Best Swiss Forex Brokers

Forex trading comes with a lot of risks and a large percentage of traders lose money. Trading with a top-notch broker could be the difference between earning profits or taking losses. The best brokers always put their clients in a position to succeed in trading. They do this by providing a fair trading environment with fairly low fees and ultra-fast execution.

Today, we are going to look at some of the best Swiss forex brokers. But before that, we would like to cover our bases on two important things.

Is It Legal To Trade Forex in Switzerland?

Yes, forex trading is completely legal in Switzerland and is regulated by a reputable body, FINMA. The FINMA is in charge of maintaining a fair operating environment for brokers and traders alike. FINMA is a tough regulator with some strict rules for forex brokers to follow. For example, forex brokers have to register under banks and the section Supervised Banks and Securities firms. This means that they need to have very high operational capital which protects clients in case the company goes bankrupt.

Additionally, FINMA-regulated brokers must protect their clients with a compensation scheme of up to 100,000 CHF in case of the company’s insolvency. Fortunately, you can check which brokers are licensed by the Swiss Financial Market Supervisory Authority (FINMA) via FINMA’s online register. Additionally, FINMA maintains and publishes a list of companies that may be operating without their authorization on its Waning List page.

Our Criteria For Selecting The Best Swiss Forex Brokers

There are 4 key features when trying to identify the best forex trader:

- Regulations and licenses - We will only review brokers that are regulated by a reputable organization.

- Trading platform - Brokers that provide world-class trading platforms always have some of the best order execution times.

- Spreads and other fees - When the charges are minimal, the broker is ranked higher considering no trader wants to pay large sums of money when trading.

- Variety and availability of assets - Brokers that offer a variety of trading instruments allow traders to diversify their investments and hence they are ranked higher.

And now with that out of the way, let’s see some of the best Swiss Forex Brokers.

Swissquote

Swissquote is widely considered one of the best trading platforms in Switzerland. This broker site is regulated by FINMA and is a member of the Swiss Bankers Association. Additionally, the company is regulated by the FCA in the UK, the CySEC in Cyprus, and the DFSA in Dubai, among others.

In terms of trading instruments, clients of Swissquote are spoiled for choice. They can speculate on a variety of global market instruments including forex, stocks, cryptocurrencies, bonds, indices, ETFs, commodities, and more. In total, the company claims to provide access to 3 million products. Evidently, this is a great place for Swiss traders to diversify their investments.

For a trading platform, Swissquote provides its in-house-built eTrading software. The company promises that this platform is designed to help clients invest in the simplest and the most intuitive manner. As such, the platform is suitable for both beginner and experienced traders.

Finally, Swissquotes features some fairly competitive spreads starting from as low as 1.7 pips for major currency pairs on the standard account. For lower spreads, clients need to be on other accounts that require larger minimum deposits. They can also trade on custom spreads on the professional account that is volume based.

Saxo Bank

Saxo Bank is one of the oldest trading platforms connecting investors and traders to the global market. Saxo Bank clients have access to more than 72,000 financial instruments that include forex, stocks, EFTs, bonds, crypto, and mutual funds among others. With this, it's no surprise as to why Saxo is highly rated as one of the best Swiss brokers.

Moreover, it has regulations from some well-respected organizations including the FINMA in Switzerland. It also has regulations from the FCA in the UK, and the ASIC in Australia. Strong regulators help to win the trust of clients and investors.

The prices for trading on this broker site are low, with spreads on major currency pairs starting from as low as 0.6 pips. Saxo has its own in-house platforms, SaxoTraderGO and SaxoTraderPRO, which are fully customisable, professional-grade platforms that are easy to use.

IG

IG is yet another quality broker that has regulations in Switzerland. This broker is regulated by FINMA alongside other organizations including the FCA, the ASIC, and the FSCA. Such regulations elevate IG to one of the best forex brokers in Switzerland.

Besides, IG offers one of the deepest collections of market instruments. There are over 18,000 market instruments that include CFDs on forex, indices, commodities, shares, cryptocurrencies, and more. The possibility to invest in multiple markets is always an attractive feature for brokers of all kinds. These instruments are available to trade on industry-standard platforms including MetaTrader 4, ProRealTime, L2 Dealer, and the ProgressiveWebApp.

Finally, the spreads in IG are manageable and most Swiss traders would be able to afford to trade with this broker. The average spreads on IG can fall as low as 0.6 pips for some major currency pairs.

Other Brokers That Accept Swiss Clients

The brokers below do not have regulations from FINMA. However, they are some of the most reputable brokers in the world and have regulations from tier-one regulators from other jurisdictions. Better yet, they accept clients from Switzerland. Let’s look at their offerings.

XTB

XTB was founded in 2002 and now enjoys over 20 years of experience in forex trading. Its longevity in the market and regulations from well-known organizations make XTB one of the best Swiss brokers in the market. With regulations from well-known organizations that include CySEC in Cyprus, the FCA in the UK, KNF in Poland and IFSC in Belize, XTB activities are well supervised.

XTB offers its own trading platform(xStation 5) which is suitable for both beginner and experienced traders. This platform has quick execution and is customizable to the needs of every client. Moreover, it gives clients access to over 2,200 market instruments and helps manage investments quickly and easily.

XTB traders can trade CFDs on Forex, Cryptocurrencies, Indices, Commodities and ETFs. XTB offers no commissions and no hidden fees. Finally, XTB offers some of the tightest spreads in the market that go as low as 0.5 pips. These are some of the lowest spreads you will find in the market.

77% of retail investor accounts lose money when trading CFDs with this provider.

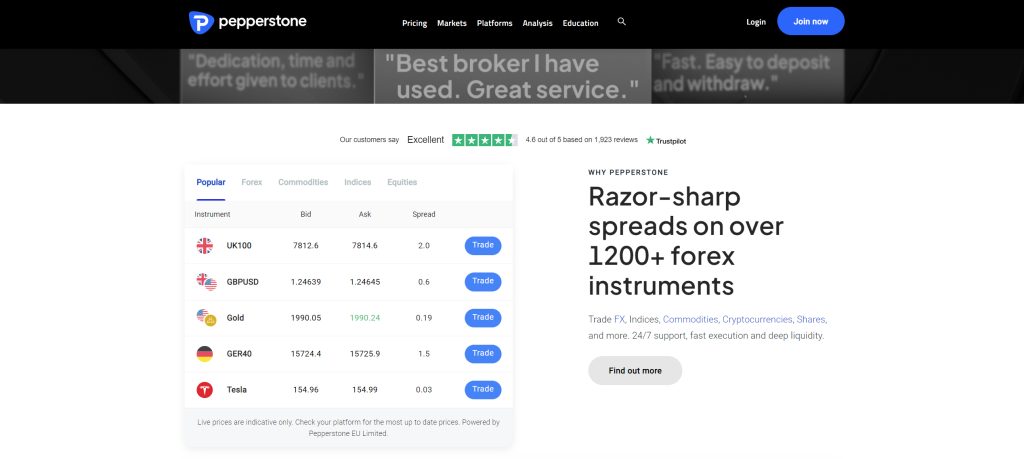

Pepperstone

Pepperstone is regulated by several reputable organizations in multiple jurisdictions. These include the CySEC in Cyprus, the FCA in the UK, the BaFin in Germany, the ASIC in Australia, and the CMA in Kenya. While not regulated by FINMA, this company still has to follow very strict regulatory laws.

Notably, clients can invest in over 1200 CFDs on forex, indices, EFTs, commodities and shares. These are available to trade on a variety of trading platforms. These include the MT4, MT5, TradingView, and cTrader which give traders fast execution time and flexibility to better suit your strategy. Most orders are executed in less than 30 milliseconds (Pepperstone Group Limited) and 60 milliseconds (Pepperstone Limited).

Lastly, Pepperstone has two accounts to choose from, the standard and the razor accounts. The spreads that Pepperstone offers depend on the account a client uses. The Standard account features spreads as low as 1.0 pips on major currencies with no commission paid. In comparison, the Razor account has spreads starting from 0.0 pips and a $3.50 per side per lot commission is charged.

75.5% of retail CFD accounts lose money

eToro

eToro has over 30 million registered users and has regulations from the best watchdogs in the industry. These regulators include the CySEC in Cyprus, the FCA in the UK, the ASIC in Australia and many others. This is one of the most heavily regulated brokers in the market today.

eToro has no hidden fees and no commissions. The company reveals all charges that apply when trading on its website under fees. In terms of spreads, the company offers fair pricing starting from as low as 1.0 pips for major currency pairs.

eToro has its own in-house trading platform that comes with a plethora of trading tools. The eToro platform is easy to use for both beginner and advanced traders. It also comes with the CopyTrader technology that allows users to copy the moves of expert traders on the platform.

Further, there are a variety of trading instruments on eToro. The broker provides the kind of instrument collection that traders crave. They can easily spread their investment across the various markets and reduce their risk. The variety of trading instruments on eToro includes CFDs on stocks, commodities, EFTs, forex, crypto, and indices. The broker also allows clients to trade real stocks and cryptocurrencies.

51% of retail investor accounts lose money when trading CFDs with this provider.

AvaTrade

AvaTrade is yet another great broker that accepts clients from Switzerland and has ample regulations. AvaTrade is regulated by well-known organizations that include the CySEC in Cyprus, the ASIC in Australia and the Central Bank of Ireland, among others. These regulators have strict rules to follow, which ensure brokers maintain fair trading environments.

On the availability of instruments, clients can trade CFDs on forex, cryptocurrency, stocks, commodities, indices, bonds and others. The variety of instruments on this broker site helps traders spread the risk of their investment and enjoy a great trading experience.

Moreover, AvaTrade offers market-standard trading platforms that include the MetaTrader 4 and MetaTrader 5 in addition to its own trading platform AvaTradeGO. Clients are able to get the best platforms in the market and choose the one that suits them. Also, AvaTrade offers some of the tightest spreads in the market that go as low as 0.9 pips for major currency pairs.

76% of retail CFD accounts lose money

AXI

Since AXI was founded in 2007 it has grown into a global business with over 60,000+ customers. AXI is popular in the Swiss market and traders seem to enjoy the trading conditions offered by the platform. While not regulated by FINMA, it still has world-class regulations by the ASIC in Australia and the FCA in the UK.

With this broker, traders trade using a top-tier Axi platform that is industry standard and simple enough for both beginner and advanced traders. MT4, offered by Axi, is one of the most popular trading platforms in the world right now. With this platform, traders receive 4 different trading systems, several analytical functions, trading signals, and copy trading capabilities. The platform gives clients access to CFDs on forex, gold and silver, oil, commodities, indices, and cryptocurrencies.

On top of a huge collection of instruments, AXI offers low spreads. There are three accounts that come with different spreads. The first is the standard account that has a spread as low as 0.4 pips the other is the pro account with spreads from 0.0 and lastly is the elite account with spreads from 0.0 pips.

Finally, let’s look at the fees charged by this broker. Axi offers low spreads in the market that start from 0.4 pips, 0.0 pips and 0.0 pips for the standard, pro, and elite accounts respectively. There is no commission on the standard account. However, the Pro account charges a commission of $7 per round trip and the Elite account charges a $3.50 commission per round trip.

IC Markets

IC Markets has over 500,000 trades per day and with over two-thirds of all trades coming from automated trading systems. It is easy to see why IC Market is regarded as one of the best forex brokers in Switzerland.

In terms of regulations, IC Markets does not disappoint. This broker site is regulated by two of the best regulators in the market including the CySEC in Cyprus and ASIC in Australia. Note that regulation from a reputable organization is a major factor when choosing a broker.

Further, IC Market offers spreads as low as 0.6 pips on the standard account with no commissions. Clients can also trade on 0.0 pip spreads on the raw accounts. The raw account requires a commission of $3.0 per 100k traded for cTrader clients and $3.5 for MetaTrader clients. These low spreads and general pricing is characteristic of some of the best ECN brokers in the world.

Regarding trading instruments, IC Market has over 2,200 instruments for traders to choose from. These instruments are from various global markets including forex, commodities, indices, futures, stocks and metal. These are tradeable on MT4, MT5 or cTrader.

Final Thoughts on The Best Swiss Forex Brokers

In the review, we have listed some of the best Swiss forex brokers. We looked at four key features which we believe are crucial for any reputable broker. We considered the company’s regulations, fees, trading platform, and availability of trading instruments. While not all brokers are regulated by FINMA on this list, they are all reputable brokers with regulations from top-notch organizations from around the world.

While we believe that these are some of the best choices for Swiss traders, we still call upon everyone to do their own research. This way, they can pick and choose the broker that best suits their needs.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.