Best Forex Brokers in Dubai & UAE

The United Arab Emirates, and particularly Dubai, have emerged as prominent players in the forex space. In fact, people even move from other places around the world to base their operations in Dubai. This has led to Dubai and the UAE in general becoming a hub for forex trading. These traders in Dubai and the UAE are eager to capitalise on the opportunities presented by the forex market. They often seek reliable brokers that align with their financial goals and preferences.

In this article, we will look at some of the best forex brokers in Dubai and the UAE. We will shed some light on their regulatory status, the trading instruments available, the trading platforms offered, and the fees involved. We will also look at some other special features the brokers have to offer. But before we do that, let’s cover our bases on a few important topics.

Regulatory Landscape in Dubai and the UAE

Understanding the regulatory environment is paramount when choosing a forex broker. In the UAE, several regulatory bodies oversee financial activities, each with its specific jurisdiction. The primary regulators relevant to forex trading are the Securities and Commodities Authority (SCA), Dubai Financial Services Authority (DFSA), Abu Dhabi Global Markets (ADGM), and the Central Bank of the UAE (CBUAE). Let’s briefly look at each of these regulators and their mandates.

Securities and Commodities Authority (SCA)

The SCA is the federal regulatory authority overseeing securities and commodities markets in the UAE. It plays a crucial role in ensuring the integrity and transparency of financial markets. Forex brokers operating in the UAE must comply with SCA regulations to provide a secure trading environment for investors. In essence, the SCA operates in the whole UAE.

Dubai Financial Services Authority (DFSA)

The DFSA is an independent regulator that oversees financial services in the Dubai International Financial Centre (DIFC). Forex brokers operating within the DIFC jurisdiction must obtain a license from the DFSA. The regulator assures traders within the jurisdiction of a high level of regulatory scrutiny and compliance.

Financial Services Regulatory Authority (FSRA)

ADGM is a financial-free zone in Al Maryah Island, Abu Dhabi. Its regulatory authority oversees financial services within the free zone. Forex brokers operating within the ADGM jurisdiction must adhere to the regulatory framework set by the Financial Services Regulatory Authority (FSRA).

Central Bank of the UAE (CBUAE)

The CBUAE oversees monetary and financial stability in the UAE. It regulates and supervises financial service companies operating in the UAE. The Central Bank of the UAE also provides exchange rates for more than 70 global currencies, which are updated daily. It plays a crucial role in determining how the market operates in the UAE.

Evidently, there is not a lack of regulations in the UAE for forex trading. There are several organizations all working within their jurisdictions and in tandem when necessary.

Halal/Haram - Islamic Accounts

For many traders in Dubai and the UAE, adhering to Islamic principles is a significant consideration when engaging in financial activities. Islamic finance principles prohibit earning or paying interest (Riba) and engaging in uncertainty (Gharar). Forex brokers have responded to this demand by offering Islamic or swap-free accounts that comply with Islamic finance principles. Traders adhering to Islamic finance principles can engage in Forex trading without compromising their religious beliefs.

Note that Islamic accounts may have a fixed administrative fee or a wider spread in the place of interest. Some Forex brokers go the extra mile by obtaining halal certification for their Islamic accounts. This certification provides additional assurance to traders that the broker's Islamic accounts comply with Islamic finance principles. This is because not all accounts labelled Islamic actually adhere to Islamic finance laws.

Now with all that said, it is time to look at some of the best forex brokers in Dubai and the UAE.

Pepperstone

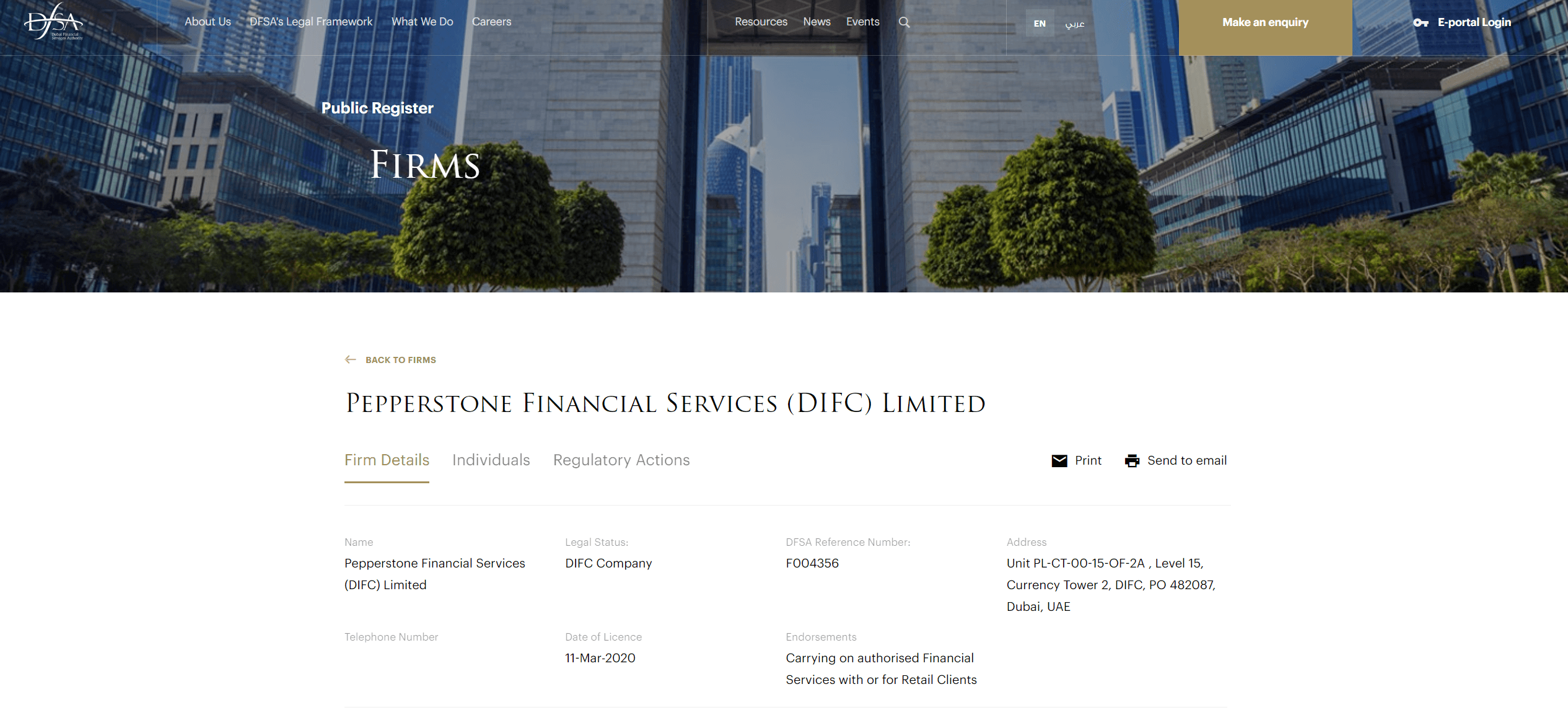

Pepperstone is a well-known forex and CFDs broker that offers over 1,200 different market instruments. Notably, this broker has a presence in various jurisdictions around the world, including in Dubai, UAE. The company has an office at Al Fattan Currency House, Tower 2, Level 15 - Office 1502A, DIFC Dubai, United Arab Emirates. Additionally, it holds a regulatory license from the DFSA in the DIFC with license number F004356. On top of that, this broker has regulations from other organisations including the FCA in the UK, the CySEC in Cyprus, and the ASIC in Australia, among others.

The global markets available to traders on this broker site include forex, cryptocurrencies, shares, commodities, indices, and ETFs. Having access to a plethora of markets on a single trading site is always an advantage to traders. Further, this broker offers its traders a lineup of four world-class trading platforms. These include MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

Now let’s look at the spreads offered by the broker. The standard account of the broker has spreads from as low as 1.0 pips with no commission paid. The razor account, on the other hand, has spreads from 0.0 pips plus a commission depending on the platform used. The commission is at $3.5 per side per lot for MetaTrader and TradingView users. In comparison, it is at $3 per side per lot for cTrader users.

On a positive note, traders can access the Pepperstone in Arabic alongside English and other languages. This makes it easier for traders in Arabic countries who only speak Arabic.

75.5% of retail CFD accounts lose money

XM

XM is licensed by the DFSA under the name Trading Point MENA Limited with license number F003484. This broker gives traders in Dubai and the UAE a lot of market instruments to invest in. Traders have access to over 1,000 different instruments that range from CFDs on forex, precious metals, cryptocurrencies, shares, indices, and energies.

Just like Pepperstone, XM’s website is available in a variety of languages including Arabic and English. Customer support is also available in Arabic and English, among other languages. This makes it easier for traders in such jurisdictions to make their trades. Further, this broker offers its Muslim traders Islamic accounts to ensure they trade without any worries. This account has no interest on overnight positions, no spread widening, and positions can be held with no time limit.

The spreads that traders have access to on this account start from as low as 1.6 pips for major currency pairs with no commission. In comparison, the normal standard account has spreads from as low as 1.0 pips for major currencies. The XM ultra-low account has even lower spreads that start from 0.6 pips for major currencies.

The trading platforms available to use include MetaTrader 4 and MetaTrader 5, two of the best trading platforms in the world. Further, this broker also holds licenses from several other institutions in the world. These include the ASIC in Australia, the CySEC in Cyprus, and the FSC in Belize.

72.82% of retail investor accounts lose money when trading CFDs with this provider.

HFM

HFM is another popular forex trading platform that is regulated by the DFSA under the license number F004885. Additionally, this broker is under the regulation of the CySEC in Cyprus, the FCA in the UK, the FSCA in South Africa, and the CMA in Kenya. This regulatory status, particularly the license from the DFSA, makes HFM one of the best forex brokers in Dubai and the UAE.

Moreover, this broker supplies its traders with a plethora of market instruments for them to invest in. These market instruments include CFDs on forex, ETFs, metals, stocks, commodities, indices, energies, and bonds. Positively, these market products are available to trade on a great lineup of trading platforms including MetaTrader 4, MetaTrader 5, and the HFM Platform.

There are four different accounts to choose from on HFM. These include the cent, zero, pro, and premium accounts. The cent and the premium account both have spreads from as low as 1.2 pips for major currencies with no commission required. The pro account features spreads from 0.5 pips for major currencies with no commission. Finally, the zero account has spreads as low as 0.0 pips plus a commission from $3 per 100,000 lot traded upwards.

Notably, HFM offers its Muslim traders swap-free trading, allowing them to invest without breaking religious laws. The swap-free option comes with no extra charges or additional charges. Additionally, the broker offers customer support in Arabic plus a specific email for traders in Arabic-speaking regions. The website is also available to view in full Arabic, English, and Spanish, among many other languages.

ADSS

ADSS is authorised and regulated by the Securities and Commodities Authority (SCA) in the United Arab Emirates. This broker operates out of the 8th floor, CI Tower, Corniche Road, PO Box 93894, Abu Dhabi, United Arab Emirates. Basing its operations at the heart of the UAE helps the reputation of this broker in the UAE. Moreover, it also has regulations from the CBUAE in the UAE and the FCA in the UK, which also helps.

In terms of market products, this broker offers traders in the UAE the opportunity to invest in multiple markets at the same time. In particular, people have access to spot forex currency pairs plus CFDs on indices, equities, cryptocurrencies, and commodities. The platforms available to invest in these various markets include MetaTrader 4 and the in-house built ADSS platform.

Further, there are three main trading accounts available to traders. These include the classic, the elite, and the pro accounts. Traders on the classic account trade with spreads passed straight from the underlying market with no markups. However, the elite account gives traders a 25% discount on spreads. Further, the pro account allows traders to trade with spreads starting from as low as 0.0 pips plus low commissions. There are both convention and swap-free versions for these accounts.

Like the other brokers on this list, ADSS also allows traders to access its website in full Arabic and English. Additionally, customer support is also available in Arabic and English.

Amana App

Amana App is another forex broker that deserves to be on the list of the best forex brokers in Dubai and the UAE. This broker is duly regulated by the DFSA in the DIFC with the license number F000048. The broker also has regulations from the CySEC in Cyprus, the FCA in the UK, and the CMA in Kenya. This shows that this broker is keen on following the financial laws of the jurisdictions in which they operate.

Amana App allows its traders to access a variety of market instruments including CFDs on forex, cryptocurrencies, oil, and gold alongside ETFs and stocks. Such a variety of trading instruments is a welcomed feature that traders crave. However, there is only one trading platform available to use, the in-house-built Amana App.

Unfortunately, this broker does not state the spreads that traders can expect on the website which shows a lack of transparency. As such, we cannot compare the spreads they offer to the competition. On a positive note though, the Amana App website is available in full Arabic and English. Customer support is also available in Arabic and English with a phone number specifically dedicated to clients in the UAE. Finally, Amana App offers traders swap-free accounts only upon request.

IG

Finally, let’s look at IG. IG is one of the most recognisable forex brokerage firms in the world with regulations in various jurisdictions. In the UAE, this broker has a license from Dubai’s DFSA with license number F001780. In other jurisdictions, the broker has regulations from the FCA in the UK, the ASIC in Australia, and the FSCA in South Africa, among others.

Regulations are not the only thing that traders look at when choosing a broker to invest with. A deep collection of market instruments is also a coveted feature. Luckily, IG provides its traders with more than 17,000 different trading instruments. These include CFDs on forex, shares, commodities, and ETFs, among others. The trading platforms available to use include MetaTrader 4, ProRealTime, and L2 Dealer which is one of the best depth-of-market trading platforms.

In terms of spreads, IG maintains a transparent fee structure with competitive spreads. The spreads start from as low as 0.6 pips with no commission required. Overnight fees are charged for any positions held overnight on this broker site. Luckily, traders have access to a swap-free account upon request. This makes it possible for Muslim traders to trade the markets without breaking religious laws. The site and customer support are both fully accessible in Arabic, English, and Espanyol, among other languages.

Why You Should Only Trade With Regulated Brokers

Investor Protection - Regulated brokers are required to adhere to strict financial and ethical standards set by regulatory authorities. This helps protect traders from fraud, malpractices, and financial misconduct.

Segregated Client Funds - Regulated brokers are often obligated to keep client funds in separate accounts from their operational funds. This segregation of funds helps protect traders' capital in the event of a broker's insolvency or financial difficulties.

Fair and Transparent Practices - Regulated brokers are bound by rules and regulations that promote fair and transparent trading practices. This includes providing accurate and timely information, fair pricing, and ensuring that clients have access to relevant market data.

Dispute Resolution - Regulatory organizations usually have in place mechanisms for resolving disputes between traders and brokers. This provides traders with a formal channel to address grievances and seek resolution in case of any issues.

Regulatory Oversight and Audits: Regulators conduct regular audits and oversight of regulated brokers to ensure compliance with industry standards. This oversight contributes to the overall integrity of the financial markets.

Market Integrity - Trading with a regulated broker contributes to overall market integrity. Regulatory authorities work to maintain a level playing field and ensure that players stick to a set of rules and standards.

Final Verdict

Evidently, the UAE has a well-established regulatory framework with different organizations in charge of different jurisdictions. Nonetheless, most any broker that has a license from any of the organisations within this jurisdiction shows a willingness to follow the region's financial laws. In this review, we looked at some of the best forex brokers in Dubai and the UAE. We mentioned their regulations, spreads, trading platforms, and market products offered. Most of the brokers listed have regulations from the DFSA as Dubai seems to be the most active region for forex trading.

Nonetheless, we understand that every trader has their own needs that require careful consideration. As such, we must insist that everyone do their own research to make sure the broker they choose best suits them. You can always start with the brokers on this list to see how well they might serve you.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.