FP Markets List of Supported & Banned Countries

FP Markets is currently one of the best brokers in the world today. With over 10,000 trading instruments, this broker is very attractive to traders who want to diversify their portfolios. This company currently serves clients from many countries in the world. It is especially popular among European clients. However, there are countries where FP Markets does not accept clients.

Today, we will be looking at FP Markets' list of supported and banned countries. We will also give you some alternatives to FP Markets with reliable trading conditions.

72.5% of retail CFD accounts lose money

What FP Markets Has To Offer

As mentioned, FP Markets offers over 10,000 trading instruments to invest in. On this broker site, clients can trade forex currencies and CFDs in shares, metals, commodities, indices, cryptocurrencies, bonds, and ETFs. There are over 60 different currency pairs, 5 different cryptocurrencies, and well over 10,000 international shares for clients to speculate on. These trading instruments are available for trading on a variety of trading instruments provided by FP Markets. These include MetaTrader 4, MetaTrader 5, Iress Trader, FP Markets mobile app, and cTrader. These platforms are available on a variety of devices and all kinds of traders are catered for. Whether you are a mobile user, PC, Mac, or web, there is a trading platform for you.

Further, FP Markets charges fairly low spreads to clients when trading. The Standard account charges clients a variable spread starting from 1.0 pips for major currency pairs. On the other hand, the spreads on the Raw account start from 0.0 pips while charging a commission of $3 per side per lot. Clients can test out the offering by FP Markets on a demo account that remains active as long as the client uses it. Now let’s look at the regulatory status of FP Markets. Well, this broker is regulated by the CySEC, the FSCA, and the ASIC. The CySEC and the ASIC are two of the best regulators in the market today. Moreover, the regulatory licenses this broker holds allow it to operate freely across Europe, Africa, and Australia. Sadly, the services offered by FP Markets are not available to all people. There are countries from which this broker does not accept clients. Let’s look at them below.

FP Markets Prohibited Countries

Unfortunately, FP Markets does not accept clients from the United States, Japan, New Zealand, Belgium, Iraq, Iran, North Korea, and Syria. These are just a few examples of countries not supported by FP Markets. When opening an account, clients can check whether their country is supported on a drop-down menu found on the registration page.

Some of the countries on this list have some of the most active traders in the world. Luckily, there are great alternatives to FP Markets that accommodate clients from these countries. Let’s look at some of them.

Some Great Alternatives to FP Markets

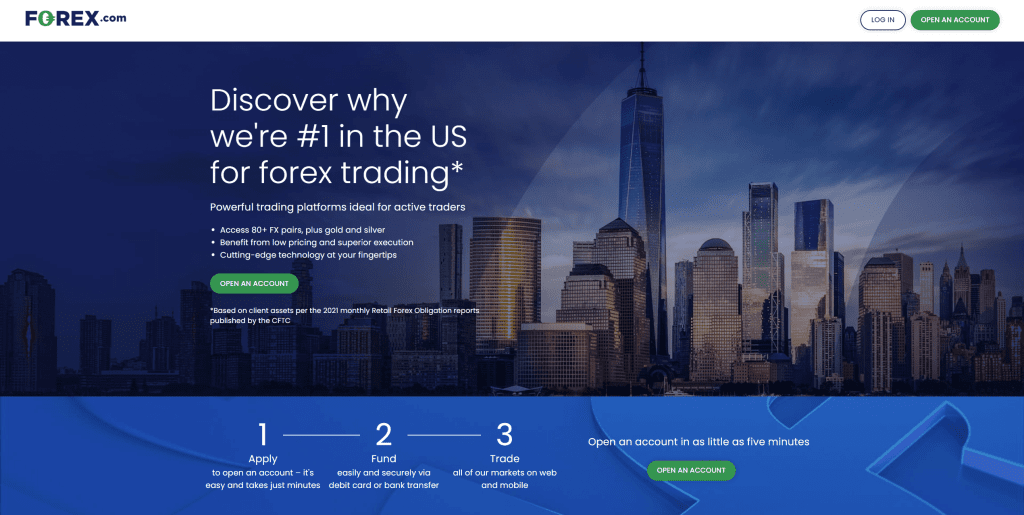

Forex.com (Alternative for US Traders)

This is a great option for investors from the US and Canada. For starters, this broker is regulated in both of these jurisdictions by the IIROC in Canada and the CFTC and NFA in the US. Further, the company is regulated by the FCA in the UK and the CySEC in Cyprus.

There are a lot of currency pairs to trade on this broker site. Some of the best currency pairs for US and Canadian investors to trade include EURUSD, USDJPY, GBPUSD, AUDUSD, AUDCAD and USDCAD, among others. In total, there are over 80 different tradable currency pairs on Forex.com. The spreads on these currency pairs can go as low as 1.0 pips for major currency pairs. Clients can also invest in gold, silver, futures, and futures options alongside forex.

Forex.com avails four main trading platforms for clients to use. These include MetaTrader 4, MetaTrader 5, WebTrader, and Forex.com Trader. Both the MetaTrader platforms and Forex.com Trader are available on PC, Web, and mobile devices. On the other hand, WebTrader does not need installation and runs on any device that supports the web.

Online trading involves significant risk of loss and is not suitable for all investors.

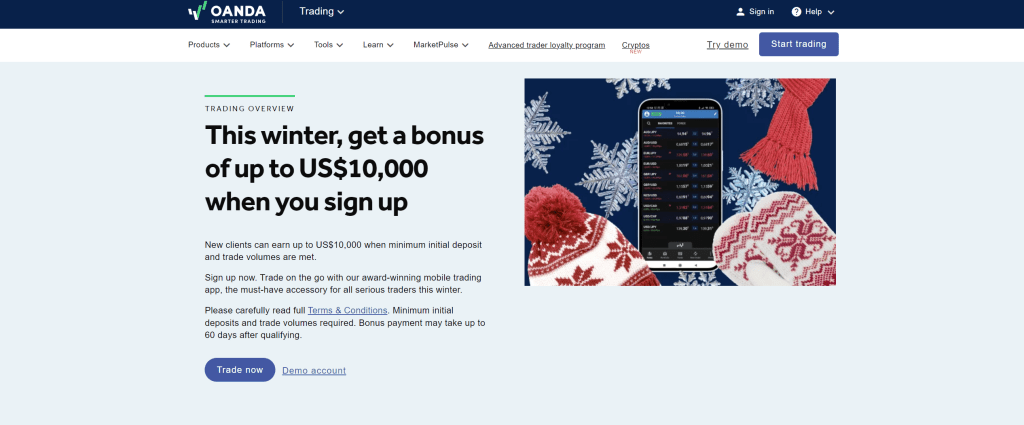

OANDA US (Alternative for US)

OANDA US is another great option for traders situated in the US. For starters, the company is registered by the CFTC and is a member of the NFA. Its activities are governed by the NFA whose job is to safeguard the integrity of the derivatives market, protect the interests of investors, and ensure members follow regulatory laws.

Notably, OANDA US avails a total of 45 different currency pairs to trade on its website. Some of the best currency pairs for US clients to trade include EURUSD, AUDUSD, GBPUSD, NZDUSD and USDCAD. Clients of OANDA US can only trade forex currencies as CFD trading in the US is illegal.

Luckily, this broker site does not charge clients highly for trading forex. Typical spreads on OANDA start from 1.0 pips for major currency pairs. Further, the trading platforms provided by this broker include the fxTrade mobile app and the MetaTrader 4 and MetaTrader 5 platforms. These are customary platforms that meet the demands of the majority of traders. A demo account is available for investors who want to test out OANDA before investing real money.

Online trading involves significant risk of loss and is not suitable for all investors.

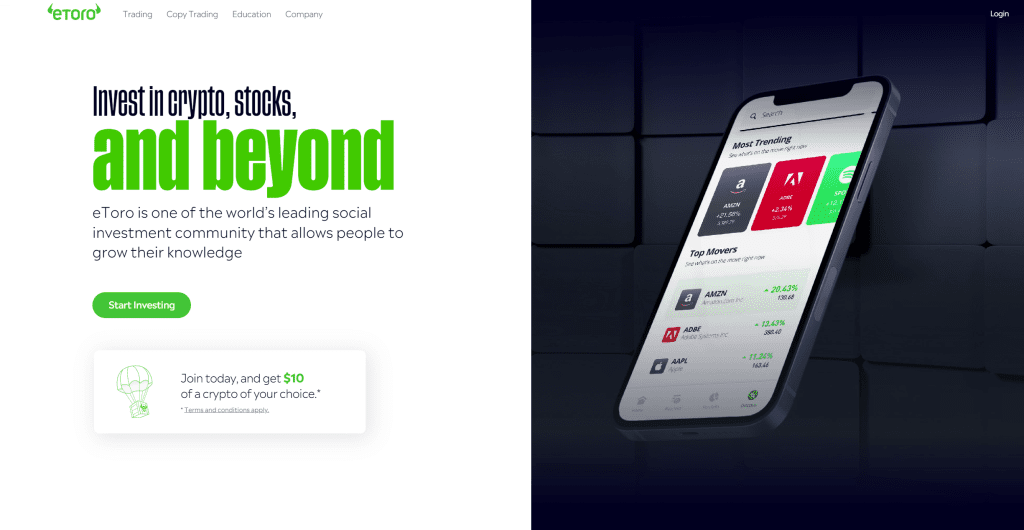

eToro US (Alternative for US)

eToro US is a perfect option for clients who want to diversify their portfolios. While it currently does not offer forex trading in the US they do support investing in other instruments such as stocks and cryptocurrencies. The good thing about eToro is that it is regulated and authorized by FINRA under the firm reference number 298361. On top of that, the company is regulated by the SEC in the US.

Some ways clients can fund their account on eToro include Credit/Debit cards, Wire Transfers, Skrill, Neteller and WebMoney. The minimum first-time deposit is $10 in the US. After that, the minimum deposit is $50. There is a free demo account and an educational section for traders who want to learn and practice new trading strategies.

Some ways clients can fund their account on eToro include Credit/Debit cards, Wire Transfers, Skrill, Neteller and WebMoney. The minimum first-time deposit is $10 in the US. After that, the minimum deposit is $50. There is a free demo account and an educational section for traders who want to learn and practice new trading strategies.The eToro platform is the main trading software offered by the company. This platform has tons of features including the CopyTrader technology that allows investors to copy the moves of more successful traders. Additionally, there are no hidden fees on eToro. eToro is very transparent on the charges that apply when trading. The company features a Market Hours and Fees Page for clients to access this information.

Online trading involves significant risk of loss and is not suitable for all investors.

Our Final Thoughts

While FP Markets is an excellent trading partner for many investors globally, it is not available in all countries across the world. In this review, we mentioned a few countries from which FP Markets does not accept clients. However, we mentioned a few brokers which are great alternatives to FP Markets in these countries. If you cannot access FP Markets from your location, we hope the companies mentioned here meet your trading needs.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.