Exness Mobile Money - Deposits and Withdrawals

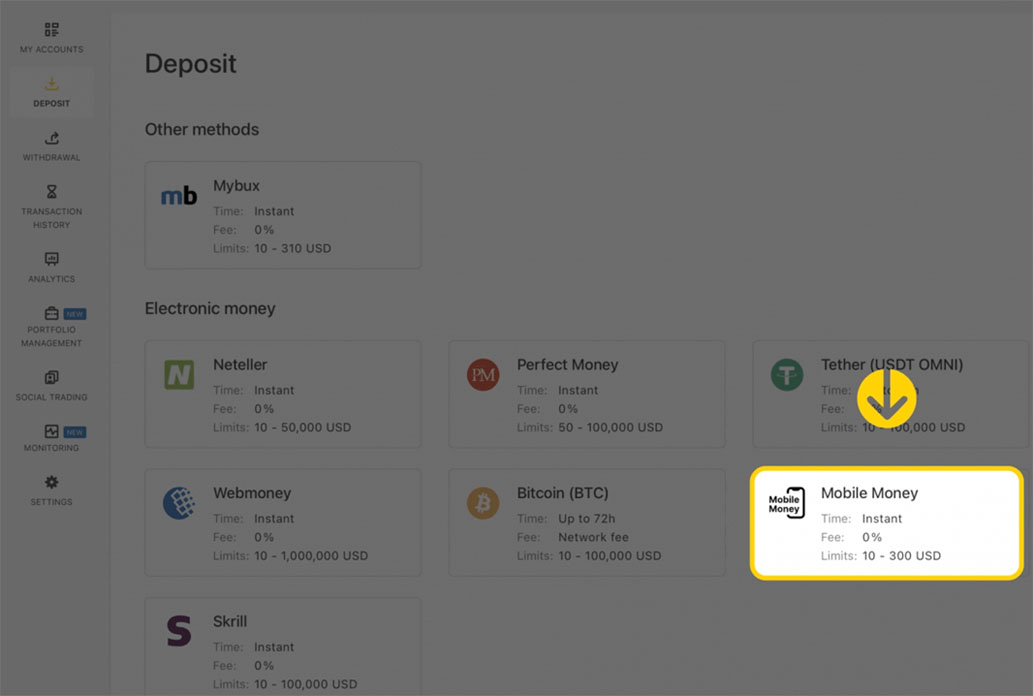

Exness supports a plethora of payment options including Mobile Money in various countries. In the forex trading space, convenience and transaction speed are crucial when traders are funding their accounts. Exness recognises this and supports a variety of Mobile Money payment systems in different countries. Today, we will look at the details of Exness Mobile Money to understand the process of deposits and withdrawals. Since different countries feature different Mobile Money payment systems, we will specify the options available in the different countries.

Exness Mobile Money Conditions

| Kenya | Tanzania | Uganda | Nigeria | Ghana | Zambia | Cameroon | |

| Mobile Money System | M-Pesa & Airtel Money | M-Pesa & Airtel Money | M-Pesa & Airtel Money | Airtel Money & MTN MoMO | Airtel Money & MTN MoMO | Airtel Money & MTN MoMO | Airtel Money & MTN MoMO |

| Minimum Deposit | 10 USD | 10 USD | 10 USD | 10 USD | 10 USD | 10 USD | 10 USD |

| Maximum Deposit | - | - | 1,050 USD | - | 180 USD | - | - |

| Minimum Withdrawal | 10 USD | 10 USD | 10 USD | 10 USD | 10 USD | 10 USD | 10 USD |

| Maximum Withdrawal | - | 1,000 USD | - | - | 160 USD | - | - |

| Deposit and Withdrawal Processing Fees | Free | Free | Free | Free | Free | Free | Free |

| Deposit and Withdrawal Processing Time | Instant | Instant | Instant | Instant | Instant | Instant | Instant |

Note: While Exness offers instant deposits and withdrawals, the processing time can be longer on the payment processor’s side. As such, some payment options can take longer for deposits and withdrawals.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

How to Deposit Money via Mobile Money on Exness

Making a deposit using mobile money on Exness is straightforward. Here are the steps to depositing funds using mobile money on Exness.

- Login to your Exness Personal Area and click on “Deposit” on the left-hand side.

- Select “Mobile Money” from the available payment options.

- Choose your desired trading account from the dropdown menu.

- Enter the amount you wish to deposit noting the maximum and minimum deposit levels and hit “Continue”.

- A page with a summary of the deposit will show for you to confirm the details. If you wish to make any changes to the transaction, you can click on the back arrow, otherwise, press “Continue”.

- Enter the mobile money number associated with your Exness account and click “Continue”.

- The next steps will depend on your mobile money provider. Follow the steps carefully to complete the transaction.

How to Withdraw Money via Mobile Money on Exness

Withdrawing money from Exness is also a straightforward process. Below are the steps to withdrawing money from Exness using Mobile Money.

- Login into your Exness Personal Area and click on “Withdraw” on the left-hand side.

- Select Mobile Money from the available payment options.

- Choose your desired trading account from the dropdown menu.

- Enter the amount you wish to withdraw noting the minimum and maximum amounts allowed and click “Continue”.

- A page will pop up with a summary of the withdrawal. If you wish to make any changes to your transaction you can click on the back arrow. Otherwise, hit “Confirm”.

- A verification code will be sent to your set security type. It will be via email or SMS. Enter the verification code and click “Confirm”.

- Select your mobile money provider from the options and enter your name and name. Make sure your country code is included in your phone number when you enter it. Also, ensure that the number you enter is the same as you used to make deposits using mobile money on Exness.

- A final page will appear to conclude the withdrawal action and your funds will be reflected in your mobile money account soon.

Advantages of Using Mobile Money

- Enhanced Accessibility - Mobile money integration enables traders to easily fund their accounts using just a mobile phone and an active mobile money account. This accessibility eliminates reliance on traditional banking channels. This offers traders greater flexibility in managing their accounts remotely.

- Financial Inclusion - By supporting mobile money transactions, forex brokers extend their services to people who lack access to traditional banking services. This inclusion empowers a broader demographic of traders, contributing positively to financial diversity and equity.

- Expedited Transactions - Mobile money transactions are characterised by their rapid processing times. This facilitates swift deposits and withdrawals. As such, traders can swiftly respond to market fluctuations without delay.

Challenges of Using Mobile Money

- Dependance on Mobile Network Reliability - The reliance on stable mobile network connections presents a notable challenge. In regions with inadequate coverage or during network disruptions, mobile money transactions can be unavailable.

- Complex Verification - The initial verification process to access mobile money services on broker platforms can be intricate. This complexity could deter some traders, posing a barrier to entry.

Trading Instruments on Exness

The payment options supported by a broker are important to consider. However, it is also important to check whether a broker allows you to diversify your portfolio. Luckily, Exness supports a wide range of market products. Here is a review of the trading instruments on Exness.

- Forex - Exness features a wide selection of forex currency pairs that include majors, minors, and exotics. In total, there are 107 different currency pairs available to buy and sell.Indices – Exness allows traders to get exposure to highly traded global indices including the US Tech 100, Dow Jones Industrial Average, the S&P, and many more.

- Cryptocurrencies - Traders on Exness can trade 27 different cryptocurrencies that are available to trade 24/7, including the weekend. The cryptocurrencies available to traders on this broker site include Bitcoin, Ethereum, Litecoin, Binance Coin, Cardano, and more.

- Metals – Gold, silver, platinum, and palladium are among the assets that investors can trade in the metals category using Exness as a broker.

- Stocks– Exness allows traders to invest in the stocks of some of the biggest companies in the world. These include stocks on Google, Amazon, Tesla, Alibaba, and Intel, among others.

- Energies– Finally, investors can trade energies including Crude Oil and Natural Gas.

Exness Spreads and Fees

It is important to understand the fees that apply when trading. Exness offers traders five different accounts to choose from which include two standard accounts and three professional accounts. Each of the accounts has different features for different traders' profiles. The five accounts include the standard, the standard cent, the pro, the zero, and the raw spread accounts.

The standard account has spreads from as low as 0.2 pips with no commissions while the standard cent account has spreads from 0.3 pips with no commissions. On the other hand, the pro account has spreads from as low as 0.1 pips with no commissions. The zero account features spreads from 0.0 pips on the top 30 instruments plus a commission from $0.05 on each side per lot. Finally, the raw spread account has spreads from 0.0 pips plus a commission of up to $3.50 for each side per lot.

Aside from the spreads and commissions, Exness also charges swap fees on positions left open overnight. The amount of the fee charged depends on the asset traded and the size of the position held. However, Exness provides swap-free versions of all its accounts for Muslim traders who cannot pay overnight charges.

Exness Credibility

Above everything, it is important to consider the credibility of a broker before investing your hard-earned cash with them. To determine the credibility, we usually check the regulatory status of the broker and the online reviews of people who have traded with them. Fortunately, Exness has regulations in various jurisdictions. These include the FSCA in South Africa, the CMA in Kenya, the FCA in the UK, and the CySEC in Cyprus, among others. Such regulations make Exness one of the best brokers that support mobile money.

Moreover, Exness enjoys great reviews online from the people who have used the broker to trade. Specifically, it has a rating of 4.5 stars out of 5 after over 5,600 reviews on Trustpilot. This suggests that the majority of traders using Exness in the market enjoy its services.

Final Comments

Exness stands out as a leading forex broker with its convenient and efficient Mobile Money payment options across multiple countries. With instant deposits and withdrawals, traders can swiftly fund their accounts and access a diverse range of trading instruments. These include forex, indices, cryptocurrencies, metals, stocks, and energies. Additionally, Exness offers competitive spreads and fees across various account types, catering to different trading preferences. Backed by strong regulatory oversight and positive customer reviews, its credibility and reliability are fostered.

Remember that forex and CFDs available at Exness are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Regulated Brokers

The table below contains links to 3rd party websites of our top partners from whom we receive compensation at no additional cost to you.