Best US30 Brokers

When trading financial markets, traders are always looking for opportunities to diversify their portfolios with assets from various markets. Among the plethora of trading options, the US30 index stands out as a key benchmark for the overall health of the U.S. stock market. The index in itself contains a diverse collection of industries and assets making it a top choice for traders to invest in. While it is an attractive asset to invest in, traders should be keen to find the best brokers in the market offering the index.

In this article, we will explore and evaluate some of the best US30 brokers. We will shed light on their features, regulations, and overall suitability for traders seeking to capitalise on the Dow's movements. But before that, let’s have a little more understanding of what the US30 index is.

Understanding the US30

Before we look at the individual brokers, it's crucial to understand what the US30 represents and why it is a popular choice among traders. The US30 is a stock market index that tracks the performance of 30 of the largest and most significant companies listed on the New York Stock Exchange (NYSE) and the NASDAQ. It is usually known as the Dow Jones Industrial Average (DJIA) and hosts companies that span various sectors. These include technology, finance, healthcare, and consumer goods. This variety of top industries makes the US30 a comprehensive indicator of the U.S. economy's health.

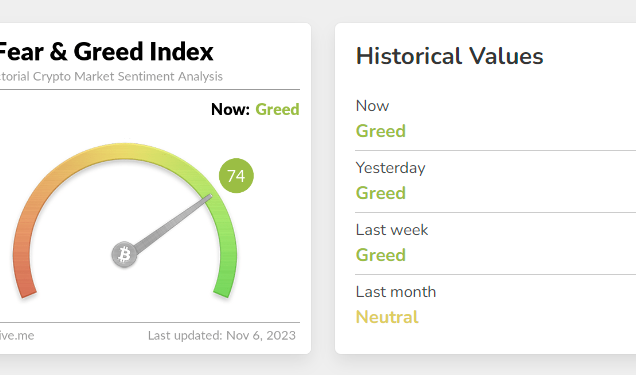

The Dow Jones Industrial Average is often considered a barometer of the broader market sentiment. Traders and investors closely monitor its movements for insights into economic trends and potential investment opportunities. As such, finding a reliable and efficient broker is paramount for those looking to capitalize on the US30's fluctuations. Below are our criteria for selecting some of the best US30 brokers in the market.

Our Criteria for Selecting The Best US30 Brokers

Choosing the right broker is a crucial decision for any trader. Several factors must be considered to ensure that the selected broker aligns with individual trading preferences and goals. Here are some key criteria we used to evaluate US30 brokers:

- Regulation - Regulatory compliance is a non-negotiable factor. The brokers listed here are licensed and regulated by reputable financial authorities.

- Trading platform - The trading platform is the interface through which traders execute their orders and conduct market analysis. A user-friendly and feature-rich platform is essential for effective trading of US30.

- Trading Instruments - A diverse range of trading instruments allows traders to explore different opportunities. In addition to the US30, brokers should offer access to a variety of assets.

- Competitive spreads - The spreads that brokers offer directly impact trading costs. Lower spreads contribute to more favourable trading conditions.

Now with that, let’s take a look at our picks for some of the best US30 brokers.

Pepperstone

Pepperstone is a well-established CFDs broker that offers traders access to the US30 index with relatively low spreads. On this broker site, the US30 index is available to trade 24 hours a day, Monday through Friday. The broker has competitive fixed spreads on this index from as low as 2.4 points. The trading platforms available to use include MetaTrader 4, MetaTrader 5, TradingView, and cTrader. These trading platforms give traders some of the fastest order execution times in the market. The order execution time is between 30 milliseconds and 60 milliseconds depending on a trader’s location.

Further, the US30 index is not the only available asset for traders to invest in. In total, Pepperstone offers traders over 1,200 different market instruments to invest in. These include CFDs on forex, other indices, shares, cryptocurrencies, currency indices, ETFs, and commodities. As such, traders can invest in more than just the US30 index on one account.

As the regulation of a broker is very crucial to consider, let’s see how Pepperstone is regulated. Well, this broker holds regulatory licenses from the FCA in the UK, the ASIC in Australia, the CySEC in Cyprus, the BaFin in Germany, and the CMA in Kenya, among others. Regulations alone are never enough. But this broker holds licenses from some of the most recognized financial watchdogs which is a good sign.

75.5% of retail CFD accounts lose money

Exness

Exness is yet another global CFDs broker that offers traders access to the US30 index. This index is available to trade between Sunday 23:05:00 to Friday 20:59:00 with spreads that depend on the account a trader has. There are four different accounts on which traders can trade this index. The standard account avails this index with spreads from as low as 7.5 pips. In comparison, on the raw spread account the spreads are as low as 2.5 pips plus a commission of $1 per side per lot. Further, on the zero account, the spread is as low as 0.5 pips with a commission of $2 per side per lot. Finally, the pro account has a spread as low as 4.7 with no commission required.

Positively, Exness offers traders access to more than just the Dow Jones Industrial Average Index. With this broker, traders can invest in CFDs on forex, indices, stocks, commodities, and cryptocurrencies. The trading platforms available to use include MetaTrader 4, MetaTrader 5, Exness Terminal, and Exness Trade App. Further, Exness also features ultra-fast order execution times that average a mere 25 milliseconds per order.

On regulations, this broker has good standing. Its activities are subject to supervision and examination by the FCA in the UK, the CySEC in Cyprus, the FSCA in South Africa, and the CMA in Kenya, among others.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

FP Markets

Next up we have FP Markets, another tier-one CFDs broker that allows its traders to invest in the US30 index. This index is available to trade on FP Markets between 01:00 - 24:00 from Monday to Friday. The average spread on this index is a low 1.32 pips which is competitively low. On another positive note, FP Markets provides traders with more than 10,000 different trading instruments for traders to invest in. This means that US30 traders do not need to leave the platform to invest in other market products.

Specifically, FP Markets allows its traders to invest in forex currency pairs alongside CFDs on ETFs, shares, metals, indices, commodities, cryptocurrencies, and bonds. The trading platforms available to use include MetaTrader 4, MetaTrader 5, cTrader, and Iress. Notably, traders can allocate their investment to an account manager through FP Markets’ PAMM accounts.

Positively, FP Markets has regulations from various organizations. These include the ASIC in Australia and the CySEC in Cyprus, two of the best financial watchdogs in the market. Additionally, it also has regulations from the FSCA in South Africa and the FSA in St. Vincent and the Grenadines.

71.23% of retail CFD accounts lose money

XM

XM offers the Dow Jones Industrial Average index as a cash CFD and as a future CFD. The cash CFD is available under the ticker US30 CASH and has spreads from as low as 2.75 pips in the quote currency. On the other hand, the future CFD is available under the symbol US30 with spreads that start from as low as 6.0 pips in the quote currency. Further, they are available to trade between 01:05 - 23:55 (GMT +2) five days a week.

Other than the US30 index, traders have access to a plethora of other assets on XM. These include CFDs on forex, stocks, other indices, energies, and commodities. This opens up the opportunity for traders to diversify their portfolios. The trading platforms available to invest in the various markets include MetaTrader 4, MetaTrader 5, and WebTrader.

Finally, XM is regulated by the FAC in the UK, the CySEC in Cyprus, and the ASIC in Australia. These are three of the best regulators in the market which helps in the broker’s reputation.

72.82% of retail investor accounts lose money when trading CFDs with this provider.

XTB

XTB is one of the top CFDs brokers that provides traders with access to the US30 index along with a variety of other trading instruments. The US30 index can be traded on XTB with competitive spreads that start from as low as 1.0 pips. The trading hours for the US30 index on XTB are typically from 00:05 to 23:15 (GMT) on weekdays.

XTB offers a diverse range of trading instruments, allowing traders to explore different markets. In addition to the US30 index, traders can invest in CFDs on forex, indices, stocks, commodities, ETFs, and cryptocurrencies. The availability of multiple asset classes enables traders to diversify their portfolios conveniently.

The trading platform offered by XTB is their proprietary platform xStation 5. This platform is known for its user-friendly interface and advanced charting tools, providing traders with efficient tools for market analysis and order execution.

Regulatory compliance is a top priority for XTB, and the broker holds licenses from reputable financial authorities. XTB is regulated by the FCA in the UK, the CySEC in Cyprus, and the KNF in Poland. Regulations by the FCA and the CySEC are noteworthy as they have very strict rules that brokers must follow.

78% of retail investor accounts lose money when trading CFDs with this provider.

IQ Option

IQ Option is one of the most popular brokers in the market that offers the US30 index to its traders. Traders can engage in US30 index CFD trading on IQ Option with competitive spreads and flexible trading hours. The spread available when trading this index is as low as 0.018% depending on the market conditions. The trading hours are from 02:00 - 01:00 every weekday except Friday when trading closes at 00:45.

The available trading platform to place orders on this index is the in-house-built IQ Option platform. It provides a user-friendly and intuitive trading platform that is accessible through both web and mobile applications. In addition to the US30 index, IQ Option offers a diverse range of trading instruments. Traders can explore opportunities in CFDs on forex, indices, stocks, commodities, cryptocurrencies, and ETFs.

Finally, IQ Option has regulations by the CySEC in Cyprus, a premier regulatory organization. This regulatory body ensures that IQ Option adheres to stringent financial standards and client protection measures.

Admiral Markets

Admiral Markets allows its traders to capitalize on movements in the Dow Jones Industrial Average. The index is available under the ticker DJI30 as a CFD instrument with competitive spreads and flexible trading hours. The trading hours typically run from 01:00 to 23:59 (GMT) on weekdays with a pre-close margining from 22:00 on Fridays. Competitive spreads are a key aspect of Admiral Markets that contribute to favourable trading conditions. Traders can benefit from low spreads on the DJI30 index that start from 2.2 pips.

One of the notable features of Admiral Markets is its commitment to regulatory compliance. The broker is regulated by top-tier financial authorities, including the FCA, the CySEC, the ASIC, the FSCA, and the JSC in Jordan. This regulatory oversight ensures a high level of transparency and security for traders.

In addition to the DJI30 index, Admiral Markets offers a diverse range of trading instruments. Traders can explore CFDs on forex, indices, stocks, commodities, bonds, and ETFs. This allows for a well-rounded and diversified investment portfolio. Admiral Markets provides traders with access to advanced trading platforms, including MetaTrader 4, MetaTrader 5, and StereoTrader.

Closing Remarks

Choosing the right broker is a pivotal step for traders aiming to capitalize on the movements of the Dow Jones Industrial Average index. The brokers discussed in this article represent some of the best options available. Of course, each has its unique strengths and features. Nonetheless, we only ensured to feature regulated brokers with competitive spreads, advanced trading platforms, and a deep collection of market instruments. Before making a decision, traders should carefully consider their individual preferences. These include both the trading style and risk tolerance. Conducting thorough research will help traders make an informed decision on this matter. Ultimately, the best US30 broker is one that aligns with a trader's goals.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.