The Options Wheel Strategy: An Insightful Guide

June 31, 2023, 6:45 PM | The content is supplied by a Guest author

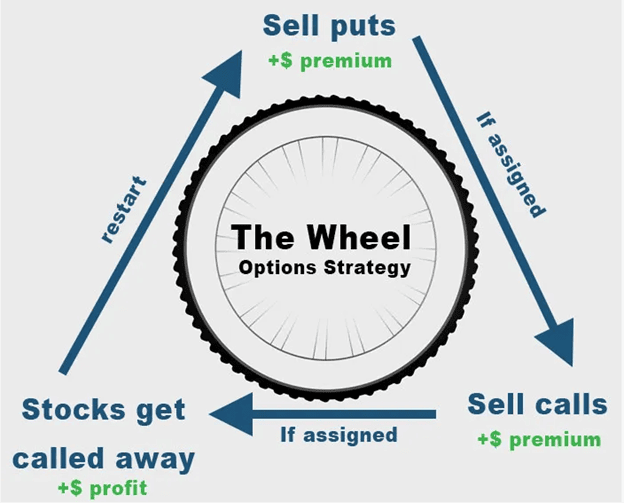

Options trading, with its myriad of strategies and trading structures, presents a world of potential for investors seeking a strategic approach to the cryptocurrency market. One such strategy, known for its systematic and repeatable nature, is the 'wheel options strategy'. It combines various elements of options trading into a singular, rotation-like approach, thus earning the moniker 'the Wheel'.

Understanding the Options Wheel Strategy:

This Strategy involves three sequential steps: selling a cash-secured put, potentially owning the cryptocurrency, and selling a covered call. It's a cyclical strategy that 'wheels' around these stages, hence its name.

1. Selling a Cash-Secured Put:

The first step involves selling a put option on a cryptocurrency exchange, and this put is cash-secured. This means you have enough cash in your account to buy the crypto at the strike price if the put option is exercised. You receive the premium from selling the put option.

2. Potentially Owning the cryptocurrency:

If the cryptocurrency's price falls below the strike price at expiration, you must buy at the strike price due to the put option you sold.

3. Selling a Covered Call:

Once you own the cryptocurrency, the next step in the wheel strategy is to sell a covered call on those crytocurrencies. This involves selling a call option where the underlying security is owned by the call seller. Again, you receive the premium from selling the call.

4. Repeating the Cycle:

After selling a covered call, one of two things can happen:

- If the cryptocurrency's price rises above the strike price and your crypto get called away, you're back to the initial stage and can start the process over by selling another cash-secured put.

- If the cryptocurrency's price stays below the strike price, the call option expires worthless. You keep the premium and continue to hold the cryptocurrency, and you can then sell another covered call.

Essentially, you repeat the 'wheel' process—selling cash-secured puts until you're assigned the cryptocurrency, then selling covered calls until the cryptocurrency is called away.

Advantages and Disadvantages:

The Wheel Strategy can be a powerful way to generate income from options premiums and potential capital appreciation from owning cryptocurrencies. However, it requires a fair amount of capital to start, as you need to be able to potentially buy the underlying cryptocurrency at the strike price.

Moreover, while the Wheel Strategy can be profitable in a neutral or slightly bearish or bullish market, it may not perform as well in strongly trending markets. For instance, in a strong bull market, you might miss out on some upside potential if your crypto get called away. In a strong bear market, you might end up owning a cryptocurrency that falls significantly in price.

Conclusion:

This strategy is a disciplined approach to options trading that combines premium income and potential ownership benefits. As with all investment strategies, it requires careful consideration of your financial goals, risk tolerance, and market expectations. It's essential to conduct thorough research and possibly seek professional advice before employing this or any options strategy.

FAQ

Can I lose money with the Wheel Strategy?

Yes, the Wheel Strategy, like all trading strategies, carries risk. In a strong bull market, you might miss out on potential profits if your crypto get called away. In a strong bear market, you could end up owning a falling cryptocurrency. Always consider your risk tolerance and investment goals before using this strategy.

Do I need a lot of capital to start the Wheel Strategy?

The Wheel Strategy does require a fair amount of capital since you need to have enough cash to potentially buy the underlying cryptocurrency at the strike price of the put option you sell.

Can the Wheel Strategy be used on any cryptocurrency?

In theory, yes. But it's best used on cryptocurrencys that you wouldn't mind owning long term, since a key part of the strategy involves potentially owning the underlying cryptocurrency.

What market conditions are best for the Wheel Strategy?

The Wheel Strategy can be profitable in a range of market conditions, but it generally works best in neutral or slightly bearish or bullish markets.

What is the Options Wheel Strategy?

This strategy is a systematic method that involves selling cash-secured puts until you are assigned the cryptocurrency, then selling covered calls until the cryptocurrency is called away. It can generate income through premiums and potential capital appreciation.

What are cash-secured puts?

A cash-secured put involves selling a put option while keeping enough cash in your trading account to buy the underlying crypto if the option is exercised. It's a way to potentially buy a cryptocurrency you want at a lower price while earning premium income.

What are covered calls?

A covered call involves selling a call option on a cryptocurrency you already own. This strategy allows you to earn premium income and potentially profit from selling the cryptocurrency if its price rises above the option's strike price.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.