Best TradingView Brokers in Australia

Australia has established itself as a hub for online trading. It has a growing community of traders who are using advanced tools and platforms to navigate the financial markets. TradingView is one of the tools that traders use the most in the market. It is a popular charting and trading analysis platform with a vast array of analysis tools. On top of that, it offers traders a user-friendly interface. To get the most out of TradingView, many traders in Australia are seeking brokers that integrate seamlessly with this platform.

In this article, we will look at some of the best TradingView brokers in Australia. But before diving into the list of the best TradingView brokers in Australia, it's essential to understand the criteria that will guide our picks.

Our Criteria for Choosing a TradingView Broker

Below are the factors we will consider when making our picks for the best TradingView brokers in Australia.

- TradingView Integration - The ability to connect your TradingView account with your chosen broker is key. We will only list here brokers that integrate easily with TradingView.

- Regulatory Status - We will ensure that the brokers we choose are regulated by reputable authorities. We will prioritize brokers with regulations from the Australian Securities and Investments Commission (ASIC).

- Collection of Trading Instruments - Different traders have diverse preferences for asset classes. A good broker should offer a wide range of assets, including stocks, forex, commodities, indices, and cryptocurrencies.

- Trading Costs - We will consider the broker's fee structure, including spreads and commissions. Low trading costs can significantly impact your profitability.

- Trading Platforms - In addition to TradingView, we will assess the trading platforms a broker provides.

Now, let's explore some of the best TradingView brokers in Australia based on these criteria.

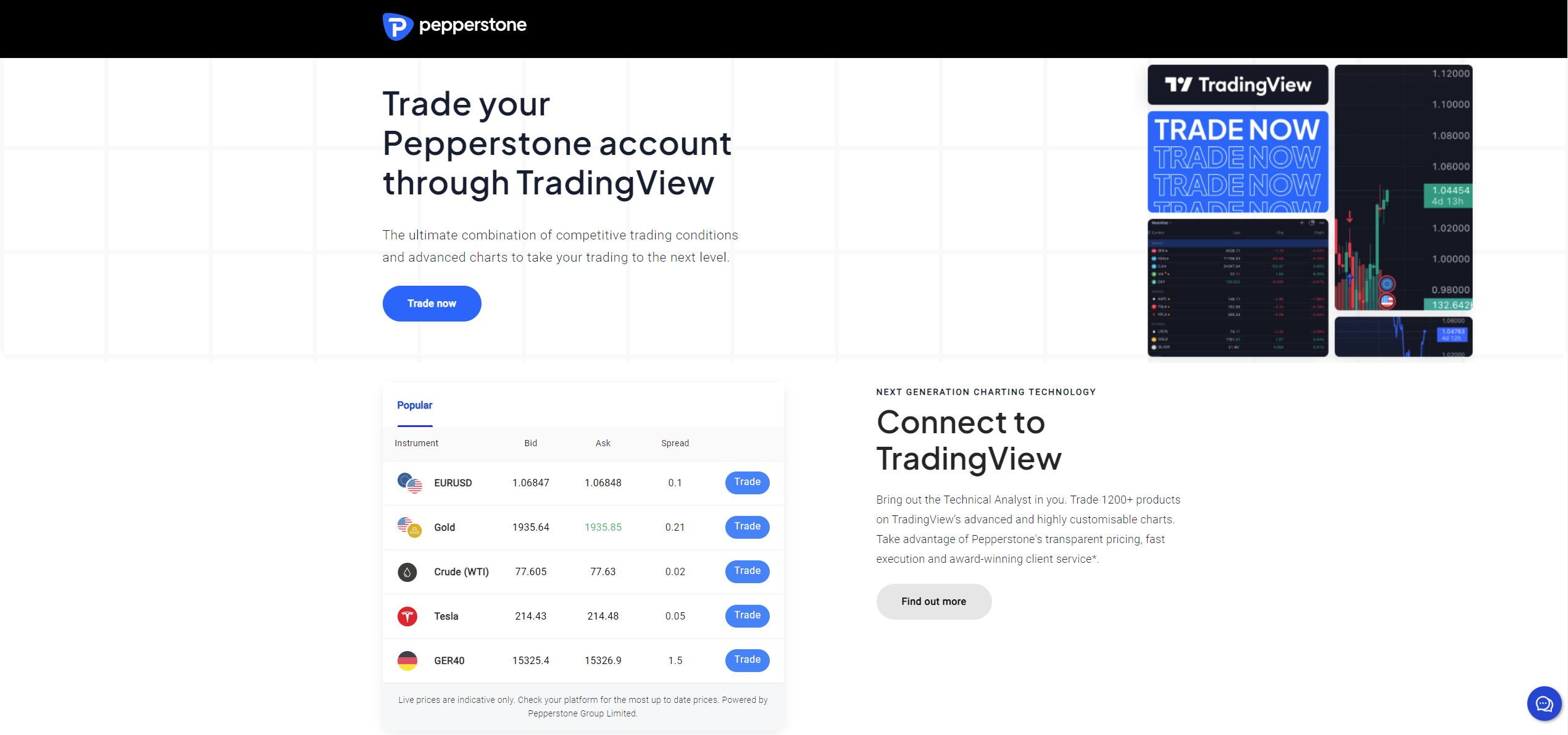

Pepperstone

Pepperstone is a popular choice for traders in Australia. With ASIC regulation and a seamless TradingView integration, Pepperstone stands out. The broker is under ASIC’s regulation with the license number AFSL 414530. The broker also has regulations from other recognized authorities across the world. It has regulations from the CySEC in Cyprus, the FCA in the UK, the CMA in Kenya, and the BaFin in Germany.

Pepperstone offers TradingView to traders as a trading platform and a charting tool. This broker was voted TradingView Broker of The Year 2022 in the TradingView Broker Awards. As such, this broker ranks high among its competitors. Apart from TradingView, there are other popular platforms available for traders to choose from. They include MetaTrader 4 and 5 which are the world's most popular platforms. Additionally, traders can use cTrader. Using the various platforms, traders can enjoy some of the fastest order execution times in the market.

On the Pepperstone broker site, traders are spoilt for choice when it comes to the trading instruments available. They can invest in over 1,200 CFDs on forex, commodities, indices, shares, ETFs, and many more. This means that the traders do not have to find a new broker if they want to invest in multiple markets at once.

Further, the broker offers competitively low fees when trading. There are two main trading accounts including the razor and the standard account. The standard account has spreads as low as 1.0 pips for major currency pairs with no commissions required. In comparison, the razor account features a spread is as low as 0.0 pips for major currency pairs. However, traders pay a small commission of $3.5 per lot per side when using TradingView, MT4, and MT5. When using cTrader people pay a commission of $3 per side per lot.

75.5% of retail CFD accounts lose money

City Index

City Index is one of the fastest brokers in the world today that offers TradingView. Notably, TradingView is available on this broker site for more than just charting purposes. Traders can use the platform to place orders directly from the charts. What's more, the broker has other trading platforms including MT4, WebTrader, and mobile trading apps.

Overall, we can consider this broker one of the top choices for Australian traders. The broker is part of the StoneX Group which is a publicly listed company listed on NASDAQ and is regulated by the ASIC in Australia with the license number AFSL 345646. Additionally, it has licenses from the CySEC in Cyprus and the FCA in the UK. This suggests that the broker is keen on following the most strict laws in the market.

On another good note, traders can choose from a wide array of trading instruments. This broker gives traders access to over 5,000 instruments. These are from various global markets including forex, indices, commodities, shares, and bonds. With such diversity, traders can spread the risk across the various markets.

Moreover, this broker offers two main accounts which include the standard and MT4 accounts. The standard account is accessible via the company’s web-based platform and TradingView. It has a low minimum spread of 0.8 pips for major currency pairs with no commission. In comparison, the MT4 account has spreads from as low as 0.5 pips with no commissions except on the shares market. As the name suggests, the MT4 account is accessible via MetaTrader 4.

69% of retail investor accounts lose money when trading CFDs with this provider.

Capital.com

Capital.com is a noteworthy addition to the list of TradingView brokers in Australia. Regulated by ASIC, Capital.com offers seamless integration with TradingView. The company’s ASIC regulatory license is under the license number AFSL 513393. Moreover, this broker has regulations from other organizations, not just the ASIC. It is also under the supervision and regulation of the FCA and the CySEC.

The broker covers a wide range of assets in the market. This includes over 3,700 CFDs on forex, indices, cryptocurrencies, commodities, and shares. Capital.com is recognized for its innovative approach to trading, offering MetaTrader 4 alongside its API for AI trading and EA integration. Moreover, Capital.com boasts highly competitive charges. For instance, the spreads start at a minimal 0.6 pips for major currency pairs. In contrast to alternative brokers, Capital.com does not impose additional fees such as commissions, currency conversion, funding, withdrawal, opening an account, and inactivity.

Saxo Bank

Saxo Bank is a global broker that serves the Australian market under the watchful regulation of the ASIC with the license number AFSL 280372. The broker’s partnership with TradingView allows clients to access its powerful charting tools and rich community of traders from around the world. However, this platform does not give traders access to all Saxo products. Traders can only trade forex, CFDs, stocks and cryptocurrencies. In comparison, traders using the company’s proprietary platforms SaxoTraderGO and SaxoTraderPRO have access to more asset classes. They can trade more than 8,800 financial instruments that range from forex, indices, stocks, ETFs, bonds, crypto, Mutual funds, and many more.

Like on many other broker sites, the charges that apply depend on the account a trader is using. The broker offers some of the lowest spreads in the market on its various trading accounts. The accounts include classic, platinum, and VIP accounts. The spreads on this broker site start from as low as 0.6 pips for major currency pairs.

Further, this broker has regulations from other well-respected organizations in the world. These include the FCA in the UK, FINMA in Switzerland, and the DFSA in the UAE. Remember that regulations alone are never enough. However, this broker has been in the market for well over 30 years without major legal concerns.

EasyMarkets

EasyMarkets will close out our list of some of the best TradingView brokers in Australia. The broker is recognized for its commitment to simplicity and transparency in trading. Regulated by ASIC with the license number AFSL 246566, the broker offers integration with the TradingView platform. Traders also gain deep market insight and a social network of traders. Nonetheless, this broker also gives traders access to other trading platforms which include MT4, MT5, and EasyMarkets App.

Additionally, the broker covers a wide range of assets, including forex, commodities, indices, and cryptocurrencies. This means traders can invest in more than one market on the same broker site. The fees are competitively low and depend on the account and the platform a trader uses. When using TradingView, the spreads are as low as 1.7 pips on the standard account for major currency pairs. The spreads can go lower starting from 0.8 pips on the VIP account with no commissions required.

Closing out on this broker, it is important to mention that it also has regulations in other jurisdictions. Specifically, the broker is licensed and authorized by the CySEC in Cyprus, the FSA in Seychelles, and the British Virgin Islands Financial Services Commission.

Final Verdict

Selecting the right broker is a critical decision for any trader. When it comes to TradingView integration in Australia, the brokers mentioned above offer excellent options to consider. Your choice should depend on your trading style, preferences, and specific needs. Always remember to prioritize regulatory compliance, competitive trading costs, and the range of assets available when making your decision. Also, consider the other trading platforms provided by the broker as you may need them.

Ultimately, the best TradingView broker for you in Australia will be the one that aligns most closely with your trading goals and provides the tools and support necessary to help you succeed. Take the time to research, compare, and consider your options carefully to make an informed choice before you embark on your trading journey with confidence.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.