Best Forex Brokers in the USA For Beginners

It is no secret that the USA is one of the most active countries in the forex market. The US Dollar is the most heavily traded currency in the world. Additionally, it is the world’s most dominant reserve currency. As expected, many forex traders hail from the US and more are entering the market each day.

As such, countless forex brokers are popping up in the market seeking to serve US clients. Unfortunately, some of these brokers do not offer the best trading conditions. In this review, we will list some of the best forex brokers in the USA for beginners. But first, let’s go over some important questions.

Is Forex Trading Legal in The USA?

Forex trading is completely legal in the USA and is heavily regulated by some of the best regulators in the world. The regulators watching over forex brokerage activities in the USA include the CFTC, the NFA, the SEC, the FINRA, the Chicago Board of Trade (CBOT) and the Securities Investor Protection Corporation (SIPC).

Here are some of the rules regulated brokers in the USA have to adhere to:

- Forex brokers must have procedures to prevent customers from entering trades that create undue financial risk. They must also have measures for negative balance protection.

- All regulated brokers must keep client funds in segregated accounts. This means they cannot hold client funds in the same account as the company’s funds.

- Regulators require brokers to ensure the market's integrity by maintaining price transparency.

- Regulators also require forex brokers only to advertise actual facts without deceit.

- Forex brokers must have at least $20 million in operating capital to maintain client positions in the market. This is why USA-regulated brokers have some of the highest liquidity in the market.

- Regulated brokers must maintain weekly statements with information on the amount of money the company holds in its accounts. They also have to present yearly audit reports to verify their holdings.

- Regulators in the US made it mandatory for forex brokers only to hire trained and knowledgeable staff.

- Regulators also set the maximum leverage at 1:50 for major currency pairs and 1:20 for minor currency pairs. This ensures traders do not overleverage and end up owing the broker money. The CFTC also implemented no hedging, which some traders consider detrimental to their trading freedom.

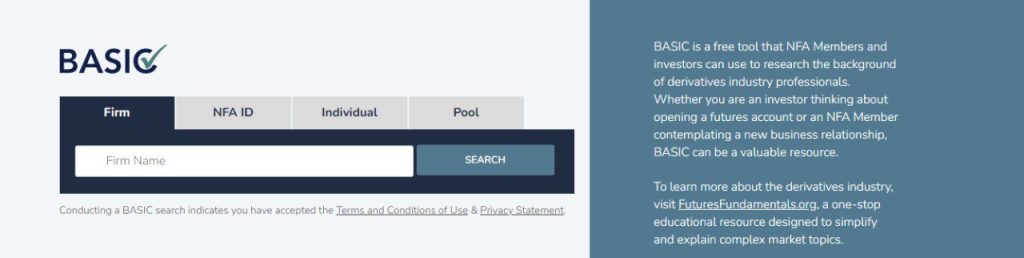

How to Verify Your Broker is Regulated in the USA

The NFA provides a free tool for investors to quickly check whether a company is regulated. This tool is known as the Background Affiliation Status Information Center (BASIC). The BASIC allows people to look up a company using its name, staff members, NFA ID, or company pool. You should always check to see whether a company has authorisation from the NFA to provide brokerage services. Many companies claim to have authorisation when they do not.

The SEC also allows investors to check a company’s regulatory status on its website. You can easily do this on the SEC’s Company Search Tool. To check FINRA company regulations, you can search the company’s name on FINRA’s BrokerCheck platform.

Now, without further delay, here is our list of the best forex brokers in the USA for beginners.

Forex.com

Forex.com is a forex provider registered with the CFTC and a member of the NFA under the reference number 0339826. The company also has regulations in Canada by the IIROC, in Cyprus by the CySEC and the FCA in the UK. This heavy regulation status significantly improves the broker's credibility.

US clients can have their Forex.com accounts in dollars (account base currency) without needing conversion. There are a lot of currencies to trade against the US Dollar. Some of the most popular currency pairs for US traders to trade include EURUSD, USDJPY, GBPUSD, AUDUSD and USDCAD, among others. In total, there are over 80 different tradable currency pairs on Forex.com.

The spreads on Forex.com can go on majors as low as 1.2 pips on the standard account and on the commission account they can be as low as 0.2 pips with a fixed commission of $5 per 100K. The maximum leverage on Forex.com stands at 1:50 for US clients. This is in line with the NFA and CFTC regulations, as the maximum leverage allowed for US forex brokers is 1:50. This helps protect investors from overleveraging and falling into debt. Interestingly enough for US traders, Forex.com has been ranked as the No. 1 FX broker in the US** (**Based on client assets per the 2022 monthly Retail Forex Obligation reports published by the CFTC).

There are a variety of ways clients can fund their Forex.com accounts. The options available include Wire Transfers, Credit and Debit card payments, PayPal and Maestro. The minimum initial deposit on Forex.com is $100. The broker gives access to a popular forex retail platform MT4 and a leading charting software TradingView.

For beginner traders, this forex broker provides an education section with many resources. These include courses, simple lessons, platform tutorials and webinars. Further, the company features a free demo account available to clients for 90 days. Traders can practice their trading strategies here before implementing them in the market.

Forex trading involves significant risk of loss and is not suitable for all investors.

OANDA

The OANDA Group is one of the oldest forex brokers in the market. This company launched its services in 1996 and continues to operate with professionalism. The OANDA Group has regulations in multiple jurisdictions, including the USA, the UK, Canada, Australia and Singapore. In the US, OANDA Corporation the company is licensed and authorized by the NFA under the NFA ID 0325821.

The US Dollar is available as the base currency for US clients. US traders have a lot of currency pairs involving the US Dollar to trade on OANDA. These include EURUSD, AUDUSD, GBPUSD, NZDUSD and USDCAD. In total, there are 45 different currency pairs available on OANDA.

The US Dollar is available as the base currency for US clients. US traders have a lot of currency pairs involving the US Dollar to trade on OANDA. These include EURUSD, AUDUSD, GBPUSD, NZDUSD and USDCAD. In total, there are 45 different currency pairs available on OANDA.The typical spreads on OANDA start from 1.0 pips on major currency pairs. Additionally, the maximum leverage for US clients on OANDA is 1:50 in compliance with CFTC regulations. Clients can fund their accounts in a variety of ways. OANDA supports funding of accounts through Bank and Wire Transfers, Credit and Debit card payments, Skrill and Neteller. There is no minimum deposit on OANDA. Therefore, you can open an account and trade from whatever deposit you make. OANDA is also one of the forex brokers that accept ITIN holders.

A demo account is available for novice and experienced traders to practice trading strategies before entering the live market.

Forex trading involves significant risk of loss and is not suitable for all investors.

Interactive Brokers

This forex broker has been operating since 1977. However, the company launched its website in 1997 and continues to offer brokerage services. Today, the company is licensed and regulated by the SEC and CFTC in the US, the FCA in the UK, the ASIC in Australia and the Monetary Authority of Singapore in Singapore. Such longevity and regulatory status always attract novice and veteran traders.

Luckily for US traders, Interactive Brokers allows them to have the US Dollar as the base currency for their accounts. Additionally, there are a variety of currencies they can trade against the USD. These include the Euro (EURUSD), the Sterling Pound (GBPUSD), the Australian Dollar (AUDUSD), the Swiss Franc (USDCHF) and the Canadian Dollar (USDCAD). All in all, over 100 currency pairs are available to trade on Interactive brokers.

Sadly, Interactive Brokers does not display its average spreads on the website. However, the company promises clients some of the tightest spreads in the market. The maximum leverage on Interactive Brokers stands at 1:50 for US clients. This is per the CFTC’s regulations to ensure investors do not overleverage.

Interactive Brokers does not support a variety of payment options. You must use Wire Transfers or Credit/Debit card payments to fund your Interactive Brokers' account. Credit/Debit card payments are only available for US citizens. There is no minimum deposit amount for individual traders.

Further, Interactive Brokers offers clients a free trial period and an education section with many resources. These are both crucial for new traders just starting their trading journey. This makes Interactive Brokers one of the best forex brokers for beginners.

IG

IG is a forex broker that allows US traders to use the US Dollar as the base currency for their accounts. This company is one of the best forex brokers in the US, with regulations from several regulators. These include the FCA, ASIC, and BaFin. In the US, IG is a registered RFED and introducing broker with the CFTC and a member of the NFA under the NFA ID 0509630.

Furthermore, IG allows clients to trade a wide variety of currency pairs. There are over 80 currency pairs available to trade on IG.com. Some of the best currencies to trade against the US Dollar include the Great British Pound (GBPUSD), the Euro (EURUSD), the Australian Dollar (AUDUSD), and the JPY (USDJPY).

Traders on IG enjoy industry-standard spreads with an average of 0.6 pips for major currency pairs. Additionally, IG does not charge commissions on forex trading. Further, the leverage is capped at 1:50 in line with CFTC regulations. Some of the payment methods supported by IG include Wire Transfers, Credit/Debit card payments, and PayPal. The minimum deposit for card payments is $300. There is no minimum deposit for bank transfers.

Traders on IG enjoy industry-standard spreads with an average of 0.6 pips for major currency pairs. Additionally, IG does not charge commissions on forex trading. Further, the leverage is capped at 1:50 in line with CFTC regulations. Some of the payment methods supported by IG include Wire Transfers, Credit/Debit card payments, and PayPal. The minimum deposit for card payments is $300. There is no minimum deposit for bank transfers.For novice traders, IG provides a wide range of resources for learning trading strategies and using trading platforms in its education section. Additionally, the company offers a free demo account to practice trading strategies before investing in the live market.

TD Ameritrade

TD Ameritrade is also among the best forex brokers in the US. Better yet, this company is favorable for both beginners and experienced traders. There is an education section with various resources to learn from. These include articles, videos, webcasts, podcasts, and even in-person events.

The US Dollar is the only currency accepted on TD Ameritrade. Therefore, US clients do not have to convert their money into another currency to start trading. Luckily, there are a variety of currencies US clients can trade against the US Dollar. In total, there are over 70 currency pairs available for trading on TD Ameritrade. The best pairs to trade for US clients include USDHUF, AUDUSD, AUDUSD, EURUSD, and USDJPY, among others.

Unfortunately, TD Ameritrade does not display the average spreads on its website. However, the company promises some of the lowest spreads in the market. There is no commission involved in forex trading on TD Ameritrade. The leverage is capped at 1:50 in compliance with CFTC regulations. To fund your account, various payment options are available on TD Ameritrade. These include electronic bank deposits, wire transfers, cheques, physical stock certificates, and account transfers from another firm. Most of these payment options do not have deposit limits. However, electronic bank deposits are limited between $50 and $250,000.

Finally, we have to talk about the regulatory status of TD Ameritrade. Fortunately, this forex broker has regulations from both the SEC and FINRA. Note that regulated companies can still commit criminal activities. However, you are better off investing in companies that have world-class regulators watching over their activities.

Conclusion on The Best Forex Brokers in The USA For Beginners

Many forex brokers make a good case for being the best brokers in the USA. This list presents the forex brokers that best met our criteria of selection. They have regulations from the best watchdogs in the US and offer some of the best trading conditions. Additionally, they allow US clients to have the US Dollar as the base currency for their accounts. Finally, they have various resources for traders to learn new trading strategies in their education sections.

Still, we always insist that every trader should do their own research to ensure they pick a forex broker that best suits their needs.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.