Forex Brokers in Uganda That Accept Mobile Money

In recent years, financial transactions in Uganda have witnessed a significant change. The introduction of mobile money has introduced a convenient and easier way to pay for goods and services. This shift has brought about a more accessible and convenient trading experience for Ugandan traders. It eliminates the need for traditional banking methods. Notably, several forex brokers in Uganda have recognized the importance of accommodating this trend.

In this article, we will look at some forex brokers in Uganda that accept mobile money. We will also assess the quality of their services to Ugandan traders. Let’s jump in.

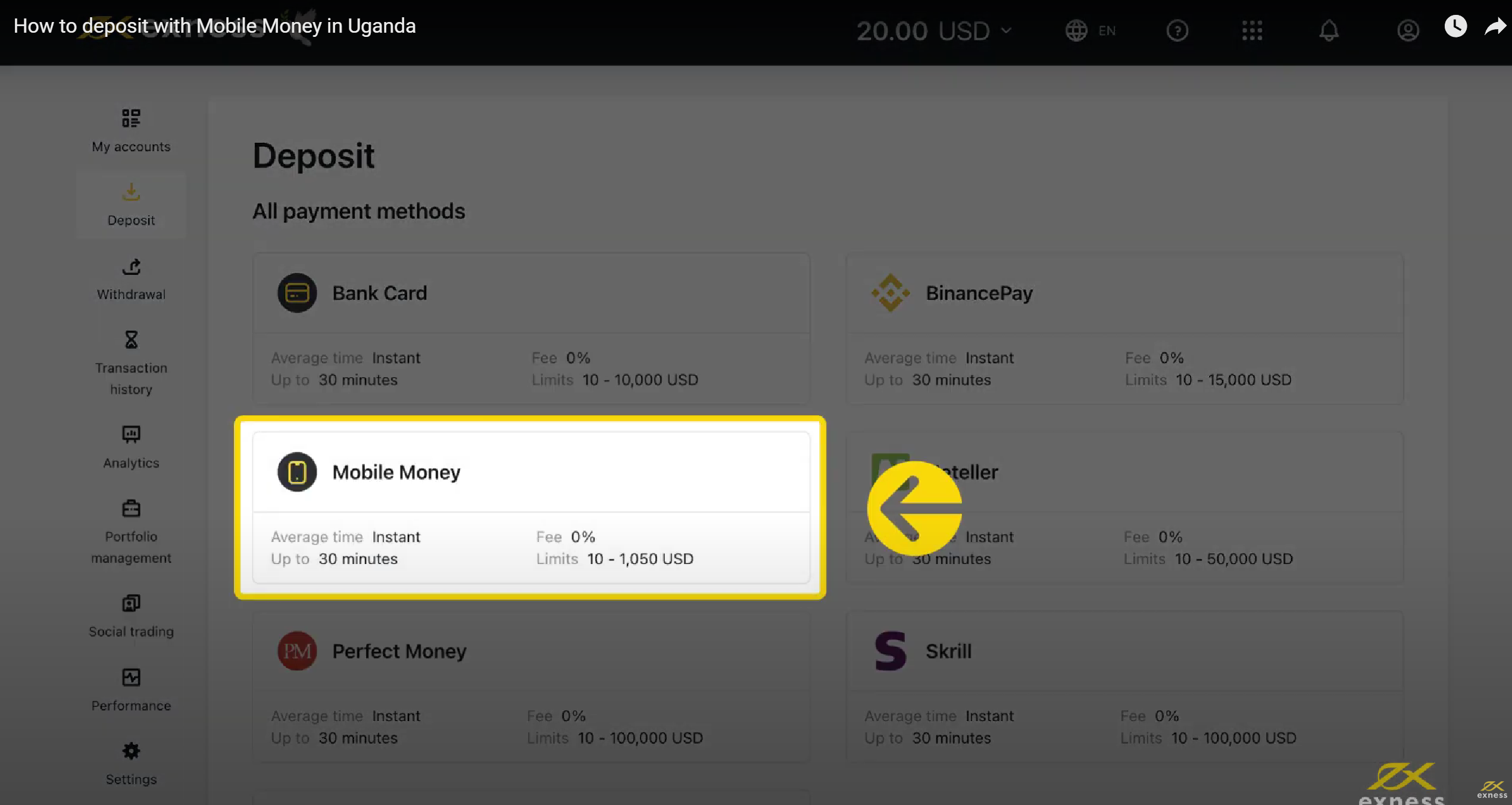

Exness

Exness is one of the brokers that support Mobile Money as a way to make deposits and withdrawals in Uganda. More specifically, the broker supports various mobile money systems in the country including M-Pesa and Airtel Money. The minimum deposit when using this payment method is in Uganda $10 and the maximum is $1,050 (in other countries the conditions differ). To make a deposit, traders can navigate to the Personal Area and click on Deposit. From there, traders can select Mobile Money as their preferred deposit method and click on Continue. A summary of the transaction will pop up for the user’s confirmation.

Exness promises instant processing of transactions. The maximum processing time for mobile money deposits is 30 minutes. Once the deposit is reflected, traders have access to a plethora of market instruments. Specifically, they can invest in CFDs on forex, stocks, indices, metals, and energies. All these market products are accessible on industry-standard platforms which include MetaTrader 4, MetaTrader 5, Exness Terminal, and Exness Trade App.

Positively, Exness offers competitive pricing when investing. There are two different standard accounts and three different professional accounts. The two standard accounts both have spreads from as low as 0.3 pips with no commissions. On the other hand, two Exness professional accounts feature spreads from as low as 0.0 pips with two charging small commissions. The zero account charges a commission from $0.2 upwards while the raw spread account has a commission of $3.50 per side per lot. However, the pro account has ultra-low spreads from 0.1 pips with no commissions.

Further, Ugandan traders will be pleased to know that Exness is a regulated broker in various jurisdictions. The broker operates under the regulation of the CMA in Kenya, the FSCA in South Africa, the CySEC in Cyprus, and the FCA in the UK.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

XM

XM supports mobile money in Uganda through three main systems. Traders can fund their accounts using Airtel Money, MTN Mobile Money, and M-Pesa. To make a deposit using mobile money, traders can click Menu and click Deposit from the menu options. Under mobile money, there are a couple of options including Airtel Money and MTN Mobile Money (MOMO). M-Pesa is a separate option but traders can still use it.

After successfully making a deposit, traders gain access to a variety of markets. Specifically, traders get access to over 1,000 different CFDs on forex, indices, cryptocurrencies, stocks, shares, precious metals, and energies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, and the XM Trading App. These are powerful trading tools with customization capabilities.

That’s not all. Traders also have access to some of the lowest spreads in the market. The micro and the standard accounts both feature spreads from as low as 1.0 pips for major currency pairs with no commissions. However, the XM Ultra Low account features even lower spreads starting from 0.6 pips with no commission.

On regulations, this broker operates under the watchful eye of several organizations. These include the ASIC in Australia, the CySEC in Cyprus, and the FSC in Belize.

71.61% of retail investor accounts lose money when trading CFDs with this provider.

IQ Option

IQ Option allows Ugandan traders to fund their accounts using Airtel and M-Pesa, two popular mobile money platforms in the country. To fund your IQ Option account with Mobile Money, you can simply click on deposit and select your preferred mobile money system. Traders can easily select Airtel Money or M-Pesa from the various options available. The deposit takes only a few minutes to reflect into a trader’s account.

Once the money is reflected in the trader’s account, they can invest in a plethora of market products. In total, there are over 250 different instruments to invest in. These include CFDs on forex, cryptocurrencies, commodities, indices, stocks, and ETFs. The fees for trading these instruments are not exorbitant. As an example, the spreads for trading major currency pairs start from as low as 1.0 pips with no commission charged. Further, the company provides its own proprietary platform for traders to use in placing orders. The IQ Option trading platform is customizable and has fast order execution speeds with an average of 0.6 seconds per order.

General Risk Warning: The financial products offered by the company carry a high level of risk and can result in the loss of all your funds.

You should never invest money that you cannot afford to lose.

FXTM

FXTM (ForexTime) is another reputable forex broker that supports mobile money in Uganda. Much like Exness, FXTM supports various mobile money payment methods. This includes popular options such as MTN Mobile Money and Airtel Money. To deposit funds using mobile money with FXTM, traders can follow a straightforward process. They can simply go to My Money and click on Deposit Funds. Then they can select Mobile Money. The process from there is easy to follow to the end. FXTM emphasizes quick transaction processing, promising fast deposits and withdrawals through mobile money.

Upon successful deposits, Ugandan traders on the FXTM platform gain access to a diverse range of market instruments. These include forex currency pairs, metals, commodities, indices, forex indices, stocks, stock baskets, and stock CFDs. Additionally, FXTM offers these products on globally recognized trading platforms. These include MetaTrader 4, MetaTrader 5, and FXTM Trader, ensuring a seamless and professional trading experience.

In terms of spreads, this broker is within market standards. There are three main trading accounts on FXTM. They include the Micro account, the Advantage account, and the Advantage Plus account. The Micro account and the Advantage Plus account both have spreads starting from 1.5 pips upwards. In contrast, the Advantage account has spreads from 0.0 pips plus average commissions of about $0.4 to $2 based on the volume.

Crucially, FXTM operates as a regulated broker, instilling confidence in Ugandan traders. The broker operates under the regulation of the CMA in Kenya, the FSCA in South Africa, the CySEC in Cyprus, and the FCA in the UK. This regulatory oversight ensures that FXTM operates with transparency and accountability.

Advantages of Forex Brokers that Accept Mobile Money

- Accessibility - One of the key advantages of using mobile money for forex trading is accessibility. Traders no longer need to rely solely on traditional banking methods. Mobile money allows traders to deposit funds and withdraw profits from anywhere using their mobile devices. This provides a level of convenience that was previously unavailable.

- Speed and Efficiency - Mobile money transactions are known for their speed and efficiency. Deposits are processed in real-time, allowing traders to fund their accounts instantly. In turn, this allows them to take advantage of market opportunities without delay. Similarly, withdrawals can be processed quickly, ensuring traders have timely access to their profits.

- Financial Inclusion - Mobile money has played a crucial role in promoting financial inclusion in Uganda. By integrating mobile money into forex trading, more people can access these forex brokers and participate in the forex market. This inclusivity is important in a country where traditional banking services may be less accessible in certain regions.

Disadvantages of Forex Brokers that Accept Mobile Money

- Limited Availability of Brokers - Not many forex brokers currently support mobile money transactions. Traders might find a more limited selection of brokers compared to those accepting traditional payment methods.

- Complex Verification - The initial verification process can be complex before a trader can access mobile money services on broker sites.

- Dependency on Mobile Networks - Mobile money transactions rely on a stable mobile network connection. Traders may face challenges in areas with poor network coverage or during network outages. This can affect the ability to make deposits and withdraw profits from broker sites.

In Conclusion

The integration of mobile money into forex trading in Uganda represents a positive forward step. It helps move the industry towards financial inclusivity and convenience. As more brokers recognize the importance of including local payment methods, the forex market becomes more accessible to people. Traders in Uganda can now enjoy the benefits of mobile money when participating in the dynamic world of forex trading, making it easier than ever to engage in this global financial market. As the industry continues to evolve, it is likely that more brokers will embrace mobile money. Currently, such brokers may be far and wide. The brokers we included here stand out for their outstanding services. They have regulations, competitively low fees, and a wide collection of market instruments.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.