can use in the decision-making process.

Clients can trade on three main trading platforms availed by Libertex. These include MetaTrader 4, MetaTrader 5, and the Libertex trading platform, which are very fast and customizable. Fortunately, clients can familiarize themselves with the company’s services or even polish their trading skills via a non-expiring demo account. Further, clients can deposit and withdraw via Wire Transfers, PayPal, Neteller, Skrill, and Credit/Debit cards.

Libertex promises some of the lowest spreads in the industry. The spreads on this broker site can go as low as 1.0 pips for major currency pairs. They can go even lower starting from 0.0 pips for professional clients. Importantly, Libertex follows the strict regulatory guidelines of the CySEC in Cyprus. This regulation allows Libertex to operate in many jurisdictions within Europe. CySEC is one of the best regulators in the market today. This is one feature that attracts many traders to Libertex.

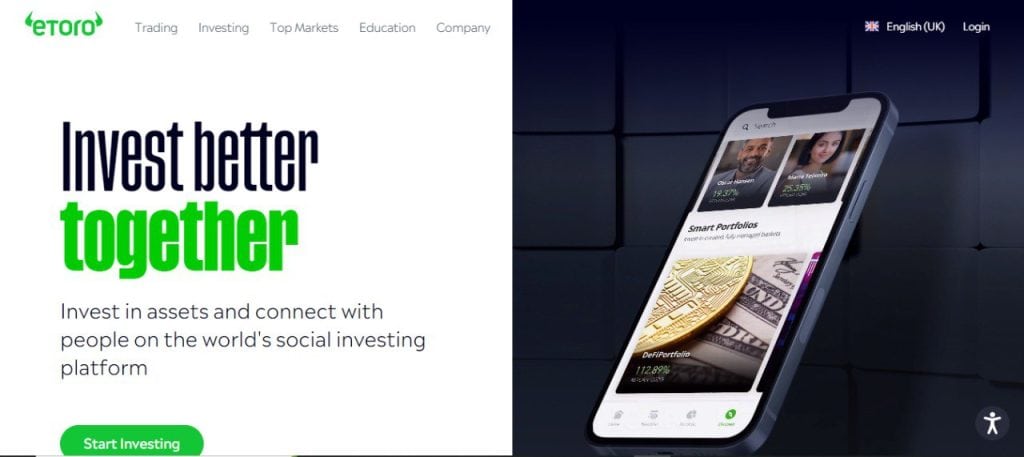

eToro

eToro is a highly reliable multi-asset broker operating in the market since 2007. It offers a platform to trade CFDs on forex, stocks, commodities, ETFs, and indices. Additionally, clients can trade real stocks and cryptocurrencies. These trading instruments are tradeable in an execution-only environment provided by eToro. The broker does not provide investment advice or recommendations. However, clients can find useful educational material that can arm them with information that might help them in the decision-making process.

On the eToro broker site, the main trading platform is the eToro Platform provided by the company itself. Notably, this platform comes with the CopyTrader technology that has elevated eToro to probably the best forex broker for copytrading. A demo account with free $100,000 in virtual funds for clients to polish their skills and familiarize themselves with the market.

Finally, eToro is one of the most heavily regulated companies. This broker has regulations in the UK by the FCA, in Cyprus by the CySEC, in Australia by the ASIC, and the FINRA and SEC in the USA. Such heavy regulations are one of the reasons why eToro has attracted over 30 million users making it one of the biggest forex brokers in the world.

51% of retail investor accounts lose money when trading CFDs with this provider.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 minutes to learn more.AvaTrade

AvaTrade offers a platform to trade a wide range of products including CFDs on forex, stocks, commodities, indices, bonds, ETFs, and Vanilla FX Options. With this broker, clients trade on an execution-only model. The broker does not offer its clients investment advice, planning, or recommendations. The broker claims that all information provided on its website is strictly for assisting traders make independent investment decisions.

A wide range of trading platforms are available for clients to place their orders. These include; AvaTrade WebTrader, MetaTrader 4, MetaTrader 5, and AvaTrade Go. Additionally, Automated trading is supported via AvaSocial, DupliTrade, ZuluTrade, and Capitalise.ai. Spreads range from 0.9 pips to 2.0 pips for major currency pairs with no hidden fees. These are some of the fairest trading fees in the industry.

Regarding regulations, AvaTrade is licensed and regulated across Europe, Africa, Australia, and North America. It is regulated by the CySEC based in Cyprus, the Central Bank of Ireland based in Ireland, the ASIC based in Australia, the FSCA based in South Africa, and the IIROC based in Canada. Notably, AvaTrade is compliant with the MiFID which provides a harmonised regulatory regime for investment services within the European Economic Area.

76% of retail CFD accounts lose money

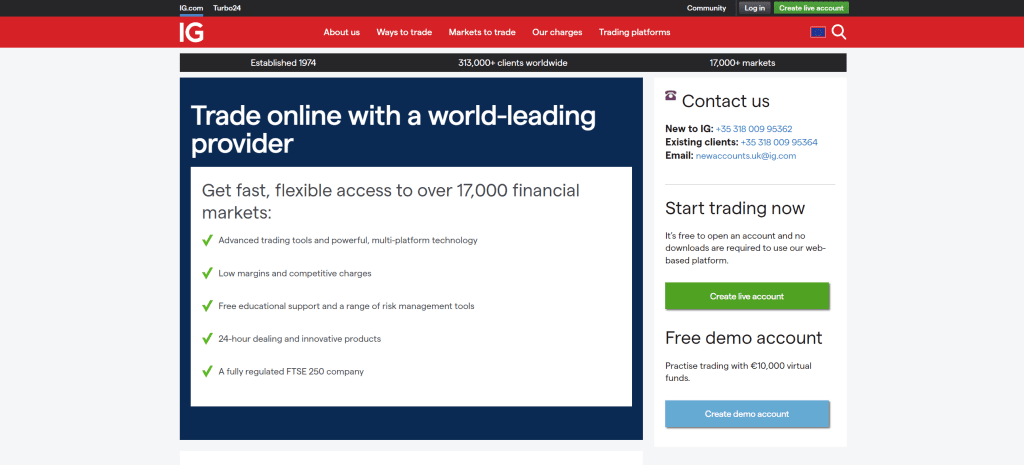

IG

IG is a highly trusted broker that deals with the brokerage of CFDs on forex, shares, commodities, indices, options and more. IG offers a wide range of trading platforms. These include the MetaTrader 4, the IG online trading site platform, ProRealTime, L2 dealer, and a wide range of user-friendly trading apps for Android and iOS. Additionally, IG offers its clients a demo account to familiarize them with the trading environment and its services.

Additionally, IG features some of the lowest spreads in the market. Typical spreads on IG can fall as low as 0.6 pips for some major currency pairs, 0.8 pips on major indices, and 0.1 pips on commodities. Note that IG does not charge commissions on forex trading.

While IG provides clients with a lot of supportive material, the company does not give clients any investing advice. The company states at the bottom of its website that it provides an execution-only service. Ultimately, the trade moves a client makes are solely dependent on their own decisions and the broker only executes them. Finally, IG is a publicly traded and regulated company. It is recognized by the FCA, the ASIC, the JFSA, and the CFTC. These are reputable brokers with a lot of rules in place to ensure clients receive fair trading environments.

Final Remarks on Best Execution Only Brokers in The UK

When brokers focus only on the execution of orders, they work hard to ensure they provide a streamlined execution process. Consequently, they provide the best trading platforms for order executions and offer lightning-fast processing. Furthermore, clients of such brokers do not have to pay extra charges for extra services. The fees on such broker sites can be considerably low as a result.

Here, we looked at some of the best execution-only brokers in the UK. We made sure to only present regulated brokers with fair trading conditions. We always encourage our readers to only trade using regulated brokers as they are much safer. On top of that, readers should make sure that the broker best suits their specific needs before investing their hard-earned cash.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.