Brokers With No Inactivity Fees

An inactivity fee is a charge imposed on clients when there is no activity on their account. This charge takes effect when clients do not make any buy or sell orders in their accounts for a given period. Most brokers are transparent about this fee ensuring clients understand what they are signing up for upfront. Traders should do a lot of research on the broker they choose to ensure they don’t get surprised when charged an inactivity fee.

This review will look at brokers with no inactivity fees. As usual, we are also going to look at the brokers’ variety of trading instruments, regulatory statuses, spreads offered, and the trading platforms the brokers provide.

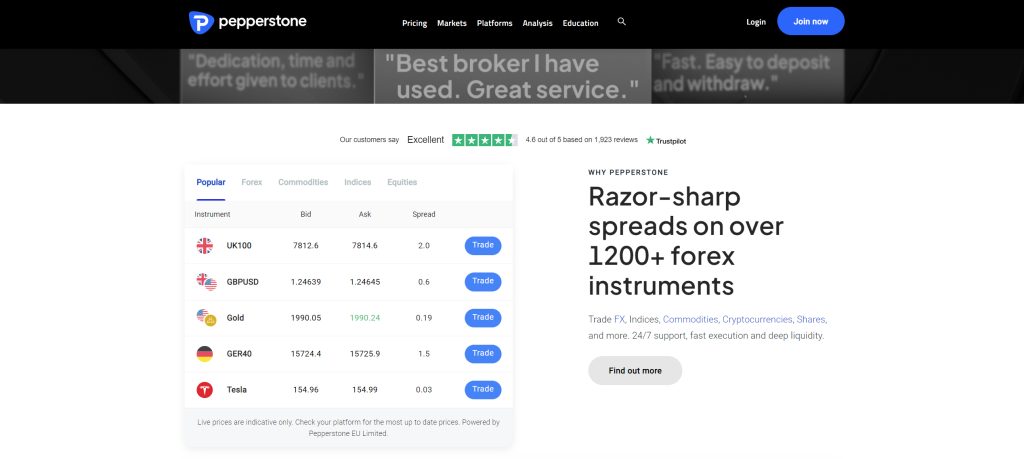

Pepperstone

Pepperstone is one of the brokers that do not charge an inactivity fee. The fees that apply include spreads commissions and swaps. There are two accounts a trader can choose from, the standard account and the razor account. The spreads depend on the type of account a trader uses. The standard account features spread as low as 1.0 pips on major currencies with no commission. Contrarily, the razor account has spreads starting from 0.0 pips with a small commission of $3.50 per lot per side on Forex.

Swap fees are charged for holding positions overnight. The swap rates charged by Pepperstone can be found on the company’s website under the pricing tab. They are updated regularly depending on market conditions. However, Islamic accounts that do not charge swap fees are available for Muslim traders.

Positively, Pepperstone traders can access a wide range of market instruments. In total, they can trade over 1,200 CFDs on forex, indices, commodities, cryptocurrencies, ETFs, and stocks. These are available on four world-class trading platforms. These include Trading View, MetaTrader 4, MetaTrader 5, and cTrader. The trading platforms are intuitive and have fast execution. Most orders are executed in less than 30 milliseconds (Pepperstone Group Limited) and 60 milliseconds (Pepperstone Limited)

Lastly, Pepperstone is regulated by several reputable organizations that include the CySEC in Cyprus, the FCA in the UK, the Bafin in Germany, the ASIC in Australia, and the CMA in Kenya. The regulators are strict hence traders can expect a fair trading environment.

75.5% of retail CFD accounts lose money

FP Markets

FP Markets is another broker that has no inactivity fees. Traders can invest in a wide range of markets that include forex, shares, commodities, indices, bonds, EFTs, and cryptocurrencies. These instruments are available for trade on their market standard trading platforms. That includes WebTrader, MetaTrader 4, MetaTrader 5, IRESS, and cTrader.

FP Markets traders can choose between two accounts: the standard and the raw account. The standard account has spreads as low as 1.0 pips with no commission on major currency pairs. The spreads are lower on the raw account starting from 0.0 pips with a relatively small commission of $3 per lot per side. Swap fees that depend on the asset traded are charged for positions held overnight. However, FP Markets is one of the best brokers that offer an Islamic Account to Muslim traders without swap fees.

FP Markets traders can choose between two accounts: the standard and the raw account. The standard account has spreads as low as 1.0 pips with no commission on major currency pairs. The spreads are lower on the raw account starting from 0.0 pips with a relatively small commission of $3 per lot per side. Swap fees that depend on the asset traded are charged for positions held overnight. However, FP Markets is one of the best brokers that offer an Islamic Account to Muslim traders without swap fees.

FP Markets has regulations from well-known regulators in the market. These include regulations from CySEC in Cyprus and the ASIC in Australia. With such regulations, FP Markets has a good standing among traders.

72.5% of retail CFD accounts lose money

Capital.com

Capital.com traders can be guaranteed not to be charged an inactivity fee when they do not trade for a long period. As such, traders can take a break from trading, come back and pick up right from where they left off. Notably, traders can invest in a wide range of markets offered by Capital.com. Some of the markets offered are forex, indices, commodities, shares, and cryptocurrencies.

Traders can choose between three main trading platforms. The platforms offered by Capital.com include MetaTrader 4, Capital.com, and TradingView. Also when trading with Capital.com you will pay one of the three main charges: the spread, overnight funding, and guaranteed stop premiums. It has competitive spreads starting as low as 0.6 pips for major currency pairs. Unlike other brokers, Capital.com do not charge traders the following when you trade: commission, currency conversion, funding, withdrawal, opening an account, and inactivity fee.

Regulations are essential when choosing a broker and Capital.com does not disappoint. With licenses and regulations from reputable organizations in the market, Capital.com stands out. The company has supervision and regulations from the CySEC in Cyprus, the ASIC in Australia, and the FCA in the UK.

IC Markets

Another reputable broker that does not charge an inactivity fee is IC Markets. Traders can invest using two main accounts. These include the raw and the standard account. The standard account offers spreads as low as 0.6 pips with no commissions. Clients can also trade on 0.0 pip spreads on the raw accounts. The raw account requires a commission of $3.0 per 100k traded for cTrader clients and $3.5 for MetaTrader clients. These low spreads and general pricing is characteristic of some of the best ECN brokers in the world.

Regarding trading instruments, IC Market has over 2,200 instruments for traders to choose from. These instruments are from various global markets including forex, commodities, indices, futures, stocks and metal. These are tradeable on MT4, MT5 or cTrader.

In terms of regulations, the broker is regulated by two of the best regulators in the market. These include the CySEC in Cyprus and ASIC in Australia. Knowing regulations play a huge role in protecting traders from defrauders, we insist that traders invest only with brokers that are regulated by reputable organizations.

Fusion Markets

One of the attractive features of Fusion Markets is that there is no inactivity fee charged. The spreads charged by this broker are competitive and fairly low. There are two main trading accounts to choose from, the Zero account and the Classic account. The classic account has spread as low as 0.9 pips with no commission. On the other hand, the zero accounts have spreads starting from 0 pips and a commission of AUD 4.50.

Nonetheless, before choosing to open an account with Fusion Markets you should familiarise yourself with how it's regulated. Fusion Markets has regulations and licenses from various organizations, including the ASIC in Australia, the VFSC, and the FSA in Seychelles. While the VFSC and FSA are not the best regulators in the market, it is nice to see that the company has regulations from the ASIC.

With this broker, clients have access to various world markets to which they can spread their risk of investment. The markets traders can invest, in are forex, precious metal, indices, commodities, and shares. For trading platforms, Fusion Markets has several market-standard platforms that include MetaTrader 4 and MetaTrader 5.

GO Markets

GO Markets has two accounts that have some of the tightest spreads in the market. The accounts available are the standard and the GO Plus+ Accounts. The standard account has fast execution, spreads as low as 1.0 pips, no commission, and no inactivity fee. While GO Plus + has no inactivity fee, spreads as low as 0.0 pips, and a commission of $3.00 per side on a standard lot.

Further, there are a variety of trading instruments offered by GO Markets. The broker provides a kind of collection for traders to easily spread their investments. Clients can trade CFDs on forex, shares, commodities, cryptocurrencies, indices, and metals. GO Markets delivers powerful platforms that are easy to use for both beginner and seasoned brokers. The platforms offered by GO Markets are MetaTrader 4, MetaTrader 5, and GO WebTrader.

Lastly, the broker has regulations from two regulators. These include the ASIC in Australia and the FSC in Mauritius. The regulation by the ASIC in Australia is notable as it is one of the best regulators in the market today.

Vantage Markets

Vantage Markets has more than 10 years of experience in connecting traders to global markets. What's more, it's a guarantee that traders are not charged an inactivity fee on their accounts when trading with Vantage Markets. The three accounts offered by Vantage Markets are the Standard, the Raw ECN, and the Pro ECN accounts. The standard account has spreads as low as 1.0 with no commission while the raw and the PRO have spread of 0.0 pips with a commission of $3.00 and $1.5 per lot per side respectively.

In terms of trading instruments, Vantage Market is spoiled for choice. They have a variety of trading instruments that include forex, indices, precious metal, energy, bonds, and share CFDs.evidently this is a good place for traders to diversify their investment. For a trading platform, Vantage Market offers two of the best platforms in the market which are MetaTrader 4 and MetaTrader 5. The platforms are suitable for seasoned and novice traders.

In terms of regulations, Vantage Markets is a regulated company in Australia by the ASIC, in Cyprus by the CySEC, in the Cayman Islands by the CIMA, and Vanuatu by the VFSC. While regulations alone are not enough, the CySEC and the ASIC are two of the best regulators in the market.

Tickmill

The last broker we will review that offers no inactivity fee is Tickmill. The broker has regulations from well-known organizations in the market. These include the CySEC in Cyprus, the FCA in the UK, and the FSCA in South Africa. It is always a good sign when a broker has regulations from multiple world-class organizations.

The company has no hidden fees and reveals all charges that they might apply on their platform. the company offers fair trading with spreads starting as low as 0.0 pips for major currency pairs.

With this broker, clients can trade using trading platforms that are market-standard and easy to use. MT4 and MT5 offered by Tickmill are fully customizable and designed to give traders that trading edge. With these platforms, traders can have access to several markets to invest in. The market instruments available for trading include forex and CFDs on stock indices, oil, precious metals, bonds, stocks and cryptocurrency.

Closing Remarks on Brokers With No Inactivity Fee

In this review, we have listed some of the brokers that do not charge inactivity fees. We have seen that the brokers have a lot of things in common from the regulations to top-tier trading platforms. We advise traders to do a lot of research when choosing a broker so as not to be surprised when charged a service fee. The lower the fees that apply, the greater the potential profits a trader enjoys when trading.

Since this is not an exhaustive list of all the brokers with no inactivity fee, we call upon traders to do research and choose a broker that best suits their needs.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.